Strengthening Incentives for Vaccine Development

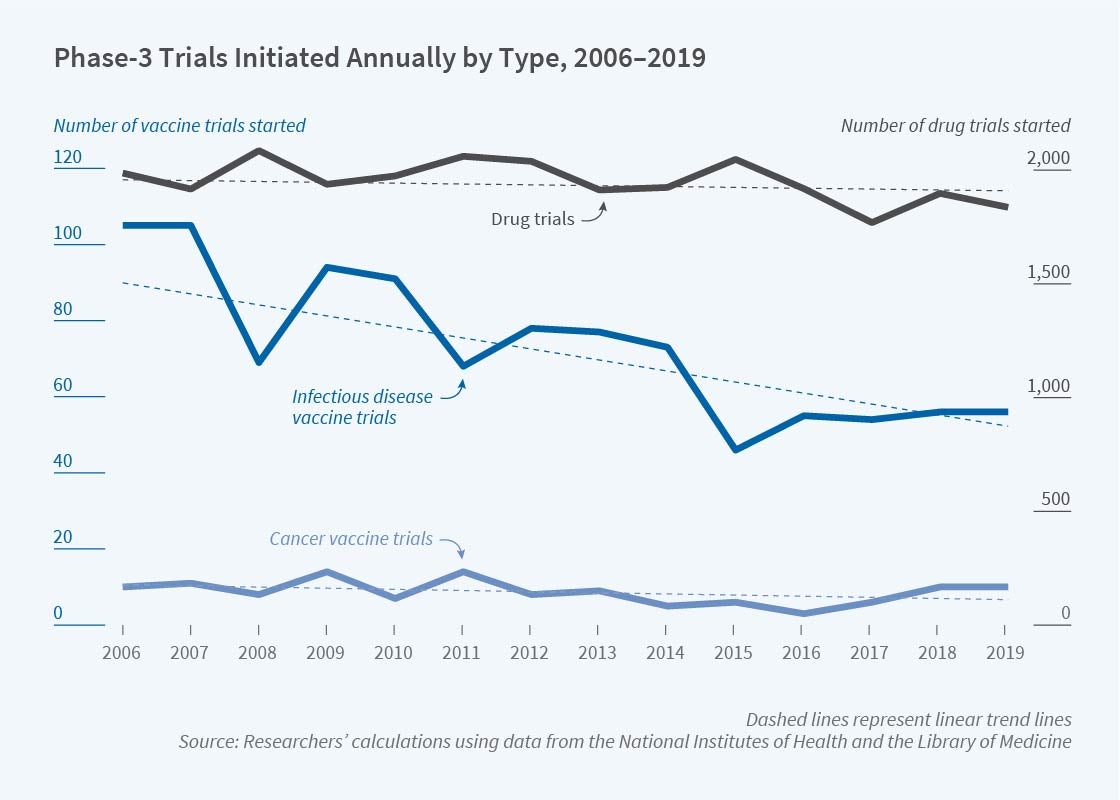

Along with improvements in sanitation and nutrition, vaccines have been given credit for substantial reductions in illness and death. Yet the level of research activity devoted to developing new vaccines, at least prior to COVID-19, raises concerns about whether the incentives to develop vaccines are commensurate with the benefits derived from them. Figure 1 shows counts of Phase 3 clinical trials registered annually from 2006 to 2019 by the National Institutes of Health. The number of vaccine trials (left scale), averaging about 75 per year for infectious diseases, is overshadowed by drug trials (right scale), averaging about 1,950 per year. Annual trials for infectious-disease vaccines trend sharply downward compared with the relatively constant number for drugs and for cancer vaccines.

