The Social Value of Science and Innovation Investments and Sources of Breakthroughs

Per capita income in the United States today is about 50 times greater than it was in 1820, and life expectancy is decades longer. Amidst these impressive gains, there is a broad appreciation that science and innovation — the discovery and implementation of new ways of doing things — is critical. Yet there is also substantial skepticism about the value of investments in research and development, including those in science. Many R&D investments fail to yield successful outcomes, whether in science or the marketplace. Most pharmaceutical development projects and new business ventures fail, most patents have little apparent market value, and most scientific research projects, even if they are published, receive very few citations.

Uncertainty about the value of R&D investments makes it difficult to answer fundamental questions about R&D policy, including the appropriate direction and scale of research spending. The US economy invests between 2 and 3 percent of GDP annually in R&D. Is that the right amount? The economy now appears to be caught in a productivity growth slowdown. If innovation is key to productivity gains, can R&D policy accelerate the rate of progress? And how might we do this?

Answering these questions is both important and challenging. A central difficulty is the issue of spillovers: the value of scientific and innovative outputs accrues not just to the original creator but in substantial part to others, including those who use, imitate, or build further upon the advance. Think of calculus, the internet, and the smartphone. Tracing streams of benefits to disparate parties, including future parties, is a fundamental challenge. So is selection. Studies of R&D sometimes compute returns by picking winners, assessing the value of R&D through the lens of developments like mRNA vaccines, or Moore’s Law. Such studies show extremely high returns, while the return to R&D projects more generally may look very different, and be much lower. On the other hand, skeptical observers of science funding often pick losers, emphasizing the regular failures in R&D efforts. Think of Senator William Proxmire’s Golden Fleece Awards, which pilloried public investment in frivolous research, or more recent criticisms of the US Department of Energy’s $535 million in loan guarantees to Solyndra, a solar-panel maker that failed.

In a recent series of projects, my colleagues and I have been tracing the costs and benefits of R&D in a more comprehensive fashion and assessing the overall social returns to the R&D enterprise. This work builds in part on the availability of remarkable new datasets that provide increasingly detailed and wide-ranging views of scientific and innovative activity. Further, beyond “bottom-up” approaches from microdata, novel “top-down” measurement frameworks can help step past microdata limitations and elucidate macroeconomic implications. In this summary, I describe several recent studies that speak to the value and scale of scientific and innovative activities, and also consider new insights about key sources of breakthroughs.

Measuring the Use of Science

Scientific research is a substantial component of R&D investment, and scientific discoveries are often seen as opening new doorways to progress. As Vannevar Bush wrote, science “creates the fund from which the practical applications of knowledge must be drawn.”1 This canonical perspective emphasizes science’s spillovers. It also motivates the public goods approach to science, in which research in universities and national labs is substantially funded through tax dollars and the fruits of these investments are placed in the public domain so that others, at least in principle, will build on these insights. Understanding the value of science, and the effectiveness of its institutional architecture, thus hinges on tracing spillovers from science into broader public use.

A key measurement approach to tracing knowledge flows uses reference linkages in microdata. Economists have long applied this approach to patents: a patent codifies an invention, and the citation linkages between patents — and hence between inventors, firms, and regions — can act as a proxy for knowledge flows. More recently, with the advent of large databases of scientific works, similar measurement ideas can be applied to journal articles and the reference linkages between them. Building on these databases, one can trace the spillovers of science beyond the bounds of science itself.

Mohammad Ahmadpoor and I investigate the use of science in patenting. We trace how scientific research largely conducted in university and government labs can form the foundation for marketplace invention largely developed by private sector firms.2 We examine all US patents and trace their references to prior scientific articles. One key finding is that a remarkable degree of connectivity exists between patenting and prior scientific work. Conditional on a scientific article being cited at least once by other scientists, 80 percent of scientific articles are part of a stream of knowledge that leads to a specific future patent. Further, on the patenting side, patents that are closer to science prove to have much larger impact and market value.3

