National Bureau of Economic Research

Latest from the NBER

A research summary from the monthly NBER Digest

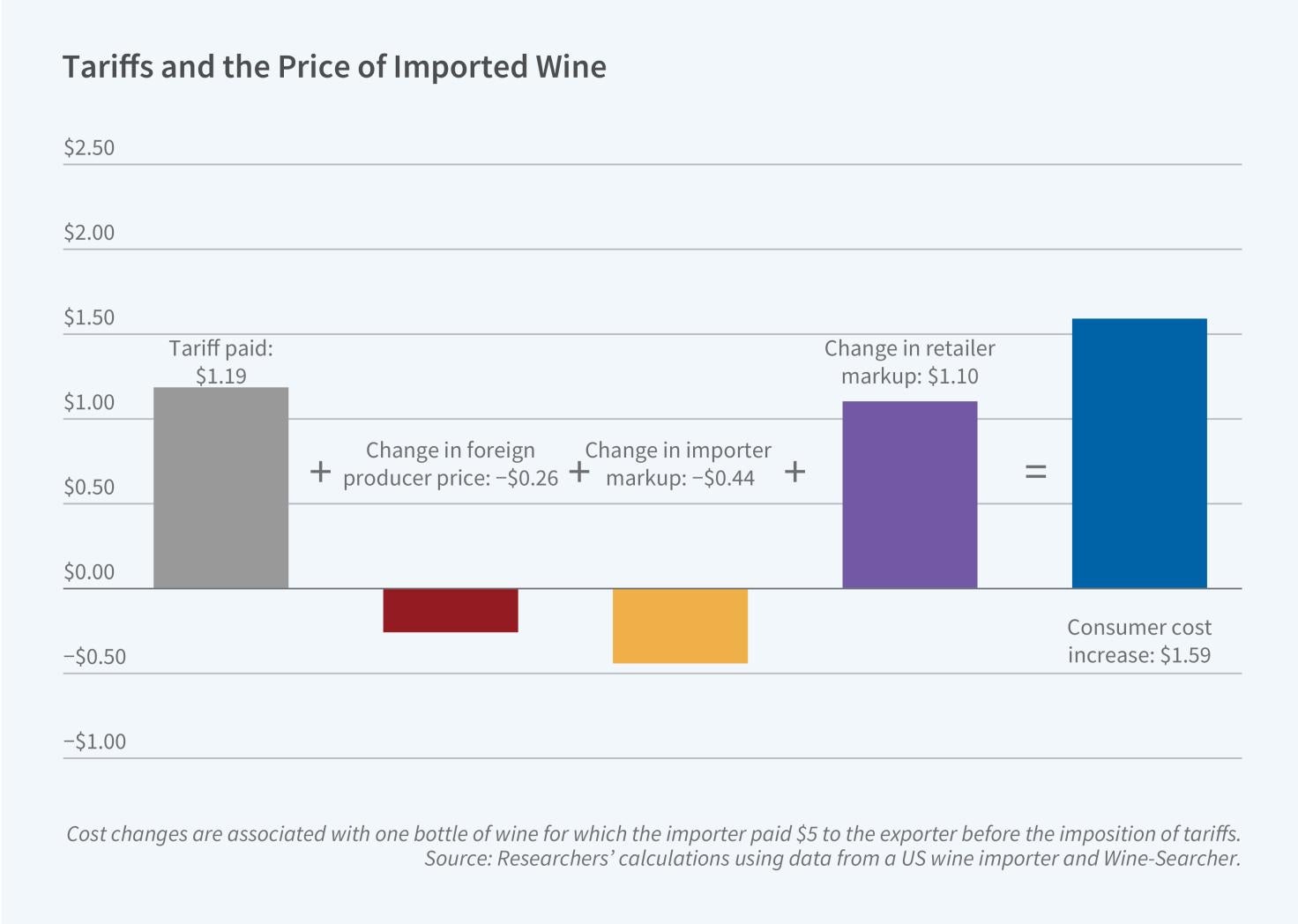

Pass-Through of Tariffs: Evidence from European Wine Imports

article

The incidence of tariffs on producers, in the form of lower pre-tariff prices, and consumers, in the form of higher tariff-inclusive prices, is a long-standing issue in international economics. While economic theory suggests various possibilities, empirical evidence on the distribution of tariff burdens across the supply chain, from producers through distributors to retailers, is limited.

