Taxation and Innovation

Innovation is the source of technological progress and, ultimately, the main driver of long-run economic growth. In recent work with several co-authors, we have shown that the U.S. states that produced the most innovations also grew fastest over the 100-year period from 1900 to 2000.1 We also have documented that innovation is strongly associated with social mobility. U.S. regions that experienced more innovation also witnessed much stronger intergenerational and social mobility, especially when innovations were attributable to new entrant firms. Innovation also correlates strongly with top income inequality, but not so much with measures of inequality such as the Gini or the 90/10 ratio, and is associated with greater well-being across the United States.2,3

Given all the important consequences of innovation, it is essential to understand how public policies impact innovation in the United States and across the world. Our joint research agenda explores the interplay between taxation and innovation.

Major changes in U.S. tax policy, such as those in the Tax Cuts and Jobs Act of 2017, raise questions about whether higher taxes stifle growth, productivity, and innovation.

If innovation, like many other economic outcomes, is the result of intentional effort and investment, then higher taxes will reduce the expected net return to these inputs and lead to less innovation. Yet for at least some path-breaking superstar inventors from history, such as Thomas Edison, Alexander Graham Bell, and Nikola Tesla, the picture that comes to mind is one of hard-working, enthusiastic scientists who are unconcerned with financial incentives and only strive for intellectual achievement.

Related questions are whether taxes impact the quality of innovation, where inventors decide to locate, and what firms they work for. In addition, there is a question of whether taxes influence where companies allocate R&D resources and how many researchers they employ.

Answers to these questions are still lacking, and there is a scarcity of empirical evidence. The gap in our understanding is especially large when it comes to the effects of tax policy on technological development over the long run.

Theory and Empirics of Taxation and Innovation

There are two complementary dimensions along which to think about the interplay between taxation and innovation. First, taxation on personal or corporate income or wealth may affect innovation. This may be an unwelcome byproduct of taxes that are set for completely unrelated goals, such as to raise revenues. Thus, reduced innovation could be one of the efficiency costs of taxation; this could affect the assessment of optimal taxes, since the elasticity of innovation with respect to taxes would influence the elasticities that enter into the optimal tax formulas.4,5 This underscores the importance of quantifying the elasticity of innovation to taxation along all the relevant margins. Second, tax policy could be designed intentionally so as not to hurt, or even to stimulate, innovation.

Our research agenda on taxation and innovation seeks to understand and quantify the effects of taxation — of personal income, corporate income, and wealth — on innovation by firms and individuals. How do taxes shape all these agents' choices leading up to innovations? Our empirical studies are based on modern-day data — European patent office data since 1975, for example — and on long-run historical data, such as the universe of U.S. inventors since 1836. Theoretically and quantitatively, we study the design of decentralized innovation policies: combinations of taxes, tax credits, and subsidies that can make agents internalize the spillovers from innovations and foster innovation. We illustrate our research approach by focusing on three distinct studies.

Taxation and Innovation in the 20th Century

Although the United States experienced major changes in its tax code throughout the 20th century, we currently do not know how these tax changes influenced innovation at either the individual or corporate level. This challenging question has largely gone unanswered because of a lack of long-run systematic data on innovation in the United States and the difficulty of identifying the effects of taxes. We leverage three new datasets, which we constructed from historical data sources, to explore these issues.6 The datasets are a panel of the universe of U.S. inventors since 1920 and their associated patents, citations, and firms; a panel of all R&D labs in the United States since 1921, matched to their patents and with data on their research employment levels and locations; and a historical state-level corporate and personal income tax database.7 This unique combination of data allows us to systematically study the effects of both personal and corporate income taxation since 1920 on the micro level of individual inventors and individual firms that do R&D and on innovation at the macro state level.

Our innovation outcomes include the quantity of innovation, as captured by the number of patents; the quality of innovation, as measured by patent citations, and the share of patents assigned to companies rather than individuals at both the state level and individual-inventor level. We also consider the location choices of firms and inventors, including superstar inventors, as well as the creation of path-breaking, highly cited inventions.