Vaccines versus Drugs

A list of reasons could be offered for why pharmaceutical manufacturers prefer developing drugs to vaccines despite the high social returns to vaccines. Vaccines are part public good: increasing the number of people who are vaccinated reduces the infection risk for those who are unvaccinated, reducing their willingness to pay. A drug that treats symptoms but does not reduce transmission would not raise this free-rider problem and thus could be more lucrative. The free-rider problem associated with vaccines is well known, and indeed has in part justified widespread government involvement in the vaccine market via US programs such as Vaccines for Children. Such involvement may enhance incentives to develop and produce vaccines, but this is not guaranteed if negotiated prices end up being lower than what firms would charge on the private market. Another reason vaccines may be less lucrative than other drugs is that liquidity-constrained consumers may be better able to afford a sequence of periodic payments for a drug regimen spread out over several months than a large, up-front payment for a vaccine delivering the same health benefits. Behavioral economics might suggest that, owing to salience effects, willingness to pay is higher for a drug taken while an illness is experienced than for a vaccine taken as a preventative.

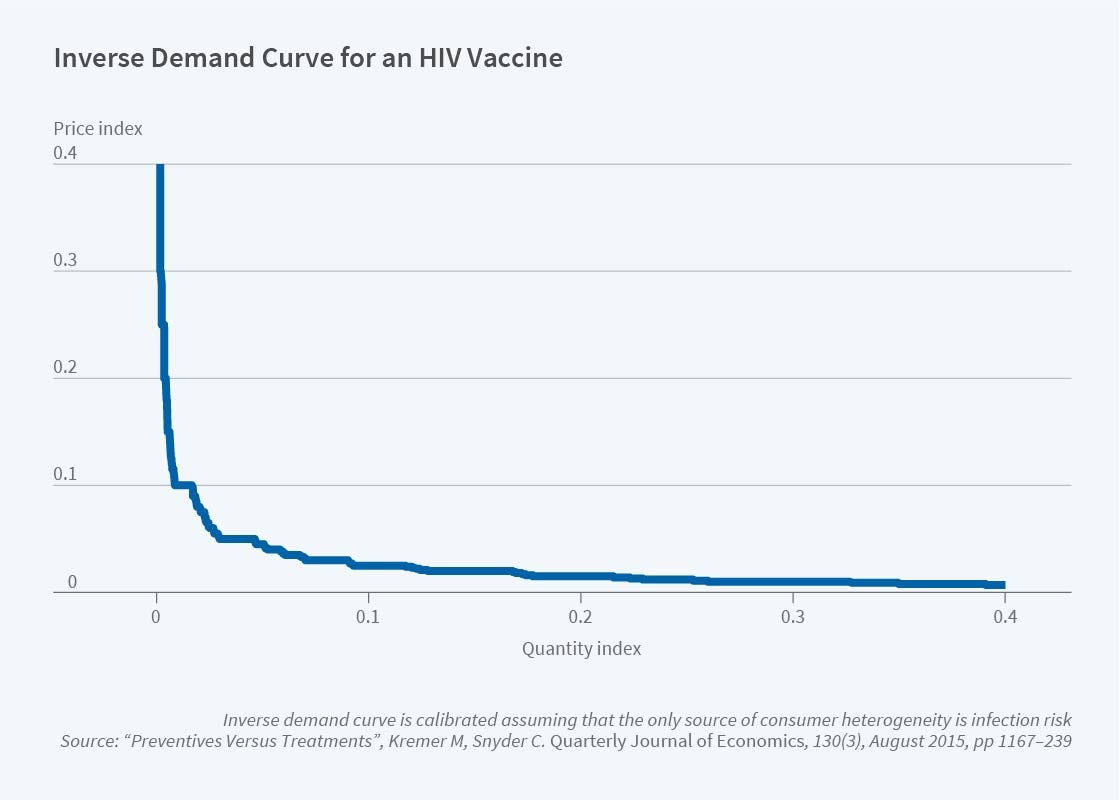

Our joint research on vaccines has provided another reason why drugs may be more lucrative than vaccines: even positing that the level of demand is the same for vaccines and drugs, the shape of the demand curves may differ.1 The shape of vaccine demand depends on the possibly quite skewed distribution of disease risk in the population. During the HIV epidemic in the United States, for example, a vaccine developer seeking to extract the high value concentrated in the high-risk population would find only a small market. Holding constant the average consumer value across the two products, the distribution of values differs across vaccines and drugs because disease-risk uncertainty is resolved once a person contracts the disease and becomes a customer for a drug. Although pharmaceuticals are not sold on pure private markets but are mediated through insurance policies and government programs, private-market outcomes still bear on equilibrium, presuming that prices are negotiated in the shadow of private markets.

