Hospital Acquisitions of Physician Practices Generate Price Increases Without Evidence of Quality Improvements

In recent years, there has been a dramatic increase in hospital acquisitions of physician practices that has transformed the structure of healthcare delivery across the United States. While antitrust enforcement has typically focused on horizontal mergers between direct competitors, there has been less regulatory scrutiny of these vertical or complementary acquisitions despite their potential impact on competition and pricing.

In Are Hospital Acquisitions of Physician Practices Anticompetitive? (NBER Working Paper 34039), Zack Cooper, Stuart V. Craig, Aristotelis Epanomeritakis, Matthew Grennan, Joseph R. Martinez, Fiona Scott Morton, and Ashley T. Swanson examine whether practice acquisitions between 2008 and 2016 led to price increases. They document the rise in physician-hospital integration during this period, with the share of physicians employed by hospitals rising from 27.5 percent to 47.2 percent. Using claims data from a large national insurer and focusing on labor and delivery services, they analyze the price consequences of 276 physician integration events and 66 hospital integration events. Their empirical strategy compares trends in outcomes for merged providers with those of nonmerging “control” providers before and after integration.

When hospitals acquire physician practices, prices increase for both, but there is little evidence of quality improvement.

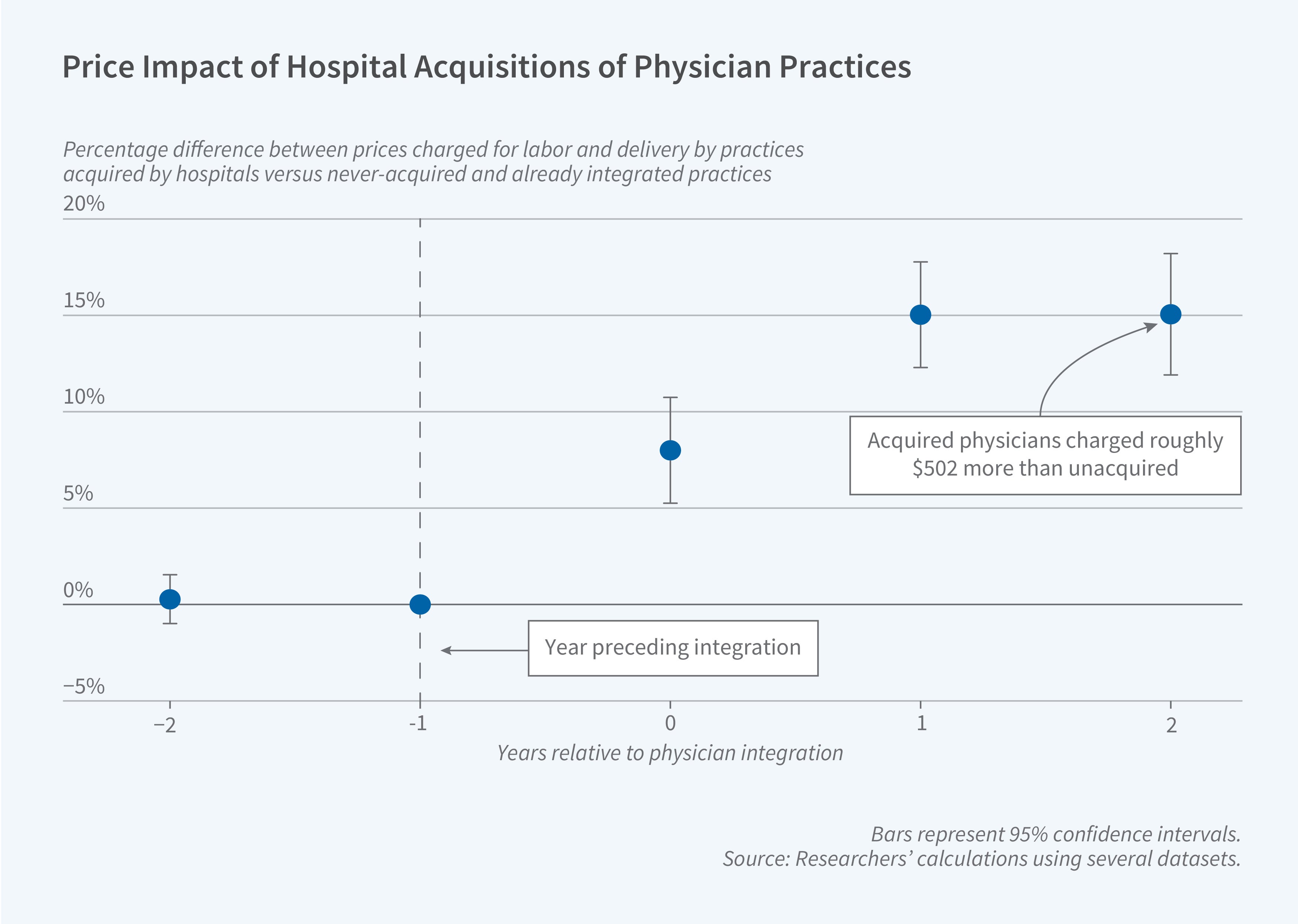

In the two years after integration, hospital prices for labor and delivery increased on average by 3.3 percent ($475), while physician prices rose by 15.1 percent ($502). The researchers find no discernible improvements in quality that might justify the price increases and, in fact, observe an increase of between 4.5 and 8.0 percent in cesarean section rates, which are often considered a sign of physician-induced demand rather than improved care.

The study identifies three key mechanisms driving price increases. First, the effect on hospital prices is larger when acquired physicians have the ability to redirect patients to acquiring hospitals. Second, physician price increases are greater when the acquiring hospital has more market power, consistent with a “recapture” mechanism where integration improves negotiating leverage with insurers. Third, price increases are larger for transactions that increase concentration in physician markets, suggesting horizontal market power effects even in nominally nonhorizontal transactions.

To distinguish competitive effects from other potential explanations for price changes, the researchers examine physicians who were already integrated with acquiring hospitals. These physicians’ prices increased by approximately 9 percent after their hospitals acquired additional physicians in their specialty, despite no change in their own integration status, negotiating skill, or presumed quality of care.

The researchers note that nearly all of the observed physician-hospital transactions fell below Hart-Scott-Rodino antitrust reporting thresholds, making them difficult for regulators to identify and challenge. However, their collective impact on healthcare prices within impacted specialties appears comparable to the effects of horizontal hospital mergers that have received much greater regulatory attention.

The researchers received financial support for this project from the Commonwealth Fund and Arnold Ventures.