Program Report: Development Economics, 2018

The Development Economics Program, the youngest NBER program, was formed in 2012 to bring together scholars working on fundamental questions related to economic development and the behavior of individuals, families, firms, and institutions in developing countries. Program researchers undertake a wide array of studies to improve understanding of economic growth and productivity, poverty, inequality, and population well-being across the globe.

Of about 125 program members, nearly three-quarters also are affiliated with other NBER programs; Development Economics is the primary affiliation for about half the program members. This reflects both the breadth of development economics within the economics discipline and the fact that many of the central questions in development are also major questions in other areas of economics. One of the key benefits of the Development Economics Program is the unparalleled opportunity to integrate cutting-edge research across fields within economics and to develop productive cross-field collaborations that yield new insights into some of the most important issues of our day. The program has benefited from recent increases in the number of exceptionally talented young economists working in the field. About half of program affiliates received their PhD in the last 10 years.

Program initiatives are supported by an active advisory committee with a broad and changing membership. Current and past advisory committee members include Abhijit Banerjee, Esther Duflo, Andrew Foster, Penny Goldberg, Chiang-Tai Hsieh, Eliana La Ferrara, Dilip Mookherjee, Benjamin Olken, and Christopher Udry. The program has collaborated with the Bureau for Research and Economic Analysis of Development (BREAD), which was well-established when the program was launched. While NBER affiliates must have primary academic appointments in North America, BREAD includes researchers with academic and non-academic appointments globally. Joint meetings therefore provide a valuable breadth of perspectives. Every other year, the program and BREAD have held well-attended, productive joint meetings.

Identifying what actually works to reduce poverty and improve population well-being is a key challenge in development economics. When something is thought to work, the next challenge is determining why it works and the conditions under which it works; that is, assessing the extent to which conclusions are generalizable. These are key research themes in the Development Economics Program.

One exciting source of new results on these questions arises from a multifaceted, focused initiative known as the "Graduation" Program. This program, developed by BRAC, a large NGO formerly known as the Bangladesh Rural Advancement Committee, was designed to provide the poorest people with a sustainable pathway out of extreme poverty. The program provides resources to address participants' immediate needs and longer-term investments, with the goal of building sustainable livelihoods. The Graduation Program has three central planks designed to provide a holistic set of resources and services to increase the productivity of the ultra-poor: a grant to acquire productive assets, access to a savings account, and two years of training and support, including life skills coaching.1

To investigate how well the program works, Abhijit Banerjee, Esther Duflo, Nathanael Goldberg, Dean Karlan, Robert Osei, William Parienté, Jeremy Shapiro, Bram Thuysbaert, and Christopher R. Udry conducted an ambitious set of coordinated randomized controlled trials (RCTs) in villages in Ethiopia, Ghana, Honduras, India, Pakistan, and Peru. They identified the poorest households in each study village and randomly offered about half of them the BRAC program, with the other households serving as controls. The program was a stunning success, as measured by a very large and broad set of markers of well-being.