To quantify this effect, Figure 2 illustrates the demand curve for a vaccine derived from a model of HIV risk that is linear in sexual partners reported in 2010 survey data. The curve shows that only a few of the potential buyers are prepared to pay high prices, which places a tight upper limit on the potential revenue that a vaccine developer can expect.2

In follow-on research, we employed international data to calibrate HIV pharmaceutical demand.3 The distribution of income across countries is such that, for a range of estimates of the income elasticity of health-care expenditures, the calibration of international demand for both vaccines and drugs is similar to the demand curve that we show in Figure 2, and therefore entails weak incentives for pharmaceutical R&D. A variety of counterfactual exercises can be performed using calibrated demands. For example, we show that uniform pricing would only deliver 44 percent of the profit earned from price discriminating across countries.

Quantifying the Free-Rider Problem

We mentioned that the free-rider problem associated with vaccines is well known. Less well known is which diseases present the worst free-rider problems and thus are the most natural targets for subsidies. We investigate this question in work with Matthew Goodkin-Gold and Heidi Williams. We analyze a susceptible-infected-recovered (SIR) model, which is standard in epidemiology, and overlay a vaccine market populated by rational consumers and profit-maximizing firms.4

We start by analyzing the steady-state equilibrium for an endemic disease such as HIV or measles that requires every new cohort to be vaccinated. The key parameter is the index of disease infectiveness provided by the basic reproductive number R0, the expected number of people directly contracting the disease from an infected person introduced into a susceptible population. While it is natural to think prevalence is increasing in R0, in fact, prevalence is hump-shaped once economic incentives of consumers and producers are considered. For moderate values of R0, the disease is too infectious to die out but not so infectious as to eliminate free riding. In our benchmark scenario, prevalence is maximized for R0 = 4, falling into the range that epidemiologists have estimated for HIV, leading to some pessimism regarding the impact of an HIV vaccine absent government subsidy.

But subsidies have shortcomings, too. The free-rider problem exacerbates monopoly incentives to distort quantity downward to keep prices high. We find that to counteract the severe distortions and achieve the first best when R0 = 4 would require a per-dose subsidy for the vaccine that would be roughly three times estimates of the monetary value that those afflicted with the disease would be prepared to pay to recover. A more practical government policy would therefore involve negotiating a bulk purchase for the population.

Adapting this analysis to the COVID-19 pandemic requires recognizing the possibility of a vaccine campaign to quell the epidemic before it becomes endemic. We describe the values of R0 and the susceptible proportion of the population under which a vaccine exhibits increasing social returns. Policymakers have proposed rolling out limited vaccine supplies evenly across jurisdictions. In our model, under conditions that appear to be satisfied by COVID-19, vaccinating one jurisdiction at a time may be more efficient. For a disease with enough explosive potential, vaccinating a small group in two places may do little to slow its spread in either. To be sure, there are good reasons to spread unlimited supplies evenly — to everyone — and to vaccinate highly vulnerable or super-spreading individuals everywhere first. However, the increasing social returns associated with vaccination programs provide a force in the opposite direction, toward concentrating limited supplies in fewer jurisdictions.

Advance Market Commitments

Vaccines are highly cost-effective tools to improve global public health.5 Yet the lag between the rollout of vaccines in rich and poor countries and the slow development of vaccines targeting diseases concentrated in poor countries suggests that private-market incentives to develop vaccines for poor countries may be particularly limited. Low-income consumers cannot afford the high prices that would make a market lucrative. Aid agencies stepping in to purchase on behalf of the countries may use their bargaining power or public pressure to push down prices.

