Empirical Analysis of Bargaining

Our most important economic transactions are conducted through bargaining. This includes wage negotiations, large purchases from homes to cars and mattresses, the organization of the household, the sale of a company, and the terms of a supplier contract. It is therefore important to understand the determinants of bargained outcomes, as well as whether, and at what cost, bargaining will be successful.

A large body of theoretical and experimental work in economics endeavors to answer these questions. However, until recently, we have had little data on real-world bargaining interactions to hold this literature to account. The economics literature on bargaining has consequently grown increasingly distant from the practice and teaching of bargaining and negotiations in law schools and business programs.

Recently, however, a number of economists have found creative sources of data that permit the study of bargaining, including in hospital procurement of medical supplies, post-auction negotiations in wholesale auto sales, negotiations over homes, the GATT negotiations, and even documented historical records of negotiations between the Catholic Church in Spain and Tunisian pirates.1 We contribute to this growing literature by studying bargaining on the eBay Best Offer platform. There are many limitations of this environment: it is small stakes as bargained transactions go, and the products bargained over are quite heterogeneous. But it also has many strengths, including the availability of detailed offer-level bargaining data, a rich and theoretically familiar bargaining protocol, and observable communication between buyers and sellers. We make a large amount of this data publicly available to foster empirical analysis of bargaining.2 In what follows we describe the dataset, as well as what we learn from studying it.

Best Offer Bargaining

Best Offer is a free listing feature for sellers on the eBay marketplace. It is only available for buy-it-now (BIN) listings, eBay’s fixed price format, and not for auction-style listings. If enabled, buyers arriving at the listing have two options: they may either purchase at the advertised BIN price or they can make the seller an offer. If an offer is submitted, the seller has 48 hours to accept, reject, or counter. If the seller counters, then the buyer, in turn, has 48 hours to accept, reject, or counter. And if the buyer counters that offer... and so on, for up to three rounds for each player. This structure is similar to the extensively studied Rubinstein-Stahl alternating sequential offers bargaining protocol.3

Behavioral and Rational Models

A large theoretical literature explores various aspects of alternating offers sequential bargaining games. In work with Thomas Blake and Brad Larsen, we present a series of descriptive analyses that seek to confirm or refute predictions from this literature.4

Many of the patterns in the dataset are broadly consistent with existing rational models of bargaining. For instance, two of the main theoretical predictions are, first, that buyers who are more patient will obtain better deals, and, second, that bargaining is costly. We confirm that buyers who select slower shipping methods, who may indeed be more patient, obtain lower prices. Also, bargaining does appear to be costly. In particular, for items listed for under $50, buyers are relatively more likely to pay the seller’s asking price rather than to make an offer. Furthermore, when the buyer does make an offer for cheaper goods, the seller is much more likely to accept it than haggle. These patterns support the notion of fixed costs of bargaining. Importantly, such fixed costs create qualitative differences for items above and below $50, which raises potential external validity concerns for the study of bargaining in laboratory settings, where stakes are typically low.

