How Tight Is the Labor Market?

It is a great honor for me to give the Martin Feldstein Lecture. I first met Marty when I was a research assistant at the NBER in the summer of 1984, shortly after he returned from serving as chairman of the Council of Economic Advisers (CEA). Later that year, I was fortunate to learn public finance at Harvard from both Marty and Larry Summers. They taught me a tremendous amount and sparked my passion for using economics in public policy. Marty also often visited me when I was chairman of the CEA, and I benefited from his wise counsel and encouragement.

Today, I'm going to talk about a question that Marty and I have discussed on many occasions: How tight is the labor market? In essence, I think this issue boils down to two questions. First, how should we think about the U-6 measure of labor slack? I won't delve into this question, however, because U-6 is elevated due to a large number of part-time workers who report that they would prefer to work full-time. The recent rebound in the average work week, however, suggests that there isn't substantial slack on the hours front. Hours appear to be back to normal. The second question, in my view, is the more important one: What's going on with long-term unemployment? Are the long-term unemployed more likely to leave the labor force or find a job? And if the long-term unemployed have already left the labor force, are they likely to come back?

By 2013 short-term unemployment had returned to normal levels. So at that time I argued that if we were going to make further progress in lowering the unemployment rate, it would be because the long-term unemployed either found jobs or left the labor force. My feeling at that time was that, unless we focused public policy on improving the odds of the long-term unemployed finding a pathway back to work, the natural forces that determine the ebb and flow of labor market participation would lead many of these workers to exit the labor force. Unfortunately, as we will see, the historical pattern in which the long-term unemployed tend to increase their labor force exit rate over the course of the business cycle has reasserted itself during the current recovery, and this is having a significant effect on the job market.

About a year and a half ago, I wrote a Brookings paper on this topic with two Princeton graduate students, Judd Cramer and David Cho. Part of what I'm going to do in today's lecture is summarize and extend our results.1 Specifically, I'll focus on where we got things right, where we got some things wrong, and what we can learn from this experience.