In Who Pays for Tariffs Along the Supply Chain? Evidence from European Wine Tariffs (NBER Working Paper 34392), Aaron B. Flaaen, Ali Hortaçsu, Felix Tintelnot, Nicolás Urdaneta, and Daniel Xu examine how tariff costs propagate through each stage of the wine distribution chain. The researchers...

From the NBER Bulletin on Health

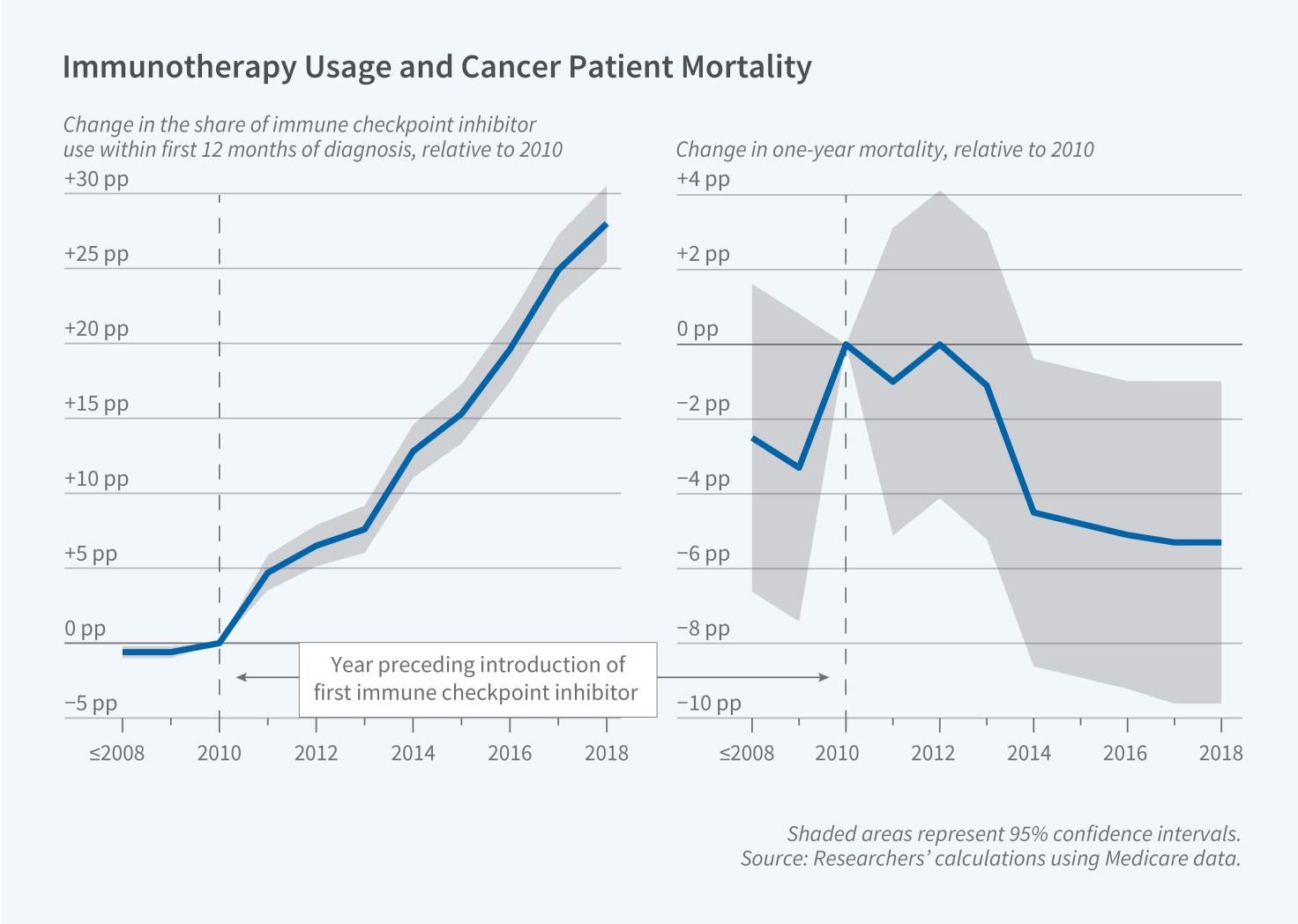

Immunotherapy Increases the Cost of Cancer Care but Reduces Mortality

article

Immune checkpoint inhibitors (ICIs) are immunotherapy drugs that mobilize the patient’s immune system to detect and attack cancer cells. They are considered a breakthrough development in cancer care, but are very expensive, with a full course of treatment costing more than $150,000 per patient. In The Impact of Immunotherapy on Reductions in Cancer Mortality: Evidence from Medicare (NBER Working Paper 34317), Danea Horn, Abby E. Alpert, Mark Duggan, and Mireille Jacobson use Medicare claims data to evaluate the impact of the first ICIs on healthcare use, costs, and mortality among beneficiaries diagnosed with...

