The Evolving Role of Gig Work during the COVID-19 Pandemic

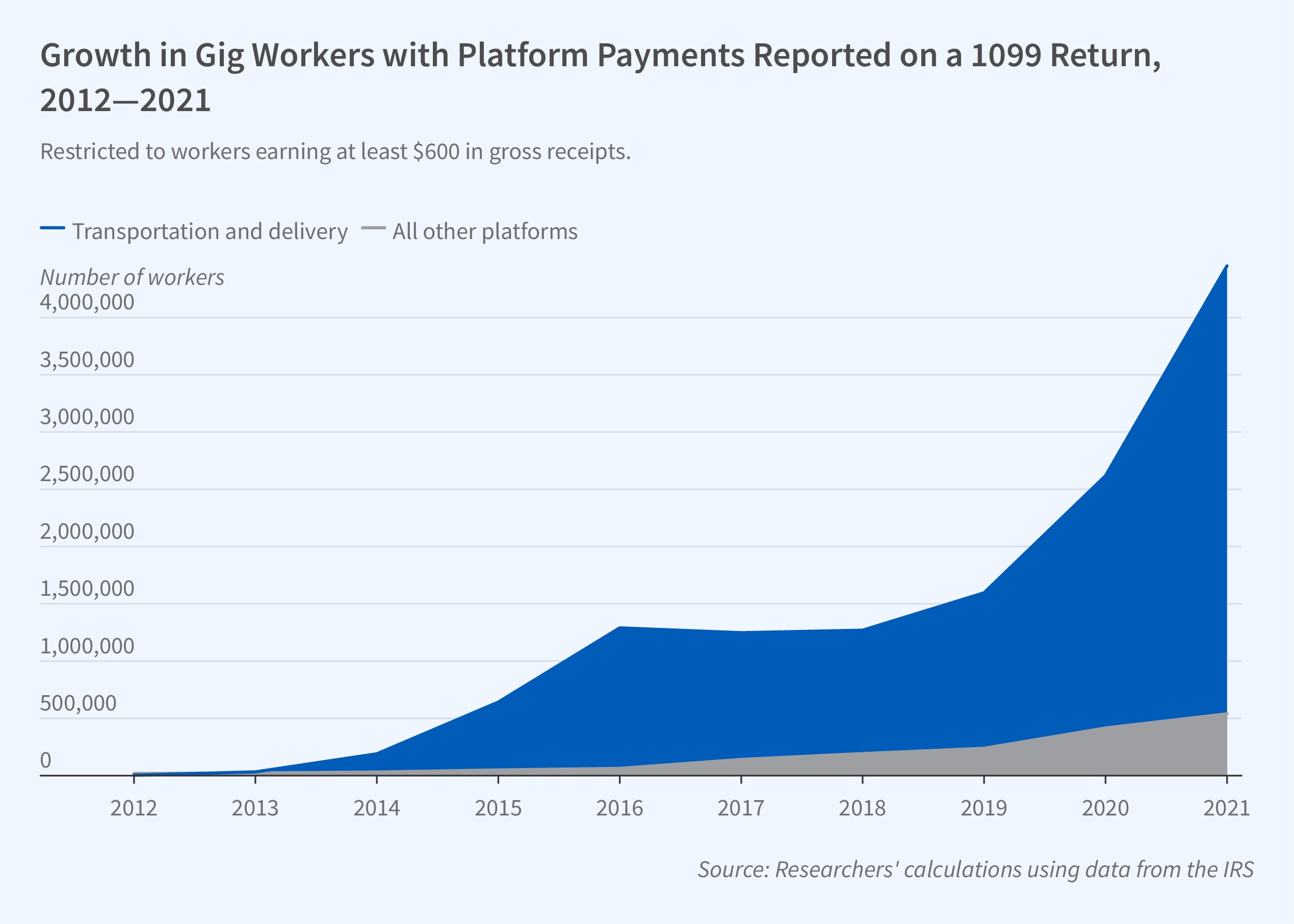

The COVID pandemic had a mixed effect on the gig economy. On the one hand, the overall number of contract and freelance workers fell. This is evident from the number of individual income tax returns that report Form 1099 income capturing these activities. On the other hand, the number of individuals with income from jobs in which assignments arrive via online platforms soared by 3.1 million between 2020 and 2021, with most of the increase in transportation and food delivery.

