Program Report: Environment and Energy Economics, 2016

The NBER's research program in Environmental and Energy Economics (EEE) was launched in 2007. It brought together participants from an NBER working group on environmental economics, which included economists in trade, productivity, and public economics, and industrial organization economists with an interest in energy markets. While drawn from different backgrounds, the members of the EEE program recognize the key role of energy markets in affecting local pollution, greenhouse gas emissions, and other environmental concerns. Research in the EEE program draws on an amazingly interesting interplay of ideas from a number of other fields.

Researchers in the NBER's Environmental and Energy Economics (EEE) program have studied a wide range of issues, including both long-standing questions and emerging issues, in recent years. One particularly notable body of research has developed in response to the expanding discussion of the potential effects of climate change and of policy proposals designed to affect future greenhouse gas (GHG) emissions. Climate concerns have generated a host of new questions for study, and in light of the novelty as well as volume of the work that addresses them, the first five sections of this report describe this body of research. The last three sections touch on other important topics.

Consequences of Reducing GHG Emissions

Many EEE researchers focus on measuring the economic consequences of various types of emissions in order to inform the design of policies to affect those emissions. With regard to GHGs, the majority of papers have focused on the economic impacts of rising temperature. Early work measured the impact of temperature on the U.S. agriculture sector. While Olivier Deschênes and Michael Greenstone found minimal impacts of rising temperatures on agricultural outputs or profits,1 Michael Roberts and Wolfram Schlenker found large negative effects.2 This work sparked a debate, which has carried over to other economic outcomes, about the merits of using cross-sectional versus panel data to measure climate impacts,3 and led to methodological contributions describing the merits of different weather datasets and climate forecasts.4

Researchers subsequently have analyzed the potential impact of rising temperatures on international agriculture,5 conflict,6 mortality,7 birth rates,8 income,9 test scores, and human capital formation.10 Other work uses observations at a more macro level and examines the impact of temperature on output growth 11 and output per capita.12

An additional strand of research explores how people value temperature by examining their decisions on where to live and how much to pay for their homes. David Albouy, Walter Graf, Ryan Kellogg, and Hendrik Wolff use a hedonic model to estimate the amenity value of hot days across locations in the U.S.,13 while Paramita Sinha and Maureen L. Cropper use a discrete choice approach and account for the disutility of moving.14 Both papers find that people would pay to avoid the temperature patterns projected to come with climate change, although both also find considerable heterogeneity. H. Allen Klaiber, Joshua Abbott, and V. Kerry Smith suggest that local landscape choices can mitigate the urban heat island effect and thus partially off-set the disutility from high temperatures.15 Schlenker and coauthors Shuaizhang Feng and Michael Oppenheimer examine the link between migration, temperature, and agricultural productivity in the U.S. between 1970 and 2009.16

Policies that Affect GHG Emissions

In addition to analyzing the value of reducing GHG emissions, other research has analyzed policies to achieve those reductions. Such papers include general comparisons of policy types, as well as specific studies of the electricity sector, the transportation sector, and energy efficiency policies.

Recent work builds on a long-standing tradition of comparing command-and-control mandates, cap-and-trade permits, and pollution taxes to control emissions.17 For example, although standard models suggest that market-based instruments are cost-minimizing, Lawrence Goulder, Marc Hafstead, and Roberton Williams III describe circumstances when standards might yield greater efficiency.18

Actual policy has mostly shied away from market-based instruments such as permits or taxes, which raise the cost of production, and instead favors energy efficiency standards, voluntary conservation,19 and subsidies.20 Some research has focused on R&D or technology policy,21 and investigated new ways to combat climate change, such as work by Garth Heutel and coauthors, Juan Moreno-Cruz and Soheil Shayegh, and Moreno-Cruz and Katharine Ricke, on geoengineering.22

In the international context, a paper by Derek Kellenberg and Arik Levinson, and other papers by Martin Weitzman, have studied the formation of multinational environmental agreements,23 and the problem posed by the possibility that a unilateral policy promulgated by one nation or coalition could provide an incentive to others to embrace policies that increase emissions.24

An emerging literature concerns adaptation policy to deal with prospective climate changes.25 For example, analyses of adaptation in cities by Devin Bunten and Matthew Kahn, and by Kahn and Randall Walsh26 complement work on emissions mitigation in cities.27

A substantial body of research has focused on the models that are used to analyze energy policy, considering for example the choices that have been made in the modeling of energy production28 and the modeling of climate phenomena, uncertainty, and discounting.29 Weitzman's seminal work on "fat tail" probability distributions for potential climate catastrophes has led to additional research on willingness to pay for current abatement.30 For example, Robert Barro uses existing models of rare macro shocks and finds that optimal environmental investment can be a significant share of GDP.31 But multiple types of potential catastrophes can affect the optimal response to any one such catastrophe.32 An ongoing debate concerns the role of "integrated assessment models." Robert Pindyck shows that these models may not reveal much about optimal policy in response to the possibility of a catastrophic climate outcome.33

GHG Reductions in the Electricity Generating Sector

The burning of fossil fuels accounts for 75 percent of GHG emissions.34 One-third of this total is from the electricity sector, one-fifth from the transportation sector, and the remainder from industry, including the production of fossil fuels.35 Recent research has analyzed existing and proposed regulations on GHG emissions in each of these sectors.