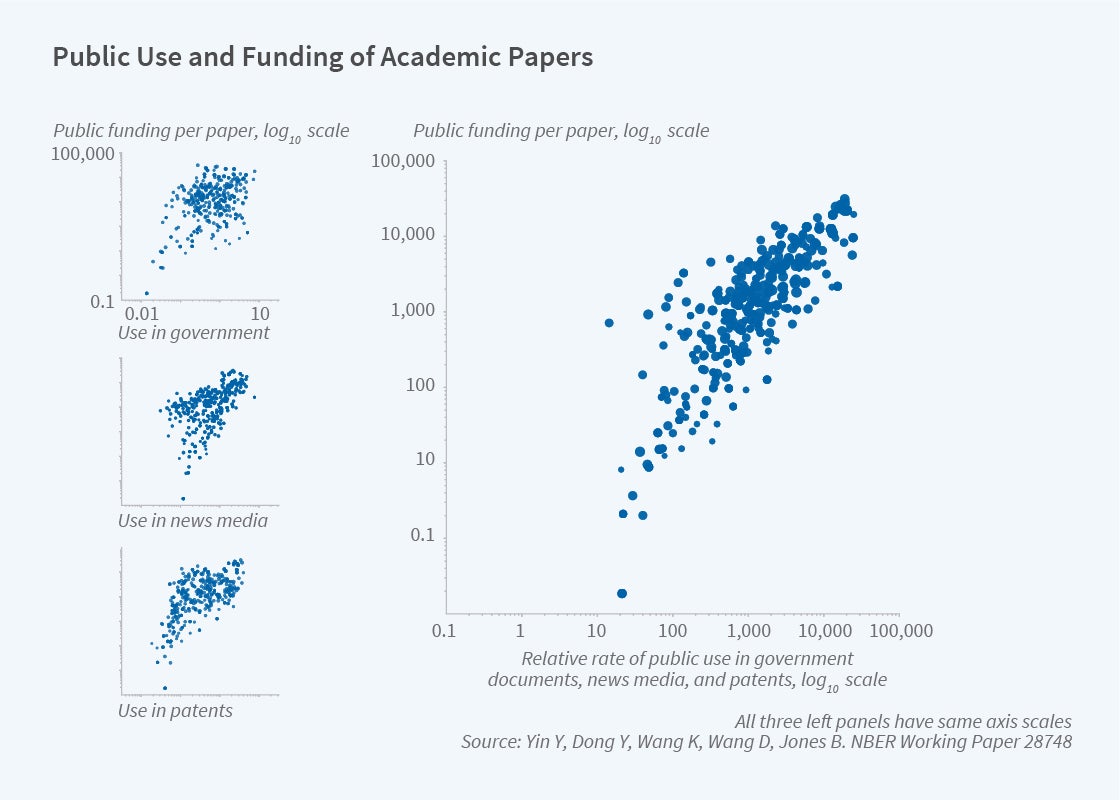

More recently, Yian Yin, Dashun Wang, and I, working with a team at Microsoft, consider the uses of science across three public domains — government documents, the news media, and patents — to provide a broader picture of the use of science beyond science.4 This study also integrates funding information across the corpus of scientific works. Whereas in a market setting it is natural to think that investment tracks consumer demand, the activity of science is innately more distant from its ultimate use and comparable demand signals are harder to identify. Indeed, there is substantial skepticism about the ivory tower nature of scientific research — the idea that scientists may follow abstract interests with little connection to broader society — and there is also substantial skepticism about how the public funding system, which includes legislators, funding agencies, and scientist review panels, makes investment choices.

Figure 1 examines the relationship between public funding and public use across the sciences and social sciences. We find a striking degree of alignment between a research field’s funding, measured as public expenditure per research paper produced, and the tendency for that field’s papers to be drawn upon in policy, media, and patenting. Pulling all three types of public uses together, we can predict the public funding of different science fields with considerable accuracy. These findings suggest that science is not an isolated or ivory tower activity disconnected from public interest. Rather, science generates a diverse range of spillovers, and public funding of science is closely related to public use.

