Demographics, Job Polarization, and Macroeconomic Analysis of Labor Markets

In the past 50 years, labor markets in the United States and other industrialized countries have experienced marked change due to technological progress and demographic shifts. In this piece, we summarize some of our joint work, much of which is in collaboration with our co-authors, on the implications of these long-run trends for macroeconomic and labor market phenomena.

This summary is organized into two themes. The first emphasizes important age differences in labor market outcomes, and how changes in an economy's age composition impact the level of aggregate unemployment and the severity of business cycle fluctuations. We then turn attention to the phenomenon of job polarization, specifically the disappearance of employment opportunities in occupations focused on "routine" tasks. Our work investigates the implications of this process for labor market dynamics for varied demographic groups, as well as for the changing nature of business cycle recoveries.

Demographics

Since World War II, industrialized countries have experienced dramatic demographic changes. We have investigated the consequence of this for business cycle analysis.1 We find that changes in the age composition of the labor force account for a significant fraction of the variation in business cycle volatility observed in the G7 economies.

To do this, we first show that, over the business cycle, the young experience much greater volatility of employment and hours-worked than the prime-aged, while those closer to retirement age experience volatility somewhere in-between. For instance, in the United States, the volatility of hours-worked for 15 to 29-year-olds over the business cycle is nearly 2.5 times greater than that of 40 to 49-year-olds; as a result, though individuals under the age of 30 account for about one-quarter of aggregate hours, they account for close to half of aggregate hours volatility. Given this, a natural conjecture is that the responsiveness of the macro-economy to business cycle shocks depends on the age composition of the workforce.

Next, we exploit variation in the nature and timing of demographic change that has been observed across countries. For instance, the dramatic baby boom of the 1950s and 1960s was followed by a baby bust in the United States. By contrast, Japan experienced a sharp decline in fertility after WWII that has continued to the present day, save for a mild rebound in the 1970s. This variation across G7 countries allows us to determine the causal role of age composition on macroeconomic volatility.

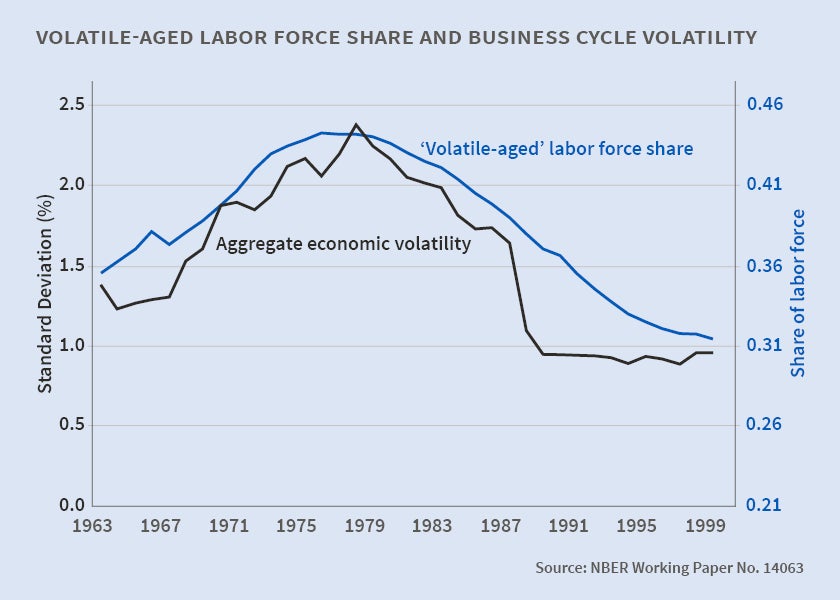

The nature of our results is illustrated in the graph below, where we display the share of the labor force of "volatile age" (i.e., the young and old), along with a measure of business cycle volatility. Cyclical volatility tracks the volatile-aged share very closely. We establish this more formally in the paper using panel data techniques for all G7 economies. We find that the aging of the baby boomers accounts for approximately one-quarter of the "Great Moderation," namely the reduction in business cycle volatility observed in the U.S. since the mid-1980s.

These results indicate the need for a theoretical understanding of why differences in labor market volatility exist across age groups. In a joint paper with Seth Pruitt, we develop a macroeconomic model to account for these large differences.2 Our starting point is the canonical stochastic neoclassical growth model with price-taking households and firms, interacting in competitive spot markets for goods and labor. Within this framework, age differences can arise from factors related to preferences (or, succinctly, differences in labor supply), technology (labor demand), or both.