The electricity sector has undergone several profound changes since the transformation brought on by regulatory restructuring in the late 1990s and early 2000s. These changes affect GHG emissions in the sector. Natural gas prices have fallen considerably, from a peak just above $14 per million Btu in 2005 to roughly $3 per million Btu in 2014. Natural gas and coal are the two primary fuel inputs to electricity generation, and as Christopher Knittel and coauthors Konstantinos Metaxoglou and Andre Trindade show, lower natural gas prices have displaced production from coal plants, particularly in regional markets that were not restructured.36 Coal emits roughly twice the CO2 per unit of energy as natural gas, so Joseph Cullen and Erin Mansur point out that falling natural gas prices provide insight on the impacts of a tax on CO2.37

Solar photovoltaic prices also have fallen precipitously, leading to debates about the relative value of rooftop solar versus grid-scale solar installations. Severin Borenstein describes the private incentives to invest in rooftop solar in California, pointing out the significant implicit subsidies created by the tiered rate structure.38 Finally, in some parts of the country, including California and New England, the electricity sector has been brought under cap-and-trade programs.39

Proposed regulations like the Clean Power Plan may bring further change to the sector. This plan allows states flexibility in complying with standards. Most notably, states can choose to comply with either a standard based on the total tonnage of their emissions or a standard based on the rate of emissions per kilowatt hour. James Bushnell, Stephen Holland, Jonathan Hughes, and Knittel use simulations to show that this flexibility could lead to inefficiencies, for example if some states choose rate-based standards while others choose mass-based.40

GHG Reductions in the Transportation Sector

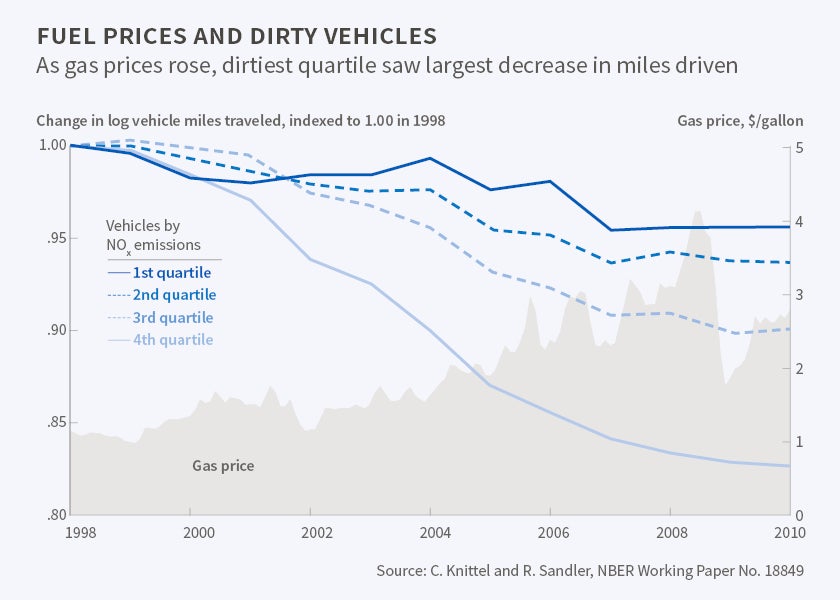

U.S. federal gasoline taxes have remained at 18.4 cents per gallon since 1993—falling significantly in real terms—and the average of state and local taxes adds 30.4 cents, for a total of 48.8 cents per gallon. Knittel uses historical polling data to show that consumers have preferred gasoline price controls, rationing, and vehicle efficiency standards to taxes.41 He also finds that dirtier vehicles respond more to fuel prices, as seen in Figure 1. This finding increases the second-best optimal fuel tax, but it is still far from a first-best tax on emissions.42

Federal policy requires car makers to meet a minimum Corporate Average Fuel Economy (CAFE). CAFE raises the average price of new cars sold, and Mark Jacobsen and Arthur van Benthem find that it delays the scrapping of older, fuel-inefficient cars, thus reducing expected fuel savings by 13 to 23 percent.43 Koichiro Ito and James Sallee find that allowing larger vehicles to meet a weaker standard can have additional welfare costs.44 CAFE standards that ignore differences in vehicle longevity obtain less than half the welfare gain of policies that account for it.45

Several studies suggest that environmental subsidies to the transport sector may have counterproductive effects. For example, biofuel subsidies shift agricultural activity with unexpected social costs;46 fuel subsidies increase externalities from fuel use;47 the "Cash for Clunkers" subsidy in the stimulus spending bill significantly reduced total spending on new vehicles for almost a year;48 and subsidies to electric cars can reduce local emissions from gasoline, but reduce overall economic welfare in significant portions of the country by increasing emissions from electric power plants.49

Energy Efficiency Policies

Detailed engineering projections, such as those summarized by the McKinsey GHG abatement cost curves, project positive net present value investments in energy efficiency based only on private returns.50 Moreover, by reducing the energy necessary to achieve a given level of energy services, these investments promise to decrease GHG emissions in addition to other local pollutants. Yet a large and persistent difference remains between the levels of investment in energy efficiency that appear to be privately beneficial and the investments that private actors undertake. This disparity is known as the "energy efficiency gap." Several explanations have been offered for this gap, and research has touched on each of them.

One explanation suggests that divergence of interests between landlords and tenants or workers and owners, information gaps, or credit constraints inhibit take-up of cost-effective, energy-efficient technologies. Several papers have explored how adding more information—for example, through sales agents at the point of purchase for water-heater consumers51 or in-home displays52—can increase efficiency. Lucas Davis and Gilbert Metcalf;53 and Richard Newell and Juha Siikamäki54 all consider the role of appliance labels in providing useful information to consumers. Sallee suggests that consumers may be "rationally inattentive" to information about energy efficiency.55 Newell and Siikamäki find considerable heterogeneity in households' discount rates, which are correlated with differences in credit scores.56 They also find that individual time preferences play a role in willingness to adopt energy efficiency.

