The Effects of Austerity: Recent Research

What are the costs in terms of output losses of so-called "austerity" policies designed to reduce large government deficits and mounting public debt? The debate on this issue is raging, especially after the latest round of austerity in Europe.

The question is difficult to answer for at least three reasons. The first is "endogeneity," the two-way interaction between fiscal policy and output growth. Suppose you observe a reduction in the government deficit and an economic boom. It would be highly questionable to conclude that deficit reduction policies generate growth, since it could be easily the other way around. Second, major episodes of austerity are often accompanied by changes in other policies: monetary policy, exchange rate movements, labor market reforms, regulation or deregulation of various product markets, tax reforms, and so on. In addition, they are sometimes adopted at times of crisis due to runaway debts, not in periods of "business as usual." Third, virtually all austerity programs are based upon multi-year plans announced in advance and then revised along the way. To the extent that expectations matter, the multi-year nature of these plans cannot be ignored.

An early literature started by Francesco Giavazzi and Marco Pagano1 and reviewed and summarized by Alberto Alesina and Silvia Ardagna2 reached two conclusions regarding austerity policies in advanced industrial economies. First, expenditure-based adjustments, namely those based upon cutting spending and not raising taxes, or relying less on tax increases than on spending cuts, were found to be much less costly in terms of output losses than tax-based approaches. Second, expenditure-based adjustments accompanied by an appropriate set of related policies can sometimes be expansionary, even in the short run.

This literature was well aware of the three problems discussed above. The first was initially addressed by considering cyclically adjusted deficit over GDP ratios as measures of fiscal policy. This variable, in principle, should eliminate the effects on deficits of output fluctuations. The second and third problems were addressed in a variety of ways, including case studies.3

In some recent research, we and our coauthors have revisited these questions, and tried to go deeper4 than previous work. In order to address the endogeneity problem, we adopt the "narrative method" proposed by Christina Romer and David Romer.5 This approach attempts to solve the endogeneity problem by identifying through direct consultation of the relevant budget documents only changes in fiscal policy not implemented to achieve cyclical stablization, but for other goals. Implementing this technique, Romer and Romer identified episodes of tax changes in the U.S.6 Using a similar methodology, Pete Devries, Jaime Guajardo, Daniel Leigh, and Andrea Pescatori identified "7 Guajardo, Leigh, and Pescatori8 analyzed these data and found results broadly consistent with those summarized by Alesina and Ardagna,9 although with some variation on the size of the difference between tax increases and spending cuts, depending on monetary policy.

In the previously cited work with Carlo Favero, we address the third problem mentioned above, namely that fiscal adjust-ments are typically carried out through multi-year plans in which announcements and revisions deeply affect the expectations of economic agents. To begin, we checked the episodes of exogenous fiscal consolidations identified by Devries, et al, and corrected a few inconsistencies. More importantly, we constructed "plans." By going back to the original sources (National Budget Reports, EU Stability Programs, IMF documents, OECD Economic Surveys, etc.), we reconstructed actions taken at the time an austerity plan was adopted, announcements made at the time of adoption regarding future periods of up to three years, and revisions of these announcements in the actual policies then carried out.

To be more precise, a fiscal plan implemented at time t typically contains three components:

- Unexpected shifts in fiscal variables, announced upon implementation at time t

- Shifts implemented at time t but which had been announced in previous years

- Shifts announced at time t, to be implemented in future years

Each year of a fiscal plan is fully characterized by these three components, which we allow to have different effects on macroeconomic variables.

To study the potentially heterogeneous effects of plans depending on their nature, we distinguish between Tax-Based (TB) and Expenditure-Based (EB) plans. A plan is labeled TB if the sum of all the tax measures (unexpected, announced in the past and currently implemented, and announced at t for future implementation) measured as a fraction of year t GDP is greater than the sum of the corresponding expenditure measures.

