Understanding Financial Crises: Theory and Evidence from the Crisis of 2007-8

For those who study economic history, financial crises are recurring phenomena, not as rare as they are often perceived to be, but showing up in new guises each time. There are often common economic forces at work across different crises, and my current research uses the financial and economic crises that erupted in August of 2007 as a laboratory for theoretical and empirical analysis of those forces. In the past, I focused on market failures, which can arise due to externalities ("neighborhood" or "spillover" effects) from the distress of financial firms, and regulatory failures, which can arise due to time-inconsistency problems, cognitive capture, or capture that is rooted in political economy problems. This article summarizes my research on these two failures and their interactions. In the conclusion, I mention my ongoing work on government failures, which can arise due to myopia of decision-making in fiscal and debt policy, and in policy designed to bail out a distressed financial sector.

Market Failure I: Short-term debt, default, and externalities

Financial firms that lend to households and corporations (both banks and "shadow banks" that perform similar economic functions) have always featured short-term debt in their funding structures. The underlying economic rationale for this can be understood by considering the problem of the financier who funds a bank but, because of information problems, lacks precise knowledge and contractibility over loans made by the bank. The financier responds to this problem by saving the option not to roll over -- in other words, by providing only short-term debt to the bank.

Financial crises occur when the economy is hit by shocks that lead the financier to exercise the option not to roll over the short-term debt because the bank is under-capitalized -- that is, because bank-owners have little equity capital left as "skin-in-the-game" to continue lending prudently. If shocks are idiosyncratic to a bank, then the under-capitalized banks can be acquired, or their activities re-intermediated, by better-capitalized banks. If shocks instead are aggregate in nature, and the entire banking sector is heavily short-term financed, then banks suffer a coincident loss of capital, and efficient re-intermediation cannot take place. There may be disorderly liquidations or allocation inefficiency. This induces financiers to not roll over the short-term debt, and a "crisis" materializes.1 Indeed, absent a sufficient pool of long-term capital in the economy, even relatively small aggregate shocks and inefficiencies perceived by financiers can lead to complete short-term debt "freezes". 2 Interestingly, losses to financiers are less likely in good economic times when the likelihood attached to aggregate shocks is small, leading to greater short-term leverage for the financial sector as a whole – including the entry of under-capitalized institutions. Therefore, somewhat counter-intuitively, crises can be more severe if an adverse aggregate shock materializes in good times than in bad times. /

This market failure arises because of the coincidence of short-term debt in the capital structures of banks and related financial firms and aggregate shocks to their asset portfolios. Regulation might attempt to address this market failure with a "tax" -- for example, a requirement that a bank hold a minimum level of equity capital that is dependent not just on its own asset portfolio risk and short-term debt but also on "systemic risk" -- that depends on the aggregate component of asset risk and the level of system-wide short-term debt.3 Policies of this type would link regulations to macro-prudential concerns that are related to financial crises and externalities, rather than (or not just) micro-prudential concerns related to the health of individual financial institutions.

In modern financial systems, much leverage is "embedded" in derivative contracts rather associated with traditional short-term debt. A related but subtler externality arises in the context of derivatives. When an insurer sells protection against a risk to a number of counterparties, each party's position potentially affects the payoff on the other parties' positions, in a state of the world where the insurer lacks capital to honor its contractual promises. To reflect this counterparty risk externality suitably in the price of insurance, market participants need to know more than the bilateral positions; they need to know "what else is being done." When risks being hedged are aggregate in nature, private derivative contract terms in general will not internalize the counterparty risk externality, unless terms can be contracted upon the aggregate positions of the insurer. This suggests a potential role for creating transparency in derivatives markets, or requiring centralized clearing of relatively large over-the-counter (OTC) derivatives markets, as part of macro-prudential regulation. 4

Regulatory Failures: Micro-prudential capital and liquidity rules

Financial crises engulfed the Western economies beginning in 2007, and most prominently affected the United States during 2007-8. In the period leading up to the crisis, banks and related financial firms had extensive short-term debt and common exposure to residential mortgage assets. When an aggregate shock materialized by end of 2006, in the form of a secular housing price decline in the United States, short-term debt rollovers became increasingly difficult. There weren't adequate pools of capital to move mortgage assets off the balance-sheets of the financial sector and, eventually, short-term debt markets froze for many financial firms, leading to en masse failures in the fall of 2008.