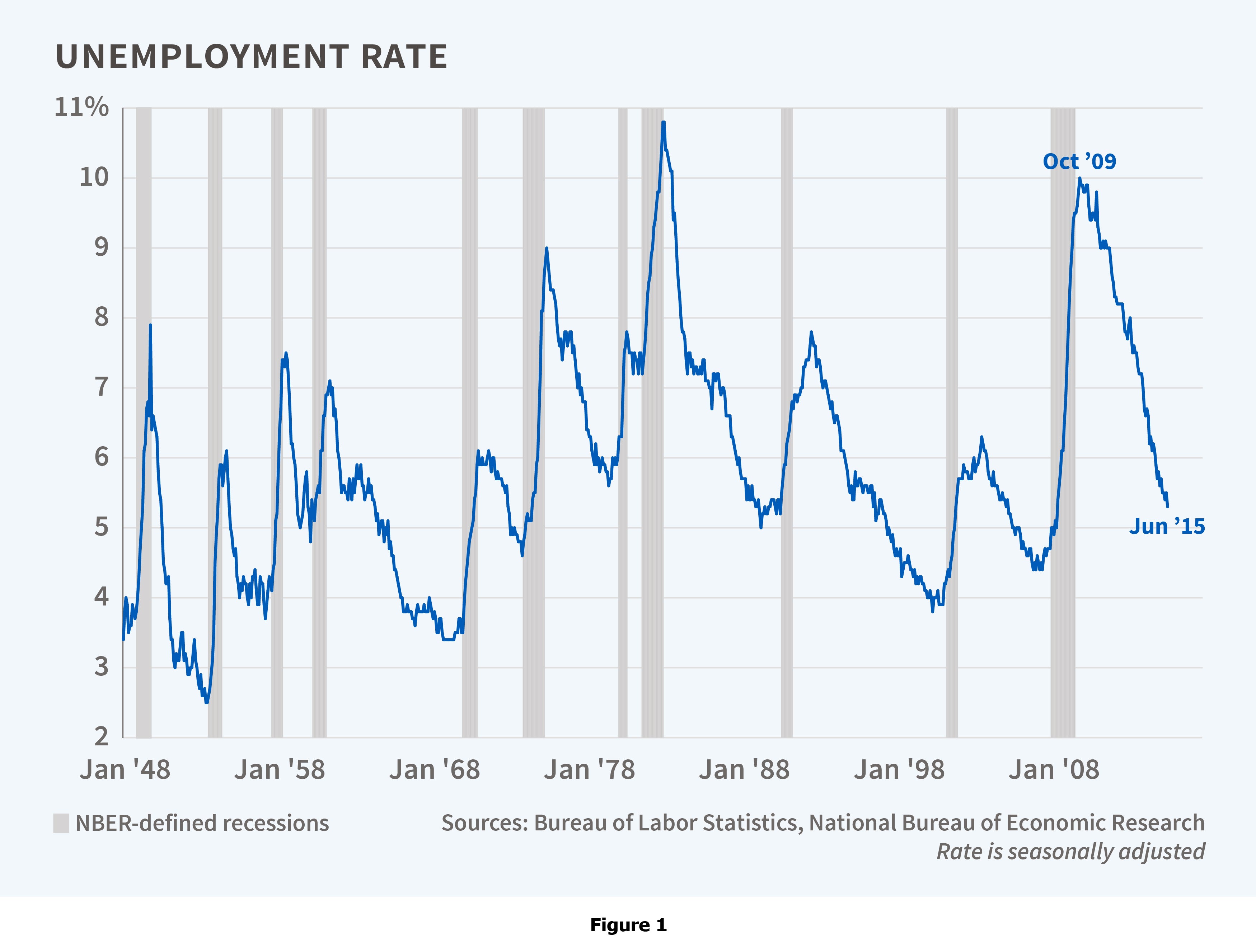

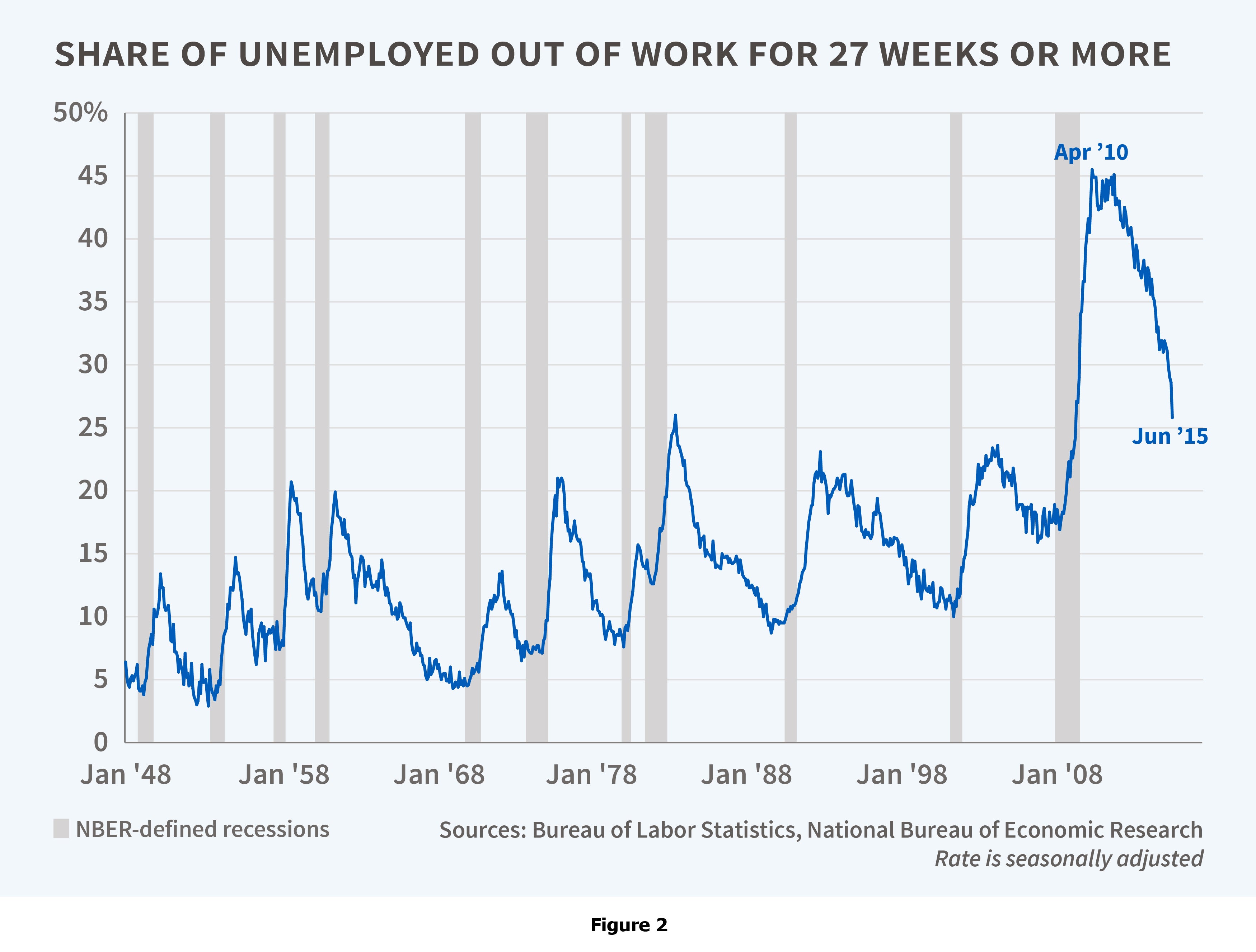

I've had the same diagnosis for the last five years: I think the outlook for the U.S. labor market has been one of gradual healing from the terrible wounds that were inflicted by the Great Recession. We've seen the unemployment rate come down from a peak of 10 percent in October 2009 to 5.3 percent as of June (Figure 1), which represents real progress. In fact, apart from the early 1980s, when Marty was CEA Chairman, the current recovery has produced the fastest drop in unemployment recorded in the postwar era. Moreover, the share of unemployed workers who have been out of work for more than half a year has fallen very rapidly, from a record high of 45 percent in 2010 to about 25 percent in June (Figure 2).

The picture isn't quite as rosy if you look at the employment-to-population ratio, which peaked around the time that the 2000 census was conducted. In a first for an expansion during the postwar era, the employment-to-population ratio declined over the course of the previous recovery, from 2001 to 2007. The share of the population that was employed then plunged an additional five percentage points during the Great Recession and has only recovered by about one point subsequently.

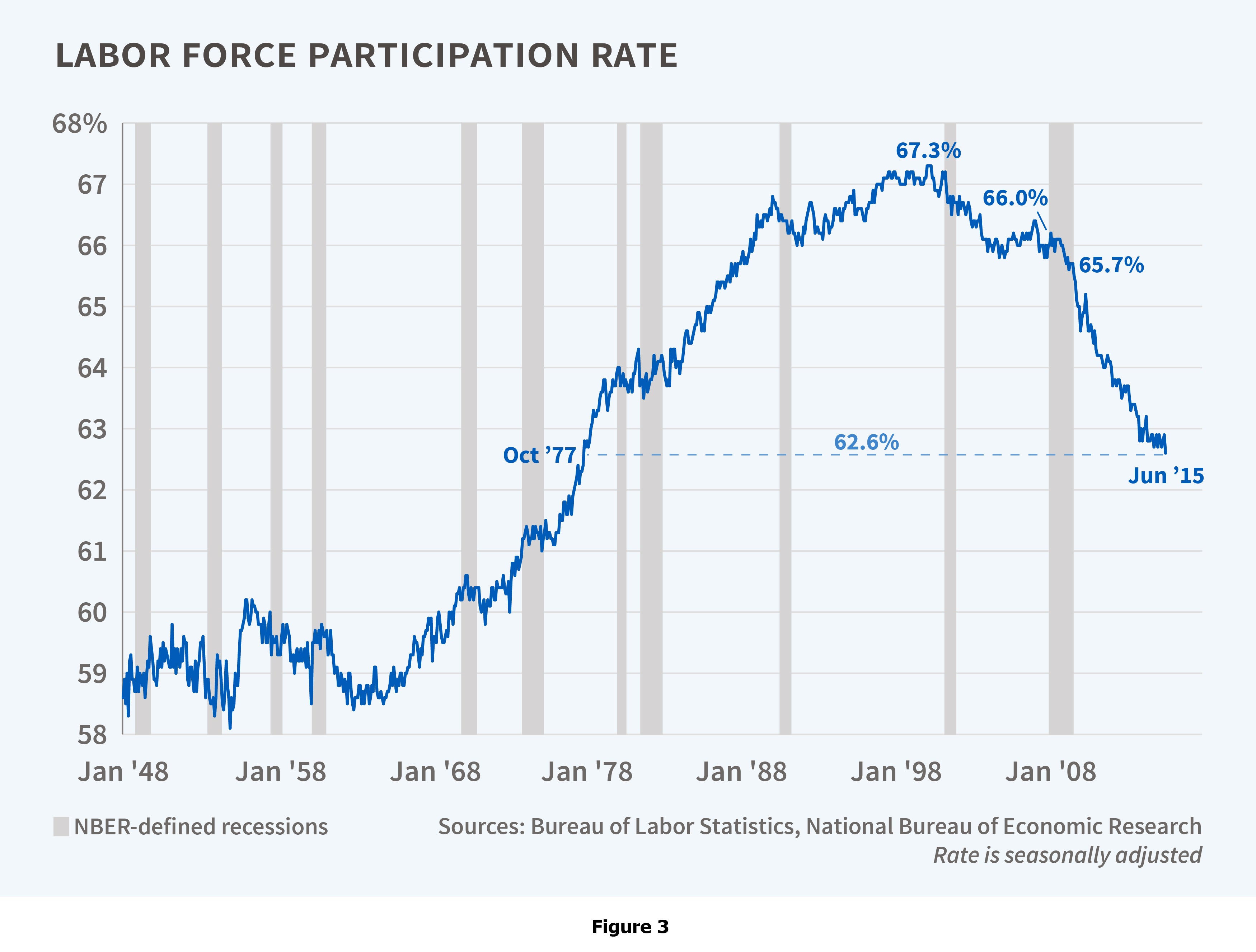

Of course, the reason for the divergence between the unemployment rate and the employment-to-population ratio is labor force participation, which also peaked around the time of the 2000 census (Figure 3). The share of those age 16 and over who were in the labor force actually fell over the course of the recovery from the 2001 recession. And despite the considerable rise in unemployment during the Great Recession, the labor force participation rate was fairly stable during the recession itself, only falling 0.3 percentage point. The decline in labor force participation didn't accelerate until after the recession officially ended.

Today, the labor force participation rate is nearly 5 percentage points below its peak. Sensible analyses suggest that about half of the 15-year decline in labor force participation is due to predictable demographic changes, particularly the aging of the Baby Boom generation.

As for the other half, I think there are two important factors. About half of this remainder (or a quarter of the overall decline) can be accounted for by trends that were taking place before the Great Recession and likely continued after it. For instance, the widespread entrance of women into the workforce that had fueled the great postwar rise in labor force participation in the United States peaked around 2000. Male labor force participation, which had been steadily declining throughout the postwar period, continued to fall during the 2000s. In addition, labor force participation of younger workers declined in conjunction with an increase in their school enrollment, which should be a net positive for the economy in the long run. The remaining quarter–or a little over a percentage point–of the overall decline in labor force participation is likely attributable to cyclical factors. I will present evidence suggesting that it's unlikely we'll see much of a recovery for this segment of the population going forward.

Now, I've been on record predicting little cyclical rebound in labor force participation for quite a while. In March 2011, for example, I wrote an article for Bloomberg in which, with unusual understatement, I predicted "we might well see the labor force shrinking more even as the measured unemployment rate falls."2 I faced some criticism at the time for this contrarian view. As an example of the conventional wisdom, Goldman Sachs's very well-respected economics research group has published a series of reports over the past four years in which they've repeatedly predicted that labor force participation would stabilize or rise as the recovery continued.3 Instead, the data have clearly shown a persistent decline.