From the NBER Reporter: Research, program, and conference summaries

Quantitative Trade Policy in a Changing World

article

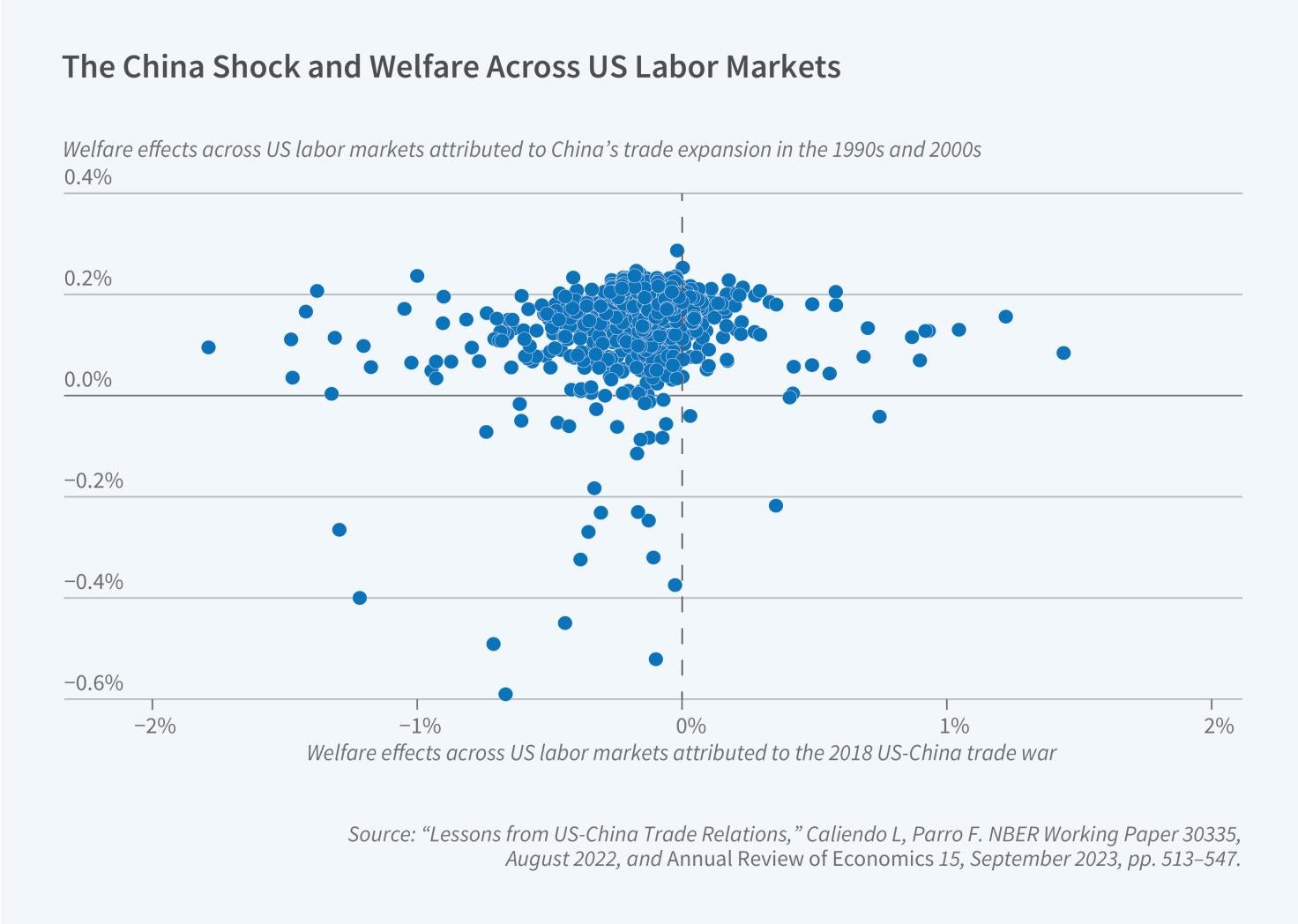

Over the past three decades trade policy has profoundly shaped the structure of production, employment, and welfare across countries. The North American Free Trade Agreement (NAFTA), China’s entry into the World Trade Organization (WTO), and the recent resurgence of tariff protectionism illustrate how deeply globalization and policy choices are intertwined. Evaluating their effects requires quantitative frameworks that capture how shocks to both technology and policy propagate through supply chains, labor markets, and international linkages.

Our research develops tractable general equilibrium models to quantify how shocks such as tariffs affect economies—both in the aggregate and across workers, regions, and sectors. These frameworks extend the Ricardian model of trade to include…