There were multiple health and economic shocks between 2019 and 2021 that affected the desirability of gig economy work. These included the direct health impacts of the pandemic on various occupations and the generosity of unemployment insurance, which may be an alternative to gig work for some individuals. In The Evolution of Platform Gig Work, 2012–2021 (NBER Working Paper 31273), Andrew Garin, Emilie Jackson, Dmitri K. Koustas, and Alicia Miller analyze these various forces. They study payments from more than 90 online labor platforms.

Nearly 2.1 million new workers entered the gig economy in 2020, double the number of entrants in 2019. Another 3.1 million entered in 2021, but more than a million left.

One of the biggest obstacles to studying the platform gig economy in tax data is the “1099-K gap,” a feature of the tax reporting landscape that can result in some gig economy income going unreported to tax authorities. Prior to 2017, platform gig economy companies commonly used the 1099-MISC tax form to report annual payments of $600 or more and/or reported all payments on a newer form, the 1099-K. Created in 2011, the 1099-K only technically requires firms to report payments if there were more than 200 transactions and their total payments exceeded $20,000 for the year. More platform gig firms began to report at these higher reporting thresholds beginning in 2017, and as a result, the pay of many gig economy workers goes unreported to tax authorities on 1099s.

The researchers estimate the magnitude of this gap by comparing payments to freelancers reported on state income tax forms in Massachusetts and Vermont, which set a $600 threshold for income reporting without any of the federal exemptions, and neighboring states, which follow the federal rules. They extrapolate the differential between these two states and national measures to estimate the unreported gig income in other states that follow the federal reporting rules. They estimate approximately 777,000 gig workers did not receive a 1099 due to the 1099-K gap by 2018, leading to approximately $323.4 million in unreported income.

The resulting “corrected” time series on the number of gig economy workers suggests more expansion in the years after 2016. The number of gig workers in 2018 exceeded 2 million. For every year after 2014, more than 90 percent of gig workers were employed in transportation, and few grossed more than $20,000 a year.

In the second part of the paper, the authors examine the evolution of the gig economy during the COVID pandemic. In 2020, the first year of the pandemic, there were 2.1 million new gig workers. In 2021, there were 3.1 million more. Most of this activity is captured on the 1099-MISC, and this was not subject to the 1099-K gap. At the same time, this was a period of record exit from the gig economy, with millions exiting.

Some of these exits may be related to the generosity of unemployment insurance (UI). Prior to the pandemic, self-employed workers did not qualify for UI unless they held and lost a wage-paying job. Thanks to a temporary program called Pandemic Unemployment Assistance that expanded access to UI for gig workers who were unable to continue working, in 2020 over half of the workers whose primary income source in 2019 was platform work received UI benefits. Among those who received UI, the ratio of median benefits to former income was about 1.4 for those who were primarily platform workers in 2019, and 1.0 for self-employed workers who did not receive any platform income. UI benefits as a share of 2019 income were greatest for those with low prepandemic earnings: the average primarily platform gig worker making less than $2,500 in 2019 got more than $17,300 in aid during 2020, compared with about $19,700 for those who earned between $30,000 and $60,000.

The benefits seem to have affected willingness to work: for every additional dollar in benefits received in state-administered pandemic assistance, reported gig earnings fell by 48 cents, compared with 29 cents among the self-employed more broadly. The lost earnings, which appear to be due to a labor supply response, were most pronounced for platform gig workers earning more than $15,000 in 2019. While the authors attribute increased exits from primary gig work to the expanded unemployment insurance benefits, these exits are swamped by new entries. Self-employment outside of platform gig work also saw excess exits; however the disincentive effects of UI were smaller due to slacker demand outside of platform delivery.

— Laurent Belsie