The joint behavior of hours and wages over the business cycle provides the necessary evidence to distinguish between these two channels. Variants of the neoclassical model featuring only age-specific labor-supply differences cannot reconcile the fact that volatilities of both hours and wages for young workers are greater than those of older workers. By contrast, variants featuring cyclical differences in age-specific labor demand can. We show how a model featuring capital-experience complementarity in production - when age is equated with labor-market experience - generates volatilities of hours and wages across age groups that match those in the U.S. data.

With Martin Gervais and Yaniv Yedid-Levi, we study another stark feature of the labor market: age differences in unemployment, and specifically why unemployment is so much higher for the young.3 For example, the unemployment rate in the U.S. for individuals aged 20-24 is approximately 2.5 times that of the prime-aged. We show that the declining age profile of unemployment is due to the fact that the rate at which workers separate from employment matches declines over the life cycle.

To address this subject, we consider a search-and-matching model of the labor market in which workers learn about their "occupational fit." This interest in occupational fit is motivated by the fact that occupational mobility also declines over the life cycle. In our model, young workers enter the labor market not knowing the occupation for which they are best suited. To learn this, they sample occupational matches over their careers, and thus accumulate knowledge about their best occupation, a form of human capital. Since young workers are more likely to be in occupations of poor fit, they are more likely to separate, and hence experience higher unemployment.

We find that a calibrated version of this model does a surprisingly good job at matching the life-cycle profile of separation rates, unemployment rates, and occupational mobility. Moreover, the model is able to rationalize a significant portion of the fall in aggregate unemployment in the U.S. from the mid-1970s to the present when aging of the workforce is accounted for.

Disappearing Routine Jobs

In the past three decades, the U.S. labor market has seen the emergence of two new phenomena: job polarization and jobless recoveries. Job polarization refers to the increasing concentration of employment in the highest- and lowest-wage occupations as jobs in middle-skill occupations disappear. Jobless recoveries refer to periods following recessions in which rebounds in aggregate output are accompanied by much slower recoveries in aggregate employment. We have argued that these phenomena are related.4 Job polarization has been linked to progress in robotics, computing, and information and communication technology. This technological progress has resulted in a decline in the demand for labor in occupations that perform "routine" tasks - tasks that are limited in scope and can be performed by following a well-defined set of procedures. The declining share of aggregate employment in routine occupations has been well documented in the job-polarization literature.

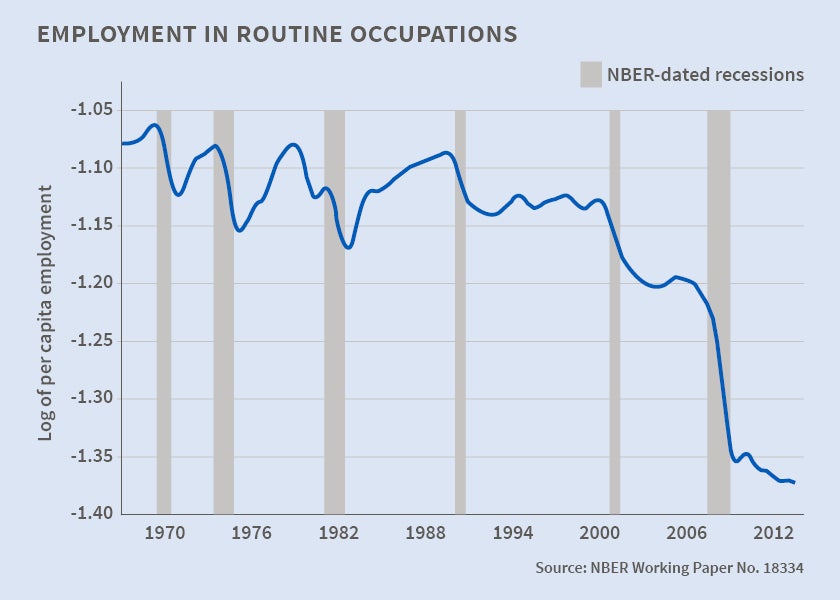

What is less well known is that not only has the share of routine occupations in aggregate employment been falling, but the per capita level of employment in those occupations has been falling as well. The graph below illustrates this: Since about 1990, there is an obvious 28 log-point fall in per capita routine employment. Equally clear is that this fall has not been gradual, but has concentrated around economic downturns; approximately 90 percent of the fall occurred in the last three recessions.