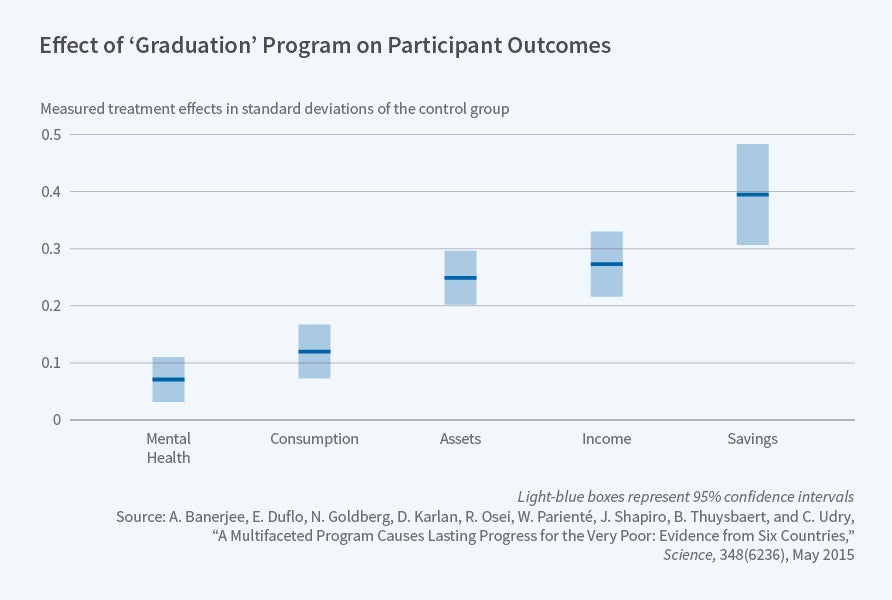

At the end of the intervention, which lasted two years, relative to controls, Graduation Program households reported higher levels of per capita consumption, more income, greater savings, more assets and improved mental health. Effects were not only large and statistically significant, but also long-lived, persisting for at least a year after the intervention ended in all the study settings2 and in India for at least another four years.3

Figure 1 illustrates estimates of the magnitude of some of the average standardized treatment effects two years after the start of the program in the six countries. Based on this evidence, many countries are currently experimenting with this type of multifaceted package as they endeavor to reduce persistent poverty.

New Thinking about Poverty Alleviation Strategies

The study clearly establishes that the Graduation Program has transformed the lives of the poorest not just in one small area but across vastly different settings over three continents. This is important because many of the most promising anti-poverty programs that have documented successful poverty reduction in some contexts have not been successful in other settings.

Microcredit is one example of an anti-poverty strategy that has been extensively analyzed. In 2006, the Nobel Peace Prize was awarded to Muhammad Yunus and Grameen Bank for leading the microcredit revolution that brought small loans first to the poor in Bangladesh, and then to the poor more broadly. Micro-loans, which are made mostly to women, involve some form of group liability and report excellent repayment rates. The number of people who have received the loans has grown rapidly and microfinance for a time was heralded as the magic bullet that would end poverty as we know it. However, results from rigorous studies investigating the impacts of microcredit have not been encouraging. Duflo, Banerjee, Rachel Glennerster, and Cynthia Kinnan conducted a randomized evaluation of the impact of a microfinance firm entering markets in Hyderabad, India, and found that, while loans were made and recipients invested in their new businesses, the effects were transitory, with no discernible improvements in consumption or well-being for any but a small fraction of recipients at the top of the income distribution.4

Non-experimental studies have drawn similar conclusions. This includes research that has taken a structural approach to modelling credit constraints, income uncertainty, and lumpy investments, exploiting quasi-experimental variation in micro-credit programs in Southeast Asia. Overall, estimated impacts of microcredit have been mixed, at best, and the outcomes that are affected vary substantially across studies and contexts. Francisco Buera, Joseph Kaboski, and Yongseok Shin summarize the evidence on microcredit as indicating that, while it can help segments of the population increase both income and consumption, there is little reason to believe that it has had a transformative impact on the lives of the poorest.5

It is possible that microcredit loans are too small and too short-term to have a sustained impact on the lives of the recipients. This was investigated in a clever RCT conducted in rural Mali by Lori Beaman, Karlan, Thuysbaert, and Udry that provided capital to farmers at the beginning of the planting season to be repaid as a lump sum after the harvest.6 About half the study villages were assigned to participate in a loan program. Women in those villages were able to form associations and apply for loans. After all loan decisions had been made, a random sub-sample of the women living in the same villages who did not borrow were given cash grants. In the other villages, randomly selected households were given a cash grant — the first plank of the Graduation Program. Those who received cash grants significantly increased investments and net revenue on their farms. In contrast, in the villages where loans were available, the farmers who borrowed increased their investments and revenue even more, whereas there were no significant increases among the cash grant recipients in these villages. The researchers conclude that when borrowers are self-selected, or selected by a loan officer, returns to credit are large, significant, and sustained, but when borrowers are not self-selected, average returns are effectively zero. A similar point is made by Pushkar Maitra, Sandip Mitra, Dilip Mookherjee, Alberto Motta, and Sujata Visaria, who show that crop yields and income of potato farmers increased when trader-lender agents were given authority to select borrowers.7

An important point of this literature is that while credit is a powerful tool for poverty alleviation for a selected group of people, credit alone is not sufficient to combat widespread poverty at the population level.

