Managing a Turn in the Global Financial Cycle

It is a tremendous honor for me to give the Martin Feldstein Lecture. Marty was an exceptional colleague at Harvard and inspired my journey from academia to the policy world. His influence in research went well beyond public finance. In fact, one of his most cited papers is a contribution to international economics, widely referred to as the Feldstein-Horioka puzzle. Marty showed empirically that most savings tended to be invested at home, which can be puzzling if international capital markets are well integrated.

In reality, capital markets have many frictions, and my lecture today focuses on the implications of these frictions for policy in emerging and developing economies. I hope to show how policy questions arise at the International Monetary Fund (IMF), the research that gets done to answer these questions, and finally, how this research influences policymaking.

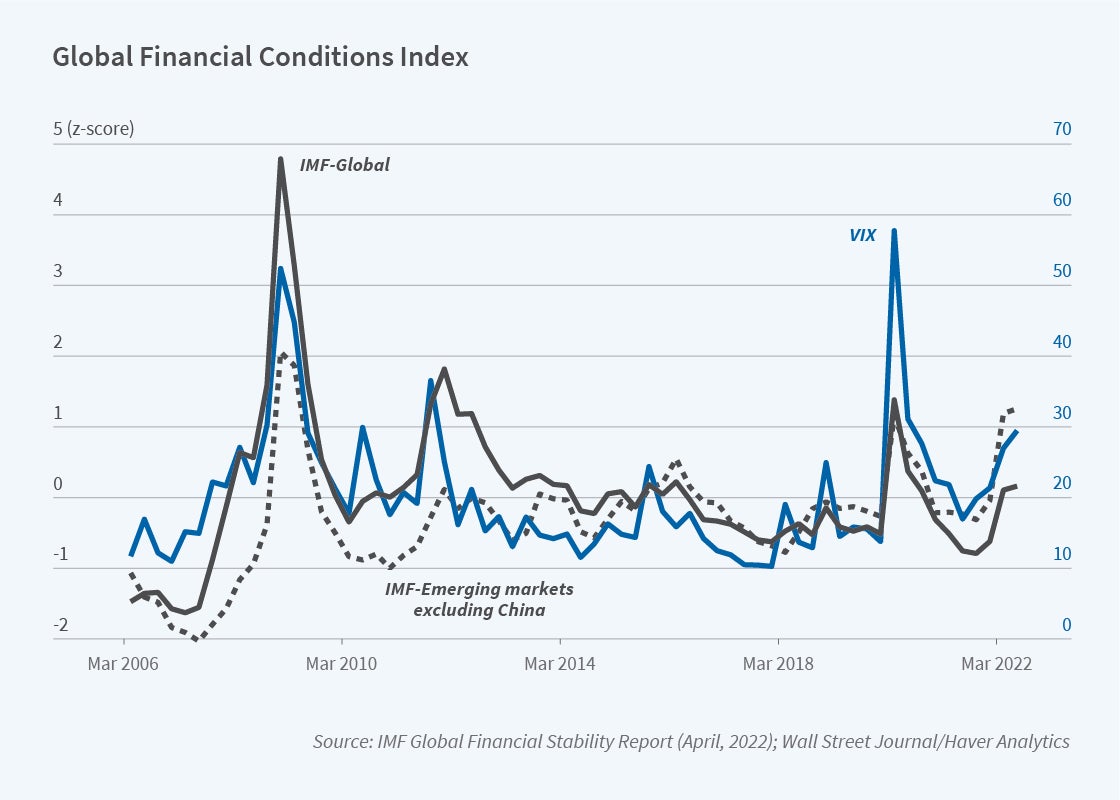

It is an opportune time to discuss this topic because after two years of easy financial conditions around the world, with monetary policy rates kept at record lows to prevent a COVID-driven depression, we are witnessing a tightening in global financial conditions. Almost all central banks are raising interest rates to deal with historically high inflation because of strong demand recoveries from the pandemic, alongside disruptions to supply and elevated energy and food prices exacerbated by Russia’s invasion of Ukraine.

As can be seen in Figure 1, global financial conditions have tightened significantly, especially for emerging markets and developing economies, excluding China. According to Figure 2, over 30 percent of emerging markets are paying interest rates over 10 percent on their sovereign foreign-currency bonds, which is close to the levels seen during the Great Financial Crisis of 2008. In addition, as is typically the case when global financial conditions tighten, the US dollar has strengthened against a wide basket of currencies [see Figure 3], raising costs for countries that have borrowed in dollars. All of this is occurring in the aftermath of a pandemic, during which debt in emerging and developing economies has grown significantly.