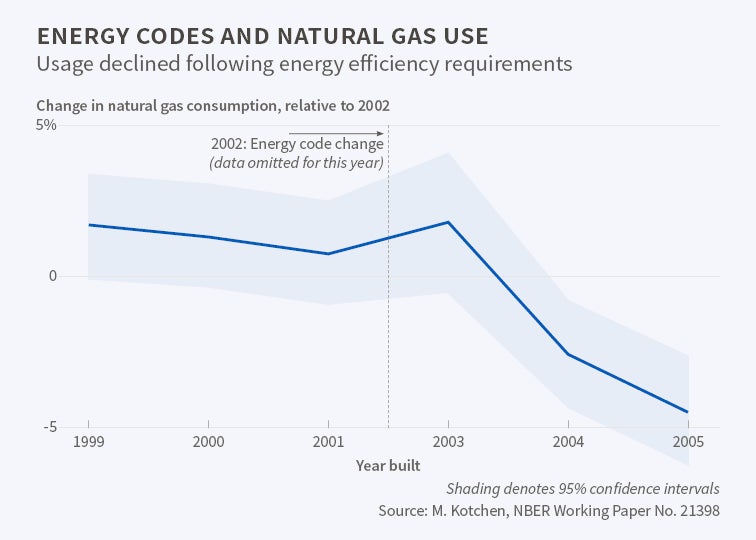

Codes and standards are often used to address the problem of market failures. Levinson questions whether California building codes have saved energy,57 while Matthew Kotchen58 finds that homes built just after Florida building codes became more stringent use less natural gas than homes built just before the change in code. [See Figure 2] Turning to appliances, Sébastien Houde and Joseph E. Aldy find that rebates for energy-efficient appliances have little additional impact on the energy efficiency of new appliance purchases in the face of state and federal standards.59 Hunt Allcott and Dmitry Taubinsky consider whether minimum efficiency standards may be welfare enhancing in the presence of limited information or consumer inattention.60

Another explanation for the energy efficiency gap, which is not necessarily at odds with the foregoing explanations, is that behavioral biases prevent consumers from making privately optimal choices around energy efficiency. Allcott and Judd Kessler point out that policies that use behavioral approaches to influencing energy consumption may have unmeasured impacts on consumer welfare, and estimate that they are small and positive on average, with considerable heterogeneity in the context of energy-use social comparisons, a popular energy-efficiency nudge.61

Another possible explanation is that the supposed gap is overstated if the engineering calculations underlying potential savings from energy-efficiency measures are too high. Borenstein elaborates on the concept of "rebound," whereby consumers decide to consume more energy services after an energy-efficiency investment (for example, to keep their homes warmer in winter).62 Rebound is often suggested as a possible explanation for discrepancies between engineering and actual estimates of savings. Meredith Fowlie, Greenstone, and Wolfram compare actual savings derived from a randomized encouragement design to before-the-fact engineering calculations and find that the engineering calculations overstated the potential savings by more than a factor of two.63 They do not find significant evidence of rebound.

Oil and Gas Production

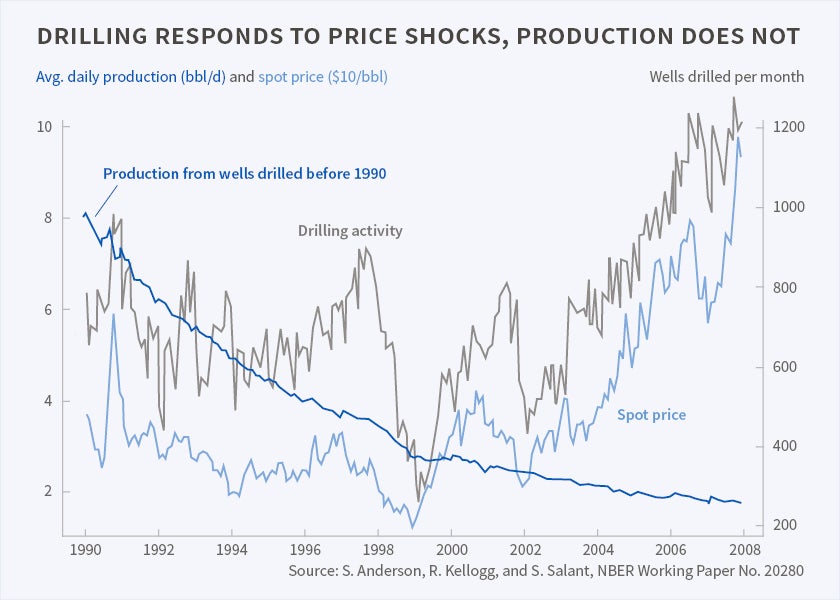

Many studies analyze the effects of prices and policies on energy production. James Hamilton explains how policy changes over the past decade affect world oil prices.64 But how do oil prices affect production? In particular, how do they affect oil exploration, drilling, and pumping from existing wells? Soren T. Anderson, Kellogg, and Stephen W. Salant find that drilling activities respond strongly to prices, but pumping from existing wells in Texas does not.65 [See Figure 3] Given that output from existing wells depends directly on reservoir pressure, which decays as oil is extracted, their analysis can help explain regional peaks of production and the way that observed patterns of price expectations follow demand shocks.

While technological innovation reduces cost and increases production of fossil fuels, Catherine Hausman and Kellogg note that the shale gas revolution also led to an increase in welfare for natural gas consumers and producers of $48 billion per year between 2007 and 2013.66 Newell and Daniel Raimi find that it led to increased local government revenue, but also increased demand for local public services.67 James Feyrer, Mansur, and Bruce Sacerdote find that horizontal drilling and hydrofracturing led to extra wages and royalties within producing counties and an overall increase of U.S. employment by 725,000 jobs.68

Crude oil prices have been volatile over the past decade, ranging from $40 per barrel in 2004 to $145 in July 2008, and then plummeting to about $30 by late 2008 before increasing to $110 in 2011 and falling again to less than $40 in parts of 2016. How much of this volatility is due to economic shocks, as opposed to speculation? Knittel and Pindyck conclude that speculators had little, if any, effect on prices and volatility.