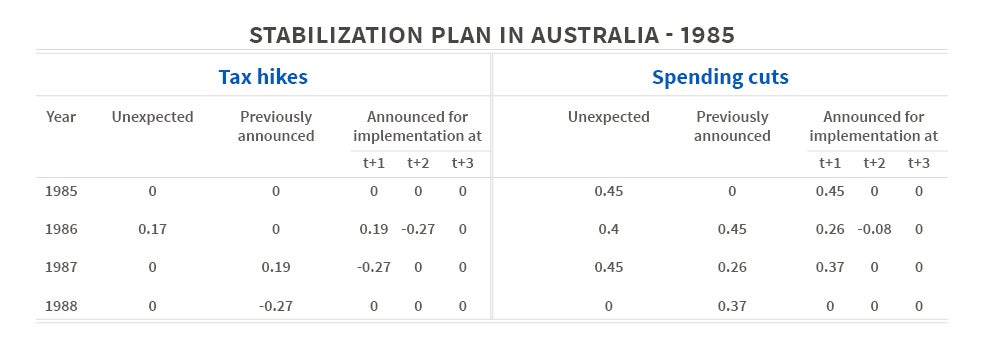

Consider as an example the Australian fiscal plan implemented between 1985 and 1988. The plan was announced in 1985 and consolidation lasted until 1988 with subsequent revisions of the original plan. In 1985 the government announced a sequence of medium-term spending cuts aimed at reducing a large, inherited budget deficit. The initial plan featured no change in taxation and spending cuts of 0.45 percent of GDP in both 1985 and 1986. In 1986, the plan was revised. The new plan called for additional spending cuts of 0.4 percent of GDP to be implemented immediately, that is, in 1986; it also announced a further spending cut of 0.26 percent of GDP to be implemented in 1987 and a small reversal of -0.08 in 1988. Eventually, in 1987, this slight spending reversal was abandoned and replaced by further cuts amounting to 0.37 percent of GDP. Revenue increases were also introduced: an unanticipated tax increase of 0.17 percent of GDP was implemented in 1986, while a further "EB" plan because expenditure cuts exceed tax increases. This example shows that overlooking pre-announced plans and considering simply unanticipated shifts in fiscal variables would ignore important information available both to firms and to consumers.

When studying fiscal plans, it is important to take into account the correlation between tax changes and spending cuts. Governments never decide the two components in isolation, but design the plan as a whole. For instance, a government may first decide it needs to implement an adjustment of, say, 2 percent of GDP and also decide that 0.5 percent of that adjustment will take place through spending cuts. Once this decision is adopted, tax increases are endogenous: They will amount to (2-0.5) = 1.5 percent of GDP. Similarly, one should also consider the correlation between unexpected measures and those announced for future implementation, because they are also jointly determined within a plan. We categorize plans according to what we call their "style," which reflects the correlation between unanticipated shifts in fiscal variables and those announced for the future. In some countries–Italy, for example–actions such as spending cuts often are reversed after being implemented. In other countries–Canada, for example–fiscal actions are persistent. Country "styles" are particularly important when we simulate the effect of an unanticipated shift in fiscal variables, amounting, say, to 1 percent of GDP, paired with the announcement of actions to be taken in the future. Omitting announcements would amount to simulating a plan that is not the one actually adopted.

In our work with Favero, we simulate the effect of the average plan implemented over the estimation period (1981-2007).10 In work with Favero, Omar Barbiero, and Matteo Paradisi,11 we simulate out of sample the plans adopted by various countries since 2010. In the first of these papers, we examine the effect of EB and TB plans on output, private consumption, investment, and consumer and investor confidence for 14 countries: Australia, Austria, Belgium, Canada, Denmark, Germany, Spain, France, United Kingdom, Ireland, Italy, Japan, Portugal and the United States. In our sample, 84 plans are EB and 51 are TB. Although our model with the TB and EB dummies could be sensitive to the categorization of plans into EB and TB, in particular if spending and tax shares were close to 50 percent, this is not the case here. The vast majority of plans in our estimation sample are far from a 50-50. In only three plans is the share of spending cuts between 49 and 51 percent and in only 15 is it between 45 and 55. The share of spending cuts in the average EB plan (in which the average total annual adjustment is 1.36 percent of GDP) is 84 percent, while in the case of TB plans (in which the average total annual adjustment is 0.89 percent of GDP) the share is 76 percent. In the estimated model, the effects of EB and TB adjustments are constrained to be the same across countries. We allow styles to differ across countries, and we allow for parameter differences between euro area and non-euro area countries.

