Assessing the Effects of Monetary and Fiscal Policy

Monetary and fiscal policies are central tools of macroeconomic management. This has been particularly evident since the onset of the Great Recession in 2008. In response to the global financial crisis, U.S. short-term interest rates were lowered to zero, a large fiscal stimulus package was implemented, and the Federal Reserve engaged in a broad array of unconventional policies.

Despite their centrality, the question of how effective these policies are and therefore how the government should employ them is in dispute. Many economists have been highly critical of the government's aggressive use of monetary and fiscal policy during this period, in some cases arguing that the policies employed were ineffective and in other cases warning of serious negative consequences. On the other hand, others have argued that the aggressive employment of these policies has "walk[ed] the American economy back from the edge of a second Great Depression."1

In our view, the reason for this controversy is the absence of conclusive empirical evidence about the effectiveness of these policies. Scientific questions about how the world works are settled by conclusive empirical evidence. In the case of monetary and fiscal policy, unfortunately, it is very difficult to establish such evidence. The difficulty is a familiar one in economics, namely endogeneity.

Consider monetary policy. The whole reason for the existence of the Federal Reserve as an institution is to conduct systematic monetary policy that responds to developments in the economy. Every Fed decision is pored over by hundreds of Ph.D. economists. This leaves little room for the type of exogenous variation in policy that is so useful in identifying the effects of policy moves on the economy. For example, the Fed lowered interest rates in the second half of 2008 in response to the developing financial crisis. Running a regression of changes in output on changes in policy in this case clearly will not identify the effect of the monetary policy actions on output since the financial crisis - the event that induced the Fed to change policy - is a confounding factor. The same problems apply when it comes to fiscal policy.

This difficulty has led macroeconomists to use a wide array of empirical methods - some based on structural models, others based more heavily on natural experiments - to shed light on the effects of monetary and fiscal policy. Over the past 10 years, there have been exciting empirical developments on both fronts.

In terms of structural methods, a core idea in macroeconomics is that the degree of price rigidity in the economy is a key determinant of the extent to which monetary and fiscal policy (and other demand shocks) affect the economy. If prices are very flexible, a change in demand from some source - say, the government - will induce prices to rise, and this will crowd out demand from other sources. However, if prices are slow to react, this crowd-out does not occur and aggregate demand increases.

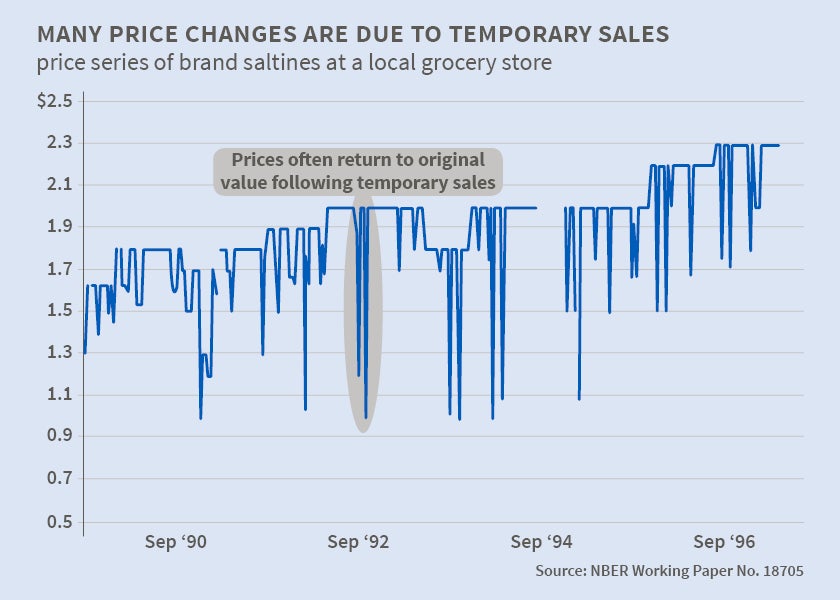

An important innovation in recent years has been the use of large micro datasets that underlie the U.S. consumer, producer, import, and export price indexes to measure the degree of price rigidity in the economy.2 We were among the first researchers to use these data to characterize price rigidity.3 One of our main conclusions was that distinguishing between different types of price changes is crucial in mapping workhorse macro models into the data.4 In particular, a very substantial fraction of price changes are due to temporary sales after which the price returns to its original level. In most workhorse macro models, the frequency of price adjustment directly determines the responsiveness of the aggregate price level to shocks. The prevalence of temporary sales raises the question of whether the raw frequency of price changes is a good measure of the responsiveness of inflation to demand shocks. Subsequent work has argued quite convincingly that, because of their transitory nature, temporary sales result in very little adjustment of the aggregate price level.5 In our own work on this topic, we present evidence that temporary sales are unresponsive to cost shocks and discuss institutional features of price setting by packaged-goods manufacturers that suggest that temporary sales follow sticky plans that are determined with long lead times.6