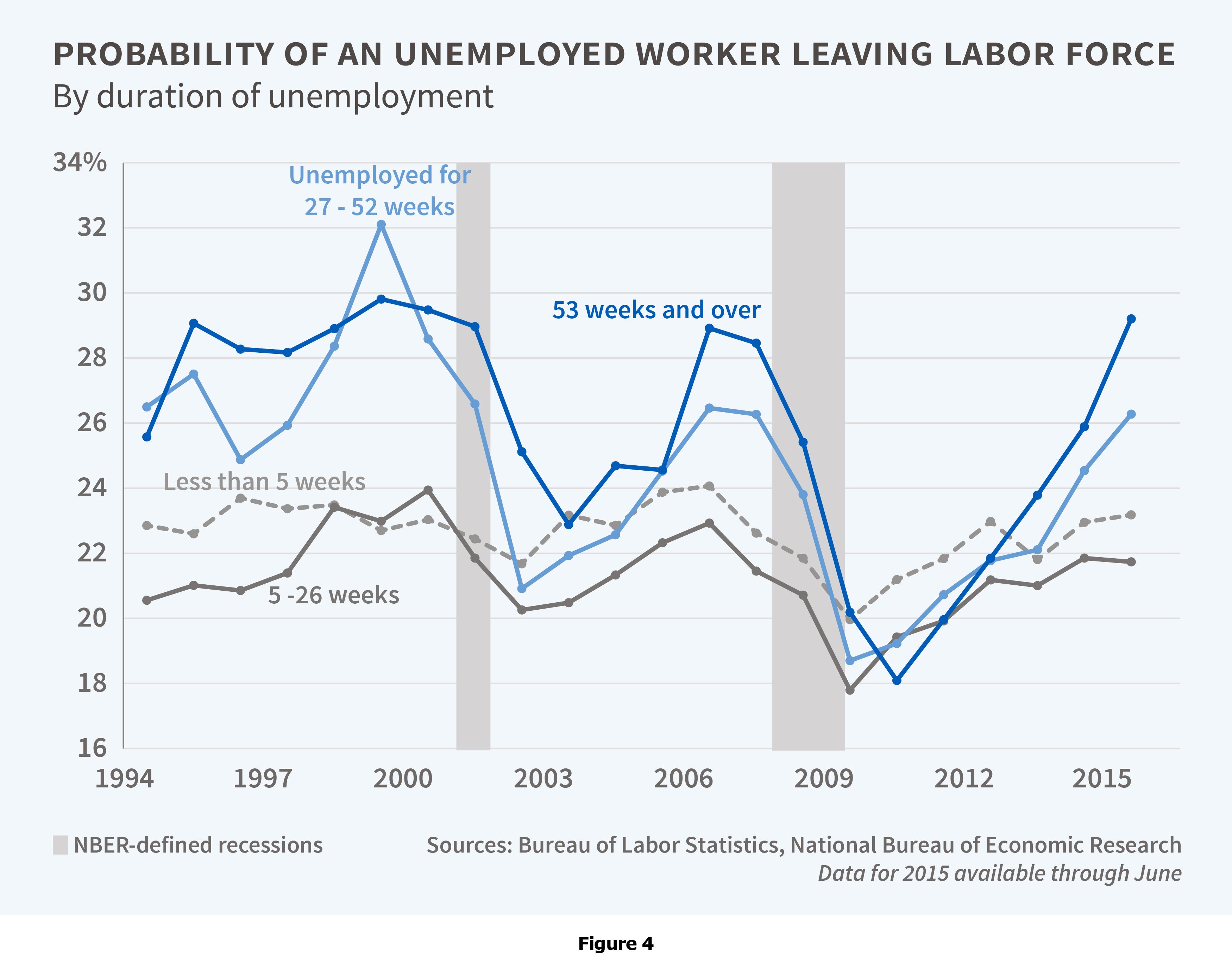

The following chart (Figure 4), an earlier version of which accompanied my Bloomberg article, shows why I was expecting labor force participation to continue to decline. Specifically, it shows the monthly labor force exit rate for the unemployed by duration of unemployment according to the Current Population Survey (CPS). These data suggest that there is a strong cyclical pattern in the probability that the long-term unemployed will leave the labor force. Workers who had been unemployed for more than half a year became more likely to leave the labor force as the economy strengthened in the late 1990s but their labor force withdrawal rate collapsed in the 2001 recession. The same pattern occurred again during the recovery in the 2000s as well as in the Great Recession. Thus, when I wrote the piece for Bloomberg in 2011, I expected a rise in labor force exits for the long-term unemployed, which has transpired. This cyclical pattern comes about because (1) the composition of the long-term unemployed changes over the cycle;4 (2) extended unemployment insurance benefits and benefit exhaustions tend to be cyclical; and, I suspect most importantly, (3) the long-term unemployed become increasingly discouraged and detached from the job market the longer they are out of work.

Notice that while there is also a cyclical pattern in the labor force exit rate for the short-term unemployed, it tends to be much weaker than is the case for the long-term unemployed.

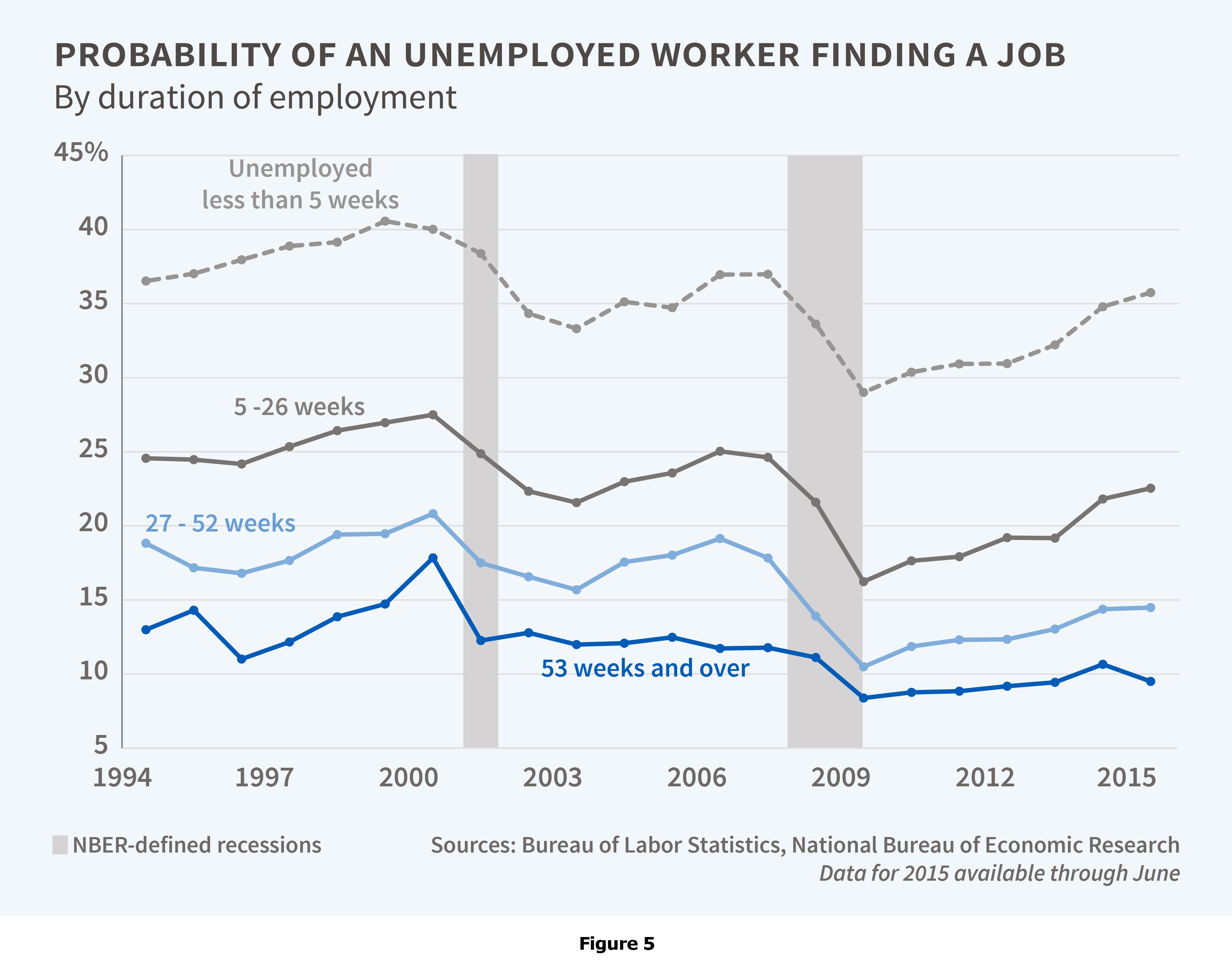

In contrast to labor force exits, the job finding rate is much higher and more pro-cyclical for the short-term unemployed than it is for the long-term unemployed (Figure 5). For example, workers who have been unemployed for less than five weeks have about a 35 percent chance of finding a job in any given month. This rate tends to be higher when the economy is stronger, and it tends to be lower during a recession. Conversely, the job finding rate for workers who have been unemployed for more than a year starts off at a lower level and moves very little over the course of the business cycle. Our research suggests that changes in the observed composition of the unemployed workforce play a relatively small role in these trends, accounting for no more than 20 percent of these cyclical patterns.