From the NBER Bulletin on Entrepreneurship

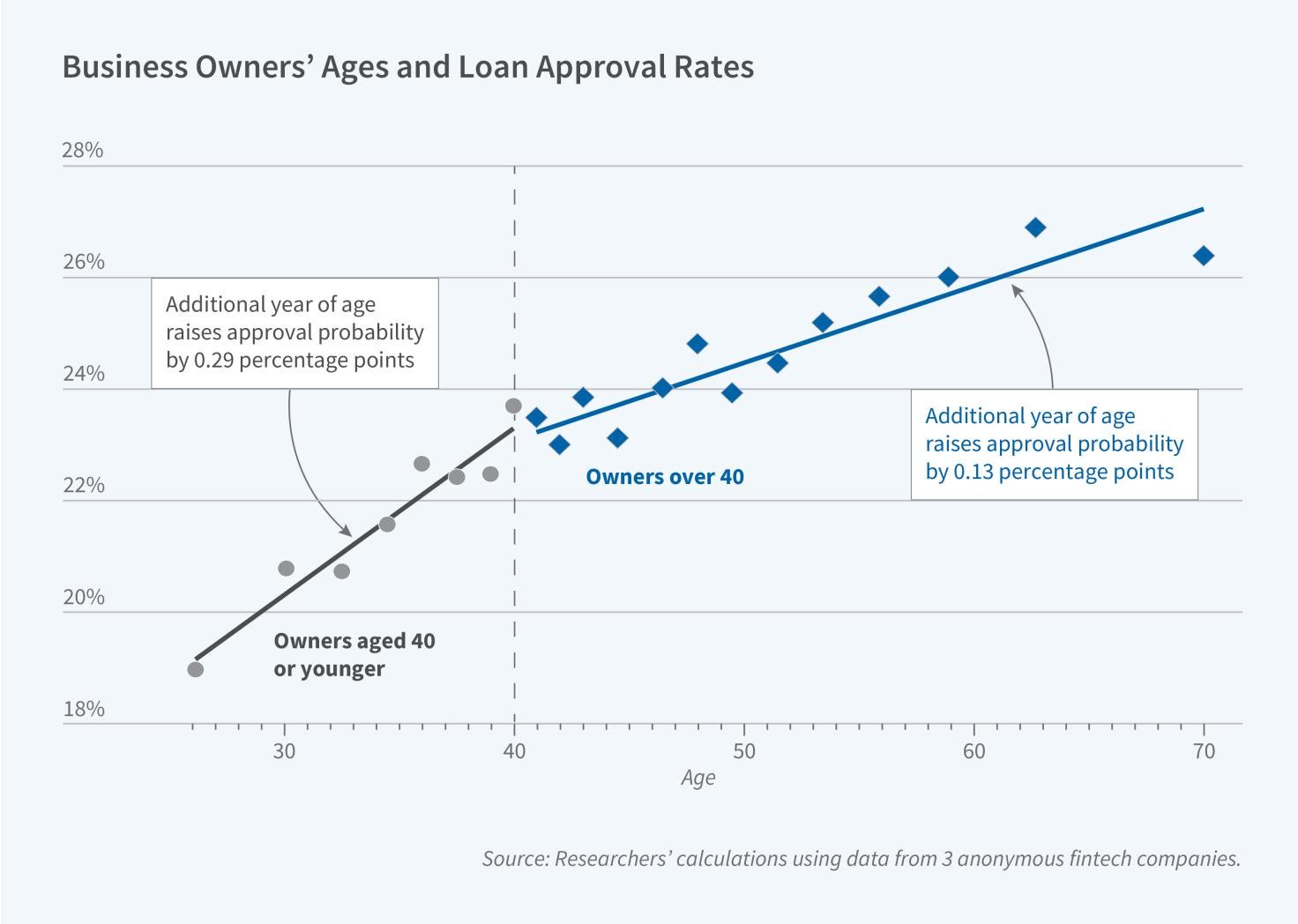

Underwriting Based on Cash Flow Helps Younger Entrepreneurs Access Credit

article

Younger entrepreneurs are disadvantaged in small business loan markets because lenders rely heavily on personal credit scores, which favor long histories of repaying debt. In Modernizing Access to Credit for Younger Entrepreneurs: From FICO to Cash Flow (NBER Working Paper 33367), researchers Christopher M. Hair, Sabrina T. Howell, Mark J. Johnson, and Siena Matsumoto document this fact and show that younger entrepreneurs benefit from underwriting that augments personal credit scores (like FICO) with cash flow data. They analyze comprehensive…

Featured Working Papers

Employees at firms founded after 2015 work from home (WFH) nearly twice as often as those at firms founded before 1990. WFH rates decline monotonically with CEO age, averaging 1.4 days per week under CEOs younger than 30 versus 1.1 days under CEOs 60 or older, according to Cevat Giray Aksoy, Jose Maria Barrero, Nicholas Bloom, Katelyn Cranney, Steven J. Davis, Mathias Dolls, and Pablo Zarate.

While daily ICE arrests rose 170 percent following Trump's second inauguration, the share of those arrested with a criminal conviction declined from 52 percent to 37 percent, according to Chloe N. East, Caitlin Patler, and Elizabeth Cox.