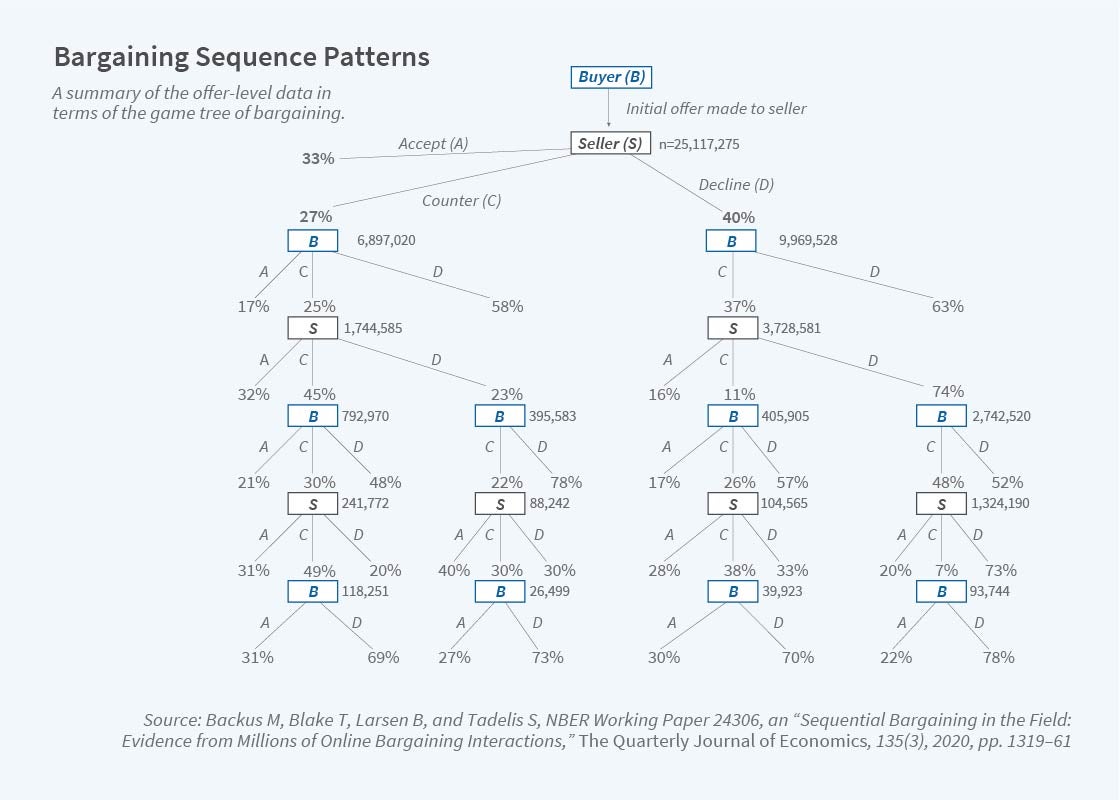

The basic Rubinstein model posits complete information and certain gains from agreement, which in equilibrium leads to immediate agreement between buyer and seller. Many theoretical papers have extended the basic Rubinstein model to incorporate asymmetric information, which in turn rationalizes many different behaviors including delayed agreements, immediate breakdown, and delayed breakdown, all of which we observe in the data. As described in Figure 1, about 17 percent of bargaining threads end in immediate agreement after the buyer’s first offer, while a majority exhibits the full richness of outcomes. Still, other patterns in the data are more difficult to explain using standard theoretical models, even those that allow for incomplete information. Two prevalent behaviors in particular stand out, which we refer to as “reciprocal gradualism” and “split-the-difference” behaviors.

Reciprocal gradualism means that larger concessions by one party are met with larger concessions by the other. This feature of real-life bargaining is notoriously difficult to explain in theoretical models. A second robust and even more puzzling pattern is the prevalence of splitting the difference behavior. The puzzle has two features. The first, perhaps the less surprising, is that bargaining parties are especially likely to make an offer that is halfway between the two prior offers. The second, however, is that these offers appear to work, and introduce a non-monotonicity in the empirical relationship between the generosity of offers and the frequency with which they are accepted. Namely, offers slightly higher than 50 percent — for example, 55 percent of the other party’s most recent ask — are less likely to be accepted even though they are more generous. What is particularly puzzling about both of these phenomena is that the reference points according to which one splits the difference are determined within the context of the bargaining process, rather than on the basis of some external standard. The reference points are merely the prior two offers, one set by each bargainer. Anticipating such behavior, it seems one would do well to engineer extreme reference points in one’s favor.

These descriptive results highlight both the strengths and weaknesses of bargaining theory, and offer paths for future empirical, experimental, and theoretical work. In particular, by highlighting features of real-world bargaining, they suggest research avenues that can productively engage with bargaining practitioners. There are, of course, myriad alternative settings in which we could learn more about bargaining. Even within our setting, however, we have focused exclusively so far on the offers, counteroffers, and outcomes, and neglected potential signaling and communication between buyers and sellers, to which we turn next.