A key policy question therefore is how emerging and developing economies should respond to this tightening cycle that is driven to an important degree by rising US monetary policy rates. The textbook answer would be to let the exchange rate be the shock absorber. An increase in foreign interest rates lowers domestic consumption. By letting the exchange rate depreciate, and therefore raising the relative price of imports to domestic goods, a country can shift consumption toward domestic goods, raise exports in some cases, and help preserve employment.

However, many emerging and developing economies find this solution of relying exclusively on exchange rate flexibility unsatisfying. This is because rising foreign interest rates come along with other troubles. They can trigger so-called “taper tantrums” and sudden stops in capital flows to their economies. In addition, the expansionary effects of exchange rate depreciations on exports in the short run are modest, consistent with their exports being invoiced in relatively stable dollar prices.1

Figure 4, on the following page, depicts one such taper tantrum episode in 2013, when the US Federal Reserve signaled an end to quantitative easing and a lift-off in rates, possibly earlier than expected. This communication triggered a sharp increase in borrowing costs for emerging markets, with median spreads increasing by more than 200 basis points even though there was no meaningful immediate policy action by the United States. Figure 5, documents episodes of sudden stops with growth impact, which are defined as an abrupt stop or reversal in capital flows to emerging and developing economies that in turn generate a sharp fall in growth. These episodes capture a sudden tightening of borrowing constraints in emerging markets because of a perceived lower capacity of the country to repay. While they are less frequently observed than taper tantrums, they have larger adverse welfare implications for the country.

Consequently, several emerging and developing economies have in practice used a combination of conventional and unconventional policy instruments to deal with turns in the global financial cycle. Unlike the textbook prescription, they not only adjust monetary policy rates but also rely on foreign exchange intervention (FXI) to limit exchange rate fluctuations, capital controls to regulate cross-border capital flows, and domestic macroprudential policies to regulate domestic financial flows. This common practice, however, lacks a welfare-theoretic framework to guide the optimal joint use of these tools. This shortcoming limited the policy advice the IMF could give to several of its members. Accordingly, to enhance IMF advice, David Lipton, the former first deputy managing director of the fund, championed the need to develop an Integrated Policy Framework that jointly examines the optimal use of conventional and unconventional instruments.

Over the last few years, a large body of work, both theoretical and empirical, has been developed at the IMF. In today’s lecture, I will focus on the theoretical work that I have been involved in with coauthors Suman Basu, Emine Boz, Francisco Roch, and Filiz Unsal.

There already exists an extensive literature on the various frictions in an open economy, but most of this literature focuses on a single friction at a time. In practice, multiple frictions coexist, and policy tools affect multiple frictions at the same time. Consequently, the challenge is to build a tractable model that facilitates an analytical understanding of the interaction of frictions and policy tools. This analysis is developed in two of our studies.2 I will share some insights from this work, and encourage you to read the papers themselves, which cover a lot more ground.

I will first describe some of the frictions that are prominent in the literature and that policymakers grapple with. After that, I will take up the motivating question of how countries should manage the current tightening in the global financial cycle. The optimal policy response will, as one might expect, depend on country characteristics and shocks.

Nominal rigidities in price setting are a key ingredient in models of the exchange rate. This friction underlies the classic Mundell-Fleming framework3 and Milton Friedman’s argument for the optimality of flexible exchange rates.4 Price stickiness gives rise to the “aggregate demand externality” as formulated by Emmanuel Farhi and Iván Werning, whereby agents fail to internalize the effect of their decisions on aggregate demand.5 This externality creates a problem when prices are misaligned and gives rise to an aggregate demand wedge — that is, a wedge between the marginal rate of substitution between consumption and leisure on the one hand, and the marginal rate of transformation arising from the production function on the other. If prices are too high (low) relative to their flexible-price level, households consume too little (much), lowering (raising) output and pushing employment below (above) efficient levels. In the open economy context, price stickiness also leads to a “terms-of-trade” externality. This arises because while firms internalize the fact that they have pricing power for their own product in international markets, they do not internalize the fact that the country also faces a downward-sloping demand curve. This externality leads to overproduction of domestic goods and a terms of trade that is less appreciated relative to the planner’s optimum. While this externality is commonly explored in the literature, policymakers appear to disregard it in practice, and we accordingly mute this channel in our analysis.

A second friction that policymakers grapple with is the shallowness of foreign exchange (FX) markets, which can give rise to volatility in the price of domestic currency bonds as market sentiment changes. Owing to balance sheet frictions, financial intermediaries demand a premium to hold domestic currency bonds that carry currency risk relative to foreign currency bonds. This financial friction was recognized early on by Pentti J.K. Kouri,6 around the same time as Robert Mundell and Marcus Fleming wrote on pricing frictions, but it received less attention in the literature until recently, when work by Xavier Gabaix and Matteo Maggiori reenergized research in this area.7

The shallow-market friction gives rise to what we call the “financial terms of trade externality.” Firms or households that issue debt in domestic currency do not internalize the impact of their decisions on the premium charged by financial intermediaries, which varies with the overall level of debt of the country. This externality gives rise to an uncovered interest parity wedge, which is the excess return paid to intermediaries for holding domestic currency bonds. This wedge has implications for policy when financial intermediaries are foreign owned, as payments to intermediaries are a net loss of resources for the country.