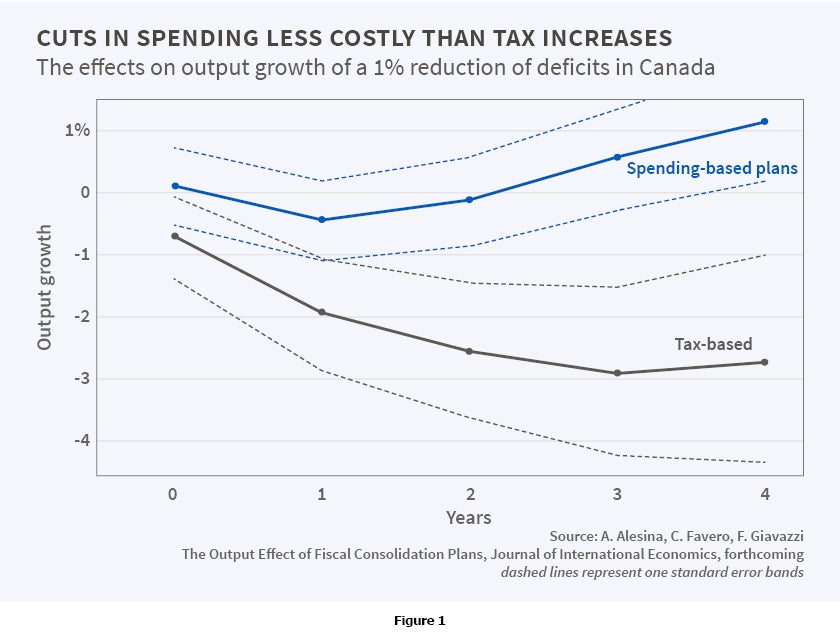

Our main finding is that fiscal adjustments based upon cuts in spending are much less costly, in terms of output losses, than those based upon tax increases. Over our estimation period (1981-2007), the output effect of an average TB adjustment plan with an initial size of one percent of GDP is a cumulative contraction in GDP of two to three percent in the following three years.12 In contrast, spending-based adjustments generate very small recessions, with an impact on output growth not significantly different from zero. As an example, Figure 1 shows the large differences between the effects of a one percent reduction of deficits implemented through an EB plan (in blue) and a TB plan (in black) in Canada. The effect on output growth of EB plans is indistinguishable from zero for about two years and then becomes significantly positive, while TB adjustments lead to deep recessions. The component of aggregate demand which seems to explain these differences in all countries, not only Canada, is investment, which is correlated with investor confidence.

In our work with Favero, Barbiero, and Paradisi, we extend the dataset up to 2013 for the following countries: Austria, Belgium, Denmark, Spain, France, Germany, United Kingdom, Ireland, Italy, Portugal, and the United States.13 The effects of recent episodes of austerity do not look different from previous ones. Out-of-sample simulations of our model projecting output growth conditional only upon exogenous fiscal adjustments do reasonably well in predicting the total output fluctuations of the countries in our sample over the years 2010-13, particularly for those countries in which the main shock in that period was a fiscal policy one. For example, our estimates suggest that the tax-based adjustment implemented in Italy in 2010-13 is sufficient by itself to explain the recession experienced by the country over the period 2011-12, with negative GDP growth of around 2 percent in each year. The expenditure-based adjustments implemented in countries such as the U.K. and Denmark are associated with much milder recessions, with GDP growth fluctuating around zero.

We cannot reject the hypothesis that recent fiscal adjustments had the same effect on output growth as past ones, although in some cases failure to reject is marginal. We do not find sufficient evidence to suggest that the recent rounds of fiscal adjustments have been especially costly for the economy, and we conclude that the fiscal multipliers estimated using data from the pre-crisis period give valuable information about the amount of output loss due to the post-crisis fiscal consolidation measures. This result is at odds with Blanchard and Leigh,14 who find that the costs of fiscal adjustments have been higher in recent years than previously estimated. The difference between the two results depends on a number of factors, including our choice not to constrain consolidations based on spending cuts and those based on increases in government revenues to have identical effects on output.

In current work in progress with Favero, Barbiero, and Paradisi,15 we take our analysis a step further by exploring the potential heterogeneity in the output effects associated with different components of revenues and expenditures. We disaggregate fiscal shocks into four components: government consumption and investments, transfers, direct taxes and indirect taxes. From a theoretical point of view, each of these components should affect GDP growth through different channels. For instance, in the short run, cuts in government consumption and investment might impact GDP growth through demand-side effects; in the medium and long run, their effect on growth might depend on the government's efficiency in providing public goods and services. Transfer cuts reduce the resources available to households, which in turn may be forced to cut consumption, especially if liquidity constrained. These measures also may have supply-side effects by increasing labor supply. In addition, a reduction in both expenditure components may generate expectations of lower taxes and correspondingly reduced future economic distortions, with potentially positive wealth effects.