At a high level, these facts fit the theoretical narrative of financial crises presented above. It is interesting to note, though, that there was elaborate regulatory apparatus in place both before and during the crisis, in particular in the form of Basel capital requirements. It is thus useful to understand why the financial sector's health eroded so rapidly following the housing price shock. Three examples of regulatory failures stand out from my work addressing the exposure of the financial sector as a whole to short-term debt and aggregate risk.

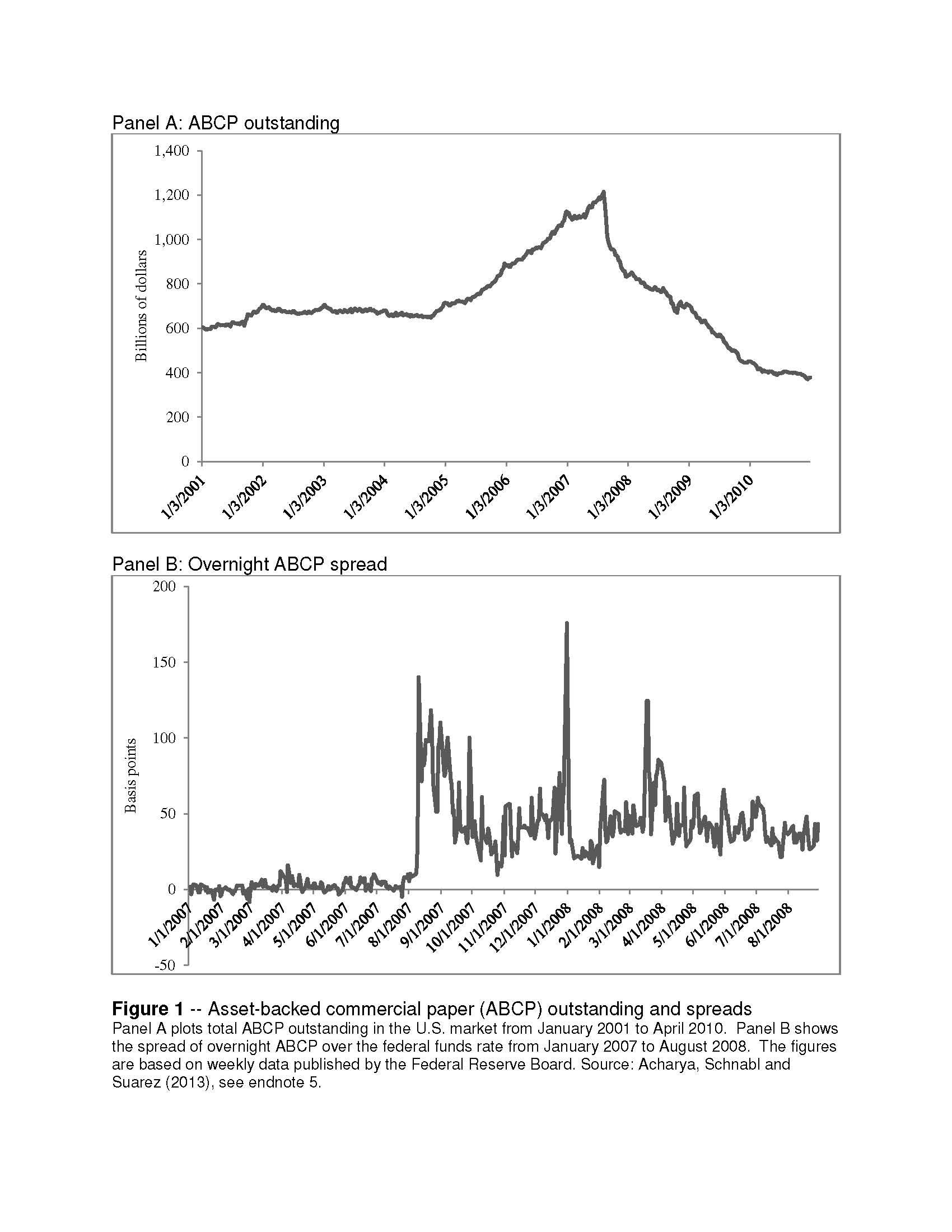

First, the financial crisis erupted in the form of rollover problems for short-term asset-backed commercial paper (ABCP) issued by special purpose vehicles (called "conduits" and structured investment vehicles, or SIVs). Many of these vehicles were sponsored by commercial banks and effectively guaranteed by them. These guarantees implied that the perceived risk transfer from special purpose vehicles was, in effect, non-existent. Adequate treatment for sponsoring such conduits with guarantees was, however, absent in regulatory capital requirements.5 The importance of this regulatory policy can be seen by examining the international data: they show that countries such as the United States, the United Kingdom, and Germany, which adopted lax capital treatment of ABCP vehicles, had significant presence of their commercial banking sectors in the ABCP market, whereas their counterparts in Spain and Portugal, which adopted more prudent capital treatment of ABCP vehicles, had virtually no presence in this market.6 In effect, while the commercial banking sector looked well-capitalized on the regulatory capital front during 2003-7, it had in fact built up significant short-term debt in shadow banks without an economic transfer of risks. This short-term debt experienced rollover problems beginning on August 8, 2007, precipitating the crisis (see Figure 1).

Second, as the rollover problems of short-term debt persisted, given the lack of housing market recovery during 2007-8, banks and shadow banks sustained severe losses. The market value of their equity collapsed. A macro-prudential or system-wide approach to capital requirement of the financial sector necessitated a prompt response at the early stage of the crisis in order to get banks to reduce their reliance on short-term debt by issuing equity capital to redeem the debt that was coming due. And, further erosion of equity capital through payouts to employees and shareholders would have made the financial sector even more fragile. Nevertheless, not only did the distressed financial firms not reduce reliance on short-term debt, but they in fact paid out significant dividends – in some cases, increasing the payouts – in spite of mounting losses.7 Throughout this period, banks were deemed to be well-capitalized by (micro-prudential) regulatory capital standards. This contributed to the lack of any significant regulatory action for addressing the worsening rollover risk of banks. In the end, this led to failure or near-failure of most of the largest financial firms in the United States and Western Europe, captured saliently by Lehman Brothers filing for bankruptcy on September 15, 2008.

