How Firms Respond to Changes in Taxation

Taxes are one of the most important microeconomic tools at governments' disposal, touching on practically every aspect of economic activity. They potentially affect a variety of corporate decisions, ranging from how much to invest in R&D, property, plant, and equipment, to the mix of debt and equity with which firms fund operations, to the amount and structure of com-pensation paid to managers and employees and the dividends offered to shareholders.

A key empirical challenge when testing whether and how particular taxes affect corporate decisions is that a firm's tax status often depends on its policies. For example, a firm's choice of investment projects will affect its future marginal tax rate by creating tax shields in the form of depreciation charges that can be deducted from its taxable profits and by increasing its debt capacity. As a result, inference based on tests that use a firm's actual or simulated tax rate are likely biased. The extensive literature on the effects of taxes on corporate policies therefore has looked for more exogenous sources of identification, favoring two approaches: the use of changes in a country's tax code over time and the use of international variation in taxes. In a sequence of recent papers, I propose a third approach: variation in state-level tax rates and tax rules across U.S. states and time.

State-level variation in corporate taxation offers two convenient advantages over prior approaches. There are numerous state tax changes, and these changes allow us to get closer to a plausible counterfactual world. To see this, consider first changes in federal taxes. Variation in federal tax rates and tax rules is relatively infrequent (the 1986 Tax Reform Act is a rare example), and when it does occur, it affects virtually all firms in the economy at the same time and in a similar way, making it difficult to find control firms with which to establish a plausible counterfactual for how firms would have behaved absent the tax change.

Cross-country approaches are designed to overcome the first shortcoming. There are many more tax changes across countries than within, and the changes don't all happen at the same time, leaving some firms treated and others untreated. But these approaches require us to make potentially implausible assumptions about treated and untreated firms being comparable despite their operating in different countries.

State tax changes, on the other hand, lend themselves to standard difference-in-difference tests. Like the tax changes used in cross-country studies, state tax changes are numerous and staggered over time, allowing us to disentangle the effects of tax changes from other macroeconomic shocks that affect firms' policies. Because they occur in a single country, it can more plausibly be argued that treated and untreated firms would have experienced similar economic conditions in time, space, industry, and so on, but for the consequences of a tax change.

To illustrate the logic of the approach, consider North Carolina, which in 1991 raised its top corporate income tax rate from 7 to 8.06 percent. Let's say we are interested in the effect of taxes on leverage, and we observe that following this state tax increase, firms operating in North Carolina increased leverage from 18.8 percent to 20.8 percent, on average. Part of this leverage increase could reflect changes in economy-wide factors such as aggregate demand or interest rates that alter the attractiveness of debt relative to equity at that particular point in time. To disentangle secular changes from those induced by North Carolina's tax increase, we can estimate the contemporaneous change in leverage among firms that experience no tax change but are otherwise exposed to the same economic forces as firms in North Carolina. We might, for example, use firms operating in the states bordering North Carolina for this purpose and, if desired, we could hold industry and other factors constant as well.

The standard identifying assumption central to a causal interpretation of differences-in-differences estimates of this kind is that treated and control firms would have behaved similarly in the absence of the tax change. In addition, interpreting a given response—say, the change in leverage—as having been caused by the tax change also requires that the tax change did not coincide with, and was not triggered by, observed or unobserved factors that in turn would have caused firms to adjust their policies for reasons unrelated to the tax change itself. For example, a state may change other rules or regulations at the same time it changes its tax rates, or it may change tax rates to balance its budget at a time of negative demand shock. Finally, a causal interpretation requires that tax changes be unpredictable, or else firms' observed behavior to a current change may reflect not the tax change itself but how the actual tax change compares to firms' prior expectations.

I illustrate the power and limitations of this approach in three recent papers that examine the effect of taxes on firms' capital structure choices, their risk taking, and their employment decisions, respectively. But first, a brief primer on state corporate taxation in the U.S.

State-level Corporate Taxation

Currently, all states except Nevada, South Dakota, and Wyoming tax corporate activities within their borders. The tax is usually based on profit, though some states instead levy taxes based on gross receipts, a measure of revenue. In 2013, state tax rates varied from a low of 4.63 percent in Colorado to a high of 12 percent in Iowa. Averaged across states, tax rates increased from 4.9 percent in 1969 to a high of 7.2 percent in 1991, then fell a little, to 6.7 percent. In 2013, seven states had lower tax rates than they did in 1969; 36 had higher rates.

