Post-Pandemic Disinflation in the Historical Context

Central banks' decisions about when and how to adjust monetary policy require weighing multiple objectives. In Trade-offs over Rate Cycles: Activity, Inflation, and the Price Level (NBER Working Paper 33825), Kristin Forbes, Jongrim Ha, and M. Ayhan Kose estimate the policy trade-offs across 24 advanced economies from 1970 through 2024 and consider the post COVID-19 monetary tightening against this backdrop. The researchers compile a comprehensive database of "rate cycles"—periods of monetary policy easing and tightening—by identifying turning points in policy interest rates while also incorporating information on quantitative easing and tightening programs.

Analysis of monetary policy cycles in 24 advanced economies finds that delayed and aggressive rate hikes after the pandemic combined with strong central bank credibility contributed to historically low output losses per unit of disinflation, but also a large increase in prices.

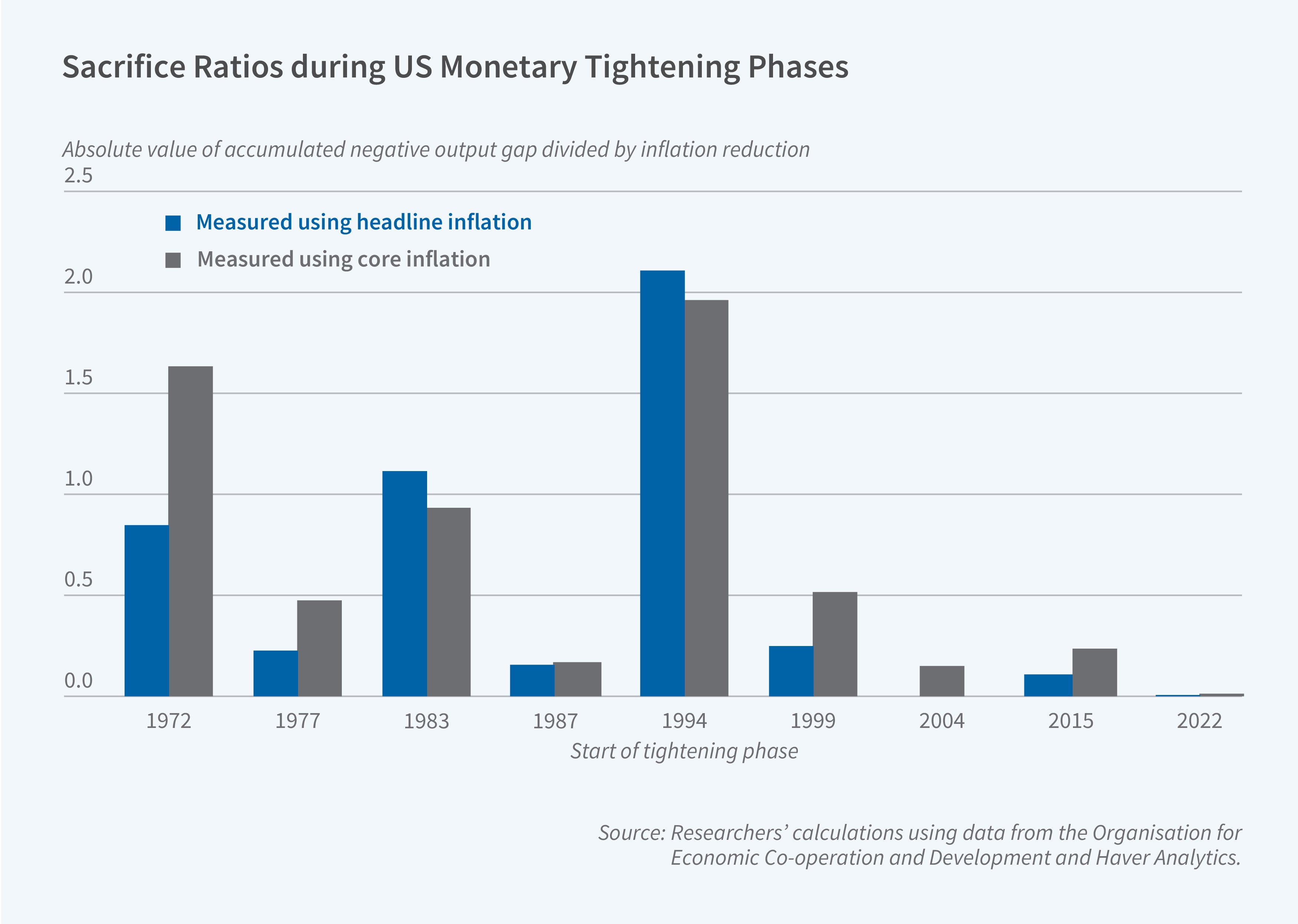

The researchers calculate the “sacrifice ratio,” the output loss per unit of inflation reduction, during tightening phases. They also calculate the increase in the price level in excess of the increase that would have occurred with 2 percent inflation, as well as a “price-output trade-off ratio” that indicates how much of the macroeconomic adjustment during tightening phases occurs through price level increases rather than output losses. They highlight the importance of considering these types of effects on prices when evaluating different strategies for monetary policy as large increases in the price level can have long-term effects on wage and price setting, including weakening the anchoring of inflation expectations and transmission of monetary policy.

The post-pandemic tightening exhibited several distinctive characteristics. Conditional on macroeconomic conditions, central banks were unusually slow to begin raising rates, but once they began, their rate hikes were unusually aggressive. The median sacrifice ratio during the post-pandemic period was close to zero—the lowest of any historical period examined. This reflected a combination of historically large disinflations—with a median decline of 8.5 percentage points in Consumer Price Index inflation across their sample of advanced economies—paired with minimal output losses. Simulations using the Federal Reserve's FRB/US model support these empirical findings.

However, the sacrifice ratio does not capture one key adjustment cost: the impact of monetary tightening on the price level. During the post-pandemic tightening, the median excess increase in the price level was about 4 percentage points per year above what would have occurred with 2 percent inflation—the largest such increase since the mid-1980s. More of the post-pandemic macroeconomic adjustment occurred through price increases than through output losses compared to historical patterns. These calculations also suggest caution in interpreting the sacrifice ratio; delayed starts to tightening monetary policy resulted in lower sacrifice ratios because they allowed for larger inflation overshoots, which in turn enabled larger subsequent disinflations, but also generated greater increases in prices.

In the cross-country analysis, central bank credibility stands out as the one institutional feature consistently associated with favorable outcomes such as lower sacrifice ratios, smaller output losses, larger disinflations, and more moderate increases in the price level.