The previous literature has addressed the issue of composition primarily by looking at revenues versus spending in the aggregate. Recent papers by Karel Mertens and Morten Ravn,16 Romer and Romer,17 and Roberto Perotti18 are exceptions. However, they focus only on the United States. Our paper presents an international panel of disaggregated fiscal consolidation plans and analyzes their economic effects. Building on the methodology established in our work with Favero, we classify fiscal plans into four categories: direct tax-based, indirect tax-based, consumption-based, and transfers-based.

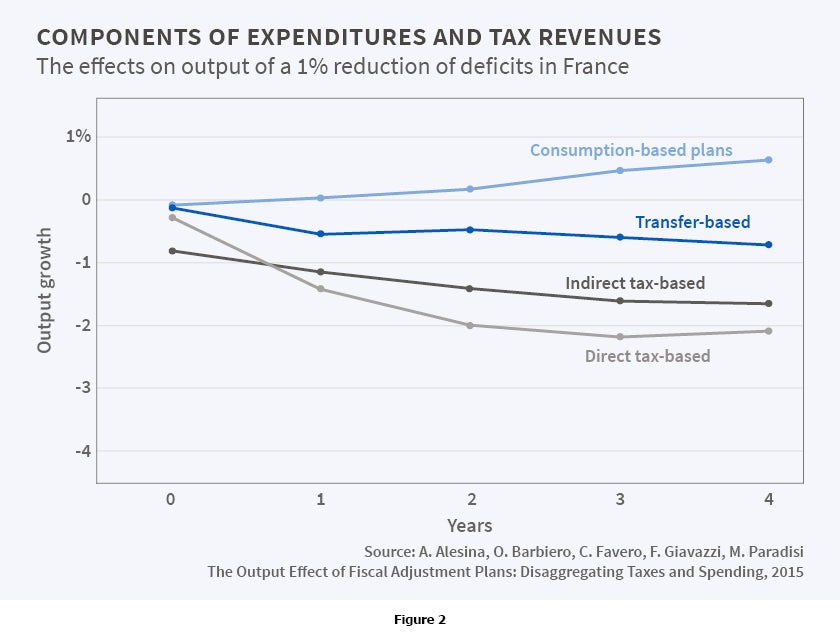

Our first finding is that plans based on different spending and revenue components indeed have heterogeneous effects on GDP growth, as Figure 2 shows for the case of France. Results for the other countries are similar. While the heterogeneity in revenue components is less pronounced, on the expenditure side transfers seem to be clearly different from consumption and investment. The effect of a cut in transfers is more similar to that of an increase in taxation than to that of a cut in expenditure. Looking at other macroeconomic variables, the similarity between tax hikes and transfers cuts is particularly evident in the case of consumption and consumer confidence. The impact of a cut in transfers on investment is more similar to a cut in government consumption.

The overall impact on output growth is more negative than that from a cut in government consumption, but less negative than a tax increase.

Overall, our findings suggest that major fiscal adjustments based upon cuts in government consumption, excluding transfers, are much less costly than tax-based fiscal adjustments in terms of foregone output growth. In fact, cuts in government consumption seem to have virtually no costs in terms of output losses on average–a result which probably balances some recessionary and some expansionary cases. Tax-based fiscal adjustments are very costly in terms of output losses. Cuts in government transfers seem to lie somewhere in between the extremes of government consumption and tax increases, though they are closer to tax hikes. Perhaps the smaller effect of transfers cuts relative to tax increases may have to do with a supply-side response, but more research is needed on this point. Regarding which tax increases are more costly, direct and indirect taxes seem to have overall similar effects, though this is also an issue to be explored further.

We also find that the differences in tax-based and expenditure-based fiscal adjustments cannot be explained by different responses of monetary policy, although the evidence points to a slightly more expansionary response of monetary policy in the case of expenditure-based adjustments, perhaps because tax-based adjustments tend to raise prices, while expenditure-based adjustments tend to lower them, or because central banks believe that expenditure-based adjustments are more long lasting and credible.

Our findings seem to hold for fiscal adjustments both before and after the financial crisis. We cannot reject the hypothesis that the effects of the fiscal adjustments, especially in Europe in 2009-13, were indistinguishable from previous ones. They certainly show the same relative patterns between tax-based and expenditure-based adjustment. This does not mean, however, that expenditure-based and tax-based plans have identical effects during periods of economic expansion and contraction. This question, in the context of disaggregated fiscal plans, remains hard to answer.