If you're familiar with the CPS, you know that the data can be extremely noisy–particularly with respect to how workers report the duration of their unemployment spells from month to month. So, in our Brookings paper, we also used data from the Survey of Income and Program Participation (SIPP) to look at the likelihood of an unemployed worker returning to steady employment one year later. The SIPP data indicate that, irrespective of the business cycle, the probability that an unemployed worker will be "steadily" employed in a full-time job for at least four consecutive months a year later is strikingly low and declines further as the duration of joblessness rises. Even in the strong job market of the late 1990s, the chance of a long-term unemployed worker finding steady, full-time employment after a year was only around 20 percent. This likelihood did not change very much during the 2001 recession, and it didn't change substantially during the Great Recession. Conversely, the likelihood that an unemployed worker will leave the labor force a year later increases substantially as the duration of joblessness rises. According to the SIPP, 35 percent of workers who became long-term unemployed during the Great Recession were out of the labor force by 2013.

Why does long-term unemployment have such an adverse effect on workers? There has been a long, unresolved debate in the economics profession about whether the job finding rate is lower for the long-term unemployed because of either unobserved heterogeneity in the characteristics of such workers or something about the nature of unemployment that adversely changes people. Although this is an inherently difficult question to answer, the literature suggests that duration dependence plays a larger role than unobserved heterogeneity in explaining this phenomenon. (Although understanding the respective roles of true duration dependence and unobserved heterogeneity is important for some policy issues, it is not central for monetary policy.)

Much research suggests that long-term unemployment has a negative impact on both the supply side and the demand side. On the supply side, an individual's mental health and self-esteem can be affected by the experience of long-term unemployment. Till von Wachter has done good work showing that one's physical health and mortality are adversely impacted by joblessness.5 Andy Mueller and I did a longitudinal study where we asked workers who were receiving unemployment insurance about the intensity of their job searches.6 We found that job search activity tends to decline the longer people are unemployed. We also found that the long-term unemployed tend to be socially isolated. A fascinating new study by Jameson Toole and co-authors analyzed cell phone records for a European country and concluded that workers who lost their job in a plant closing received and made fewer phone calls, and were geographically more isolated.7 Furthermore, long-term unemployment tends to be associated with repeated job loss and lower re-employment earnings. All of these findings point to a decline in human capital and disengagement from the labor market as a result of long-term unemployment.

On the demand side, studies have shown that employers discriminate – at least statistically – against the long-term unemployed. Kory Kroft, Fabian Lange, and Matt Notowidigdo conducted a study in which they sent out resumes with varying gaps of joblessness, and they found that the likelihood of receiving an interview depended upon the duration of unemployment.8 Rand Ghayad also found similar results.9

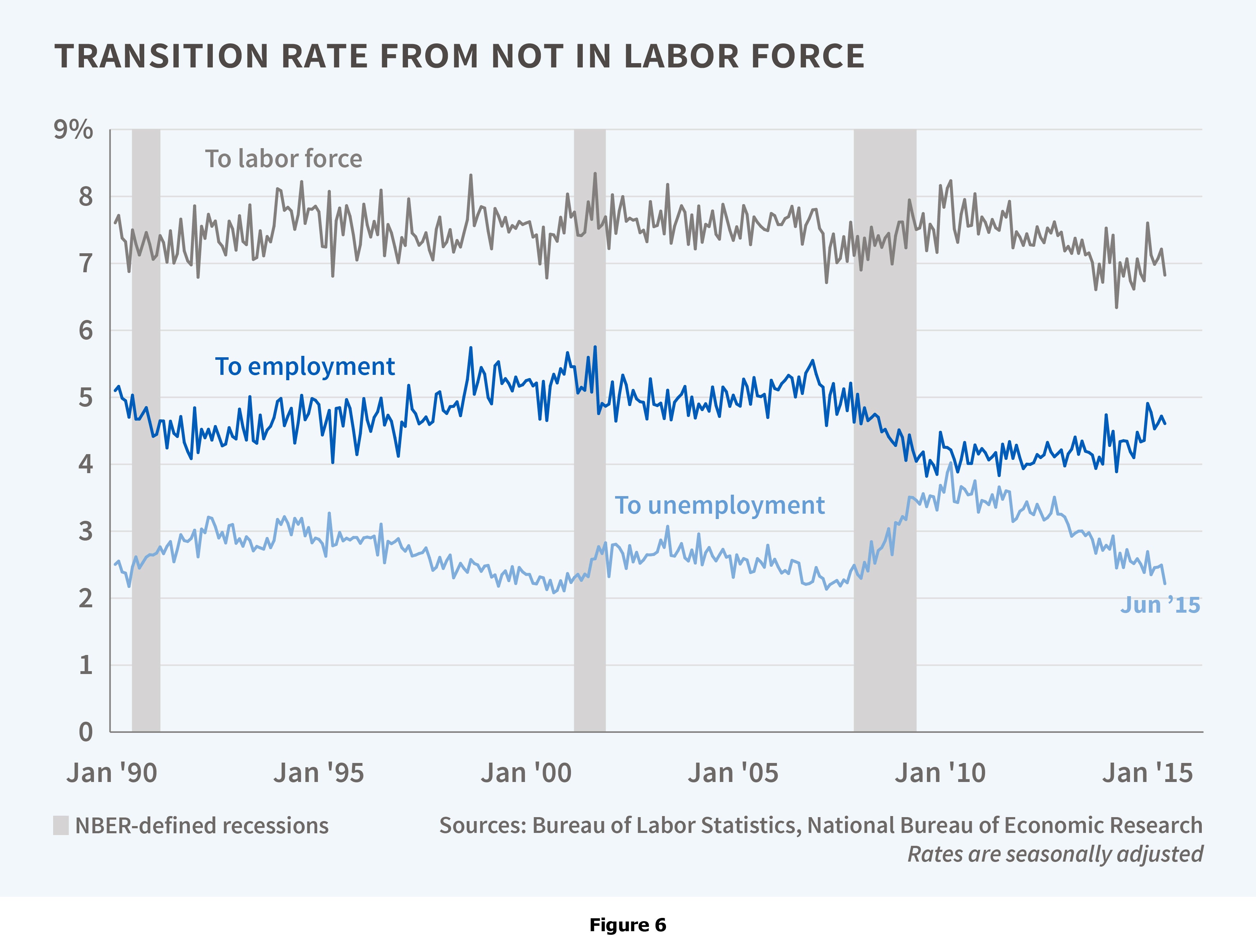

My take on the evidence is that the experience of being unemployed makes it harder for people to get back on their feet, and that even a strong economy doesn't solve this problem. In addition, once a person leaves the labor force, he or she is extremely unlikely to return. The labor force flows data from the CPS bear this out (Figure 6). According to CPS data, the monthly rate for transitioning from out of the labor force to back in the labor force is unrelated to the business cycle. We didn't see a wave of people returning to the labor force either in the late 1990s or earlier in the 2000s, and we're not seeing one now.