Costs and Benefits of Abating Local Pollution

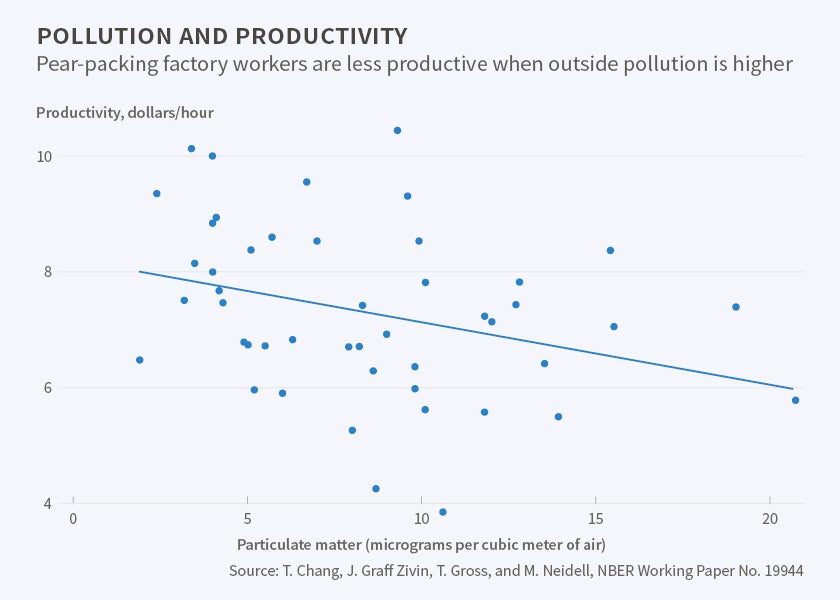

Most local pollutants are coproduced with greenhouse gases, so many of the policies to reduce GHGs also reduce local pollutants. A number of studies have measured the consequences of such reductions. For example, Jessica W. Reyes examines new outcomes in her study of the effects of lead exposure on antisocial and risky behavior.69 Joshua Graff Zivin, Matthew Neidell and coauthors Tom Chang and Tal Gross, examine the impact of particulate matter on the productivity of manual laborers in a pear-packing plant.70 [Figure 4] Evan Herrnstadt and Erich Muehlegger examine impacts on criminal activity,71 while Michael Anderson and coauthors, Fangwen Lu, Yiran Zhang, Jun Yang, and Ping Qin examine impacts on self-reported happiness.72 W. Reed Walker and coauthors Maya Rossin-Slater and Adam Isen examine impacts on labor force participation and earnings.73

Research has also considered the impact of pollution exposure on fetal development. Graff Zivin and coauthors, Prashant Bharadwaj, Matthew Gibson, and Christopher A. Neilson examine fetal exposure to carbon monoxide on fourth-grade test scores.74 Janet Currie, Graff Zivin, Jamie Mullins, and Neidell review the literature on early-life exposure.75 Several historians are accessing exciting new datasets to examine pollution impacts in early and mid-20th century America. For example, Karen Clay, and coauthors Joshua Lewis and Edson Severnini examine the impact of new coal-fired power plants on infant mortality between 1938 and 196276 and Alan Barreca, Clay, and Joel Tarr study the impacts of burning coal for residential heating between 1945 and 1960.77

Energy and the Environment in Developing Countries

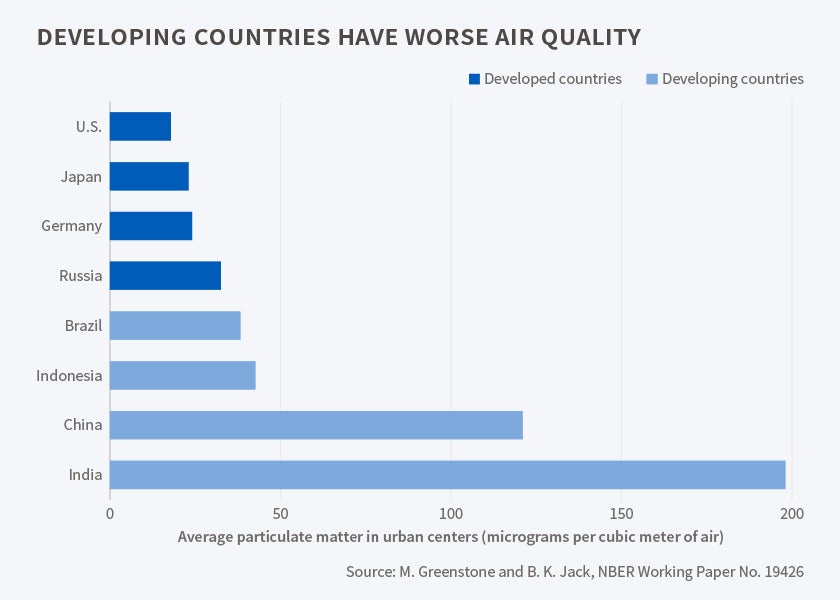

Many of the topics we have raised thus far have unique manifestations in the developing world. Figure 5 shows that air pollution levels are much higher in developing countries.78 Kahn and coauthors Siqi Zheng and Cong Sun show that avoidance behaviors—in particular purchases of masks and air filters—increase in developing countries during periods of high pollution, though primarily for the rich.79

Weak institutions can impact the provision of both environmental and energy services. In a series of papers on Indian industrial plants, Esther Duflo, Greenstone, Rohini Pande, and Nicholas Ryan study the relationship between environmental regulators and third-party inspectors, highlighting the importance of conflicts of interest and regulatory discretion.80 Ann Harrison and coauthors Benjamin Hyman, Leslie Martin, and Shanthi Nataraj find that higher coal prices constrained emissions more than command-and-control regulations in India.81 Kahn and coauthors Pei Li and Daxuan Zhao demonstrate weaker enforcement of water pollution laws around political borders in China,82 and Allcott, Allan Collard-Wexler, and Stephen O'Connell consider the impact of poor electricity reliability in India and find limited impact on short-run productivity.83 Natasha Chichilnisky-Heal and Geoffrey Heal model the political influence of multinational corporations extracting rents from resource-rich countries.84

In the rapidly growing economies in the developing world, the energy infrastructure is just being built, and consumers are purchasing energy-using durables such as cars and refrigerators for the first time. Edward Miguel, Wolfram, and coauthors Kenneth Lee, Eric Brewer, Carson Christiano, Francis Meyo, Matthew Podolsky, and Javier Rosa document that many households that are not connected to the electricity grid in western Kenya are in fact quite close to existing grid infrastructure, and thus more accurately described as "under-grid" rather than "off-grid."85 Randy Chugh and Cropper study the market for passenger vehicles in India, one of the world's fastest growing car markets, and examine consumer response to relative taxes on petrol versus diesel fuel, plus a diesel car tax.86

Researchers have also studied subsidies from the developed world, implemented in developing nations, for energy and environmental projects. B. Kelsey Jack, Paulina Oliva, and coauthors, Christopher Severen, Elizabeth Walker and Samuel Bell, examine how different forms of subsidies impact the efficacy of tree-planting programs,87 while Kotchen and Neeraj Kumar Negi examine determinants of cofinancing for projects supported by the Global Environment Facility.88

Finally, gender dynamics among families may be more extreme than in many parts of the developed world, which Grant Miller and Ahmed Mushfiq Mobarak find partially explains low demand for improved cookstoves.89

Endnotes

O. Deschênes and M. Greenstone, "The Economic Impacts of Climate Change: Evidence from Agricultural Profits and Random Fluctuations in Weather," NBER Working Paper 10663, August 2004, and American Economic Review, 97(1), 2007, pp. 354–85.