To enhance firms’ incentives to supply vaccines to poor countries, Kremer and Rachel Glennerster analyzed a funding mechanism called an advance market commitment (AMC).6 Through an AMC, donors set up a fund from which a subsidy is paid in exchange for firms’ promise to supply the vaccine at a price close to marginal cost even in the “tail period” after the AMC subsidy fund is exhausted. The donors’ commitment to pay a subsidized price above cost protects firms’ investments from hold-up. The low price in the tail period mitigates market-power distortions. Since the purchase decision is ultimately made by client countries, the product must meet the market test, ensuring the program does not pay for products that satisfy the letter of contract terms, which are impossible to specify perfectly when set far in advance of production, but not user needs.

A pilot AMC directed by the Global Alliance for Vaccines and Immunization, now known as GAVI, was announced in 2007 for a vaccine against pneumococcal disease, which at the time was responsible for annual worldwide deaths of some 700,000 children under age 5. The AMC targeted a second-generation vaccine covering strains endemic in developing countries. Much R&D had already been done on these vaccines, which were well into Phase 3 trials; the pilot AMC was directed at incentivizing investment in capacity to satisfy the projected 200 million doses needed in developing countries.

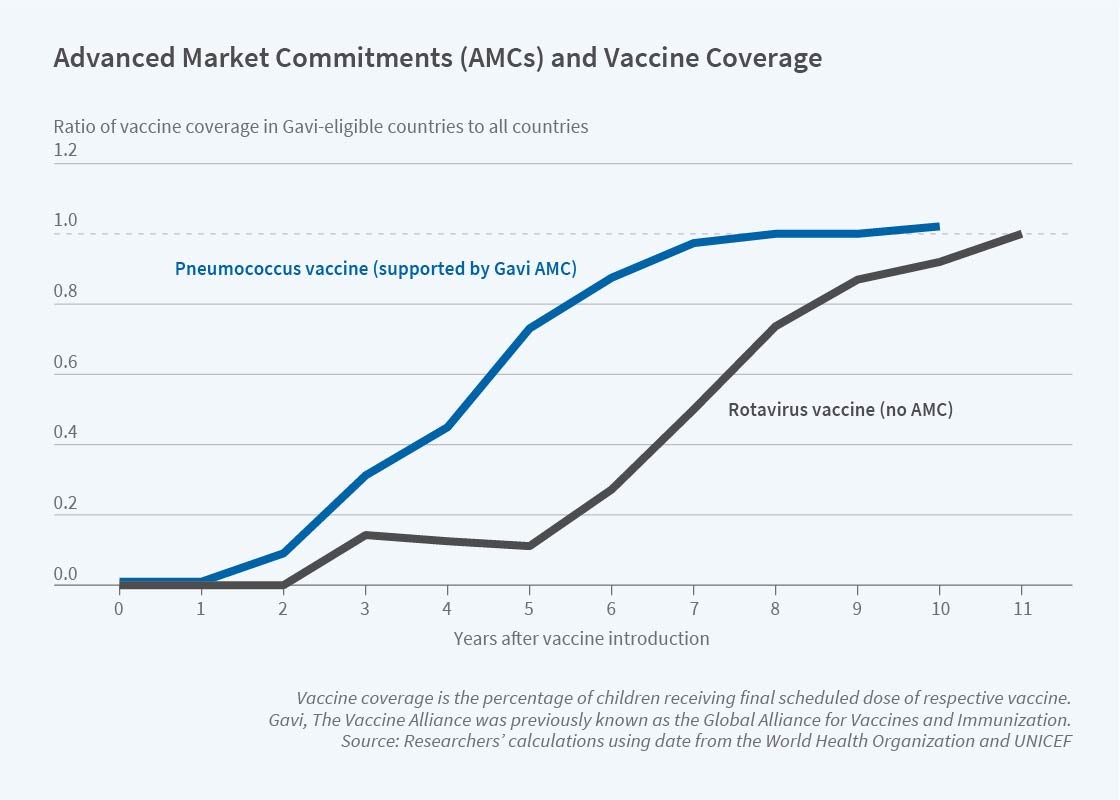

In work with Jonathan Levin, with whom we served on the Economics Expert Group tasked with finalizing design details for the pilot AMC, we explain the AMC idea, document the history of the pilot program, and provide a retrospective assessment of the program’s 10-year run.7 Figure 3 shows that coverage in GAVI countries converged to global levels about five years faster for the pneumococcal vaccine than for the rotavirus vaccine, also rolled out by GAVI and funded at levels similar to the AMC but structured in a different way.

Further work with Levin provides the first theoretical analysis of AMCs.8 A key message is that AMC design depends on the distance between the current technology and the development of full vaccine production at the time the AMC is introduced. An AMC designed to fund the R&D needed for technologically distant products like malaria vaccines may not work well to incentivize the capacity expansion needed for technologically close products like the pneumococcus vaccines in the pilot case. A naïve AMC may allow firms to extract all AMC funds without the expense of expanding capacity: if they do not expand capacity, funds will be extracted at a slower rate, but that just extends the subsidy period during which the fund accumulates interest. Indeed, a naïve AMC may be useless in incentivizing capacity in this setting. Incentives can be improved by adding a feature to the AMC called a supply commitment, limiting what firms can earn as a proportion of the target output they meet. The pilot AMC added a supply-commitment feature on the recommendation of the Economics Expert Group. Incentives can be further improved by structuring the AMC as an advance purchase commitment, a forcing contract that in effect takes the option of producing less than the target output away from firms.

