Asiaphoria Meets Regression to the Mean

Typical degrees of regression to the mean imply substantial slowdowns in China and India relative even to currently cautious forecasts.

Much analysis and forecasting treats a country's past growth experience as the best source of information on its future growth prospects. Because of this tendency, Asiaphoria - a relatively uncritical enthusiasm for the growth prospects of Asian economies - has arisen repeatedly. This was observed with regard to Japan in the 1960s, and it is seen today with regard to China and India.

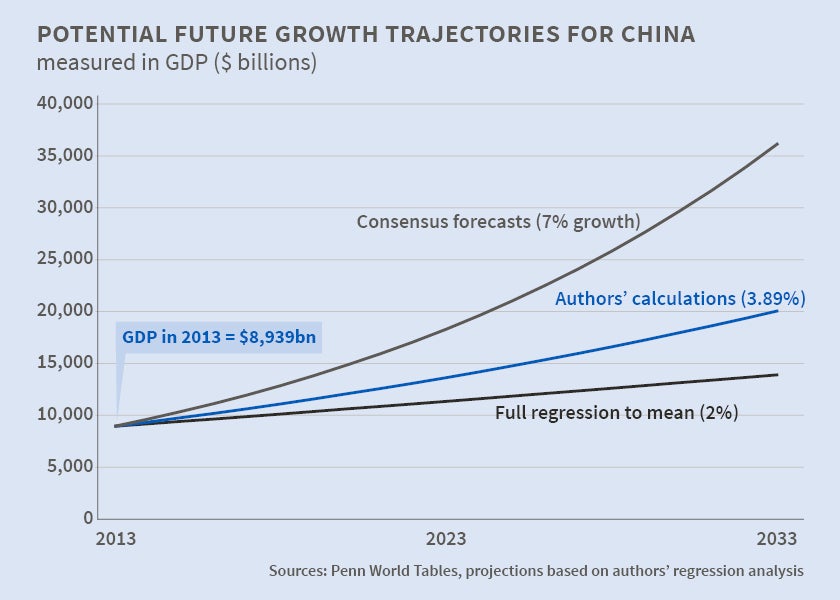

One OECD report forecasts per capita growth from 2011 to 2030 of 6.6 percent for China and 6.7 percent for India. The World Bank and the Development Research Center of the State Council of China project annual output-per-worker growth rates of 8.3 percent from 2011 to 2015, 7.1 percent from 2016 to 2020, and 6.2 percent from 2021 to 2025. In official projections through 2030, the U.S. intelligence community presents scenarios implying that China's share of the world economy will grow from 6.4 percent in 2010 to between 17 and 23 percent in 2030. For India the estimates for the same periods suggest growth from 1.8 percent of the world economy to between 6.5 and 7.9 percent. Some other estimates of China's and India's growth rates are even higher.

In Asiaphoria Meets Regression to the Mean (NBER Working Paper No. 20573), authors Lant Pritchett and Lawrence H. Summers examine historical data on growth rates and conclude that with economic growth, as with investment returns, past performance is no guarantee of future performance. They demonstrate that regression to the mean is the single most robust and empirically relevant fact about cross-national growth rates. The lack of persistence in country growth rates over medium- to long-run horizons implies that a country's current growth has less predictive power for future growth than many analyses assume.

It might be the case that China will continue to experience annual per capita growth for another two decades at a 9, or even 7 or 6 percent rate. Given the regression to the mean present in the cross-national data, however, where growth rates historically have averaged 2 percent with a standard deviation of 2 percent, the authors conclude that continued rapid growth would be an extraordinary event. China's super-rapid growth has already lasted three times longer than a typical episode and is the longest ever recorded. Similarly, while it might be the case that Indian growth will continue at 6 percent per year, this would also require a relatively rare degree of growth persistence.

The authors' findings suggest that in projecting a country's growth rates over the long term, forecasters should give heavy weight to the growth rates of all countries, rather than to the historical growth experience of the country being studied. They believe that, historically, most economic forecasting errors have come from placing excessive weight on a country's recent past. This can explain why official forecasts usually miss discontinuities in a nation's growth trajectory.

While the post-financial crisis recovery in the United States has been slower than many initially expected, and the recovery in Europe is even slower and weaker, Pritchett and Summers note that the fallout for the global economy has been much less than feared. This has been due in large part to sustained growth in China and India, which has generated positive spillovers for other economies.

Though the prevailing view in many quarters today is that rapid global growth will continue with Asia as the engine, the authors point out that that Asiaphoria proved unrealistic following the rise of Japan, the growth of the Asian Tigers (Korea, Taiwan, Singapore, and Hong Kong), and the emergence of the Asian Dragons (Malaysia, Indonesia, and Thailand). Continuation of rapid growth in Asia is only one possible path forward, and the authors call attention to the substantial possibility that the global economy will follow another one. Typical degrees of regression to the mean imply substantial slowdowns in China and India relative even to currently cautious forecasts. They also observe that high-growth episodes often end with full, and abrupt, regression to the mean.

-- Les Picker