M. J. Roberts and W. Schlenker, "Is Agricultural Production Becoming More or Less Sensitive to Extreme Heat? Evidence from U.S. Corn and Soybean Yields," NBER Working Paper 16308, August 2010 and in D. Fullerton and C. Wolfram, eds., The Design and Implementation of U.S. Climate Policy, Chicago, IL: Chicago University Press, 2012, pp. 271–82; and W. Schlenker and M. J. Roberts, "Estimating the Impact of Climate Change on Crop Yields: The Importance of Nonlinear Temperature Effects," NBER Working Paper 13799, February 2008.

S. M. Hsiang, "Climate Econometrics," NBER Working Paper 22181, April 2016.

M. Auffhammer, S. M. Hsiang, W. Schlenker and A. Sobel, "Using Weather Data and Climate Model Output in Economic Analyses of Climate Change," NBER Working Paper 19087, May 2013, and Review of Environmental Economics and Policy, 7(2), 2013, pp. 181–98.

D. Donaldson, A. Costinot, and C. B. Smith, "Evolving Comparative Advantage and the Impact of Climate Change in Agricultural Markets: Evidence from 1.7 Million Fields around the World," NBER Working Paper 20079, April 2014, and Journal of Political Economy, 124(1), 2016, pp. 205–48.

M. Burke, S. M. Hsiang, and E. Miguel, "Climate and Conflict," NBER Working Paper 20598, October 2014, and the Annual Review of Economics, 7(1), 2015, pp. 577–617.

A. Barreca, K. Clay, O. Deschênes, M. Greenstone, and J. S. Shapiro, "Adapting to Climate Change: The Remarkable Decline in the U.S. Temperature-Mortality Relationship over the 20th Century," NBER Working Paper 18692, January 2013, and Journal of Political Economy, 124(1), 2016, pp. 105–59.

A. Barreca, O. Deschênes, and M. Guldi, "Maybe Next Month? Temperature Shocks, Climate Change, and Dynamic Adjustments in Birth Rates," NBER Working Paper 21681, October 2015.

T. Deryugina and S. M. Hsiang, "Does the Environment Still Matter? Daily Temperature and Income in the United States," NBER Working Paper 20750, December 2014.

J. S. Graff Zivin, S. M. Hsiang, and M. J. Neidell, "Temperature and Human Capital in the Short- and Long-Run," NBER Working Paper 21157, May 2015.

M. Dell, B. F. Jones, and B. A. Olken, "Climate Change and Economic Growth: Evidence from the Last Half Century," NBER Working Paper 14132, June 2008, and American Economic Journal: Macroeconomics, 4(3), 2012, pp. 66–95.

G. Heal and J. Park, "Feeling the Heat: Temperature, Physiology, and the Wealth of Nations," NBER Working Paper 19725, December 2013.

D.Albouy, W. Graf, R. Kellogg, and H. Wolff, "Climate Amenities, Climate Change, and American Quality of Life," NBER Working Paper 18925, March 2013, and Journal of the Association of Environmental and Resource Economists, 3(1), 2016, pp. 205–46.

P. Sinha and M. L. Cropper, "Household Location Decisions and the Value of Climate Amenities," NBER Working Paper 21826, December 2015.

H. A. Klaiber, J. Abbott, and V. K. Smith, "Some Like it (Less) Hot: Extracting Tradeoff Measures for Physically Coupled Amenities," NBER Working Paper 21051, March 2015.

S. Feng, M. Oppenheimer, and W. Schlenker, "Climate Change, Crop Yields, and Internal Migration in the United States," NBER Working Paper 17734, January 2012.

L. H. Goulder and A. Schein, "Carbon Taxes vs. Cap-and-Trade: A Critical Review," NBER Working Paper 19338, August 2013, and Climate Change Economics, 4(3), 2013, pp. 1350010.1–28; M. Ranson and R. Stavins, "Linkage of Greenhouse Gas Emissions Trading Systems: Learning from Experience," NBER Working Paper 19824, January 2014, and Climate Policy, 16(3), 2016, pp. 284–300; S. P. Holland and A. J. Yates, "Optimal Trading Ratios for Pollution Permit Markets," NBER Working Paper 19780, January 2014, and Journal of Public Economics, 125(C), 2015, pp. 16–27; W. A. Pizer and A. J. Yates, "Terminating Links between Emission Trading Programs," NBER Working Paper 20393, August 2014, and Journal of Environmental Economics and Management, 71(C), 2015, pp. 142–59; H. R. Chan, B. A. Chupp, M. L. Cropper, and N. Z. Muller, "The Market for Sulfur Dioxide Allowances: What Have We Learned from the Grand Policy Experiment?," NBER Working Paper 21383, July 2015; and R. Schmalensee and R. Stavins, "Lessons Learned from Three Decades of Experience with Cap-and-Trade," NBER Working Paper 21742, November 2015.

L. H. Goulder, M. A. C. Hafstead, R. C. Williams III, "General Equilibrium Impacts of a Federal Clean Energy Standard," NBER Working Paper 19847, January 2014, and American Economic Journal: Economic Policy, 8(2), 2016, pp.186–218.

J. S. Holladay, M. K. Price, and M. Wanamaker, "The Perverse Impact of Calling for Energy Conservation," NBER Working Paper 20706, November 2014, and Journal of Economic Behavior and Organization, 110(C), 2015, pp. 1–18.