Given that federal corporate tax rates top out at 35 percent, it is clear that state taxes account for a smaller share of most firms’ tax bills than do their federal taxes. Florian Heider and I estimate that state taxes account, on average, for about 21 percent of publicly listed firms' overall tax burden.1

A firm's state of incorporation (often Delaware) is irrelevant for state tax purposes, as it is the location of operations that triggers a tax liability. Firms that operate—and so are taxed—in a single state are called single-state firms. Multi-state firms are taxed in every state they have "nexus" with, meaning, where they have sales, property, or employees. To reduce the scope for profit-shifting and tax arbitrage, states do not attempt to measure profits earned in-state. Instead, under the 1957 Uniform Division of Income for Tax Purposes Act, a multi-state firm's federal taxable income is apportioned to each nexus state based on an average of the fractions of the firm’s total payroll, sales, and property located in that state.

Apportionment introduces an interesting data challenge. For a multi-state firm, a given state's tax change will apply only to that portion of its federal taxable income that is apportioned to the state. In other words, a state tax change will apply to less than the firm's entire tax base. All else equal, a multi-state firm will therefore respond less strongly to a given state's tax change than a single-state firm operating there. By implication, tests that ignore the geographic distribution of multi-state firms' tax bases will understate the sensitivity of firms' responses to corporate income taxes. Addressing this issue requires data on each firm's tax exposure to each state. Standard data sources such as Compustat do not provide the necessary geographic breakdown. So, in a number of papers, I have used establishment-level data from the National Establishment Time Series (NETS) database, which provides information on the location of practically every subsidiary, branch, or plant for practically every firm in the U.S., along with data on sales and employees, going back to 1989. While not perfect, these data can be used to approximate nexus apportionment weights.

For the 45-year period from 1969 to 2013, Michael Smolyansky and I identify 140 corporate income tax increases in 45 states and the District of Columbia and 131 corporate income tax cuts in 35 states, or roughly one tax change per decade per state.2 The changes vary in size, with increases generally being larger in absolute value than decreases: Increases average 126 basis points while cuts average 71 basis points. A quarter of the cuts and two-fifths of the increases measure one percentage point or more in absolute value. The ratio of tax increases to tax cuts has fallen from 4.75 in the 1970s to 1.29 in the 1980s, 0.51 in the 1990s, 0.54 in the 2000s, and 0.18 since 2010. With few exceptions, such as the Rust Belt states in the 1980s, tax changes show no obvious geographic clustering.

States do not change taxes randomly. Heider and I investigate the political economy surrounding each change affecting at least 100 publicly listed firms since 1989 and estimate the empirical determinants of state tax changes over the period from 1986 to 2010. Perhaps the most interesting predictor of the likelihood and magnitude of state tax changes is how the state's current tax rate compares to that of the states surrounding it, with tax increases being substantially less likely, and smaller, if the state's current rate is high relative to that of its neighbors, and tax cuts being more likely, and larger, if its current rate is relatively low. Tax increases are more likely when the state budget is in deficit, consistent with widespread balanced-budget rules, while tax cuts are more likely when there is a budget surplus. Taxes are more likely to be cut under Republican than Democratic governors, and by larger amounts. Using news reports and a review of the legislative record, we find no evidence that state tax changes coincide systematically with other policy changes that plausibly affect corporate behavior independently.

Taxes and Capital Structure

One of the oldest questions in corporate finance is whether taxes affect firms' capital structure choices. It has long been recognized that debt confers a tax benefit on firms when the tax code allows interest payments to be deducted from taxable income. Some theories of capital structure hold that firms trade off this tax benefit of debt against the cost of the increased risk of default that accompanies greater use of debt. While the tax advantage of debt has been a cornerstone of corporate finance since at least the pioneering work of Franco Modigliani and Merton Miller,3 its empirical relevance continues to be debated. Opinions in the literature range from irrelevance to the belief that taxes are the key driver of debt policy.

Heider and I use the state tax changes to quantify the tax sensitivity of firms' debt policies. Our results suggest that taxes are an important determinant of firms' capital structure choices in the U.S. We find that firms increase the ratio of long-term debt to total assets by around 40 basis points for every percentage point increase in the tax rate. For the average tax increase, this corresponds to a debt increase of $32.5 million from a pre-treatment average of $570 million. Total assets are unchanged, implying that firms swap debt for equity when tax rates rise.