Bruno Cavani, Christopher Clayton, Amanda Dos Santos, Matteo Maggiori, and Jesse Schreger find that US mutual fund holdings of Chinese Renminbi-denominated bonds fell roughly 50 percent between 2021 and 2024, with about 65 percent of the decline driven by funds exiting RMB positions entirely. At the same time, total foreign holdings of Chinese bonds rose to $625 billion in 2024.

David C. Grabowski, Jonathan Gruber, and Brian E. McGarry find that a 25 percent increase in the annual net flow of immigrants would result in roughly 5,000 fewer elderly deaths per year primarily because the immigrants expand the healthcare workforce and reduce nursing home use.

Over the 1988–2016 period, Nigeria increased intergovernmental VAT transfers to states that saw active protests and that were politically aligned with the federal government by up to 2.2 percent annually, while non-aligned states saw transfers fall and greater police violence in response to protests, Belinda Archibong, Chinemelu Okafor, Evans S. Osabuohien, and Tom Moerenhout find.

In the News

Recent citations of NBER research in the media

_______________________________________

Research Projects

Conferences

Books & Chapters

Through a partnership with the University of Chicago Press, the NBER publishes the proceedings of four annual conferences as well as other research studies associated with NBER-based research projects.

Videos

Recordings of presentations, keynote addresses, and panel discussions at NBER conferences are available on the Videos page.