Endnotes

F. Giavazzi and M. Pagano, "Can Severe Fiscal Contractions Be Expansionary? Tales of Two Small European Countries," in O. J. Blanchard and S. Fischer, eds., NBER Macroeconomics Annual, 5, 1990, Cambridge, MA: MIT Press, 1990, pp. 75-122.

A. Alesina and S. Ardagna, "Large Changes in Fiscal Policy: Taxes versus Spending," in J.R. Brown, ed., Tax Policy and the Economy, 24, Chicago, Illinois: The University of Chicago Press, 2010, pp. 35-68.

See in particular the following: F. Giavazzi and M. Pagano, "Can Severe Fiscal Contractions Be Expansionary? Tales of Two Small European Countries," in Olivier J. Blanchard and Stanley Fischer, eds., NBER Macroeconomics Annual, 5, 1990, Cambridge, MA: MIT Press, 1990, pp. 75–122; F. Giavazzi and M. Pagano, "Non-Keynesian Effects of Fiscal Policy Changes: International Evidence and the Swedish Experience", NBER Working Paper 5332, November 1995, and Swedish Economic Policy Review, 3, 1996, pp. 67-103; F. Giavazzi, T. Jappelli, and M. Pagano, "Searching for Non-Linear Effects of Fiscal Policy: Evidence from Industrial and Developing Countries," NBER Working Paper 7460, January 2000, and European Economic Review, 44, 2000, pp. 1259-90; A. Alesina and S. Ardagna, "Tales of Fiscal Adjustments," Economic Policy, 13(27), 1998, pp. 487-545; and A. Alesina and S. Ardagna, "The Design of Fiscal Adjustments," in J.R. Brown, ed., Tax Policy and the Economy, 27, Chicago, Illinois: The University of Chicago Press, 2013, pp. 35-68.

See A. Alesina, C. Favero, and F. Giavazzi, "The Output Effect of Fiscal Consolidation Plans," NBER Working Paper 18336, August 2012, and Journal of International Economics, 2015, forthcoming; A. Alesina, O. Barbiero, C. Favero, F. Giavazzi, and M. Paradisi, "Austerity in 2009-13,” NBER Working Paper 20827, January 2015, and Economic Policy, 2015, forthcoming; and A. Alesina, O. Barbiero, C. Favero, F. Giavazzi, and M. Paradisi, "The Output Effect of Fiscal Adjustment Plans: Disaggregating Taxes and Spending," 2015, mimeo, https://tinyurl.com/yxm5ce9r.

C.D. Romer and D.H. Romer, "The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks," American Economic Review, 100(3), 2010, pp. 763–801.

C.D. Romer and D.H. Romer, "The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks," American Economic Review, 100(3), 2010, pp. 763-801.

P. Devries, J. Guajardo, D. Leigh, and A. Pescatori, "A New Action-based Dataset of Fiscal Consolidations," IMF Working Paper No. 11/128, 2011.

A. Alesina, C. Favero, and F. Giavazzi, "The Output Effect of Fiscal Consolidation Plans," NBER Working Paper 18336, August 2012, and Journal of International Economics, forthcoming.

A. Alesina, O. Barbiero, C. Favero, F. Giavazzi, and M. Paradisi, "Austerity in 2009-13," NBER Working Paper 20827, January 2015, and Economic Policy Journal, 2015, forthcoming.

This is comparable to the estimates in Romer and Romer, "The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks," American Economic Review, 100(3), 2010, pp. 763-801.

A. Alesina, O. Barbiero, C. Favero, F. Giavazzi, and M. Paradisi, "Austerity in 2009-13," NBER Working Paper 20827, January 2015, and Economic Policy Journal, forthcoming.

O. Blanchard and D. Leigh, "Growth Forecast Errors and Fiscal Multipliers," IMF Working Paper No. 13/1, 2013.

A. Alesina, O. Barbiero, C. Favero, F. Giavazzi, and M. Paradisi, "The Output Effect of Fiscal Adjustment Plans: Disaggregating Taxes and Spending," 2015, mimeo. https://tinyurl.com/yxm5ce9r.

K. Mertens and M.O. Ravn, "The Dynamic Effects of Personal and Corporate Income Tax Changes in the United States," American Economic Review, 103(4), 2013, pp. 1212-47.

C. D. Romer and D. H. Romer, "Transfer Payments and the Macroeconomy: The Effects of Social Security Benefit Changes," NBER Working Paper 20087, May 2014.

R. Perotti, "It's the Composition: Defense Government Spending is Contractionary, Civilian Government Spending is Expansionary," NBER Working Paper 20179, May 2014.