Credit Cards and the Financing of Small Businesses

Borrowing on credit cards is an important source of finance for many small businesses. In Credit Card Entrepreneurs (NBER Working Paper 33618), Ufuk Akcigit, Raman Singh Chhina, Seyit M. Cilasun, Javier Miranda, and Nicolas Serrano-Velarde study the experiences of small US businesses during the monetary policy tightening of 2022–23 to shed light on this important financing channel.

When the banks that issue credit cards used by small businesses cut back on credit card supply, these businesses see a decline in card balances, revenue growth, and employment growth.

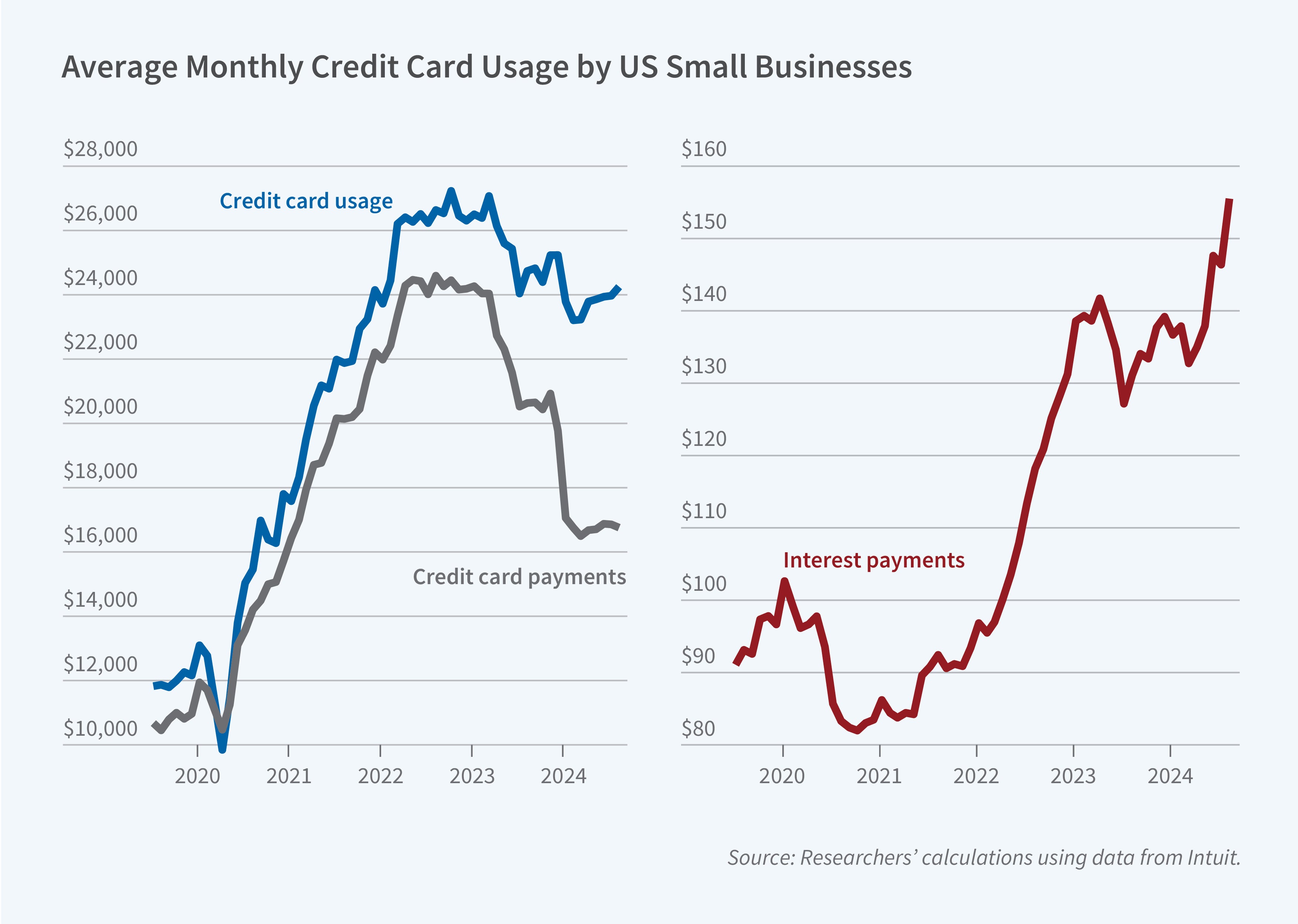

The researchers analyze transaction data from a sample of 1.6 million firms using Intuit QuickBooks, an accounting and payroll software platform for small businesses. Credit card payments (and usage) increased from $10,000 per month in 2020 to $24,000 ($26,000) per month in April 2022, a much larger increase than for loan payments. However, the Federal Reserve interest rate hikes between March 2022 and May 2023 significantly impacted small business recovery. During this period, credit card usage remained elevated, but payments fell; interest payments rose by 60 percent, and delinquencies reached a high of 2.8 percent.

To understand what drives small business credit card use, the researchers link a survey of 4,500 platform users to their transaction data. They find that 55 percent used a corporate credit card in the past 12 months, compared to 27 percent for lines of credit and 26 percent for loans. In more than 61 percent of responses, firms underlined the financial benefits of relying on business credit cards, such as ease of access, emergency use, and repayment flexibility, while the main drawbacks were debt (23 percent) and high interest rates (18 percent). In particular, credit cards help firms absorb unexpected, firm-specific shocks—like tight financial conditions or overdue payments—by delaying repayment. Their use is more common among financially constrained firms unable to access loans.

After identifying the banking partners of firms, the researchers use variation in banks’ exposure to interest rate shocks—measured by their “income gap”—to isolate the effect of credit card debt supply on small business performance. The income gap reflects a bank’s interest-rate risk, based on the mismatch in repricing timelines of assets and liabilities. Among small businesses whose banking partners were most exposed to interest-rate risk, the researchers estimate that a 5-percentage-point policy rate hike reduced credit card balances by 15.75 percent and employment growth by 1.5 percent.

The researchers develop a calibrated theoretical model to analyze the role of credit cards under interest rate or loan supply shocks. The analysis reveals a dual effect. In the short run, credit cards expand borrowing capacity and act as a financial buffer, helping small businesses maintain liquidity when revenues fall and long-term financing is limited. However, this flexibility comes at a cost: high interest rates raise debt servicing burdens over time, gradually weakening cash flows and slowing recovery.

Overall, the paper shows that small businesses have been under increasing financial strain since the onset of interest rate hikes. Given that even today’s superstar firms often began as small, young enterprises, inadequate access to financing not only weakens the current labor market—it might also jeopardize the emergence of the next generation of high-growth firms.