In addition to shallow FX markets, another common friction in emerging and developing economies arises from borrowing constraints and so-called “currency mismatch” in households’ and firms’ balance sheets. The ability of domestic agents to borrow is restricted by the extent of pledgeable collateral, which is often denominated in domestic currency. As a consequence, when the exchange rate depreciates, the ability to borrow in foreign currency is reduced. Since households and firms do not internalize the impact of their decisions on the exchange rate, there is a pecuniary externality that in turn impacts the aggregate demand wedge, leading to inefficient outcomes.

I now turn to the question of how to manage a turn in the global financial cycle. We derive the optimal policy response ex ante — prior to the shock — and ex post — during the shock — as the solution to the planner’s problem with commitment. The optimal policy depends on the particular frictions at play and the nature of the shock. Table 1 presents various scenarios that may apply in practice. In all cases, prices are assumed to be sticky.

The upper-left quadrant represents the textbook case that characterizes a developed, small, open economy with dominant currency pricing. Such a country has deep FX markets, meaning that financial intermediaries do not require an excess return for holding the country’s domestic currency bonds, and its external debt is far from the debt limit. The only friction is the nominal rigidity in prices and the associated aggregate demand externality. In this case, when the foreign interest rate rises, it reduces domestic consumption of all goods, including home goods, and opens an aggregate demand wedge. The optimal policy response is exchange rate depreciation, which increases the relative price of imports to domestic goods and thereby shifts consumption from imports toward home goods. This expenditure switching delivers the needed reduction in imports and external debt, while the country’s exports and domestic consumption of home goods and domestic output remain unchanged. Exchange rate flexibility therefore suffices to close the aggregate demand wedge.

The upper-right quadrant characterizes a country whose debt is far from its debt limit, but which has shallow FX markets, resulting in an uncovered interest parity wedge. Consider here a taper tantrum shock, where noise traders — irrational or position-limited traders who buy and sell domestic currency bonds regardless of the level of returns — decide to sell their holdings of domestic currency bonds. If the country’s FX markets are deep, as in the case of the upper-left quadrant, this shock would have no real effects because there would be a large pool of other investors who would buy the bonds without any effect on prices. However, if the FX markets are shallow, other financial intermediaries require a higher excess return on the country’s debt to absorb the bonds offloaded by noise traders, resulting in higher borrowing costs for the country. To offset this shock, the following policies can be deployed: policy rates can be raised so that domestic bonds pay a higher interest rate, capital inflow taxes that are paid by intermediaries can be cut so that the effective return they earn increases, or policymakers can deploy FXI, whereby the central bank buys the offloaded domestic bonds and sterilizes the purchase by selling foreign currency bonds.

In the case where noise trader shocks are symmetric, it turns out that optimal policy calls for leaving the policy rate alone and relying exclusively on a reduction in the tax on capital inflows and FXI. The reason is that when the policy rate is changed, it affects the consumption decisions of domestic agents and leads to excessive deleveraging. On the other hand, the cut in capital inflow taxes benefits financial intermediaries without raising borrowing costs for domestic agents. The reason that optimal policy calls for both FXI and capital inflow tax cuts is that each instrument is costly. Cutting capital inflow taxes results in a loss of resources to foreigners, while foreign exchange intervention forgoes carry profits. The joint use of both instruments insulates the economy from nonfundamental shocks like noise trader shocks. This overturns the result of the textbook case: optimal policy calls for an unchanged policy rate and exchange rate, and instead the country should rely on capital controls and FXI, which are more targeted to addressing the problem.

The lower two quadrants consider the case of a sudden stop shock, when a financial tightening leads to a tighter borrowing constraint for the country and limits the foreign currency value of its external debt. This shock is relevant when the country’s debt is close to its debt limit, unlike in the case of the upper two quadrants. A tightening of the borrowing constraint generates a drop in demand. When prices are sticky, this reduction in demand opens an aggregate demand wedge because output is too low relative to efficient levels. In this case, the optimal policy response calls for a cut in interest rates and a depreciation of the currency, which stimulates higher consumption today and tilts demand toward domestic goods. However, if a country’s debt is in foreign currency and the pledgeable collateral is in domestic currency — in other words, there is currency mismatch on the balance sheet — a depreciation exacerbates the shock by further tightening the borrowing constraint. In this case, policy needs to trade off the distortion in the aggregate demand wedge against the tightness of the debt limit. Accordingly, exchange rate depreciations cannot close the output gap ex post. Optimal policy requires the imposition of ex-ante capital controls that limit the extent of ex-ante foreign currency borrowing by domestic agents. The situation is improved when debt is partially in domestic currency because the ex-post exchange rate depreciation reduces the foreign currency value of the debt that needs to be repaid. In some circumstances, a greater reliance on domestic currency debt instead of foreign currency debt can lead to a lower optimal level of ex-ante capital controls.