Third, markets as well as regulators were caught off-guard by the case of AIG Financial Products, which had over $500 billion in notional outstanding insurance ("credit protection") sold to counterparties which were themselves large banks and financial firms. AIG FP was essentially deemed to be safe based on its current rating, but in effect it had significant leverage conditional on a future downgrade, and especially so if such downgrade coincided with system-wide stress: such stress would lead to recognition of losses in market prices of its assets and a demand for immediate collateral by its counterparties. The public disclosures provided by AIG FP show that the rollover risk it faced was never stated with adequate granularity with respect to significant downgrades, nor did it take account of the underlying aggregate risk exposure of the insurance it had sold to counterparties. Such disclosure or transparency was also not required by AIG FP's regulators, allowing the build-up of its significant derivatives book in an unchecked manner. 8

Why did these "regulatory failures" arise? While potential explanations abound, a leading candidate is that regulation was focused on ensuring the safety and soundness of individual financial institutions. The rules and tools were in many cases inappropriate for assessing the buildup of aggregate risk of assets and of rollover risk from short-term debt of the financial sector.

Market Failures II: Transmission from distressed financial firms to the economy

The market failures arising from failures of large banks, or of banking systems at large, have received substantial attention in the literature. The focus is typically on the contraction of lending from banks to small and medium-sized enterprises – information-sensitive borrowers – and thus bank lending to those not easily re-intermediated by other lenders. My recent empirical work, exploiting as a "laboratory" the period immediately following August 2007 when banks faced rollover risk in the ABCP market, shows that effects of such failures are more far-reaching and multi-faceted than has been traditionally documented.

First, unlike the market stress episodes of the prior decade (notably the 1998 episode surrounding the near-collapse of Long Term Capital Management), the banking sector in the 2007-8 crisis did not experience an immediate net inflow of deposits. From early 2007 until the government bailout package was put in place, depositors appeared concerned about the banking sector's health and moved to prime money-market funds which invested only in government securities. Indeed, several banks with significant exposure to ABCP vehicles and undrawn lines of credit experienced significant rollover risk in the form of withdrawals of uninsured deposits. These banks responded by offering higher deposit rates in order to maintain their deposit base; up until a month before their failure, they succeeded in doing so by luring insured deposits even as their uninsured deposit base shrunk. Focusing jointly on deposit flows and rates helps us understand that rather than banks being passive liquidity backstops or preferred "safe havens" for investors in a crisis, banks are in fact active seekers of funding liquidity. Importantly, the fact that banks in trouble sought funding at aggressive rates imposed a deposit-rate externality on the funding costs other banks.9