Other work on microcredit highlights the importance of liquidity constraints after a shock. Emily Breza and Kinnan show that after the 2010 crackdown on microfinance in Andhra Pradesh, India, there were declines in wages and consumption.8

Elizabeth Frankenberg and I reported similar evidence during the Indonesian financial crisis, a large-scale, unanticipated shock, although they also note that families draw on all of their resources, including savings and even their own health and human capital, to mitigate deleterious impacts of the negative shock on the well-being of family members.9

Access to a savings account is the second important component of the Graduation Program. Research at the macro level has established the importance of the banking sector for growth and development, and many national and international agencies have invested substantial resources in an effort to shift people from informal savings structures into formal institutions. In a series of RCTs, Pascaline Dupas, Karlan, Jonathan Robinson, and Diego Ubfal find that expanding access to basic bank accounts to a population-representative sample of unbanked households in Uganda, Malawi, and Chile results in more deposits to accounts but has no impact on savings or incomes.10 Similar results are reported by Simone Schaner in Kenya.11 As Dupas and colleagues point out, other studies have found that access to basic savings accounts is associated with positive impacts on economic security, but they conclude that the majority of these results are based on analysis of samples that are selected on characteristics associated with a propensity to save, making it difficult to draw general conclusions about impacts at the population level.

This is not to say that access to reliable saving mechanisms is not important: There is abundant evidence that increasing access to formal saving institutions for those who are predisposed to use the services can have long-lasting benefits, as noted, for example, by Dupas, Anthony Keats, and Robinson,12 as well as Karlan, Beniamino Savonitto, Thuysbaert, and Udry.13

The evidence on saving resembles that on the impact of providing capital to Malian farmers and credit to Indian farmers; the estimated effect of the programs depends critically on taking into account selectivity of recipients.

The third plank of the Graduation Program is training and skill development. There is a good deal of evidence that those who apply for and complete vocational training can realize positive, significant, and persistent improvements in labor market outcomes. In Colombia, Orazio Attanasio, Arlen Guarin, Carlos Medina, and Costas Meghir report long-lasting impacts for applicants randomized into vocational training. Ten years after the training program, those who received training earned 12 percent more than the controls.14

While effects were larger for young males relative to females in this Colombian program, other studies report the reverse. In a study in the Dominican Republic that included an intensive treatment of hard and soft skill training as well as an internship, Paloma Acevedo, Guillermo Cruces, Paul Gertler, and Sebastian Martinez found that the lives of females were transformed by the training. In contrast, for males the training raised expectations that were subsequently dashed, and there were no measurable long-term benefits.15 In a recent study of on-the-job soft skill training of female garment workers in India, Achyuta Adhvaryu, Namrata Kala, and Anant Nyshadham report very large productivity increases among trainees — around 20 percent — with no concomitant rise in wages.16 It is important, however, to underscore that, in all of these studies, trainees are self-selected in one way or another; evidence on the impact of non-targeted training programs is much more fixed.

The weight of the evidence, then, indicates that while each of the components of the Graduation Program can benefit specific sub-groups of the population, it is the program taken as a whole that is critical for achieving a transformative impact on the lives of the program beneficiaries. Banerjee, Karlan, Osei, Trachtman, and Udry explicitly test this hypothesis using data from Ghana designed to separately identify the impacts of the productive asset grant and the access to savings. They conclude that neither, alone, substantially improved the lives of the poorest. This is an extremely important insight that has had a major impact on thinking in the field.17

A different approach to reducing poverty is to provide income to households. Large-scale cash transfers, particularly conditional cash transfers, have improved population economic security and well-being. In recent work, for example, Susan Parker and Tom Vogl compare cohorts of adults who were and were not exposed to PROGRESA in Mexico during childhood. They find that the exposed cohorts are significantly better educated, more geographically mobile, perform better in the labor market, and live in more economically secure households. Economic benefits are especially large for females.18

Similar results are reported by Adriana Kugler and Ingrid Rojas for the same program using a different research design.19 Universal basic income programs are being rolled out in several countries although it is too early to know what their longer-term impacts will be on the economic security and well-being of recipients. It is also unclear how such programs will impact society more broadly if they are implemented on a large scale in developing countries. Munenobu Ikegami, Michael Carter, Christopher Barrett, and Sarah Janzen develop a dynamic model of consumption and asset accumulation that includes random shocks; they conclude that state-of-the-world contingent transfers are likely to be more cost-effective than either conditional or unconditional cash transfers.20