Round Numbers in Bargaining

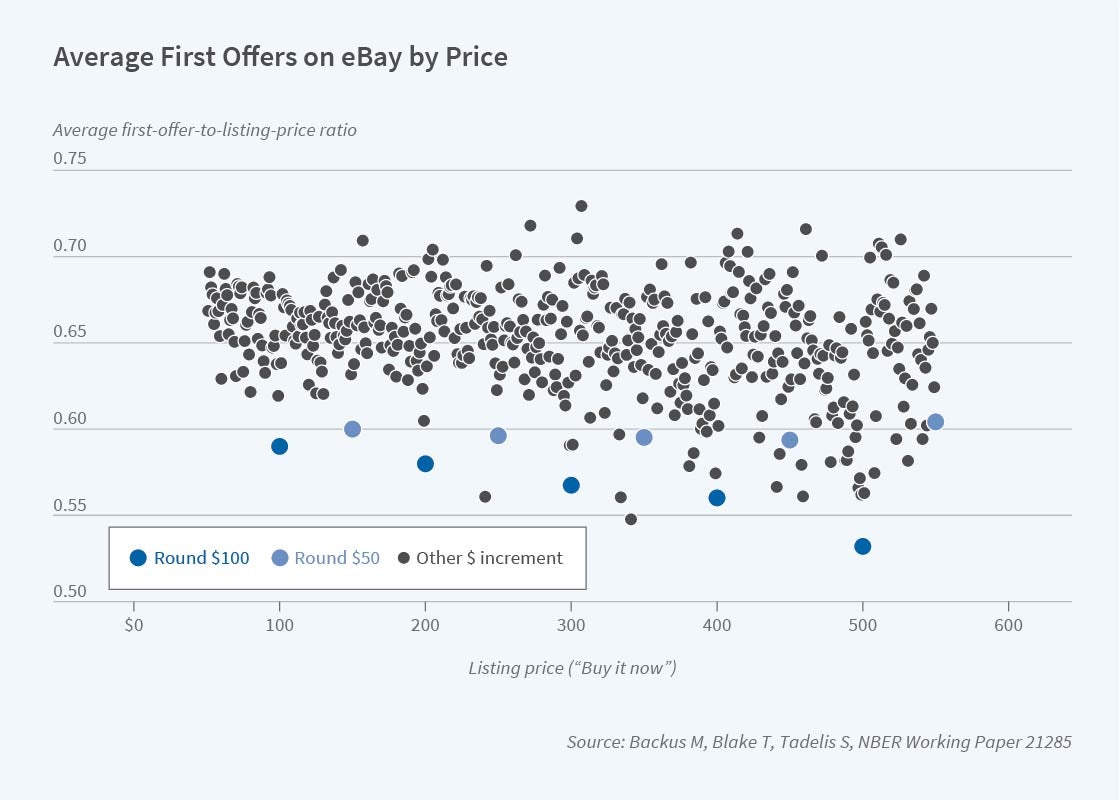

One of the most notable stylized facts we discover is well known to social psychologists: round numbers offers seem to perform poorly in bargaining. The result is depicted in Figure 2. Remarkably, sellers who use round-number listing prices on the 100s receive first offers from buyers that are 8 to 12 percentage points lower than sellers who use nearby round numbers. Prior work attributed this phenomenon to behavioral biases and offered a practical lesson: that round-number offers are to be avoided.

This is particularly puzzling because sellers disproportionately use round-number listing prices. If the social psychologists are right, these sellers are leaving money on the table. We conjecture an alternative explanation: using a round number offer is rational, a “cheap talk” signaling device.

This hypothesis offers a number of testable predictions, which we explore in our work with Blake.5 First, for it to be incentive-compatible for sellers to use round numbers, there must be some other compensating factor. Indeed, there is; we find round-number sellers to be 15 to 25 percent more likely to successfully sell their products. Second, it must be that sellers of different types are sending different signals by choosing round or precise-number listing prices. Again, the evidence supports our hypothesis: buyers who make the same offer, measured by the discount as a fraction of the listing price, to round-number sellers are much more likely to have their offer accepted. Third, and finally, it must be that buyers observe the signal and update their beliefs about seller types. Here the evidence is less direct, but still quite consistent: at the search results page, buyers are much more likely to click on round-number listings, consistent with both expectations of getting a lower price as well as our finding that those sellers are more likely to transact.

To summarize, on these and a few other points the evidence is starkly — and surprisingly — consistent with our “cheap talk” signaling model. The model rationalizes not only the finding in Figure 2, but a whole constellation of empirical regularities that match what we would expect from equilibrium cheap-talk signaling. This sort of model might seem far-fetched in the absence of empirical validation. Our findings illustrate how using rich data from real bargaining and negotiations can offer new directions for research about bargaining.