Interestingly, firms do not reduce their leverage when tax rates fall. This asymmetry is inconsistent with textbook (or "static") tradeoff models and favors dynamic tradeoff models. Dynamic models combine the tradeoff between the benefit of tax shields and the cost of default with an explicit contingent-claims model for how a firm's debt is priced. In dynamic models, shareholders have little incentive to reduce the firm's use of debt. Doing so would reduce the value of shareholders' option to default, benefiting debtholders at shareholders' expense.

Taxes and Risk-Taking

Liandong Zhang, Luo Zuo, and I focus on a different corporate choice: how much risk to take.4 The kinds of corporate actions that affect an economy's long-run growth potential nearly always involve risk. Prominent examples are investments in physical assets, production processes, and new products or technologies.

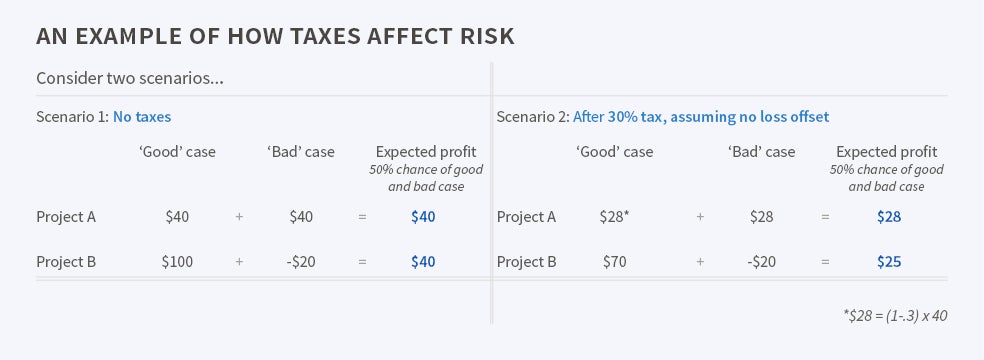

As has been recognized since at least the 1940s, income taxes affect risk-taking because they induce an asymmetry in a firm's payoffs. To see how, consider a firm that has access to two projects, A and B, with two equally likely outcomes, "good" and "bad." [See Figure1] Project A yields a profit of $40 under both scenarios while project B yields a profit of $100 under the good scenario and a loss of $20 under the bad scenario. Project risk is idiosyncratic and hence diversifiable. Absent taxes, the expected profit of each project is $40 and so a risk-neutral firm is indifferent between them. If the tax rate increases from zero to 30 percent, the expected after-tax profit of each project falls, but it falls by more for the risky project B than for the safe project A. The reason is that the government shares in the firm's profit but not—absent full tax loss offsets—in the firm's loss. Given this asymmetry, a risk-neutral firm will prefer the safe project to the risky project as the tax rate increases.

Again using the state tax changes, we estimate the tax sensitivity of various firm-level measures of risk-taking, such as the volatility of quarterly earnings. We find that firms reduce earnings volatility by an average of 2.4 percent to 3.2 percent for every one-percentage-point increase in their nexus-weighted tax rates relative to other firms operating in neighboring states and in the same industry that are not subject to a tax change where they operate. This effect is estimated over the three years following a tax increase and becomes stronger when we give firms more time to adjust their risk profiles. The main way in which firms reduce risk is to shorten their operating cycles, which puts less capital at risk, in particular in the form of inventories.

As in the case of the tax sensitivity of debt, we find evidence of asymmetry: While firms reduce risk significantly when tax rates increase, they do not, on average, increase risk when tax rates fall. One reason to expect firms not to increase risk in response to a tax cut is that their creditors, whose claims would decline in value if risk increased, constrain their ability to do so, for example through the use of debt covenants. Consistent with this prediction, we show that firms with low financial leverage, which presumably face fewer constraints, increase risk in response to tax cuts, whereas high-leverage firms, which presumably face more constraints, do not.

Taxes, Wages, and Employment

Smolyansky and I investigate how firm employment and wages respond to tax changes. Firm-level data on employment and wages are not systematically available, even for publicly listed firms, so instead we use county-level data from the U.S. Bureau of Economic Analysis. To disentangle the effect of corporate taxes from business cycle effects that may coincide with, or potentially even drive, state tax changes, we compare contiguous counties straddling state borders. The idea is to exploit a spatial policy discontinuity when forming control groups. Because a state's tax jurisdiction stops at its border, a county's immediate neighbors on the other side of the border share plausibly similar economic conditions while being subject to discretely different tax policies.