In this same period, the behavior of the employment-to-population ratio following recessions has undergone a distinct break from previous postwar episodes. During the recoveries from the last three latest recessions (those ending in 1991, 2001, and 2009), aggregate employment continued to decline for years following the turning point in aggregate output. By contrast, previous postwar recoveries were characterized by vigorous rebound of both per capita real GDP and employment.

We link this change in the nature of economic recoveries to the behavior of routine employment. As evidenced in Figure 2, per capita employment in routine occupations fell and never recovered following each of the 1991, 2001, and 2009 recessions. Prior to job polarization, routine-job loss in recessions was accompanied by strong routine-job recoveries. This, too, is evident in Figure 2 after the recessions of 1970, 1975, and 1982, which were all typical "job-yes" recoveries. Moreover, we find that jobless recoveries are observed only in these disappearing, middle-skill jobs; employment in "non-routine" occupations experience only mild contractions - if at all - during recessions, and have experienced essentially no change in the nature of their recoveries. Together, these facts indicate that the lack of recovery in routine occupations accounts for the jobless recoveries experienced in the aggregate. Unsurprisingly, prior to job polarization, jobless recoveries did not occur.

We further establish this link quantitatively, via simple counterfactual exercises. Had employment in routine occupations recovered as it did prior to job polarization, the U.S. economy would not have experienced jobless recoveries. Finally, we develop a simple search-and-matching model of the labor market linking job polarization and jobless recoveries, and show how it can account for our salient empirical findings. The model emphasizes the role of job-finding rates in the dynamics of jobless recoveries. Using the Current Population Survey (CPS), we demonstrate that the model is consistent with the key properties of transition rates derived from the individual-level data.

With Guido Matias Cortes and Christopher J. Nekarda, we conduct a more in-depth study of the matched individual-level data from the CPS.5 We analyze flows into and out of employment in routine occupations to better understand the process by which routine occupations have declined, and who the disappearance is affecting at the microeconomic level.

The bulk of the disappearance of routine employment is accounted for by changes in the "entry rates" (i.e. job-finding rates) into routine occupations. First, we find a fall in job-finding rates from unemployment into routine employment; this includes falls for both the unemployed who most recently worked in routine jobs and for the unemployed who most recently worked in non-routine jobs. The second important change is the fall in job-finding rates from non-participation to routine employment.

We then consider the extent to which these key entry-rate changes are due to changes in the demographic composition of the U.S. population, or in the behavior of individuals with particular demographic characteristics. We find that these changes reflect behavioral changes. The fall in the entry rate into routine "brawn" occupations is particularly acute for males, the young, and those with lower levels of education; the fall in the entry rate into routine "brain" occupations is particularly strong for females, and those with higher levels of education.

Finally, we disentangle the relative importance of demographic vs. behavioral channels in the decline of routine employment. Changes in demographic composition account for only a small part of the decline in the aggregate. By contrast, the changes in the labor market that appear to account for the largest part of the decline in routine jobs are the declines in the probabilities of transitioning from unemployment and nonparticipation into routine jobs. Changes in the transition propensities of young workers are of greatest importance.

1. N. Jaimovich and H. E. Siu, "The Young, the Old, and the Restless: Demographics and Business Cycle Volatility," NBER Working Paper No. 14063, June 2008, and the American Economic Review, 99(3), 2009, pp. 80426. ↩

2. N. Jaimovich, S. Pruitt, and H. E. Siu, "The Demand for Youth: Implications for the Hours Volatility Puzzle," NBER Working Paper No. 14697, January 2009, and the American Economic Review, 103(7), 2013, pp. 3022-44, (as "The Demand for Youth: Explaining Age Differences in the Volatility of Hours"). ↩

3.M. Gervais, N. Jaimovich, H. E. Siu, and Y. Yedid-Levi, "What Should I Be When I Grow Up? Occupations and Unemployment over the Life Cycle," NBER Working Paper No. 20628, October 2014. ↩

4.N. Jaimovich and H. E. Siu, "The Trend is the Cycle: Job Polarization and Jobless Recoveries," NBER Working Paper No. 18334, August 2012. ↩

5.G. M. Cortes, N. Jaimovich, C. J. Nekarda, and H. E. Siu, "The Micro and Macro of Disappearing Routine Jobs: A Flows Approach," NBER Working Paper No. 20307, July 2014. ↩