Agriculture, Rural Markets, and Migration

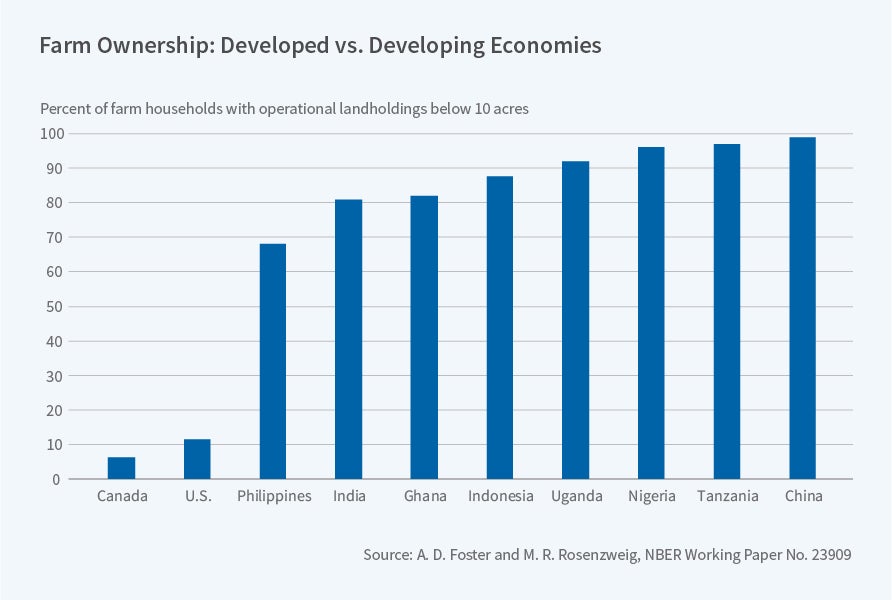

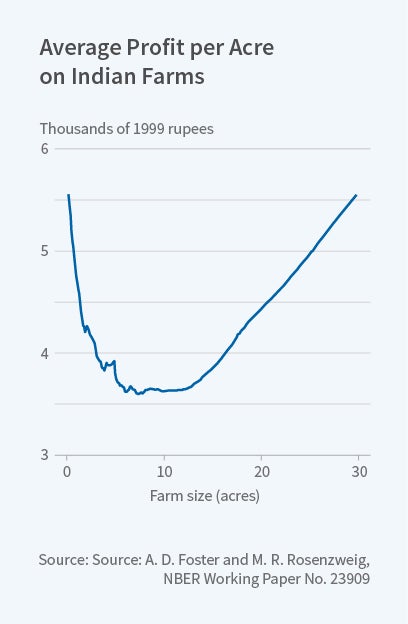

Understanding the rural economy has been a central topic in development research, in part because many of the poorest eke out an existence working in agriculture. The vast majority of farms in developing countries are small, which, as shown in Figure 2, contrasts sharply with farms in developed countries. Andrew Foster and Mark Rosenzweig explain that, in developing countries, small farms tend to be more productive than medium-scale farms because they largely rely on family labor, eschewing purchased labor that carries high transaction costs. However, above a size threshold, there are economies of scale in capital that result in higher productivity but these economies are rarely realized in developing countries.21 This research highlights the importance of modelling and better understanding frictions in rural markets, rather than assuming farmers behave as if rural markets are complete, an assumption that has been the mainstay of much of the literature but recently was rejected by Dan LaFave and Thomas.22

Indeed, studies underscore the point that several features of rural markets and some of the policies intended to help the poor in fact exacerbate poverty. For example, using data from 600 Indian districts over 50 years, Supreet Kaur establishes that nominal wages rise in response to higher than normal levels of rainfall but do not adjust downwards later, and nominal wages do not fall during droughts. She estimates that demand for the poorest rural dwellers, who are landless workers, is 9 percent lower than it would be if wages were flexible. The poor pay a heavy penalty for this wage rigidity, which apparently is sustained by beliefs on the parts of both workers and employers that nominal wage cuts are unfair and result in reduced effort.23