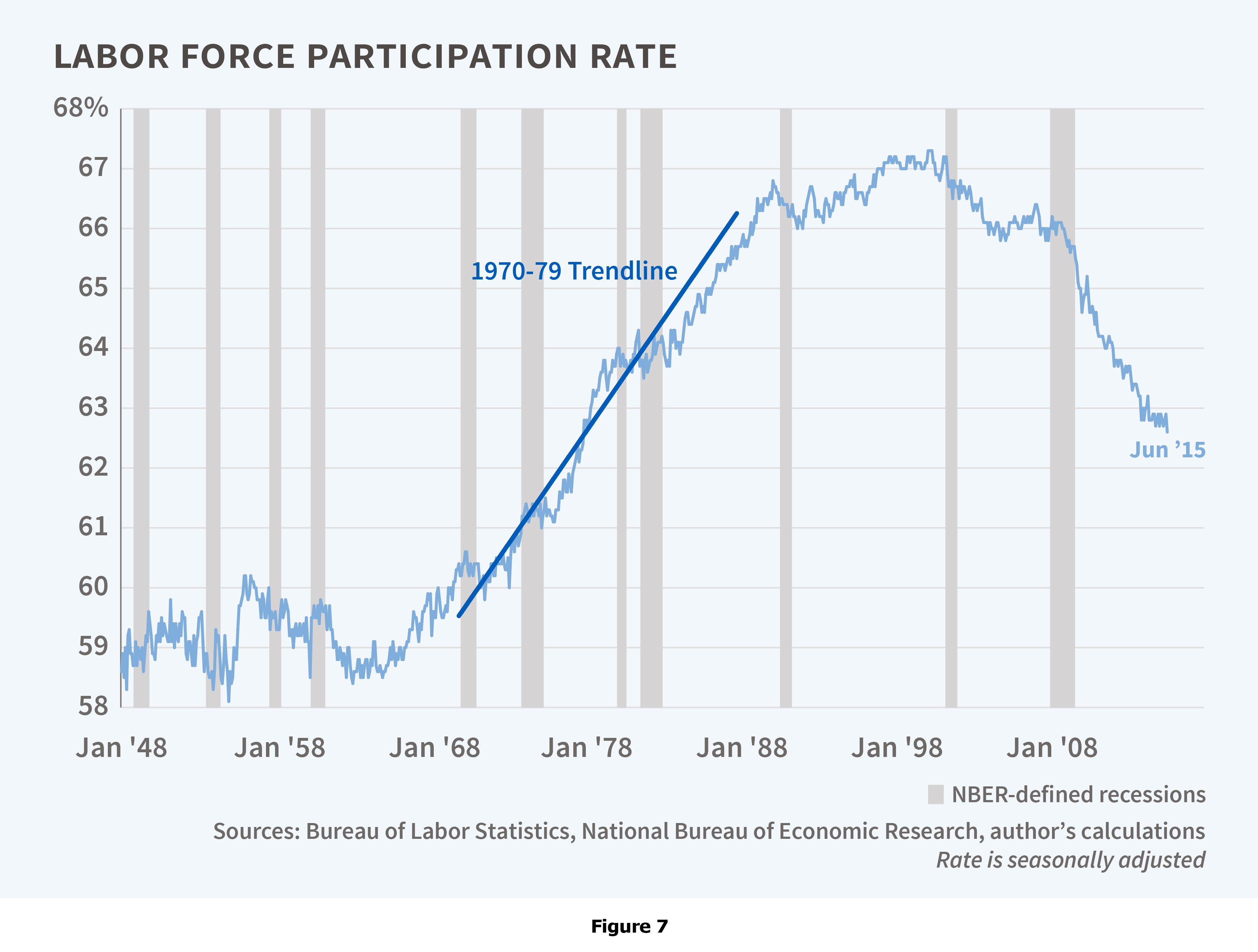

Personally, I think the presumption that labor force participation would bounce back in the current recovery comes from a misreading of what happened during the 1980s. A lot of people remember that labor force participation rose sharply after the double-dip recession ended in 1982. However, if you make a linear forecast based on the data from 1970 to 1979, the labor force participation rate stayed about a percentage point below the previous trend line and never caught up (Figure 7).

We did a more sophisticated version of this analysis when I was at the CEA. We looked at the trends in labor force participation for various demographic groups both during the decade before the 1980 recession as well as the decade before the Great Recession. We concluded that, after adjusting for the business cycle, both recessions caused the overall labor force participation rate to be roughly a percentage point lower than it would have been otherwise.10

Thus, I think there is a coherent story on labor force participation. Over the course of the business cycle, the long-term unemployed increasingly withdraw from the labor force, and they do not tend to return in large numbers as the economy strengthens.

The Beveridge Curve

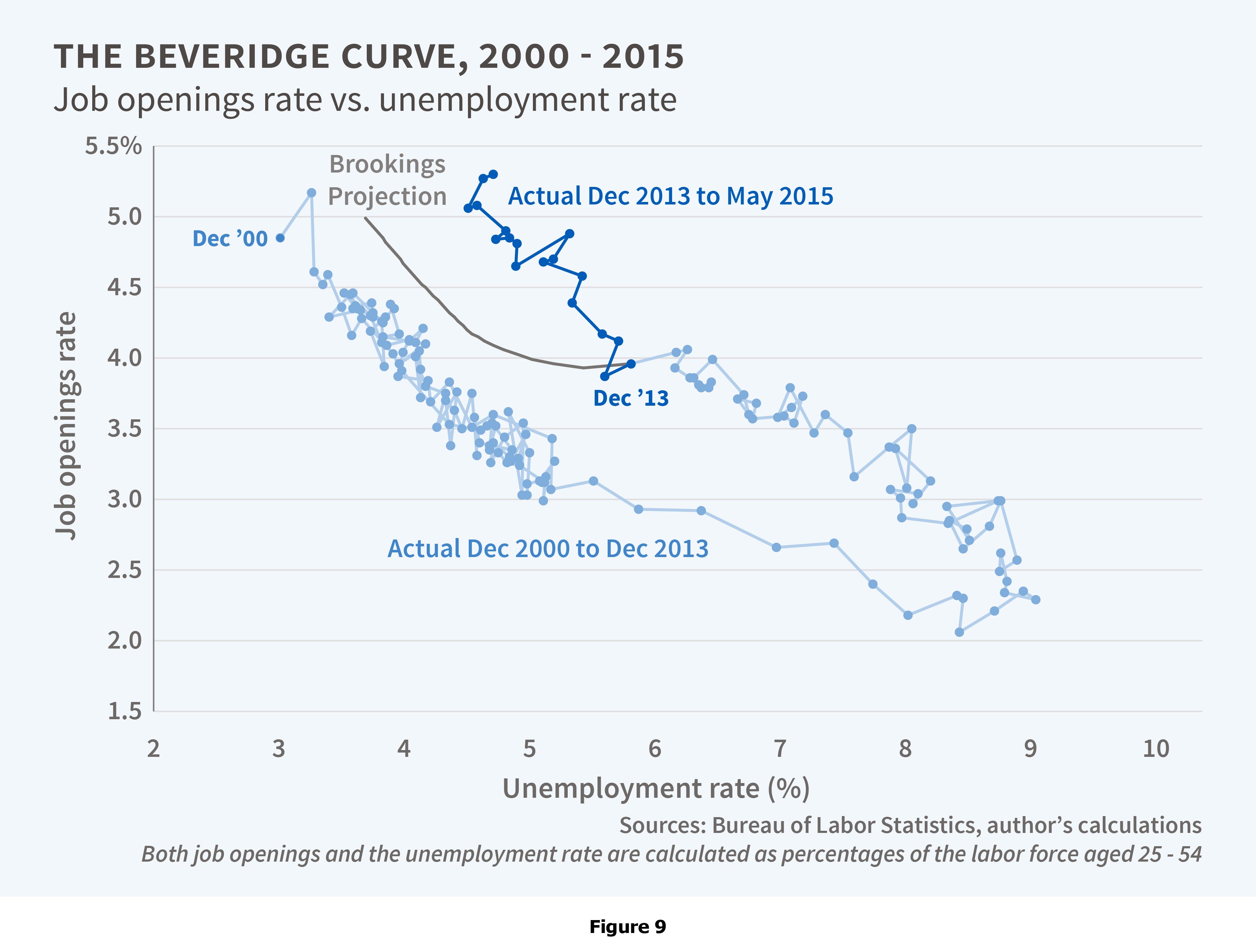

An implication of the cyclical patterns in transition rates for the long-term unemployed is that the relationship between vacancies and unemployment will vary over the course of the business cycle. Indeed, previous studies have found that the Beveridge curve, which measures the inverse relationship between job openings and the unemployment rate, tends to shift outward during a recession. For instance, research by Peter Diamond and Ayşegül Şahin suggests that the Beveridge curve typically loops around as the economy recovers from a downturn and eventually returns to its previous position.11

Kory Kroft, Fabian Lange, Matt Notowidigdo, and Larry Katz did very nice work where they estimated a structural job matching model in order to explain the cyclical behavior of the long-term unemployed during the Great Recession.12 Specifically, Kroft et al. were able to account for the observed rise in the share of unemployed workers who had been out of work for more than six months as well as reproduce an outward shift in the Beveridge curve using their matching model.