To mitigate the negative impact of exchange rate depreciations on balance sheets, policymakers in emerging and developing economies often regulate the currency mismatch on the balance sheet of domestic-owned financial intermediaries. By encouraging reliance on domestic currency borrowing, policies that engineer a state-contingent exchange rate depreciation can lower the foreign currency value of the debt owed externally in adverse states, and shift demand toward domestic goods in those states. There is a side effect, however, when the country’s FX markets are shallow (lower-right quadrant): restricting domestically owned financial intermediaries from taking on currency mismatch does not just reduce the size of the FX market that intermediates domestic and foreign currency bonds. It also tilts the composition of active intermediaries toward those owned by foreign investors. This side effect worsens the financial terms of trade externality because the increase in the premium to be paid to intermediaries is a net loss of resources from the country’s perspective. Consequently, the optimal level of regulation of currency mismatch depends on FX market depth and, in particular, banning FX mismatches entirely may be suboptimal when FX markets are shallow.

To summarize, the optimal policy response to a tightening in the global financial cycle depends on country-specific circumstances. When a country’s financial markets are deep and its debt is well below the debt limit, the textbook prescription of relying exclusively on interest rates and flexible exchange rates can work well. But there are other cases when such a policy response does not suffice. In fact, after noise-trader shocks that disrupt the economy, the deployment of instruments such as foreign exchange interventions or capital inflow controls dominates the use of exchange rate flexibility.

The work at the IMF goes beyond theory to empirically evaluate the effectiveness of different policy instruments and to put in place safeguards to ensure that unconventional instruments are not deployed as a substitute for necessary macroeconomic adjustment. In addition, there may be dynamic trade-offs from excessive reliance on unconventional instruments. For example, government intervention in financial markets may delay the development of deep FX markets. Accordingly, Integrated Policy Framework advice goes hand in hand with advice that the IMF provides to countries on structural reforms, ensuring that short-term actions do not detract from long-term reforms. In the fall of 2020, the IMF Board approved work on the Integrated Policy Framework,8 and this work was an essential ingredient in the 2022 reform of the IMF’s Institutional View on Capital Flows, which now puts greater emphasis on stocks of debt in addition to flows and allows the pre-emptive use of capital flow management measures to address financial stability risks even when there is no surge in capital inflows, especially when a country’s debt is in foreign currency.9 Armed with the Integrated Policy Framework toolkit and policy recommendations, the IMF is much better placed than it was previously to address the growing demands from member countries for advice on how to best respond to the tightening of the global financial cycle.

Endnotes

“Dominant Currency Paradigm,” Gopinath G, Boz E, Casas C, Díez F, Gourinchas PO, Plagborg-Møller M. American Economic Review 110(3), March 2020, pp. 677–719.

“A Conceptual Model for the Integrated Policy Framework,” Basu S, Boz E, Gopinath G, Roch F, Unsal F. IMF Working Paper 2020/121, International Monetary Fund, Washington, DC; “Integrated Monetary and Financial Policies for Small Open Economies,” Basu S, Boz E, Gopinath G, Roch F, Unsal F. Working Paper, 2020.

“Capital Mobility and Stabilization Policy under Fixed and Flexible Exchange Rates,” Mundell R. Canadian Journal of Economics and Political Science 29(4), November 2014, pp. 475–485; “Domestic Financial Policies under Fixed and Under Floating Exchange Rates,” Fleming J. Staff Papers, International Monetary Fund 9(3), November 1962, pp. 369–380.

“The Case for Flexible Exchange Rates,” Friedman M. In Essays in Positive Economics, pp. 157–203. Chicago: University of Chicago Press, 1953.

“A Theory of Macroprudential Policies in the Presence of Nominal Rigidities,” Farhi E, Werning I. Econometrica 84(5), September 2016, pp. 1645–1704.

‘‘The Exchange Rate and the Balance of Payments in the Short Run and in the Long Run: A Monetary Approach,’’ Pentti K. Scandinavian Journal of Economics 78(2), June 1976, pp. 280–304.

“International Liquidity and Exchange Rate Dynamics,” Gabaix X, Maggiori M. The Quarterly Journal of Economics 130(3), August 2015, pp. 1369–1420.

“Review of The Institutional View on The Liberalization and Management of Capital Flows,” International Monetary Fund Policy Paper, March 2022.