We employ several identification strategies, and find consistent results across the different approaches. First, we control for state, year, and, at the individual level, inventor-fixed effects, and include individual or state-level time-varying controls in our specification. These go a long way toward absorbing unobserved heterogeneity. In addition, we exploit tax schedule differences across individuals within a given state-year, due to tax progressivity, and compare individuals in different tax brackets. Thus, we can also include state-times-year fixed effects to filter out other policy variations or confounding economic circumstances. Second, at both the macro and micro levels, we use an instrumental variable strategy that consists of predicting the total tax burden facing a firm or inventor — a composite of state and federal taxes — with the changes in the federal tax rate only, holding the state taxes fixed at some past level. This provides variation that is only driven by federal-level changes and, thus, exogenous to any individual state. Third, we use a border county strategy as a stand-alone and in combination with our instrumental variable. Finally, we study specific, sharp, tax-change episodes.

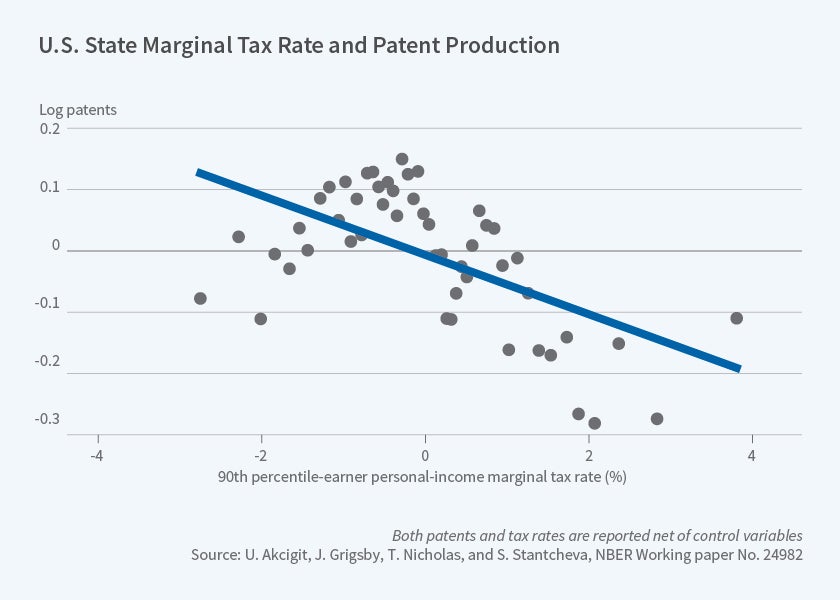

We find that taxation of both corporate and personal income negatively affects the quantity, quality, and location of innovation at the state level and the individual inventor and firm levels.8 The elasticities of all these innovation outcomes with respect to taxes are relatively large, especially at the macro level, where cross-state spillovers and extensive margin responses add to the micro elasticities. Figure 1 illustrates the negative correlation between the personal income tax at the 90th income percentile and the log of patents in a state.

We also find that corporate inventors are more elastic with respect to personal and corporate income taxation than non-corporate inventors. Agglomeration effects appear to matter as well: Inventors are less sensitive to taxation in places where there is already more innovation done in their technological field.

The International Mobility of Superstar Inventors in Response to Taxation

There is a long-standing debate about whether higher top tax rates will cause a "brain drain" of high-income and high-skill economic agents. In fact, many of the great inventors were international immigrants: Alexander Graham Bell, inventor of the telephone and founder of the Bell Telephone Company; James Kraft, inventor of a pasteurization technique and founder of Kraft Foods; and Ralph Baer, creator of a TV gaming unit that launched the video game industry, are examples.

Inventors are frequently more mobile than other high-skill individuals, and they carry and transmit their valuable knowledge and expertise to others, which makes them important for both new knowledge creation and for its diffusion. Yet little is known about the international mobility of labor in response to taxation. Rigorous evidence is lacking because of a scarcity of international panel data.

We use a unique type of international panel data on inventors from the European and U.S. patent offices and from the Patent Cooperation Treaty to study the international migration responses of superstar inventors to top income tax rates for the period of 1977–2003.9 We are able to tackle one major challenge that arises when studying migration responses to taxes, namely, to model the counterfactual payoff that an inventor would get in each potential location, thanks to a set of detailed controls that come from the patent data, most notably, measures of an inventor's quality based on past citations.