In our Brookings paper, we extended their model along two dimensions to more accurately reflect the differential experiences of the short-term and long-term unemployed. First, we allowed the long-term unemployed to have a lower coefficient in the matching function itself. Second, we allowed the short-term and long-term unemployed to transition out of the labor force at different rates. This latter change was particularly important because the labor force exit rates for the short-term and long-term unemployed diverged after 2010. We estimated the parameters of the model from 2002 to 2007 in order to simulate the path of unemployment, the loop in the Beveridge curve, and the rise in the share of workers who were long-term unemployed since the Great Recession. It's worth noting that the period over which we fit the matching function did not coincide with any notable extensions of the duration of unemployment insurance benefits. So the matching model does not rely on the passage of extended unemployment benefits in order to explain the rise in long-term unemployment during the Great Recession. In addition, we restricted our analysis to workers who were 25 to 54 years old to limit the impact of workers either retiring early or returning to school, both of which are key avenues whereby workers leave the labor force. Despite these restrictions, the long-term unemployed are still relatively more likely than the short-term unemployed to exit the labor force as the economy strengthens.

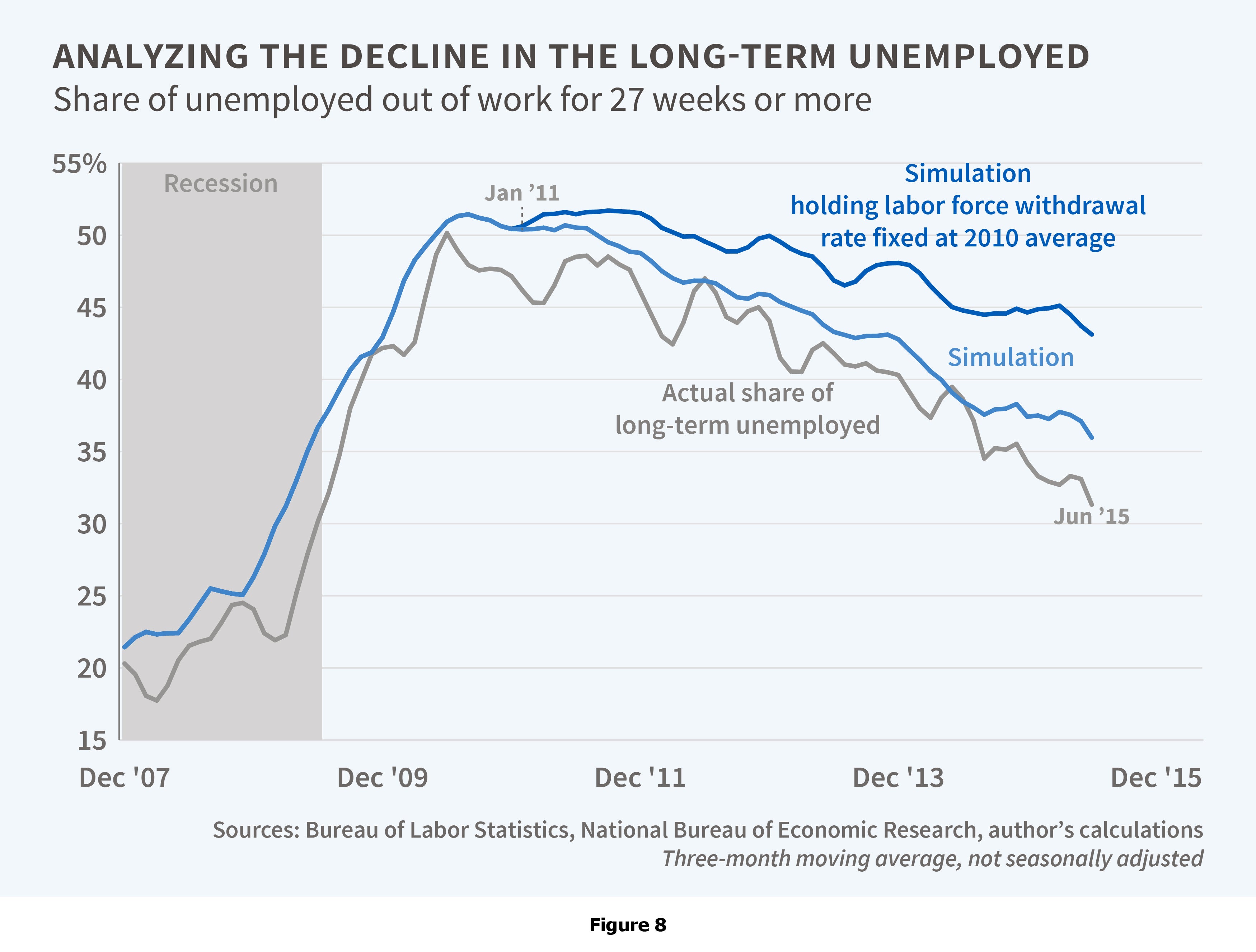

We used the model to conduct some counterfactual exercises with respect to the current recovery. For instance, the share of unemployed workers who had been jobless for more than six months has fallen substantially since 2010. Using the matching model, we estimated how the share of long-term unemployment would have behaved if we held the probability that the long-term unemployed exit the labor force fixed at its 2010 level (Figure 8). This exercise suggests that the rise in the rate of labor force withdrawal for the long-term unemployed over the course of the recovery explains about half of the observed decline in the share of long-term unemployment.

Alternatively, we also considered how much the share of unemployed workers who had been jobless for more than six months likely would have declined if the job finding rate for such workers had remained at its average for 2010 instead of rising modestly as the economy strengthened. This counterfactual exercise indicates that the improved job finding rate for the long-term unemployed only accounted for about 10 percent of the decline in the share of long-term unemployment since 2010.

We also conducted counterfactual analyses for the nearly 4 percentage point decline since 2010 in the unemployment rate itself. The rise in the labor force withdrawal rate for the long-term unemployed appears to have been responsible for roughly 20 percent of the decline in the overall unemployment rate. The improvement in the job finding rate, by contrast, accounts for only about 5 percent of the drop in the total unemployment rate since the Great Recession.

There is one area in which the forecast from our Brookings paper fell notably short. Our matching model has not done a particularly good job in predicting the recent path of the Beveridge curve (Figure 9). In our Brookings paper, we projected that the Beveridge curve would nearly return to its pre-recession position if vacancies continued to increase at the pace that had been observed from 2011 to 2013 and if the various transition rates in the model returned to their 2006 averages by the year 2016. However, job openings have grown much more quickly than we initially projected, which is a positive sign regarding the strength of the economy but bad news for our projection. Furthermore, the unemployment rate has not declined as quickly as we forecasted that it would in the Brookings paper, even though it has fallen rapidly since 2010.

Our model provides an important explanation for why the Beveridge curve could shift out and eventually loop back to its original position over the business cycle: As the share of unemployed workers who are long-term jobless declines, the matching efficiency for the unemployed should improve correspondingly. Although I still expect the withdrawal of the long-term unemployed to result in a leftward turn toward the original Beveridge curve, one has to acknowledge that it has not occurred yet.

These results raise the question of whether the U.S. labor market is more inefficient now than it had been in the past. I have to say that I'm skeptical of this view, and research by Eddie Lazear and Jim Spletzer also casts doubt on such an interpretation.13 Steve Davis and John Haltiwanger have proposed an alternative explanation for the shift in the Beveridge curve: Companies may have become more selective in their hiring processes and, as a result, the nature of vacancies may have changed in recent years.14 The longer the shift in the Beveridge curve persists, the more seriously I take their hypothesis.

What About Wages?

If the labor market is getting tight–as the decline in the unemployment rate from 10 percent in October 2009 to 5.3 percent in June would indicate–and the long-term unemployed are on the margins of the labor market and place less downward pressure on the job market, a natural question is: What is happening to wage growth? So I will now turn to the Phillips curve, which captures the relationship between inflation and unemployment.

In my highly stylized model of how the labor market operates, companies and workers meet around the beginning of the year and bargain over wages for the coming 12 months. Both sides are concerned about real wages, but since neither one precisely knows how prices will change in the coming year, they use the previous year's inflation rate as their best estimate of inflation in the coming year. Consequently, we can consider an "accelerationist" version of the Phillips curve in which the previous year's change in prices serves as a proxy for inflation expectations. This is a fairly common specification, and my results are robust to allowing an unrestricted coefficient on last year's inflation rate.