The Role of Cheap Talk

We also study the role of cheap talk more broadly, moving beyond signaling using round numbers to consider communication between potential buyers and sellers. With Blake and Jett Pettus, we study how communication affects the likelihood of bargaining success.6 Informed by prior experimental work, we had reason to believe that cheap talk communication may facilitate successful bargaining, which we are able to explore by taking advantage of a convenient natural experiment. On eBay.com, a buyer or seller can accompany an offer with a 250-character message. But for largely idiosyncratic reasons, on eBay.de (the German incarnation of eBay), no such communication was allowed prior to May 26, 2016, when the site was adjusted to match the US counterpart. The rollout was immediate for buyers using the desktop version of the platform, but much later for mobile users, setting up a simple difference-in-differences identification strategy.

We find that the availability of text communication improves the probability of successful negotiation, in this case by 7 percent for bargainers who elect to send a message. This effect, however, was not immediate. It rose steadily over the first four weeks, and then stabilized.

We take advantage of the richness of the data and use text analyses to make sense of this pattern. We find that while buyers are typically one-off participants in the mechanism, sellers are repeat players. Moreover, sellers who send multiple messages are adjusting the content of their messages, and doing so in a pattern that converges in those first few weeks. These findings suggest that what we are observing in these dynamics is bargainers learning what to say.

We find that sending a message that is closer in content to what sellers were sending 10 weeks after the introduction of messaging was substantially more likely to be successful in the first few weeks when communication was possible. Using text analysis, we can offer some cursory hints at what they were saying. We find that experienced sellers were polite but less effusive, and that they called particular attention to fees that buyers might not anticipate, such as money transfer processing fees.

Summary

Our research agenda explores the performance of game-theoretic models of bargaining and shows that some features of these models hold up surprisingly well. At the same time, however, it also raises new puzzles and opportunities for future research.

We hope that making the data public will encourage new research on bargaining behavior and outcomes. This research agenda will flourish further once new large-scale bargaining datasets become available, which seems like a reasonable aspiration given the growth of digitally recorded rich data. For example, Kyle Bagwell, Robert Staiger, and Ali Yurukoglu have constructed a novel large-scale dataset on the trade negotiations behind GATT.7 We also expect that new tools will play a role in better understanding the ins and outs of bargaining behavior. Our work uses natural language processing tools to parse text documents, a method that we believe will be central to empirical attempts to understand bargaining.

Endnotes

“Transparency and Negotiated Prices: The Value of Information in Hospital-Supplier Bargaining,” Grennan M, Swanson A. NBER Working Paper 22039, February 2016, and Journal of Political Economy 128(4), April 2020, pp.1234–1268; “The Efficiency of Real-World Bargaining: Evidence from Wholesale Used-Auto Auctions,” Larsen B. NBER Working Paper 20431, August 2014, and forthcoming in The Review of Economic Studies; “The Microstructure of the US Housing Market: Evidence from Millions of Bargaining Interactions,” Mateen H, Qian F, Zhang Y. Stanford University Working Paper, November 2020; “Multilateral Trade Bargaining: A First Look at the GATT Bargaining Records,” Bagwell K, Staiger R, Yurukoglu A. NBER Working Paper 21488, August 2015, and American Economic Journal: Applied Economics 12(3), July 2020, pp. 72–105; “Pirates of the Mediterranean: An Empirical Investigation of Bargaining with Asymmetric Information,” Ambrus A, Chaney E, Salitskiy I. Quantitative Economics 9(1), April 2018, pp. 217–246.

Data are available via NBER at https://www.nber.org/research/data/best-offer-sequential-bargaining.

“Perfect Equilibrium in a Bargaining Model,” Rubenstein A. Econometrica 50(1), January 1982, pp. 97–109.

“Sequential Bargaining in the Field: Evidence from Millions of Online Bargaining Interactions,” Backus M, Blake T, Larsen B, Tadelis S. NBER Working Paper 24306, February 2018, and The Quarterly Journal of Economics 135(3), August 2020, 1319–1361.

“Cheap Talk, Round Numbers, and the Economics of Negotiation,” Backus M, Blake T, Tadelis S. NBER Working Paper 21285, June 2015, and published as “On the Empirical Content of Cheap-Talk Signaling: An Application to Bargaining,” Journal of Political Economy 127(4), August 2019, pp. 1599–1628.

“Communication and Bargaining Breakdown: An Empirical Analysis,” Backus M, Blake T, Pettus J, Tadelis S. NBER Working Paper 27984, October 2020.

“Multilateral Trade Bargaining: A First Look at the GATT Bargaining Records,” Bagwell K, Staiger R, Yurukoglu A. NBER Working Paper 21488, August 2015, and American Economic Journal: Applied Economics 12(3), July 2020, pp. 72–105.