Our measure of the effects of the top tax rate filters out all country-year level variation and exploits the differential impacts of the top tax rate on inventors at different points in the income distribution within a country-year cell. To implement this strategy, we define superstar inventors as those in the top 1 percent of the quality distribution, and similarly construct the top 1–5 percent, the top 5–10 percent, and subsequent quality brackets. We know from other research that inventor quality is strongly correlated with income and that top 1 percent inventors rank very high in the top tax bracket. The probability of being in the top bracket and the fraction of an inventor's income in the top bracket declines as one moves down the quality distribution. Top 1 percent inventors and those of somewhat lower quality are comparable enough to be similarly affected by country-year level policies and economic developments; but only those inventors in the top bracket are directly affected by top taxes. Hence, the lower-quality top 5–10 percent, top 10–25 percent, and below top 25 percent groups serve as control groups for the top 1 percent group.

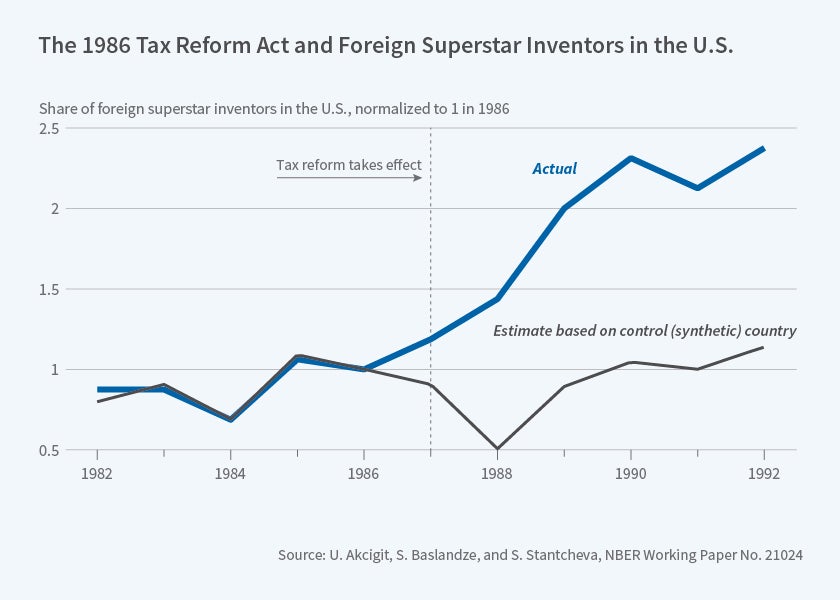

Figure 2 provides some preliminary visual evidence of the effects of taxes. It shows how the number of superstar top 1 percent foreign inventors in the U.S. increased after the Tax Reform Act of 1986 relative to a counterfactual path estimated from a synthetic control country.

Overall, we find that superstar inventors' location choices are significantly affected by top tax rates. The elasticity to the net-of-tax rate of the number of domestic superstar inventors is around 0.03, while that of foreign superstar inventors is around 1. These elasticities are larger for inventors who work for multinational companies. Inventors are less sensitive to taxes in a country if their company performs a higher share of its research there, suggesting that the location decision is influenced by the company and by career concerns that may dampen the effects of taxes.

R&D Policy Design

Countries enact many different, often very costly policies designed to foster research and development by firms. These are motivated by the view that there is underinvestment in R&D because of the non-internalized spillovers that the innovations of one firm can have on other firms and, ultimately, on society. Yet, there is no consensus on how such policies should be designed.

We therefore study the joint design of R&D policies and corporate taxation.10 The key new elements in our analysis are the assumptions that firms are heterogeneous in their ability to produce innovations, and that this ability is known to the firm, but not to the government. In addition, while some of the inputs into the R&D process are observable (R&D investment), others are unobservable (R&D effort). The returns to these inputs are also stochastic, which makes innovation risky.

These ingredients capture some of the very real constraints facing policymakers. For instance, it is very difficult to predict a firm's innovation success, even based on many observables. The government would like to encourage the best firms, but policies have to work despite the asymmetric information and unobservable inputs, and need to distinguish productive firms from less productive ones.