Second, the effect of aggregate risk on bank intermediation activity is not limited to spot or term lending as is the focus of current literature. Banks provide liquidity insurance in the form of lines of credit to corporations, enabling corporations to free up cash holdings for profitable investments. As aggregate risk rises, the ability of the banking sector to smooth fees across firms and to honor the lines of credit declines, limiting the extent of liquidity insurance provided to corporations (fewer initiations of lines of credit, as well as higher fees, smaller amounts, and shorter maturities on initiations. This, in turn, induces greater cash holdings and lower investment, even by relatively large corporations of the economy. 10

Third, these effects were not limited to banks in the United States. Foreign banks provide a significant proportion of intermediation in the form of lines of credit in the United States. While the U.S. banks struggled for deposit funding too, as explained above, their funding was eased in part by the provision of public funding (starting in the fall of 2007) by the Federal Reserve and Federal Home Loan Banks. In contrast, many foreign banks without a depository base in the United States lacked access to public funding and faced "dollar shortages" -- that is, rollover risk in dollars. As a result, the terms on lines of credit provided by foreign (European) banks to U.S. corporations relative to foreign borrowers worsened until December 2007 (when dollar swap lines were put in place by the Federal Reserve for foreign central banks), relative to such a differential effect in terms of lines of credit provided by U.S. banks. 11

Fourth, inter-bank markets were significantly impaired because of the precautionary demand for liquidity of banks exposed to rollover risks. Using data from the United Kingdom, where large settlement banks indicate to the Bank of England each month their desired liquidity in the form of requested reserves, it can be seen that (exposed) banks raised their liquidity demands (more) following the ABCP freeze in August 2007 and the failure of Bear Stearns in March 2008. This liquidity demand was coincident with a rise in spreads charged in the inter-bank market, over and above the Bank of England policy rate, in both secured and unsecured markets. Furthermore, using data on bilateral inter-bank transactions, this rise in spreads can be attributed to the funding problems faced by lending banks rather than to the condition of borrowing banks. This suggests that the inter-bank market stress during 2007-8 was at least in part attributable to precautionary hoarding of liquidity by a significant part of the banking sector that faced rollover risk, and not just to an increase in the counterparty risk of borrowers. 12

Finally, besides the precautionary demand for liquidity by banks facing rollover risk, relatively healthier banks can have strategic demand for liquidity for acquiring troubled banks, especially as the crisis gets deeper and bank failures become imminent. This can lead to further reduction in liquidity that is available in the aggregate for funding the financial system, households, and corporations. Evidence suggests that such a motive for holding cash took hold, especially around the failure of Lehman Brothers in September 2008.13

Conclusion

To summarize, existing theories and evidence on banking crises based on market failures (namely, the reliance of financial firms on short-term debt and the externalities from en masse failures of financial firms to roll over short-term debt) and regulatory failures (imperfect, incomplete, and sometimes misguided regulation) help us to understand both the regular incidence of crises in modern financial systems and their adverse consequences. Financial crises in the Western economies that started in 2007 bear testimony to the usefulness of this existing paradigm. Indeed, the paradigm appears to be a good starting point for thinking about the role of macro-prudential regulation, which considers the financial system at large, as well as micro-prudential regulation that is narrowly focused on the health of individual financial firms.

My current research explores a third failure, government failure, which arises because of myopic decision making in fiscal policy as well as policy aimed at bailing out a distressed financial sector. These government failures have the dramatic implication that financial sector and sovereign credit risks are intimately tied. Bank failures can trigger sovereign credit risk if bailouts lead the sovereign to sacrifice its creditworthiness; conversely, deterioration of sovereign credit risk can impose "collateral damage" on the financial sector directly through its holdings of government bonds and indirectly through the implicit government guarantees of the financial sector. 14 Perversely, this bank-sovereign two-way feedback may in fact be preferred by myopic governments that are reluctant to cut back on populist spending: entanglement of the financial sector with the sovereign is perceived by investors as a sign that the sovereign will find it too costly to default, boosting the sovereign's ex-ante ability to raise debt and spend, but resulting in a worse sovereign and financial crisis ex post. 15 Integrating governments and public policy into the existing models of banking crises remains an important topic for further work, as suggested by the ongoing banking and sovereign crises in the Eurozone.