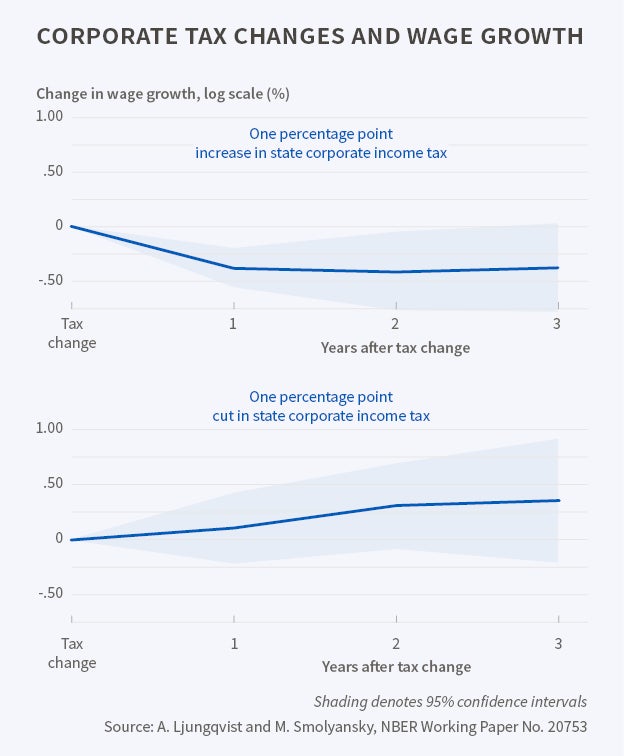

Our empirical results show that corporate tax changes affect firm employment and wages [See Figure 2], and that they do so asymmetrically: While tax increases hurt employment and income in treated counties, tax cuts have little effect. All else equal, a one-percentage-point increase in corporate income taxes reduces employment by between 0.3 percent and 0.5 percent and wages by between 0.3 percent and 0.6 percent, net of contemporaneous changes in neighboring counties on the other side of the state border. Tax cuts, on the other hand, have no significant effect on either employment or wages unless they are implemented during a recession, when they lead to sizeable increases in both employment and wages.

One potential challenge to our contiguous-border-county strategy is that tax changes on one side of the border could trigger changes in the behavior of firms or households across the border. For example, the fall in wages following a tax increase could spill over to control counties if affected households spend less money not just at home but also in neighboring counties. This would attenuate the estimated tax sensitivity, as the tax increase would hurt both the treated and the control county. To deal with such potential spillovers, we compare border counties to hinterland counties located further inside the untreated states. To the extent that spillovers dissipate with distance from the state border, we would expect employment and wages to decline in border control counties compared to hinterland counties. Instead, we find no difference in employment or wage growth within untreated states, regardless of proximity to the border, suggesting that spillovers do not play a major role in our setting.

Conclusions

The examples presented above suggest that state-level variations in taxes are useful for exploring a number of tax-related research questions. While these changes are generally small, measuring perhaps a percentage point, they apparently are economically meaningful in light of the responses they elicit from firms, in terms of their use of debt, their risk-taking, and their employment decisions. Whether these responses are too large, too small, or just right is an open question.

An interesting theme that emerges from these three examples is that taxes often have an asymmetric effect. In the case of capital structure, asymmetry is a prediction of one prominent class of models but not of others, which can help us to discriminate empirically between different capital structure theories. In the case of risk-taking, asymmetry is to be expected—if not predicted—given the insights of the literature on risk shifting and asset substitution at highly leveraged firms. In the case of firms' employment decisions, asymmetry is more of a surprise. There remains much interesting work to be done on the various ways in which corporate taxes affect economic activity. State taxes, modest though they may often seem, are a useful addition to our empirical toolbox.

Endnotes

F. Heider and A. Ljungqvist, "As Certain as Debt and Taxes: Estimating the Tax Sensitivity of Leverage from State Tax Changes," NBER Working Paper 18263, July 2012, and Journal of Financial Economics, 118(3), 2015, pp. 684–712.

A. Ljungqvist and M. Smolyansky, "To Cut or Not to Cut? On the Impact of Corporate Taxes on Employment and Income," NBER Working Paper 20753, December 2014.

F. Modigliani and M. H. Miller, "Corporate Income Taxes and the Cost of Capital: A Correction," The American Economic Review, 53(3),1963, pp. 433–43.

A. Ljungqvist, L. Zhang, and L. Zuo, "Sharing Risk with the Government: How Taxes Affect Corporate Risk-Taking," NBER Working Paper 21834, December 2015.