Firms are likely to have better private information about capacity and production costs for technologically closer products, which poses an asymmetric-information problem for the AMC designer. Principles of mechanism design suggest that AMCs should allow firms to earn some information rent when costs of discovery and production turn out to be low, in order to avoid having to distort incentives in the high-cost state of the world further than necessary. Firm rents nevertheless carry the political risk of being viewed as giveaways by those who ignore the asymmetric-information problem. The asymmetric-information problem may be so severe with a technologically close product that an AMC could be cheaper for a technologically distant product despite having to defray R&D in addition to capacity.

AMC for a COVID-19 Vaccine

To mitigate illness and death during the COVID-19 pandemic, countries have gone into economic hibernation, resulting in near-term losses of $11 trillion and longer-term losses of $28 trillion in economic output alone.9 Acceleration of the development and distribution of a vaccine can shorten the pandemic and thereby avoid some of these losses; this can entail spending billions to avoid trillions in losses.

Research with a team of economists, epidemiologists, and policy experts including Amrita Ahuja, Susan Athey, Arthur Baker, Eric Budish, Juan Camilo Castillo, Glennerster, Scott Kominers, Jean Lee, Canice Prendergast, Alexander Tabarrok, Brandon Tan, and Witold Więcek solves the optimal portfolio problem for a country selecting vaccines from the list of over 80 candidates in the pipeline at the outset of the pandemic.10 We account for correlation patterns in success across candidates based on a hierarchical model of technology families and platforms parametrized with input from industry experts. The optimal portfolio, which may include some lower probability candidates that are less correlated with other technologies, is of course larger for richer countries with more GDP at stake — a portfolio of over 20 candidates could be optimal for the United States — but even some of the poorest countries benefit from investing at risk in a handful of candidates. Shifting some funding from “pull” (paying for delivery of successful doses ex post, the standard way AMCs are structured) to “push” (paying developers’ investment costs as they are expended) can reduce program costs, since inducing the marginal candidate to enter with pull funding means paying a potentially large rent to inframarginal candidates with higher success probabilities. Push funding entails its own problems, providing a weaker screen of candidates with unrealistic prospects (adverse selection) and less discipline of cost bloat (moral hazard).11 So a mix of push and pull may be optimal. Indeed, this was the strategy employed in the international COVAX funding program launched by GAVI, and in Operation Warp Speed, launched by the US government. Both programs are designed to incentivize COVID-19 vaccine development. Members of the research team are currently designing an exchange on which allocations of multiple successful candidates could be traded, allowing countries to focus on vaccines best suiting their specific needs and avoid straining their health systems by rolling out too many different candidates.

