Fed Pronouncements, Expectations, and Stock Prices

A measure derived from the federal funds futures market appears to offer predictive power for stock price movements.

Monetary policy, Ben Bernanke once blogged, "is 98 percent talk and only two percent action." This underscores the challenge of deciphering how monetary policy announcements affect asset markets. A new study develops a way of measuring how speeches and other official pronouncements of Federal Reserve officials affect market predictions of future monetary policy, and how these expectations in turn affect stock prices.

The new measure, which its creators call the "slope factor," appears to predict future changes in interest rates as well as stock prices. For the latter, in weekly data, it has the same order of predictive power as the dividend-price ratio, the Chicago Board Options Exchange Volatility Index (VIX), and the variance risk premium. It also appears to be independent of those measures.

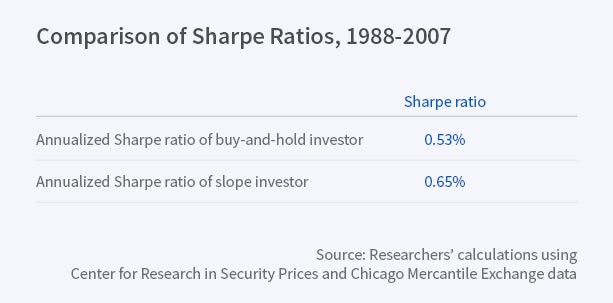

"Investors can achieve increases in weekly Sharpe ratios — a measure of risk-adjusted returns — of 20 percent conditioning on the slope factor," Andreas Neuhierl and Michael Weber write in Monetary Policy and the Stock Market: Time-Series Evidence (NBER Working Paper 22831).

The slope factor is constructed from the weekly differences in the values of two federal funds futures. It is computed as the residual from a regression of the change in the implied interest rate on the three-month federal funds futures on the change in the implied interest rate on the one-month futures. The changes in the futures prices at both maturities reflect market judgements about future monetary policy. The slope factor for a given week can be either positive or negative. When it is positive, it suggests that market participants in a given week have increased their expectations of three-month interest rates by more than their expectations of one-month interest rates. The larger the value of slope, the larger the difference between the value of the change in the three-month rate and the component of that rate that can be explained by the change in the one-month rate.

Many studies of how Fed pronouncements affect asset prices focus on only eight periods of the year, when the Fed's interest-rate setting Federal Open Market Committee meets. This study takes a different tack. The researchers find that Fed officials are constantly communicating to the markets about the direction of future interest rates. This has been especially true since 1994, when the Fed adopted a more transparent approach to communicating with market participants.

The researchers point out that the slope factor provides information that investors could use in portfolio construction. It predicts weekly excess returns, measured from Wednesday to Wednesday, on the value-weighted index of U.S. stock returns created by the Center for Research in Security Prices. After testing their model on data from 1988, when the federal fund futures market began, to 2007, the researchers conclude that "[t]he slope factor explains around 2 percent of the weekly variation in stock returns and is robust to the inclusion of lagged weekly returns."

With regard to the potential implications for portfolio practice, they write, "an investor conditioning on the slope factor can increase his weekly Sharpe ratio by more than 20 percent compared to a buy-and-hold investor...[T]rading based on the predictions of the slope factor is feasible and transaction costs are small."

—Laurent Belsie