Measuring the Social Return to R&D

These analyses show how the integration of new datasets can help in assessing longstanding hypotheses and skepticism about the use of science. These microlevel studies do not, however, provide an overall assessment of the value of R&D or a comparison of its benefits and costs. Tracing knowledge using microdata only goes so far. For example, trade secrets remain a kind of “dark matter” in innovation. Surveys suggest that trade secrets are extremely important to business but, essentially by definition, they defy easy observation. Further, reference linkages provide an incomplete picture of R&D spillovers. Negative spillovers in R&D, such as the duplication of R&D efforts or stealing among business competitors, typically will not appear through citation linkages.

In a recent study, Lawrence Summers and I introduced a top-down approach that seeks to overcome many of the measurement limits in microdata.5 Our basic insight is that productivity growth in the economy captures the net result of innovative investments. Separately, total innovation investment costs capture the funding for both the successes and the dry holes, avoiding the problem of selection in studying R&D returns. One can then compare the present value of the productivity gains along the economy’s growth path to the total innovation investment costs to calculate a transparent, overall measure of the social returns.

We find that average returns to investments in innovation are very large. Conservative estimates suggest that $1 invested in R&D returns at least $5 on average. Adding in other benefits — such as health gains — can raise these social returns higher, to $10 of benefit per $1 spent, or more. Our relatively comprehensive analysis echoes the high social returns to additional R&D funding found in studies that focus on narrower contexts. These results suggest that expanding R&D investment would pay for itself many times over, and would be a direct way to overcome the productivity slowdown.

Scientific and Innovative People

A key input to R&D is people — the scientific and innovative labor force. Understanding who produces breakthroughs is key to R&D policy, since accelerating advances hinges on the capacity to scale and invest in the innovative workforce. How might we do this? And on whom might we bet?