Endnotes

“Preventives versus Treatments,” Kremer M, Snyder, CM. NBER Working Paper 21012, March 2015, and The Quarterly Journal of Economics 130(3), August 2015, pp. 1167–1239.

The distortions in pharmaceutical markets when consumer values have a distribution of this form carry over to general product markets, as we show in “Worst-Case Bounds on R&D and Pricing Distortions: Theory with an Application Assuming Consumer Values Follow the World Income Distribution,” Kremer M, Snyder CM. NBER Working Paper 25119, October 2018.

“Preventives versus Treatments Redux: Tighter Bounds on Distortions in Innovation Incentives with an Application to the Global Demand for HIV Pharmaceuticals,” Kremer M, Snyder CM. NBER Working Paper 24206, January 2018, and Review of Industrial Organization 53(1), August 2018, pp. 235–273.

“Optimal Vaccine Subsidies for Endemic and Epidemic Diseases,” Goodkin-Gold M, Kremer M, Snyder CM, Williams H. NBER Working Paper 28085, November 2020.

“Cost-Effectiveness and Economic Benefits of Vaccines in Low- and Middle-Income Countries: A Systematic Review,” Ozawa S, Mirelman A, Stack ML, Walker DG, Levine OS. Vaccine 31(1), December 2012, pp. 96–108.

Strong Medicine: Creating Incentives for Pharmaceutical Research on Neglected Diseases, Kremer M, Glennerster R. Princeton, NJ: Princeton University Press, 2004. Additional work by Kremer on AMCs includes “Creating Markets for New Vaccines Part I: Rationale,” Kremer M. NBER Working Paper 7716, May 2000, and Innovation Policy and the Economy 1, pp. 35–72, “Creating Markets for New Vaccines Part II: Design Issues,” Kremer M. NBER Working Paper 7717, May 2000, and Innovation Policy and the Economy 1, pp. 73–118, and “Incentivizing Innovation: Adding to the Tool Kit,” Kremer M, Williams H. Innovation Policy and the Economy 10, pp. 1–17.

“Advance Market Commitments: Insights from Theory and Experience,” Kremer M, Levin J, Snyder CM. NBER Working Paper 26775, February 2020, and American Economic Association Papers and Proceedings 110, May 2020, pp. 269–273. An early assessment of the AMC was provided by “Economic Perspectives on the Advance Market Commitment for Pneumococcal Vaccines,” Snyder CM, Begor W, Berndt E. Health Affairs 30(8), August 2011, pp. 1508–1517.

“Designing Advance Market Commitments for New Vaccines,” Kremer M, Levin J, Snyder CM. NBER Working Paper 28168, December 2020.

“A Long, Uneven, and Uncertain Ascent,” Gopinath G. IMFBlog, October 13, 2020.

“Investing in Accelerating a COVID-19 Vaccine,” Ahuja A, Athey S, Baker A, Budish E, Castillo JC, Glennerster R, Kominers SD, Kremer M, Lee J, Prendergast C, Snyder CM, Tabarrok A, Tan BJ, Więcek W. American Economic Association Papers and Proceedings, forthcoming 2021.

On the optimal design of a pure pull-funding mechanism, see “Designing Pull Funding for a COVID-19 Vaccine,” Snyder CM, Hoyt K, Gouglas D, Johnston T, Robinson J. Health Affairs 39(9), September 2020, pp. 1633–1642.