A number of observers have noted that price inflation did not decline by very much during the Great Recession despite a sharp rise in unemployment. Indeed, if we estimate a price Phillips curve using the core personal consumption expenditures price index, we find a puzzling shift in the relationship between inflation and the unemployment rate from 2009 to 2011. However, if one uses the short-term unemployment rate to estimate the Phillips curve, the rate of inflation changed by about as much as would have been expected during this period.

Several economists have done analyses along these lines using aggregate time series data and concluded that the long-term unemployed put less pressure on inflation.15 An older paper by Ricardo Llaudes found that the Phillips curve fit better for various OECD countries using the short-term unemployment rate rather than the overall rate.16 These results are consistent with the view that the long-term unemployed are on the margins of the labor market.

Of course, others have presented alternative explanations for why inflation did not decline by very much during the Great Recession. Ben Bernanke argued that the anchoring of inflation expectations prevented prices from falling by as much as the Phillips curve would have predicted.17 Laurence Ball and Sandeep Mazumder18 and George Akerlof, William Dickens, and George Perry19 have argued that the Phillips curve is convex, which could also explain the behavior of inflation during the recession.

Because my interest in this lecture is on the extent of labor market tightness, I will focus on wage Phillips curves. Also, we should not be fooled by money illusion, so I focus on the real wage Phillips curve.

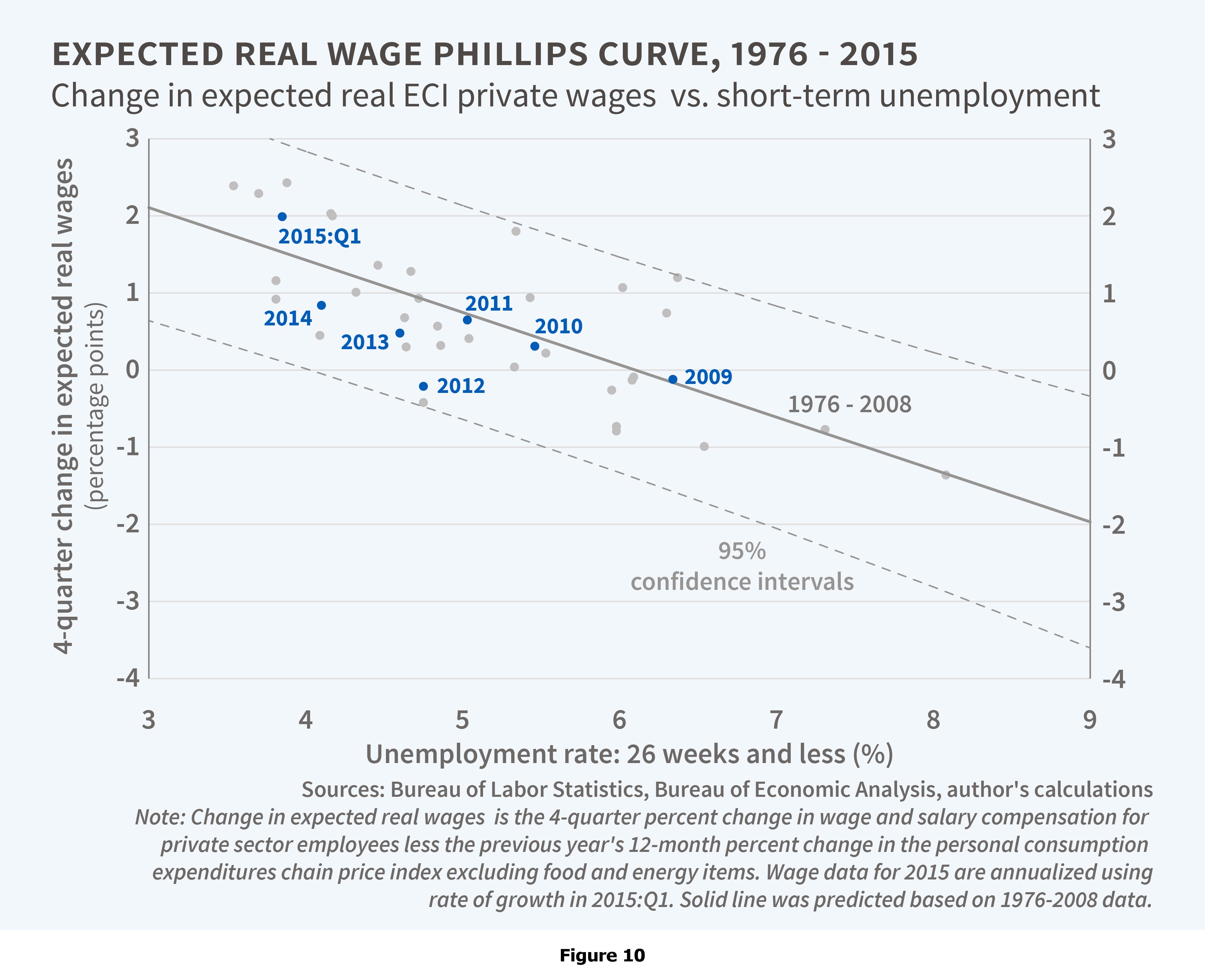

I take the conventional wisdom on wage Phillips curves to be a 1999 Brookings paper that Larry Katz and I wrote entitled, "The High-Pressure U.S. Labor Market of the 1990s."20 We estimated Phillips curves using expected real wage growth as the dependent variable, which we defined as the percentage change in wages for a given year less the previous year's rate of consumer price inflation. We calculated that the unemployment rate threshold at which expected real wages would start to grow was around 5.5 percent, and this threshold was notably similar for various deciles of the wage distribution in the 1990s. Thus, with the unemployment rate falling below 5.5 percent in June, the conventional wisdom, as I see it, predicts that we will begin to see real wage growth right around now.

Last year, Cramer, Cho, and I estimated the Phillips curve by regressing expected real wage growth on various measures of labor market slack, including short-term and long-term unemployment rates.21 We found that the coefficient on the short-term unemployment rate was much larger than that on the long-term unemployment rate, and a test of the difference between these two effects was statistically significant. Although this analysis generated some controversy at the time, it has actually held up fairly well.

Consider first the Employment Cost Index (ECI), which is widely regarded as the best measure of wage pressures. It measures compensation growth within the same firms and occupational groups. On a nominal basis, the ECI rose 2.8 percent over the four quarters ended in 2015:Q1. If we subtract the previous year's rate of core consumer price inflation, expected real wages grew by 1.5 percent over that period, the strongest pace in over a decade.

The Phillips curve that Cramer, Cho, and I estimated using data on the short-term unemployment rate and the ECI from 1976–2008 does a good job of predicting expected real wage growth over the last couple of years (Figure 10), suggesting that real wage growth has been consistent with the pace of improvement in the labor market as reflected by the decline in the short-term unemployment rate. Moreover, we continue to find a better fit with the short-term unemployment rate than the total unemployment rate, which is consistent with the long-term unemployed exerting less pressure on the job market.

Although the ECI presents the strongest picture in terms of wage growth, other measures of wages tell a similar story. For instance, the average hourly earnings of production and nonsupervisory workers from the BLS establishment survey also shows a pickup in real wage growth in the first half of 2015 consistent with the Phillips curve.

Our work set off a cottage industry of research estimating state-level Phillips curves. A number of economists, primarily in the Federal Reserve System, have recently produced analyses of the Phillips curve using state-level data. The state-by-year level of analysis is often justified by the argument that national time series data do not provide sufficient variability to distinguish between the effects of short-term and long-term unemployment. I have found five such studies that analyze state-level wage growth.22 They yield a remarkably discordant picture of the relationship between wage growth and short-term and long-term unemployment. While some studies find that only short-term unemployment predicts wage growth, others find that both short-term and long-term unemployment are equally strong predictors. One theme that emerges, however, is that studies that utilize growth in the average wage, as opposed to the median wage, as the dependent variable tend to find that the short-term unemployment rate is a significantly stronger predictor of wage growth than is the long-term unemployment rate.