G. Heutel and D. L. Kelly, "Incidence and Environmental Effects of Distortionary Subsidies," NBER Working Paper 18924, March 2013, and published as "Incidence, Environmental, and Welfare Effects of Distortionary Subsidies," Journal of the Association of Environmental and Resource Economists, 3(2), 2016, pp. 361–415; S. Li, M. E. Kahn, and J. Nickelsburg, "Public Transit Bus Procurement: The Role of Energy Prices, Regulation, and Federal Subsidies," NBER Working Paper 19964, March 2014, and Journal of Urban Economics, 87(C), 2015, pp. 57–71.

G. Heutel and C. Fischer, "Environmental Macroeconomics: Environmental Policy, Business Cycles, and Directed Technical Change," NBER Working Paper 18794, February 2013, and Annual Review of Resource Economics, 5(1), 2013, pp. 197–210; F. Vona, G. Marin, D. Consoli, and D. Popp, "Green Skills," NBER Working Paper 21116, April 2015; M. Webster, K. Fisher-Vanden, D. Popp, and N. Santen, "Should We Give Up After Solyndra? Optimal Technology R&D Portfolios under Uncertainty," NBER Working Paper 21396, July 2015; and D. Popp, "Using Scientific Publications to Evaluate Government R&D Spending: The Case of Energy," NBER Working Paper 21415, July 2015.

G. Heutel, J. Moreno-Cruz, and S. Shayegh, "Solar Geoengineering, Uncertainty, and the Price of Carbon," NBER Working Paper 21355, July 2015; G. Heutel, J. Moreno-Cruz, and S. Shayegh, "Climate Tipping Points and Solar Geoengineering," NBER Working Paper 21589, September 2015; and G. Heutel, J. Moreno-Cruz, and K. Ricke, "Climate Engineering Economics," NBER Working Paper 21711, November 2015.

D. Kellenberg and A. Levinson, "Waste of Effort? International Environmental Agreements," NBER Working Paper 19533, October 2013, and Journal of the Association of Environmental and Resource Economists, 1(1), 2015, pp. 135–69; M. Weitzman, "Can Negotiating a Uniform Carbon Price Help to Internalize the Global Warming Externality?," NBER Working Paper 19644, November 2013, and Journal of the Association of Environmental and Resource Economists, 1(1), 2014, pp. 29–49; and M. Weitzman, "Voting on Prices vs. Voting on Quantities in a World Climate Assembly," NBER Working Paper 20925, February 2015.

J. Elliott and D. Fullerton, "Can a Unilateral Carbon Tax Reduce Emissions Elsewhere? "NBER Working Paper 18897, March 2013, and Resource and Energy Economics, 36(1), pp. 6–21; and K. Baylis, D. Fullerton, and D. H. Karney, "Leakage, Welfare, and Cost-Effectiveness of Carbon Policy," NBER Working Paper 18898, March 2013, and American Economic Review, 103(3), 2013, pp. 332–37.

A. Barreca, K. Clay, O. Deschênes, M. Greenstone, and J. S. Shapiro, "Adapting to Climate Change: The Remarkable Decline in the U.S. Temperature-Mortality Relationship over the 20th Century," NBER Working Paper 18692, January 2013, and Journal of Political Economy, 124(1), 2016, pp. 105–15; H. Kunreuther and E. U. Weber, "Aiding Decision-Making to Reduce the Impacts of Climate Change," NBER Working Paper 19776, January 2014, and Journal of Consumer Policy, 37(3), 2014, pp. 397–411; and M. C. Freeman, B. Groom, and R. Zeckhauser, "Better Predictions, Better Allocations: Scientific Advances and Adaptation to Climate Change," NBER Working Paper 21463, August 2015, and Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 373(2055), 2015, pp. 1–24.

D. Bunten and M. E. Kahn, "The Impact of Emerging Climate Risks on Urban Real Estate Price Dynamics," NBER Working Paper 20018, March 2014; M. E. Kahn, R. Walsh, "Cities and the Environment," NBER Working Paper 20503, September 2014.

M. J. Holian, and M. E. Kahn, "The Rise of the Low Carbon Consumer City," NBER Working Paper 18735, January 2013, and published as "Household Carbon Emissions from Driving and Center City Quality of Life," Ecological Economics, 116, 2015, pp. 362–68; M. E. Kahn, N. Kok, and J. M. Quigley, "Commercial Building Electricity Consumption Dynamics: The Role of Structure Quality, Human Capital, and Contract Incentives," NBER Working Paper 18781, February 2013, and published as "Carbon Emissions from the Commercial Building Sector: The Role of Climate, Quality, and Incentives," Journal of Public Economics, 113, 2014, pp. 1–12; S. Zheng, M. E. Kahn, W. Sun, and D. Luo, "Incentivizing China's Urban Mayors to Mitigate Pollution Externalities: The Role of the Central Government and Public Environmentalism," NBER Working Paper No. 18872, March 2013, and published as "Incentives for China's Urban Mayors to Mitigate Pollution Externalities: The Role of the Central Government and Public Environmentalism," Regional Science and Urban Economics, 47, 2014, pp. 61–71; and M. E. Kahn and N. Kok, "Big-Box Retailers and Urban Carbon Emissions: The Case of Wal-Mart," NBER Working Paper 19912, February 2014.

J. Moreno-Cruz and M. S. Taylor, "A Spatial Approach to Energy Economics," NBER Working Paper 18908, March 2013.

G. Heal and A. Millner, "Uncertainty and Decision in Climate Change Economics," NBER Working Paper 18929, March 2013, and Review of Environmental Economics and Policy, 8(1), 2014, pp.120–37; G. Heal and A. Millner, "Discounting under Disagreement," NBER Working Paper 18999, April 2013; M. C. Freeman, G. Wagner, and R. Zeckhauser, "Climate Sensitivity Uncertainty: When is Good News Bad?," NBER Working Paper 20900, January 2015, and Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 373(2055), 2015, pp. 1–15; K. Gillingham, W. D. Nordhaus, D. Anthoff, G. Blanford, V. Bosetti, P. Christensen, H. McJeon, J. Reilly, and P. Sztorc, "Modeling Uncertainty in Climate Change: A Multi-Model Comparison," NBER Working Paper 21637, October 2015.