Uncertainty plays a central role in agricultural decision-making, with weather at the heart of much of that uncertainty. Uninsured weather risks are a major source of welfare loss although, as pointed out by Jing Cai, Alain de Janvry, and Elisabeth Sadoulet, weather insurance products typically face low take-up rates by farmers.24 What are the impacts of these products? Studies have shown that when farmers buy weather-based insurance, agricultural output and labor demand are more sensitive to weather because farmers switch to riskier, higher-yield production methods. This point is made by Ahmed Mobarak and Rosenzweig, who examine the general equilibrium implications on labor market outcomes of offering insurance to both farmers and to landless laborers. When agricultural laborers are offered insurance, their labor supply responses result in wages being smoothed across weather states. When farmers who own land are offered insurance, their incomes benefit, but that insurance exacerbates the impact of weather shocks on the wages of landless laborers — the poorest of the poor — and makes them worse off than they would be in a world without insurance.25

In a similar vein, Rosenzweig and Udry focus on the quality of rainfall forecasts in rural India and show that weather forecasts affect farmer investment decisions, particularly in areas where forecasts are more reliable, which results both in higher profits and in more-variable profits.26 Moreover, a forecast of good weather lowers out-migration from the farming area, which reduces wages and improves labor allocations, other things being equal. However, if the forecast turns out to be wrong, equilibrium wages are further reduced, resulting in greater volatility than would have been the case in the absence of weather forecasts.27 The researchers conclude that improvements in weather forecasting will benefit both farmers and landless laborers.

More generally, while migration has played an important role in mitigating spatial misallocation of factors in developing economies, large productivity gaps across sectors persist. For example, Gharad Bryan and Melanie Morten estimate that labor productivity would increase by 22 percent in Indonesia if barriers to migration were removed.28 A long literature in development has shown that migration provides insurance. Morten estimates a structural model using panel data from India to investigate the links between migration and insurance, distinguishing informal, collective risk-sharing and self-insurance. She concludes that improving access to risk-sharing reduces temporary migration by 20 percentage points while reducing the cost of migration reduces collective risk-sharing by 8 percentage points.29

An innovative experimental study conducted by Mobarak established that a modest, one-time subsidy randomly assigned to some households in rural Bangladesh substantially raised out-migration rates during periods of low labor demand. These effects persist for several years, indicating important financial and non-financial barriers to migration. His work with David Lagakos and Michael Waugh investigates the welfare effects of the subsidy in a dynamic model of migration with incomplete markets. This research shows that non-financial factors play a major role in migration decisions, and that — since it is the poorest who are most likely to move when offered the subsidy — welfare gains are greatest for the poorest households.30

Entrepreneurship, Firms, and the Self-Employed

Turning to the non-agricultural sector, a long-standing puzzle is the "missing middle" of mid-sized firms in developing countries. Many studies have sought to understand why so many small firms in these countries do not grow. As Chang-Tai Hsieh and Benjamin Olken point out, however, it is not just mid-sized firms but also large firms that are missing. They document that, as is the case for farms in the rural sector, a very large fraction of firms in developing countries are small. However, in contrast to agriculture, small firms have low levels of productivity relative to larger firms and so the researchers conclude that it is larger firms that face binding capital or labor constraints.31 This is consistent with some of the evidence on the limits to expansion of microenterprises. For example, Karlan, Ryan Knight, and Udry conduct an experiment in Ghana that provides financial capital (a cash grant) and managerial capital (consulting services) to microenterprises. While entrepreneurs invest the cash and take the advice, their profits decline and they revert to their prior practices.32

A contrasting study of Ghanaian microenterprises by Marcel Fafchamps, David McKenzie, Simon Quinn, and Christopher Woodruff finds that, in the case of females, in-kind services raise profits but cash grants have no impact, while among males both cash grants and in-kind services positively impact profits.33 Microenterprises tend to be operated by households and, as Arielle Bernhardt, Erica Field, Rohini Pande, and Natalia Rigol point out, the failure to carefully separate the activities of husbands and wives leads to incorrect inferences about the productivity of female entrepreneurs. They conducted a randomized trial with female micro-entrepreneurs in India in which microfinance repayment constraints were relaxed by providing a grace period to the treatment group. They find that profits of household enterprises, taken together, rose substantially for the group that received the grace period. When there were multiple enterprises in the household, resources were allocated to the most profitable enterprise, which was often managed by the husband. Moreover, when the only enterprise in the household belonged to the wife, the profits of her enterprise rose. They find similar patterns in the Ghanaian data used by Fafchamps and colleagues as well as in data from an earlier Sri Lankan study and conclude that when capital is provided to a household member, household-level income gains are equivalent regardless of the recipient of the grant or loan.34