To solve this problem, we build on new dynamic mechanism design methods developed in several recent papers and offer a new approach to allow for spillovers between agents (here, firms) with asymmetric information.11 We then estimate the model and use it to simulate a range of policies for firms of different ages, sizes, and productivities. We use U.S. Patent and Trademark Office patent data matched to Compustat data on publicly traded firms, as well as the Longitudinal Business Database (LBD) for all firms. This allows us to see the observable inputs to innovation, that is, a firm's R&D expenses, as well as the outputs of innovation as captured by the patents and their citations.

We show that the need to screen firms can starkly influence the shape of R&D policies and firm taxation. The central policy tradeoff is between the Pigouvian correction for innovation spillovers and the correction for the monopoly power induced by the intellectual property rights system that emerges from the method of distinguishing good firms from bad ones. The more complementary observable R&D investment is to firm research productivity, as opposed to being complementary to the unobservable R&D effort, the more rents a firm can extract if R&D investment is subsidized. This puts a brake on how well the government can correct for spillovers and monopoly distortions. On the other hand, if R&D investments are more complementary to unobservable firm R&D effort, the optimal R&D subsidy will be greater because subsidizing the observed input will lead the firm to put in more of the unobservable input as well.

The policies that efficiently trade off these considerations are different from current policies as well as simpler policies, such as linear R&D subsidies and taxes. Nonlinear policies, such as an R&D subsidy that depends on the amount of R&D investment and a profit tax that depends on the level of profits, can come closer to the constrained-efficient outcome. Our findings suggest that taxes significantly affect innovation and that they can thus have far-reaching consequences on technological progress and growth. If designed properly, the tax system could help foster innovation by better aligning the incentives of private agents with the social value of innovation.

Endnotes

1.U. Akcigit, J. Grigsby, and T. Nicholas, "The Rise of American Ingenuity: Innovation and Inventors of the Golden Age," NBER Working Paper No. 23047, January 2017. ↩

P. Aghion, U. Akcigit, A. Bergeaud, R. Blundell, and D. Hémous, "Innovation and Top Income Inequality," NBER Working Paper 21247, June 2015, and forthcoming in The Review of Economic Studies.

P. Aghion, U. Akcigit, A. Deaton, and A. Roulet, "Creative Destruction and Subjective Well-Being," NBER Working Paper 21069, April 2015, and the American Economic Review, 106(12), 2016, pp. 3869–97.

E. Saez, "Using Elasticities To Drive Optimal Income Tax Rates," NBER Working Paper 7628, March 2000, and The Review of Economic Studies, 68(1), 2001, pp. 205–29.

E. Saez and S. Stantcheva, "A Simpler Theory of Optimal Capital Taxation," NBER Working Paper 22664, September 2016, and the Journal of Public Economics, 162, 2018, pp. 120–42.

U. Akcigit, S. Caicedo, E. Miguelez, S. Stantcheva, and V. Sterzi , "Dancing with the Stars: Innovation through Interactions," NBER Working Paper 24466, March 2018.

The authors constructed the corporate tax database; the personal income tax database was constructed by Jon Bakija. [J. Bakija, "Documentation for a Comprehensive Historical U.S. Federal and State Income Tax Calculator Program," Williams College Working Paper, 2008.]

U. Akcigit, J. Grigsby, T. Nicholas, and S. Stantcheva, "Taxation and Innovation in the 20th Century," NBER Working Paper 24982, September 2018.

U. Akcigit, S. Baslandze, and S. Stantcheva,"Taxation and the International Migration of Inventors," NBER Working Paper 21024, March 2015, and the American Economic Review, 106(10), 2016, pp. 2930–81.

U. Akcigit, D. Hanley, and S. Stantcheva, "Optimal Taxation and R&D Policies," NBER Working Paper 22908, December 2016.

A. Pavan, I. Segal, and J. Toikka, "Dynamic Mechanism Design: A Myersonian Approach," Econometrica, 82(2), 2014, pp. 601–53; S. Stantcheva, "Optimal Taxation and Human Capital Policies over the Life Cycle," NBER Working Paper 21207, May 2015, and the Journal of Political Economy, 125(6), 2017, pp. 1931–90; S. Stantcheva, "Learning and (or) Doing: Human Capital Investments and Optimal Taxation," NBER Working Paper 21381, July 2015; S. Stantcheva, "Optimal Income, Education, and Bequest Taxes in an Intergenerational Model," NBER Working Paper 21177, May 2015.