1. For a formal model capturing both the private desirability of short-term debt and how it can lead to aggregate crises (especially in times of good fundamentals), see V. V. Acharya and S. Viswanathan, "Leverage, Moral Hazard and Liquidity", NBER Working Paper No. 15837, March 2010, published in the Journal of Finance, 66, (2011), pp.99-138.

2. Such rollover risk and short-term debt freeze is modeled in V. V. Acharya, D. Gale, and T. Yorulmazer, "Rollover Risk and Market Freezes", NBER Working Paper No. 15674, January 2010, published in the Journal of Finance, 66, (2011), pp.1175-1207.

3. An implementable tax calculation based on systemic risk assessment of the financial sector can be found in V. V. Acharya, L. H. Pedersen, T. Philippon, and M. Richardson, "How to Calculate Systemic Risk Surcharges", published in Quantifying Systemic Risk, J. G. Haubrich and A.W. Lo, eds. Chicago, IL: University of Chicago Press, 2012.

4. Counterparty risk externality arising in opaque over-the-counter derivatives markets is formalized in V. V. Acharya and A. Bisin, "Counterparty Risk Externality: Centralized versus Over-the-counter Markets", NBER Working Paper No. 17000, April 2011.

5. Description of the ABCP conduits, their guarantees from commercial banks, and their eventual "runs", can be found in V. V. Acharya, P. Schnabl, and G. Suarez, "Securitization without Risk Transfer", NBER Working Paper No. 15730, February 2010, published in the Journal of Financial Economics, 107, (2013), pp. 515-36.

6. V. V. Acharya and P. Schnabl, "Do Global Banks Spread Global Imbalances? The Case of Asset-Backed Commercial Paper During the Financial Crisis of 2007-09", NBER Working Paper No. 16079, June 2010, published in IMF Economic Review, 58, (2010), pp.37-73.

7. V. V. Acharya, I. Gujral, N. Kulkarni, and H. S. Shin, "Dividends and Bank Capital in the Financial Crisis of 2007-09", NBER Working Paper No. 16896, March 2011.

8. See a discussion of current disclosure practices of large financial institutions with regard to derivatives-linked collateral or margin liabilities, in V. V. Acharya, "A Transparency Standard for Derivatives", NBER Working Paper No. 17558, November 2011, published in Risk Topography: Systemic Risk and Macro Modeling, M, K. Brunnermeier and A. Krishnamurthy, eds., forthcoming from the University of Chicago Press.

9. These results are contained in V. V. Acharya and N. Mora, "Are Banks Passive Liquidity Backstops? Deposit Rates and Flows during the 2007-09 Crisis", NBER Working Paper No. 17838, February 2012.

10. V. V. Acharya, H. Almeida, and M. Campello, "Aggregate Risk and the Choice between Cash and Lines of Credit", NBER Working Paper No. 16122, June 2010, forthcoming in the Journal of Finance.

11. V. V. Acharya, G. Afonso, and A. Kovner, "How do Global Banks Scramble for Liquidity? Evidence from the Asset-Backed Commercial Paper Freeze of 2007", forthcoming as an NBER Working Paper.

12. V. V. Acharya and O. Merrouche, "Precautionary Hoarding of Liquidity and Inter-Bank Markets: Evidence from the Sub-prime Crisis", NBER Working Paper No. 16395, September 2010, published in Review of Finance,17(1), (2013), pp.107-60.

13. See theory and empirical evidence for strategic demand for cash in a crisis in V. V. Acharya, H. S. Shin, and T. Yorulmazer, "Crisis Resolution and Bank Liquidity", NBER Working Paper No. 15567, December 2009, published in Review of Financial Studies, 24(6), (2011), pp. 2166-2205.

14. For theoretical and empirical treatment of this bank-sovereign nexus, see V. V. Acharya , I. Drechsler, and P. Schnabl, "A Pyrrhic Victory? Bank Bailouts and Sovereign Credit Risk", NBER Working Paper No. 17136, June 2011.

15. V. V. Acharya and R. G. Rajan, "Sovereign Debt, Government Myopia and the Financial Sector", NBER Working Paper No. 17542, October 2011, forthcoming in Review of Financial Studies.