What are the key limiting factors that constrain the growth of small firms in developing countries? McKenzie and Woodruff conducted surveys of managerial practices in small firms in Bangladesh, Chile, Ghana, Kenya, Mexico, Nigeria, and Sri Lanka. They conclude that firm profits and productivity are higher in firms with better business practices, and that the better-educated and the children of entrepreneurs are more likely to employ these practices.35

Political Economy of Institutions

It is difficult to overstate the importance of institutions in development. As Duflo points out, drawing insights from economics to improve both the design and development of institutions will likely contribute to the field of implementation science and yield high returns for society.36 Frederico Finan, Olken, and Pande emphasize this point, noting that public sector employees tend to earn more than they would in the private sector, particularly in contexts where concerns about governance quality are most severe. They point to the importance of taking into account the roles of selection, incentive structures, and monitoring of public sector workers in the design of programs and policies37 as well as the time of recruitment and election.38 As Duflo, Greenstone, Pande, and Nicholas Ryan document, the costs of corruption can be huge. They show that changing the incentives of third-party environmental auditors in India to reduce corruption results in plant emissions not only being reported correctly but also in substantial reductions in poisonous emissions.39

Leakage from public programs to local public officials is an enduring concern, particularly in very large and expensive programs. One approach to mitigating such capture is increasing transparency in program implementation. This idea has been rigorously tested and shown to be extremely effective in some very large-scale field experiments.

Indonesia's "Rice for the Poor" (Raskin) is a targeted transfer program that provides subsidized rice to over 17 million people. Collaborating with the Indonesian government, Banerjee, Hanna, Kyle, Olken, and Sudarno Sumarto provided information to eligible households in almost 400 villages about the benefits they should receive and compared the amounts they actually received with households in about 200 control villages. Beneficiaries received larger subsidies following the information campaign, with beneficiary households who were informed of the official price receiving the largest additional subsidies.40 Moreover, they show that by opening up distribution to competition, the performance of the subsidized-rice distribution system was improved.41

India's National Rural Employment Guarantee Scheme (NREGS), the world's largest workfare program, is mandated to provide employment at a specified wage to all who apply to work on improving local infrastructure. Leakage of funds has been thought to be a serious problem as funds are diverted by local officials out of the program by paying ghost beneficiaries and by under-paying beneficiaries for their work. A large-scale randomized field experiment in Bihar designed and implemented by Banerjee, Rema Hanna, Jordan Kyle, Olken, and Sumarto increased transparency and accountability by shifting to electronic fund transfers and building in checks and balances. The reforms resulted in significantly lower leakage and thus lower program costs, while employment and wages of program beneficiaries did not change.42 For the same program, Karthik Muralidharan, Paul Niehaus, and Sandip Sukhtankar showed that shifting to Smartcards, a biometrically authenticated payment system, resulted in faster and more predictable payments to beneficiaries, as well as less corruption.43 Similarly, in India and Indonesia, Sean Lewis-Faupel, Yusuf Neggers, Olken, and Pande show that shifting public procurement procedures to an electronic platform results in improved quality of public works in both countries.44

These and other studies suggest that new technologies, if carefully implemented, have the potential to cut corruption and improve the performance of public programs. This is important because these programs are often designed to reduce poverty.

Conclusions

This brief summary describes some major themes in ambitious and innovative development studies that have recently been completed or are currently underway.

That this is an exciting time for development as a field is an understatement. In part, this is because of the many shared interests with other fields in economics and other disciplines. It is also because important substantive questions are being investigated both to advance science and to make a difference to global well-being. Studies creatively draw on theory in combination with a diverse array of empirical methods in a push to answer very hard questions. This has propelled investments in developing and testing ambitious research designs along with innovation in measurement and data collection. These ongoing investments augur well for continued important contributions to scientific understanding of the development process.