Given the disparity in these findings, I conducted my own investigation using a panel of state-level data from the CPS. My results were similar to those of Anil Kumar and Pia Orrenius at the Dallas Fed as well as Pat Higgins at the Atlanta Fed, who found that the short-term unemployment rate is a significant predictor of average wage growth, while the long-term rate is not. Thus, my interpretation of these studies is that they are consistent with Phillips curve research using aggregate time series data. The short-term unemployment rate appears to be more meaningful than the long-term unemployment rate in the determination of average real wage growth at both the state and national level. It is unclear why, and whether, both measures of labor market slack predict median wage growth, but if one is interested in analyzing the relationship between slack and wage growth because of potential pass-through effects of factor costs on prices, then understanding the determinants of growth in the average wage is key.

These results–together with the low rate of job finding among the long-term unemployed and their relatively high labor force withdrawal rate–suggest that, if anything, the standard U-3 measure of the unemployment rate understates the degree of labor market tightness in the current environment. A variety of evidence points to the long-term unemployed being on the margins of the labor market, with many on the verge of withdrawing from searching for a job altogether. As a result, the long-term unemployed exert less downward pressure on wages than do the short-term unemployed. They are increasingly likely to transition out of the labor force, which is a loss of potential for our economy and, more importantly, a personal tragedy for millions of workers and their families.

Conclusion

To conclude, I will briefly comment on policies to address the problem of long-term unemployment. One of the overriding lessons that I take away from this body of research is that, if left untreated, long-term unemployment can have hysteresis-type effects on the labor market. A cyclical recovery does not cure the problems created by long-term unemployment. Going forward, I think one of the lasting legacies of the Great Recession is that the labor force participation rate will be about one percentage point lower than it otherwise would have been. This analysis argues in favor of using "overwhelming force" in a deep recession to prevent those who lose their jobs from becoming long-term unemployed in the first place.

Since long-term unemployment has been so widespread throughout sectors of the economy, "industry-specific" policies are insufficient to solve the problem. In 2012, for example, only 10 percent of long-term unemployed workers were from the construction sector, and only 11 percent were from manufacturing, despite the fact that these industries were hit particularly hard by the Great Recession.

Instead, I would prefer more targeted measures geared specifically toward helping the long-term unemployed stay in the labor force and find employment, such as a tax credit for employers who hire the long-term unemployed or direct employment. There also has been some research to support the notion that volunteering can help jobless workers make new connections, learn new skills, and stay engaged in the labor force. In the United States, job search assistance has typically been found to be effective in helping workers regain employment. I also think wage loss insurance might be worth considering, especially for older long-term unemployed workers.

Lastly, given that many of the long-term unemployed have already left the labor force, we should consider policies that address the structural decline in labor force participation. For example, more family-friendly policies might help greater numbers of women either enter or remain in the labor force. Likewise, reforms to the disability insurance system could possibly prevent some workers from permanently exiting the labor force.

This is an edited and annotated version of the Martin Feldstein Lecture delivered on July 22, 2015.

Endnotes

A.B. Krueger, J. Cramer, and D. Cho, "Are the Long-Term Unemployed on the Margins of the Labor Market?" Brookings Papers on Economic Activity, Spring 2014, pp. 229-80.

A.B. Krueger, "Why Unemployment Rose So Much, Is Falling So Fast: Alan Kreuger," Bloomberg, March 30, 2011, http://www.bloomberg.com/news/articles/2011-03-31/why-unemployment-rose-so-much-dropped-so-fast-commentary-by-alan-krueger.

On May 5, 2011, for example, Goldman's Global Macro Research Group wrote in their newsletter, "We find that the labor force participation rate is likely to stop falling, which would raise the minimum amount of job growth needed to lower the unemployment rate." Since then, the rate has fallen by 1.6 percentage points. On July 2, 2015, they wrote, "The sharp decline in both unemployment and labor force participation in June looks statistically anomalous."

If you control for the education, occupation, and industry of the long-term unemployed, you can only account for a little less than 20 percent of this cyclical pattern in the labor force exit rate for the long-term unemployed.

D. Sullivan and T. von Wachter, "Job Displacement and Mortality: An Analysis Using Administrative Data," The Quarterly Journal of Economics, 124(3), 2009, pp. 1265-1306.

A. Mueller and A.B. Krueger, "Job Search, Emotional Well-Being, and Job Finding in a Period of Mass Unemployment: Evidence from High-Frequency Longitudinal Data," Brookings Papers on Economic Activity, Spring 2011, pp. 1-57.

J.L. Toole, Y.R. Lin, E. Muehlegger, D. Shoag, M.C. González, and D. Lazer, "Tracking Employment Shocks Using Mobile Phone Data," Journal of the Royal Society Interface, 12(107), 2015.

K. Kroft, F. Lange, and M.J. Notowidigdo, "Duration Dependence and Labor Market Conditions: Evidence from a Field Experiment," NBER Working Paper 18387, September 2012, and The Quarterly Journal of Economics, 128(3), 2013, pp. 1123-67.

R. Ghayad, "The Jobless Trap," Working Paper, 2013. https://bit.ly/1RZUOHP

K. Kroft, F. Lange, M.J. Notowidigdo, and L.F. Katz, "Long-Term Unemployment and the Great Recession: The Role of Composition, Duration Dependence, and Non-Participation," NBER Working Paper 20273, July 2014, and forthcoming, Journal of Labor Economics.

E.P. Lazear and J.R. Spletzer, "The United States Labor Market: Status Quo or a New Normal?" NBER Working Paper 18386, September 2012, and The Federal Reserve Bank of Kansas City's Jackson Hole Economic Policy Symposium, 2012, pp. 405–51.

S.J. Davis, R.J. Faberman, and J.C. Haltiwanger, "The Establishment-Level Behavior of Vacancies and Hiring," NBER Working Paper 16265, August 2010, and The Quarterly Journal of Economics, 128(2), 2013, pp. 581-622.

Examples include: J.H. Stock, "Discussion of Ball and Mazumder," Brookings Papers on Economic Activity, Spring 2011, pp. 387-402; R.J. Gordon, "The Phillips Curve is Alive and Well: Inflation and the NAIRU During the Slow Recovery," NBER Working Paper 19390, August 2013; and, M.W. Watson, "Inflation Persistence, the NAIRU, and the Great Recession," American Economic Review: Papers and Proceedings, 104(5), 2014, pp. 31-6.

R. Llaudes, "The Phillips Curve and Long-Term Unemployment," European Central Bank Working Paper Series, No. 441, February 2005.

B.S. Bernanke, "The Economic Outlook and Monetary Policy," The Federal Reserve Bank of Kansas City's Jackson Hole Economic Policy Symposium, August 27, 2010. http://www.federalreserve.gov/newsevents/speech/bernanke20100827a.htm

L.M. Ball and S. Mazumder, "Inflation Dynamics and the Great Recession," NBER Working Paper 17044, May 2011, and Brookings Papers on Economic Activity, Spring 2011, pp. 337-81.

G.A. Akerlof, W.T. Dickens, and G.L. Perry, "The Macroeconomics of Low Inflation," Brookings Papers on Economic Activity, 1, 1996, pp. 1-59.

L.F. Katz and A.B. Krueger, "The High-Pressure U.S. Labor Market of the 1990s," Brookings Papers on Economic Activity, 1, 1999, pp. 1-65.

A.B. Krueger, J. Cramer, and D. Cho, "Are the Long-Term Unemployed on the Margins of the Labor Market?" First draft of paper presented at Spring 2014 Brookings Panel on Economic Activity.

These five studies are: A. Kumar and P. Orrenius, "A Closer Look at the Phillips Curve Using State Level Data," Federal Reserve Bank of Dallas Working Paper 1409, May 2015; R. Dent, S. Kapon, F. Karahan, B. W. Pugsley, and A. Şahin, "The Long-Term Unemployed and the Wages of New Hires," Federal Reserve Bank of New York Liberty Street Economics, November 19, 2014; D. Aaronson and A. Jordan, "Understanding the Relationship Between Real Wage Growth and Labor Market Conditions," Chicago Fed Letter No. 327, October 2014; C.L. Smith, "The Effect of Labor Slack on Wages: Evidence From State-Level Relationships," FEDS Notes, June 2, 2014; and P. Higgins, "Using State-Level Data to Estimate How Labor Market Slack Affects Wages," Federal Reserve Bank of Atlanta macroblog, April 17, 2014.