M. Weitzman, "On Modeling and Interpreting the Economics of Catastrophic Climate Change," Review of Economics and Statistics, 91(1), 2009, pp. 1–19.

R. J. Barro, "Environmental Protection, Rare Disasters, and Discount Rates," NBER Working Paper 19258, July 2013, and Economica, 82(325), 2014, pp. 1–23.

I. W. R. Martin and R. S. Pindyck, "Averting Catastrophes: The Strange Economics of Scylla and Charybdis," NBER Working Paper 20215, June 2014, and American Economic Review, 105(10), 2015, pp. 2947–85.

R. S. Pindyck, "Climate Change Policy: What Do the Models Tell Us?," NBER Working Paper 19244, July 2013, and Journal of Economic Literature, 51(3), 2014, pp. 860–72; R. S. Pindyck, "The Use and Misuse of Models for Climate Policy," NBER Working Paper 21097, April 2015.

Intergovernmental Panel on Climate Change (IPCC), 2014. Climate Change 2014: Mitigation of Climate Change. Accessible at: https://www.ipcc.ch/report/ar5/wg3/

Intergovernmental Panel on Climate Change (IPCC), 2014. Climate Change 2014: Mitigation of Climate Change. Accessible at: https://www.ipcc.ch/report/ar5/wg3/

C. R. Knittel, K. Metaxoglou, and A. Trindade, "Natural Gas Prices and Coal Displacement: Evidence from Electricity Markets," NBER Working Paper 21627, October 2015.

J. A. Cullen and E. T. Mansur, "Inferring Carbon Abatement Costs in Electricity Markets: A Revealed Preference Approach using the Shale Revolution," NBER Working Paper 20795, December 2014.

S. Borenstein, "The Private Net Benefits of Residential Solar PV: The Role of Electricity Tariffs, Tax Incentives, and Rebates," NBER Working Paper 21342, July 2015.

S. Borenstein, J. Bushnell, F. A. Wolak, and M. Zaragoza-Watkins, "Expecting the Unexpected: Emissions Uncertainty and Environmental Market Design," NBER Working Paper 20999, March 2015.

J. B. Bushnell, S. P. Holland, J. E. Hughes, and C. R. Knittel, "Strategic Policy Choice in State-Level Regulation: The EPA's Clean Power Plan," NBER Working Paper 21259, June 2015.

C. R. Knittel, "The Energy-Policy Efficiency Gap: Was There Ever Support for Gasoline Taxes?" NBER Working Paper 18685, January 2013, and Tax Policy and the Economy, 28(1), 2014, pp. 97–131.

C. R. Knittel and R. Sandler, "The Welfare Impact of Indirect Pigouvian Taxation: Evidence from Transportation," NBER Working Paper 18849, February 2013.

M. R. Jacobsen and A. A. van Benthem, "Vehicle Scrappage and Gasoline Policy," NBER Working Paper No. 19055, May 2013, and American Economic Review, 105(3), 2015, pp. 1312–38. ↩

K. Ito and J. M. Sallee, "The Economics of Attribute-Based Regulation: Theory and Evidence from Fuel-Economy Standards," NBER Working Paper 20500, September 2014.

M. R. Jacobsen, C. R. Knittel, J. M. Sallee, and A. A. van Benthem, "Sufficient Statistics for Imperfect Externality-Correcting Policies," NBER Working Paper 22063, March 2016.

S. P. Holland, J. E. Hughes, C. R. Knittel, and N. C. Parker, "Unintended Consequences of Transportation Carbon Policies: Land-Use, Emissions, and Innovation," NBER Working Paper 19636, November 2013.

L. W. Davis, "The Environmental Cost of Global Fuel Subsidies," NBER Working Paper 22105, March 2016.

M. Hoekstra, S. L. Puller, and J. West, "Cash for Corollas: When Stimulus Reduces Spending," NBER Working Paper 20349, July 2014.

S. P. Holland, E. T. Mansur, N. Z. Muller, and A. J. Yates, "Environmental Benefits from Driving Electric Vehicles?" NBER Working Paper 21291, June 2015.

McKinsey & Company. 2009. "Unlocking Energy Efficiency in the U.S. Economy." Accessible at: https://mck.co/2Jc0TlQ

H. Allcott and R. Sweeney, "The Role of Sales Agents in Information Disclosure: Evidence from a Field Experiment," NBER Working Paper 20048, April 2014.

S. Z. Attari, G. Gowrisankaran, T. Simpson, and S. M. Marx, "Does Information Feedback from In-Home Devices Reduce Electricity Use? Evidence from a Field Experiment," NBER Working Paper 20809, December 2014.

L. W. Davis and G. E. Metcalf, "Does Better Information Lead to Better Choices? Evidence from Energy-Efficiency Labels," NBER Working Paper 20720, November 2014.

R. G. Newell and J. V. Siikamäki, "Nudging Energy Efficiency Behavior: The Role of Information Labels," NBER Working Paper 19224, July 2013, and Journal of the Association of Environmental and Resource Economists, 1(4), 2014, pp. 555–98.

J. M. Sallee, "Rational Inattention and Energy Efficiency," NBER Working Paper 19545, October 2013, and Journal of Law and Economics, 57(3), 2014, pp. 781–820.

R. G. Newell and J. V. Siikamäki, "Individual Time Preferences and Energy Efficiency," NBER Working Paper 20969, February 2015.

A. Levinson, "How Much Energy Do Building Energy Codes Really Save? Evidence from California," NBER Working Paper 20797, December 2014.

M. J. Kotchen, "Do Building Energy Codes Have a Lasting Effect on Energy Consumption? New Evidence From Residential Billing Data in Florida," NBER Working Paper 21398, July 2015.

S. Houde and J. E. Aldy, "Belt and Suspenders and More: The Incremental Impact of Energy Efficiency Subsidies in the Presence of Existing Policy Instruments," NBER Working Paper 20541, October 2014.

H. Allcott and D. Taubinsky, "The Lightbulb Paradox: Evidence from Two Randomized Experiments," NBER Working Paper 19713, December 2013.