Endnotes

A. Banerjee, D. Karlan, R. Osei, H. Trachtman, and C. Udry, "Unpacking a Multi-Faceted Program to Build Sustainable Income for the Very Poor," NBER Working Paper 24271, February 2018.

A. Banerjee, E. Duflo, N. Goldberg, D. Karlan, R. Osei, W. Parienté, J. Shapiro, B. Thuysbaert, and C. Udry, "A Multifaceted Program Causes Lasting Progress for the Very Poor: Evidence from Six Countries," Science, 348(6236):1260799), 2015.

A. Banerjee, E. Duflo, R. Chattopadhyay, and J. Shapiro, "The Long term Impacts of a 'Graduation' Program: Evidence from West Bengal," MIT Working Paper, September 2016.

E. Duflo, A. Banerjee, R. Glennerster, and C. Kinnan, "The Miracle of Microfinance? Evidence from a Randomized Evaluation," NBER Working Paper 18950, May 2013.

F. Buera, J. Kaboski, and Y. Shin, "Taking Stock of the Evidence on Micro-Financial Interventions," NBER Working Paper 22674, September 2016.

L. Beaman, D. Karlan, B. Thuysbaert, and C. Udry, "Self-Selection into Credit Markets: Evidence from Agriculture in Mali," NBER Working Paper 20387, August 2014, revised August 2015.

P. Maitra, S. Mitra, D. Mookherjee, A. Motta, and S. Visaria, "Financing Smallholder Agriculture: An Experiment with Agent-Intermediated Microloans in India," NBER Working Paper 20709, November 2014.

E. Breza and C. Kinnan, "Measuring the Equilibrium Impacts of Credit: Evidence from the Indian Microfinance Crisis," NBER Working Paper 24329, February 2018.

E. Frankenberg and D. Thomas, "Human Capital and Shocks: Evidence on Education, Health and Nutrition," NBER Working Paper 23347, April 2017.

P. Dupas, D. Karlan, J. Robinson, and D. Ubfal, "Banking the Unbanked? Evidence From Three Countries," NBER Working Paper 22463, July 2016, revised October 2016.

S. Schaner, "The Persistent Power of Behavioral Change: Long-Run Impacts of Temporary Savings Subsidies for the Poor," NBER Working Paper 22534, August 2016.

P. Dupas, A. Keats, and J. Robinson, "The Effect of Savings Accounts on Interpersonal Financial Relationships: Evidence from a Field Experiment in Rural Kenya," NBER Working Paper 21339, July 2015.

D. Karlan, B. Savonitto, B. Thuysbaert, and C. Udry, "Impact of Savings Groups on the Lives of the Poor," Proceedings of the National Academy of Sciences, 114(12), pp.3079–84, 2017.

O. Attanasio, A. Guarin, C. Medina, and C. Meghir, "Long Term Impacts of Vouchers for Vocational Training: Experimental Evidence for Colombia," NBER Working Paper 21390, July 2015.

P. Acevedo, G. Cruces, P. Gertler, and S. Martinez, "Living Up to Expectations: How Job Training Made Women Better Off and Men Worse Off," NBER Working Paper 23264, March 2017.

A. Adhvaryu, N. Kala, and A. Nyshadham, "The Skills to Pay the Bills: Returns to On-the-job Soft Skills Training," NBER Working Paper 24313, February 2018.

A. Banerjee, D. Karlan, R. Osei, H. Trachtman, and C. Udry, "Unpacking a Multi-Faceted Program to Build Sustainable Income for the Very Poor," NBER Working Paper 24271, February 2018.

S. Parker and T. Vogl, "Do Conditional Cash Transfers Improve Economic Outcomes in the Next Generation? Evidence from Mexico," NBER Working Paper 24303, February 2018.

A. Kugler and I. Rojas, "Do CCTs Improve Employment and Earnings in the Very Long-Term? Evidence from Mexico," NBER Working Paper 24248, January 2018.

M. Ikegami, M. Carter, C. Barrett, and S. Janzen, "Poverty Traps and the Social Protection Paradox," NBER Working Paper 22714, October 2016.