A second important conclusion that emerges from the recent empirical literature on price rigidity is that, while prices change often if one looks at an average across the whole economy, price adjustment is highly concentrated in certain sectors. Some products (like gasoline) have prices that adjust repeatedly within the span of a quarter, while other products (like services) often do not adjust for a year or longer. We show that this uneven distribution of price changes yields substantially less aggregate price flexibility than if price flexibility were more evenly distributed.7 A more-even distribution of price changes across sectors would be associated with a greater frequency of changes in prices that had not yet adjusted to past aggregate shocks. We also show it is important to recognize the degree of flexibility in intermediate good prices when analyzing monetary non-neutrality. If a firm's input prices do not adjust, it will have less incentive to adjust the prices of its output than when its input costs are rising. Incorporating heterogeneity in price flexibility and intermediate inputs into a menu cost model allows us to generate a substantial role for nominal shocks in business cycle fluctuations, in line with evidence from aggregate data.

Progress in structural modeling has dovetailed with important innovations in assessing the effects of monetary policy using natural experiments and other non-structural methods. Again, the key challenge in estimating the effects of monetary policy is the endogeneity of monetary policy actions. In recent work, we use a discontinuity-based identification strategy to address the endogeneity problem.8 Our identification approach is to study how real interest rates respond to monetary shocks in the 30-minute intervals around Federal Open Market Committee announcements. We find that in these short intervals, nominal and real interest rates for maturities as long as several years move roughly one-for-one with each other. Changes in nominal interest rates at the time of monetary announcements therefore translate almost entirely into changes in real interest rates, while expected inflation moves very little except at very long horizons.

We use this evidence to estimate the parameters of a conventional monetary business cycle model. A popular approach to estimating such models in the literature has been to match the impulse responses from structural vector autoregressions (VARs). We use a similar approach, but instead of using impulse responses from a structural VAR, we use the responses from our high-frequency-based identification strategy. This approach suggests that monetary non-neutrality is large. Intuitively, our evidence indicates that a monetary shock that yields a substantial response for real interest rates also yields a very small response for inflation. This suggests that prices respond quite sluggishly to changes in aggregate economic conditions and that monetary policy can have large effects on the economy.

Another area in which there has been rapid progress in using innovative identification schemes to estimate the impact of macroeconomic policy is that of fiscal stimulus.9 Just as with monetary policy, there is an important identification problem: Fiscal stimulus is generally undertaken in response to recessions, so one cannot assume that correlations reflect a causal effect. Much of the literature on fiscal stimulus that makes use of natural experiments focuses on the effects of war-time spending, since it is assumed that in some cases such spending is unrelated to the state of the economy. Fortunately - though unfortunately for empirical researchers - there are only so many large wars, so the number of data points available from this approach is limited.

In our work, we use cross-state variation in military spending to shed light on the fiscal multiplier.10 The basic idea is that when the U.S. experiences a military build-up, military spending will increase in states such as California - a major producer of military goods - relative to states, such as Illinois, where there is little military production. This approach uses a lot more data than the earlier literature on military spending but makes weaker assumptions, since we require only that the U.S. did not undertake a military build-up in response to the relative weakness of the economy in California vs. Illinois. We show that a $1 increase in military spending in California relative to Illinois yields a relative increase in output of $1.50. In other words, the "relative" multiplier is quite substantial.11

There is an important issue of interpretation here. We find evidence of a large "relative multiplier," but does this imply that the aggregate multiplier also will be large? The challenge that arises in interpreting these kinds of relative estimates is that there are general equilibrium effects that are expected to operate at an aggregate but not at a local level. In particular, if government spending is increased at the aggregate level, this will induce the Federal Reserve to tighten monetary policy, which will then counteract some of the stimulative effect of the increased government spending. This type of general equilibrium effect does not arise at the local level, since the Fed can't raise interest rates in California vs. Illinois in response to increased military spending in California relative to Illinois.

We show in our paper, however, that the relative multiplier does have a very interesting counterpart at the level of the aggregate economy. Even in the aggregate setting, the general equilibrium response of monetary policy to fiscal policy will be con-strained when the risk-free nominal interest rate is constrained by its lower bound of zero. Our relative multiplier corresponds more closely to the aggregate multiplier in this case.12 Our estimates are, therefore, very useful in distinguishing between new Keynesian models, which generate large multipliers in these scenarios, and plain vanilla real business cycle models, which always generate small multipliers.

The evidence from our research on both fiscal and monetary policy suggests that demand shocks can have large effects on output. Models with price-adjustment frictions can explain such output effects, as well as (by design) the microeconomic evidence on price rigidity. Perhaps this evidence is still not conclusive, but it helps to narrow the field of plausible models. This new evidence will, we hope, help limit the scope of policy predictions of macroeconomic models that policymakers need to consider the next time they face a great challenge.

Endnotes

C. Romer, "Back from the Brink," Speech delivered at the Federal Reserve Bank of Chicago, September 24, 2009. https://eml.berkeley.edu/~cromer/CEA/Back_from_the_Brink2.pdf.