H. Allcott and J. B. Kessler, "The Welfare Effects of Nudges: A Case Study of Energy Use Social Comparisons," NBER Working Paper 21671, October 2015.

S. Borenstein, "A Microeconomic Framework for Evaluating Energy Efficiency Rebound And Some Implications," NBER Working Paper 19044, May 2013, and The Quarterly Journal of the IAEE's Energy Economics Education Foundation, 36(1), 2015, pp. 1–21.

M. Fowlie, M. Greenstone, and C. Wolfram, "Do Energy Efficiency Investments Deliver? Evidence from the Weatherization Assistance Program," NBER Working Paper 21331, July 2015.

J. D. Hamilton, "The Changing Face of World Oil Markets," NBER Working Paper 20355, July 2014.

S. T. Anderson, R. Kellogg, and S. W. Salant, "Hotelling Under Pressure," NBER Working Paper 20280, July 2014.

C. Hausman and R. Kellogg, "Welfare and Distributional Implications of Shale Gas," NBER Working Paper 21115, April 2015 and Brookings Papers on Economic Activity, 50(1), 2015, pp. 71–139.

R. G. Newell and D. Raimi, "Shale Public Finance: Local Government Revenues and Costs Associated with Oil and Gas Development," NBER Working Paper 21542, September 2015.

J. Feyrer, E. T. Mansur, and B. Sacerdote, "Geographic Dispersion of Economic Shocks: Evidence from the Fracking Revolution," NBER Working Paper 21624, October 2015.

J. W. Reyes, "Lead Exposure and Behavior: Effects on Antisocial and Risky Behavior among Children and Adolescents," NBER Working Paper 20366, August 2014, and Economic Inquiry, 53(3), 2015, pp. 1580–1605.

T. Chang, J. S. Graff Zivin, T. Gross, and M. J. Neidell, "Particulate Pollution and the Productivity of Pear Packers," NBER Working Paper 19944, February 2014.

E. Herrnstadt and E.Muehlegger, "Air Pollution and Criminal Activity: Evidence from Chicago Microdata," NBER Working Paper 21787, December 2015.

M. L. Anderson, F. Lu, Y. Zhang, J. Yang, and P. Qin, "Superstitions, Street Traffic, and Subjective Well-Being," NBER Working Paper 21551, September 2015.

A. Isen, M. Rossin-Slater, and W. R. Walker, "Every Breath You Take—Every Dollar You'll Make: The Long-Term Consequences of the Clean Air Act of 1970," NBER Working Paper 19858, January 2014.

P. Bharadwaj, J. S. Graff Zivin, M. Gibson, and C. A. Neilson, "Gray Matters: Fetal Pollution Exposure and Human Capital Formation," NBER Working Paper 20662, November 2014.

J. Currie, J. S. Graff Zivin, J. Mullins, and M. J. Neidell, "What Do We Know About Short- and Long-Term Effects of Early Life Exposure to Pollution?" NBER Working Paper 19571, October 2013, and Annual Review of Resource Economics, 6(1), 2014, pp. 217–47.

K. Clay, J. Lewis, and E. Severnini, "Canary in a Coal Mine: Infant Mortality, Property Values, and Tradeoffs Associated with Mid-20th Century Air Pollution," NBER Working Paper 22155, April 2016.

A. Barreca, K. Clay, and J. Tarr, "Coal, Smoke, and Death: Bituminous Coal and American Home Heating," NBER Working Paper 19881, February 2014.

M. Greenstone and B. K. Jack, "Envirodevonomics: A Research Agenda for a Young Field," NBER Working Paper 19426, September 2013, and Journal of Economic Literature, 53(1), 2015, pp. 5–42.

S. Zheng, C. Sun, and M. E. Kahn, "Self-Protection Investment Exacerbates Air Pollution Exposure Inequality in Urban China," NBER Working Paper 21301, June 2015.

E. Duflo, M. Greenstone, R. Pande, and N. Ryan, "Truth-telling by Third-party Auditors and the Response of Polluting Firms: Experimental Evidence from India," NBER Working Paper 19259, July 2013, and The Quarterly Journal of Economics, 128(4), 2013, pp. 1499–1545; and E. Duflo, M. Greenstone, R. Pande, and N. Ryan, "The Value of Regulatory Discretion: Estimates from Environmental Inspections in India," NBER Working Paper 20590, October 2014.

A. Harrison, B. Hyman, L. Martin, and S. Nataraj, "When Do Firms Go Green? Comparing Price Incentives with Command and Control Regulations in India," NBER Working Paper 21763, November 2015.

M. E. Kahn, P. Li, and D. Zhao, "Pollution Control Effort at China's River Borders: When Does Free Riding Cease?" NBER Working Paper 19620, November 2013.

H. Allcott, A. Collard-Wexler, and S. D. O'Connell, "How Do Electricity Shortages Affect Industry? Evidence from India," NBER Working Paper 19977, March 2014.

N. Chichilnisky-Heal and G. Heal, "Host-MNC Relations in Resource-Rich Countries," NBER Working Paper 21712, November 2015.

K. Lee, E. Brewer, C. Christiano, F. Meyo, E. Miguel, M. Podolsky, J. Rosa, and C. Wolfram, "Barriers to Electrification for 'Under Grid' Households in Rural Kenya," NBER Working Paper 20327, July 2014, and published as "Electrification for 'Under Grid' households in Rural Kenya," Development Engineering, 1, 2015, pp. 26–35.

R. Chugh and M. L. Cropper, "The Welfare Effects of Fuel Conservation Policies in the Indian Car Market," NBER Working Paper 20460, September 2014.

B. K. Jack, P. Oliva, C. Severen, E. Walker, and S. Bell, "Technology Adoption Under Uncertainty: Take-Up and Subsequent Investment in Zambia," NBER Working Paper 21414, July 2015.

M. J. Kotchen and N. K. Negi, "Cofinancing in Environment and Development: Evidence from the Global Environment Facility," NBER Working Paper 21139, May 2015.

G. Miller and A. M. Mobarak, "Gender Differences in Preferences, Intra-Household Externalities, and Low Demand for Improved Cookstoves," NBER Working Paper 18964, April 2013.