A. Foster and M. Rosenzweig, "Are There Too Many Farms in the World? Labor-Market Transaction Costs, Machine Capacities, and Optimal Farm Size," NBER Working Paper 23909, October 2017.

D. LaFave and D. Thomas, "Farms, Families, and Markets: New Evidence on Completeness of Markets in Agricultural Settings," NBER Working Paper 20699, November 2014, revised May 2016.

S. Kaur, "Nominal Wage Rigidity in Village Labor Markets," NBER Working Paper 20770, December 2014, revised November 2017.

J. Cai, A. Janvry, and E. Sadoulet, "Subsidy Policies and Insurance Demand," NBER Working Paper 22702, September 2016.

A. Mobarak and M. Rosenzweig, "Risk, Insurance and Wages in General Equilibrium," NBER Working Paper 19811, January 2014.

M. Rosenzweig and C. Udry, "Forecasting Profitability," NBER Working Paper 19334, August 2013.

M. Rosenzweig and C. Udry, "Rainfall Forecasts, Weather and Wages over the Agricultural Production Cycle," NBER Working Paper 19808, January 2014.

G. Bryan and M. Morten, "The Aggregate Productivity Effects of Internal Migration: Evidence from Indonesia," NBER Working Paper 23540, June 2017.

M. Morten, "Temporary Migration and Endogenous Risk Sharing in Village India," NBER Working Paper 22159, April 2016.

D. Lagakos, A. Mobarak, and M. Waugh, "The Welfare Effects of Encouraging Rural-Urban Migration," NBER Working Paper 24193, January 2018.

C. Hsieh and B. Olken, "The Missing 'Missing Middle'," NBER Working Paper 19966, March 2014.

D. Karlan, R. Knight, and C. Udry, "Hoping to Win, Expected to Lose: Theory and Lessons on Micro Enterprise Development," NBER Working Paper 18325, August 2012.

M. Fafchamps, D. McKenzie, S. Quinn, and C. Woodruff, "When is Capital Enough to get Female Microenterprises Growing? Evidence from a Randomized Experiment in Ghana," NBER Working Paper 17207, July 2011.

A. Bernhardt, E. Field, R. Pande, and N. Rigol, "Household Matters: Revisiting the Returns to Capital among Female Micro-entrepreneurs," NBER Working Paper 23358, April 2017.

D. McKenzie and C. Woodruff, "Business Practices in Small Firms in Developing Countries," NBER Working Paper 21505, August 2015.

E. Duflo, "The Economist as Plumber," NBER Working Paper 23213, March 2017.

F. Finan, B. Olken, and R. Pande, "The Personnel Economics of the State," NBER Working Paper 21825, December 2015.

E. Dal Bo, F. Finan, and M. Rossi, "Strengthening State Capabilities: The Role of Financial Incentives in the Call to Public Service," NBER Working Paper 18156, June 2012.

E. Duflo, M. Greenstone, R. Pande, and N. Ryan, "Truth-telling by Third-party Auditors and the Response of Polluting Firms: Experimental Evidence from India," NBER Working Paper 19259, July 2013.

A. Banerjee, R. Hanna, J. Kyle, B. Olken, and S. Sumarto, "The Power of Transparency: Information, Identification Cards and Food Subsidy Programs in Indonesia," NBER Working Paper 20923, February 2015.

A. Banerjee, R. Hanna, J. Kyle, B. Olken, and S. Sumarto, "Contracting out the Last-Mile of Service Delivery: Subsidized Food Distribution in Indonesia," NBER Working Paper 21837, December 2015.

A. Banerjee, E. Duflo, C. Imbert, S. Mathew, and R. Pande, "E-governance, Accountability, and Leakage in Public Programs: Experimental Evidence from a Financial Management Reform in India," NBER Working Paper 22803, November 2016.

K. Muralidharan, P. Niehaus, and S. Sukhtankar, "Building State Capacity: Evidence from Biometric Smartcards in India," NBER Working Paper 19999, March 2014, revised October 2014.

S. Lewis-Faupel, Y. Neggers, B. Olken, and R. Pande, "Can Electronic Procurement Improve Infrastructure Provision? Evidence From Public Works in India and Indonesia," NBER Working Paper 20344, July 2014.