We survey the resulting literature in E. Nakamura and J. Steinsson, "Price Rigidity: Microeconomic Evidence and Macroeconomic Implications," NBER Working Paper 18705, January 2013, and Annual Review of Economics, 5, 2013, pp. 133–63.

See also M. Bils and P. Klenow, "Some Evidence on the Importance of Sticky Prices," NBER Working Paper 9069, July 2002, and Journal of Political Economy, 112(5), 2004, pp. 947–85; P. Klenow and O. Kryvtsov, "State-Dependent or Time-Dependent Pricing: Does it Matter for Recent U.S. Inflation?" NBER Working Paper 11043, January 2005, and Quarterly Journal of Economics, 123(3), 2008, pp. 863-904; G. Gopinath and R. Rigobon, "Sticky Borders," NBER Working Paper 12095, March 2006, and Quarterly Journal of Economics 123(2), 2008, pp. 531–75.

E. Nakamura and J. Steinsson, "Five Facts about Prices: A Reevaluation of Menu Cost Models," Quarterly Journal of Economics, 123(4), 2008, pp. 1215–1464.

See P. Kehoe and V. Midrigan, "Prices Are Sticky After All," NBER Working Paper 16364, September 2010; B. Guimaraes and K. Sheedy, "Sales and Monetary Policy," American Economic Review, 101(2), 2011, pp. 844–76.

E. Anderson, E. Nakamura, D. Simester, and J. Steinsson, "Information Rigidities and the Stickiness of Temporary Sales," NBER Working Paper 19350, August 2013.

E. Nakamura and J. Steinsson, "Monetary Non-Neutrality in a Multi-Sector Menu Cost Model," NBER Working Paper 14001, May 2008, and Quarterly Journal of Economics, 125(3), 2010, pp. 961-1013. See also, C. Carvalho, "Heterogeneity in Price Stickiness and the New Keynesian Phillips Curve," B.E. Journals in Macroeconomics: Frontiers of Macroeconomics, 6(3), 2006, 1–58.

E. Nakamura and J. Steinsson, "High Frequency Estimation of Monetary Non-Neutrality," NBER Working Paper 19260, July 2013. Our work builds on important early papers using this identification strategy, including T. Cook and T. Hahn, "The Effect of Changes in the Federal Funds Rate Target on Market Interest Rates in the 1970s," Journal of Monetary Economics, 24(3), 1989, pp. 331–51; K. Kuttner, "Monetary Policy Surprises and Interest Rates: Evidence from the Fed Funds Rate Market," Journal of Monetary Economics, 47(3), 2001, pp. 523–44; R. Gurkaynak, B. Sack, and E. Swanson, "Do Actions Speak Louder than Words? The Response of Asset Prices to Monetary Policy Actions and Statements," International Journal of Central Banking, 1(1), 2005, pp. 55–93. See also the recent literature studying the effect of monetary shocks, including: S. Hanson and J. Stein, "Monetary Policy and Long-Term Real Rates," Harvard University Working Paper, 2014. https://scholar.harvard.edu/files/stein/files/long_rate_paper_20140418_final.pdf; M. Gertler and P. Karadi, "Monetary Policy Surprises, Credit Costs and Economic Activity," NBER Working Paper 20224.

Interesting work along these lines includes D. Shoag, "The Impact of Government Spending Shocks Evidence on the Multiplier from State Pension Plan Returns," Harvard University Working Paper, 2011. http://www.hks.harvard.edu/fs/dshoag/Documents/shoag_jmp.pdf; A. Acconcia, G. Corsetti, and S. Simonelli, "Mafia and Public Spending Evidence on the Fiscal Multiplier from a Quasi-Experiment," American Economic Review, 104(7), 2014, pp. 2185–2209; G. Chodorow-Reich, L. Feiveson, Z. Liscow, and W. G. Woolston, "Does State Fiscal Relief During Recessions Increase Employment? Evidence from the American Recovery and Reinvestment Act," American Economic Journal: Economic Policy, 4(3), 2012, pp. 118–45; J. Serrato, and P. Wingender, "Estimating Local Fiscal Multipliers," Duke University Working Paper, 2014. http://www.jcsuarez.com/Files/Suarez_Serrato-Wingender-ELFM_Resubmitted.pdf.

E. Nakamura and J. Steinsson, "Fiscal Stimulus in a Monetary Union: Evidence from U.S. Regions," NBER Working Paper 17391, September 2011, and American Economic Review, 104(3), 2014, pp. 753–92.

See G. Eggertsson, "What Fiscal Policy Is Effective at Zero Interest Rates?" in D. Acemoglu and M Woodford, eds., NBER Macroeconomics Annual, 25, Chicago, Illinois, University of Chicago Press, 2010, pp. 59–112; and L. Christiano, M. Eichenbaum, and S. Rebelo, "When Is the Government Spending Multiplier Large?" NBER Working Paper 15394, October 2009, and Journal of Political Economy, 119(1), 2011, pp. 78–121. ↩