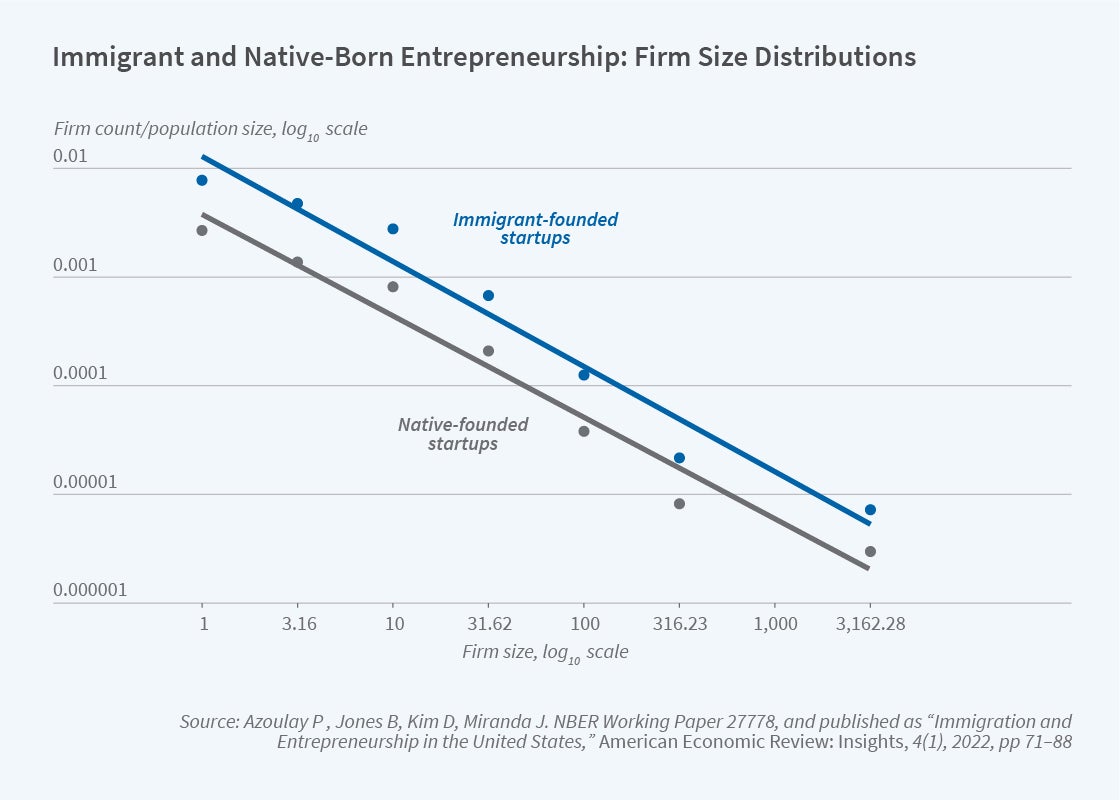

On the scaling dimension, one key pathway may be immigration. Recent research has shown the exceptionally productive role immigrants play in both invention and entrepreneurship in the US. Pierre Azoulay, Daniel Kim, Javier Miranda, and I use administrative data from the US Census to study the founders of all new businesses in the country from 2007–15.6 We measure the rate at which immigrants and native-born individuals started businesses and their degrees of success. We find that immigrants are highly entrepreneurial: an immigrant is 80 percent more likely to start a business than a native-born individual. And immigrants don’t just start businesses that remain small. Rather, as Figure 2 shows, immigrants are more likely than native-born individuals to start businesses of every size, with immigrant founders overrepresented among businesses that grow to be the biggest employers or have the greatest sales. Immigrants’ firms are also more likely to hold patents in every size class, indicating the technology orientation of these firms. Other recent work has shown that immigrants are overrepresented among inventors in the US and are especially successful in the quantity and value of their inventions.7

In additional work with a variety of colleagues, I have been studying the sources of scientific and innovative breakthroughs, from people inputs to idea inputs to forms of collaboration. One line of inquiry concerns the life cycle of scientists and innovators. A common view is that young people are especially capable of creating transformative advances; this view can influence the funding choices for investors. However, systematic data analysis rejects this view. In science and invention, including in Nobel Prize-winning work, peaks come later in life, sometimes very late.8 In a recent paper, Azoulay, Kim, Miranda, and I study a census of all business founders in the US and examine the founders behind the upper tail of successes.9 We find that young founders are disproportionately unlikely to produce high-growth companies, with founders in middle and even late-middle age having the highest likelihood of starting the highest-growth companies. Our findings have implications for those in whom we invest when pursuing breakthrough ideas.

Overall, new data and measurement approaches are helping to answer longstanding questions about science and innovation and generate new and often surprising insights. Much remains to be learned, and the advent of high-scale data about the science and innovation system opens many pathways to new discoveries.

Endnotes

“Science: The Endless Frontier,” Bush V. US Government Printing Office, 1945.

“The Dual Frontier: Patentable Inventions and Prior Scientific Advance,” Ahmadpoor M, Jones B. Science 57(6351), August 2017, pp. 583–587.

Ibid. See also “Standing on the Shoulders of Science,” Watzinger M, Schnitzer M. Centre for Economic Policy Research Discussion Paper 13766, July 2021.

“Science as a Public Good: Public Use and Funding of Science,” Yin Y, Dong Y, Wang K, Wang D, Jones B. NBER Working Paper 28748, April 2021.

“A Calculation of the Social Returns to Innovation,” Jones B, Summers L. NBER Working Paper 27863, September 2020, and in Innovation and Public Policy, Goolsbee A, Jones B, editors. Chicago: University of Chicago Press, 2022.

“Immigration and Entrepreneurship in the United States,” Azoulay P, Jones B, Kim JD, Miranda J. NBER Working Paper 27778, September 2020, and American Economic Review: Insights 4(1), March 2022, pp. 71–88.

“The Contribution of High-Skilled Immigrants to Innovation in the United States,” Bernstein S, Diamond R, McQuade T, Pousada B. Stanford Graduate School of Business Working Paper 3748, November 2018.

“Age and Great Invention,” Jones B. NBER Working Paper 11359, May 2005, and Review of Economics and Statistics 92(1), February 2010, pp. 1–14.

“Age and High-Growth Entrepreneurship,” Azoulay P, Jones B, Kim JD, Miranda J. NBER Working Paper 24489, April 2018, and American Economic Review: Insights 2(1), March 2020, pp. 65–82.