Pandemic-Related Shifts in Low Wage Labor Markets

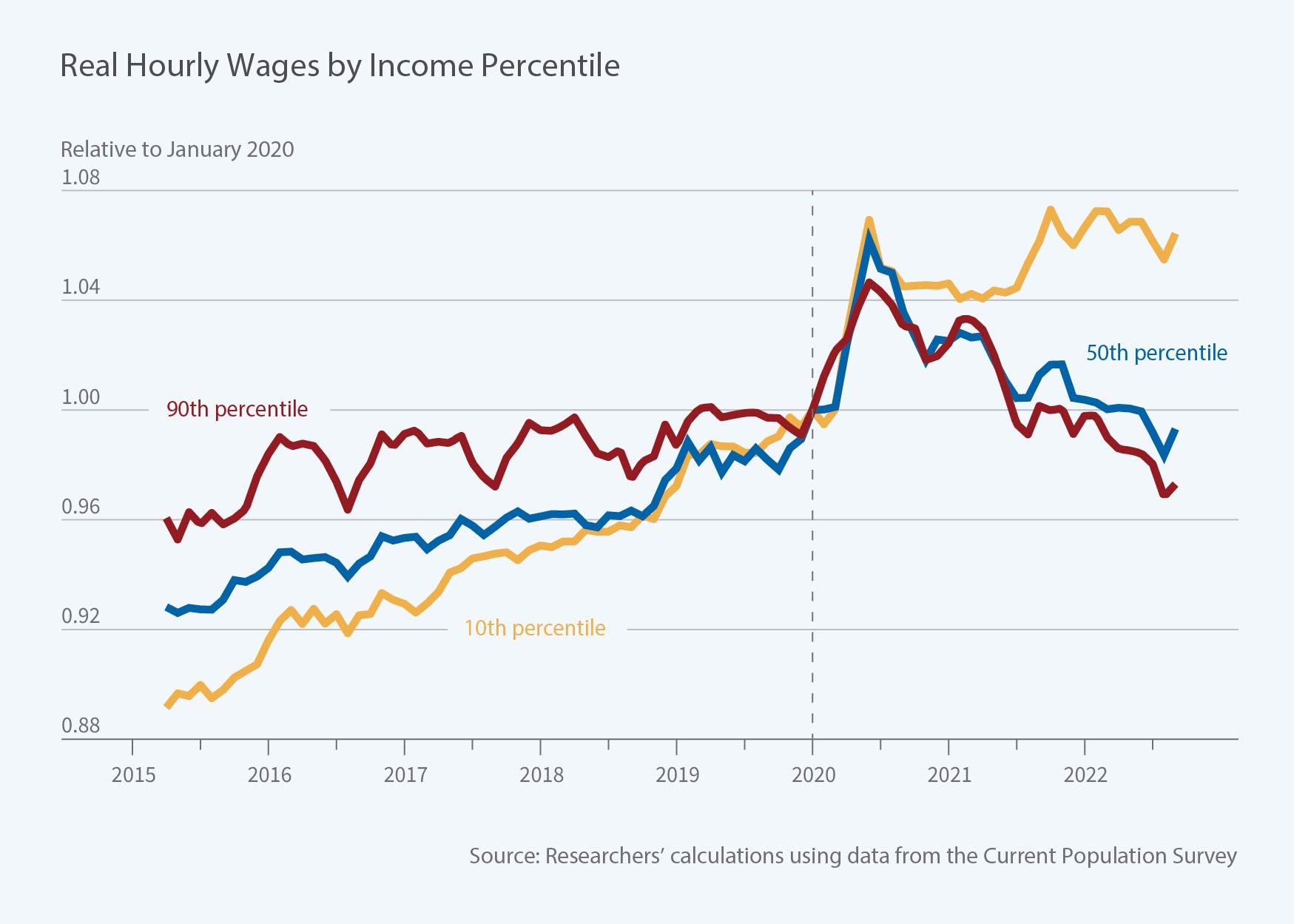

While the onset of the COVID-19 pandemic saw the sharpest drop in US employment of the post-WWII era, the post-2020 employment rebound has been as dramatic as the fall that preceded it. Amidst this labor market tightening, the relative standing of young, non-college-educated workers — who are disproportionately near the bottom of the earnings distribution — improved. Real wages of workers at the 10th percentile of the hourly earnings distribution rose by 6.4 percent between January 2020 and September 2022. Simultaneously, they fell by 0.7 percent at the median and 2.7 percent at the 90th percentile. This erased more than one-fourth of the growth in 90-10 log wage inequality in the US labor market over the past 40 years, and it contracted the wage premium for college-educated workers, David Autor, Arindrajit Dube, and Annie McGrew report in The Unexpected Compression: Competition at Work in the Low Wage Labor Market (NBER Working Paper 31010).

Job transitions increased in mid-2021 and remained above prepandemic levels, particularly among younger workers, high school educated workers, and workers in the service and hospitality industries.

What’s changed? A textbook interpretation is that the labor market has moved from one efficient competitive equilibrium to another, the latter featuring higher wages for young, non-college-educated workers. An alternative interpretation is that the low-wage labor market has become more competitive, with less-productive firms less able to hold on to workers. The distinction matters: a more competitive labor market doesn’t just raise pay; it improves allocative efficiency as workers decamp from less- to more-productive employers.

The researchers distinguish between these cases by analyzing the link between labor market tightness, job moves, and wage growth. In the textbook competitive model, a tightening labor market operates like a rising wage tide: all boats float higher at their moorings. In the imperfectly competitive setting, however, a tightening labor market accelerates reallocation. The “quit elasticity” — meaning the sensitivity of worker job changes to (low) wage levels — grows in magnitude, and the ensuing wage gains are concentrated among job-changers, not job-stayers.

This latter case appears consistent with the data. The researchers find that job-to-job transitions increased in mid-2021 and remained above prepandemic levels, particularly among younger workers, high school educated workers, and workers in the service and hospitality industries. While the quit elasticity in the overall workforce declined slightly, it increased among young, high school educated workers. Simultaneously, these workers saw significantly more mobility towards higher-wage industries. Although industry moves are less than one-fourth as frequent as industry stays, such moves account for 40 percent of the differential post-2020 wage growth among young, high school educated workers, with both the wage premium of industry movers and the rate of industry moves rising as the labor market tightened. This collage of evidence suggests that the pandemic reduced employer market power, enabling young non-college-educated workers to disproportionately move from lower-paying to higher-paying and potentially more-productive jobs.

The researchers caution that due to the small sample size of the monthly Current Population Survey dataset, which undergirds their analysis, and the absence of consistent annual data on job separations, these inferences await further testing.