New Approaches to Understanding Choice of Major

College major choice and its relationship to labor market outcomes has long been a topic of study for social scientists. Stretching back at least to the 1970s, researchers have recognized that the particular field, and not just the level of education, deserves attention. A number of studies have demonstrated that the choice of post-secondary field is a key correlate of future earnings, and that choice of college major may be an important factor in explaining earnings differences, in particular by gender. Beyond individual welfare, major choice affects the skill composition of the workforce, making an understanding of how these choices are affected by changes in skill demand and wages important to research on the dynamics in the overall economy.

Our recent work on college major choice is focused on identifying the importance of earnings to major choice, relative to any other nonpecuniary considerations. Across our work, we bring new approaches to this classic issue, including the collection of new survey data on college students’ expectations about the consequences of majors on their own future earnings and other outcomes, including future labor supply, marriage, and fertility. We show how information interventions, lab experiments, and hypothetical/stated choice designs can supplement subjective expectations data to provide further evidence on the factors that affect choice of major. Although this work has used a sample of high-ability college students from a selective university, we demonstrate that the richness of our data collection brings important new insights into the choice of a major and serves as a model for subsequent work.

Earnings Beliefs

The standard economic literature on decisions made under uncertainty, such as occupational and educational choices, generally assumes that individuals, after comparing the expected outcomes from various choices, choose the option that maximizes their expected utility. In the absence of expectations data, assumptions have to be made on expectations to infer the decision rule, including assumptions about expectations for counterfactual choices — the majors not chosen by the student. Although previous studies allow varying degrees of individual heterogeneity in beliefs about future earnings, they typically assume that expectations are either myopic or rational and use realized choices and realized earnings to identify the choice model. This approach is problematic because observed choices and realized earnings can be consistent with several combinations of expectations and preferences.

We designed a survey of major-specific earnings expectations and fielded it to undergraduates at New York University. We distinguish between two kinds of beliefs: what we term self-beliefs concern how much each respondent expects to earn in the future if they were to complete their degree in each major category, while population beliefs concern the realized distribution — for example, beliefs about average earnings for past graduates in each major. Whether correct or not, self-beliefs are the bases of choices, and collecting this information allows us to robustly estimate the importance of earnings to college major choices, free from the bias of incorrectly assuming the wrong model of expectations. Population beliefs, on the other hand, may not be directly relevant at all to self-beliefs or choices, but they provide some indications of how well-informed college students are about the labor market and whether some information intervention would be effective.

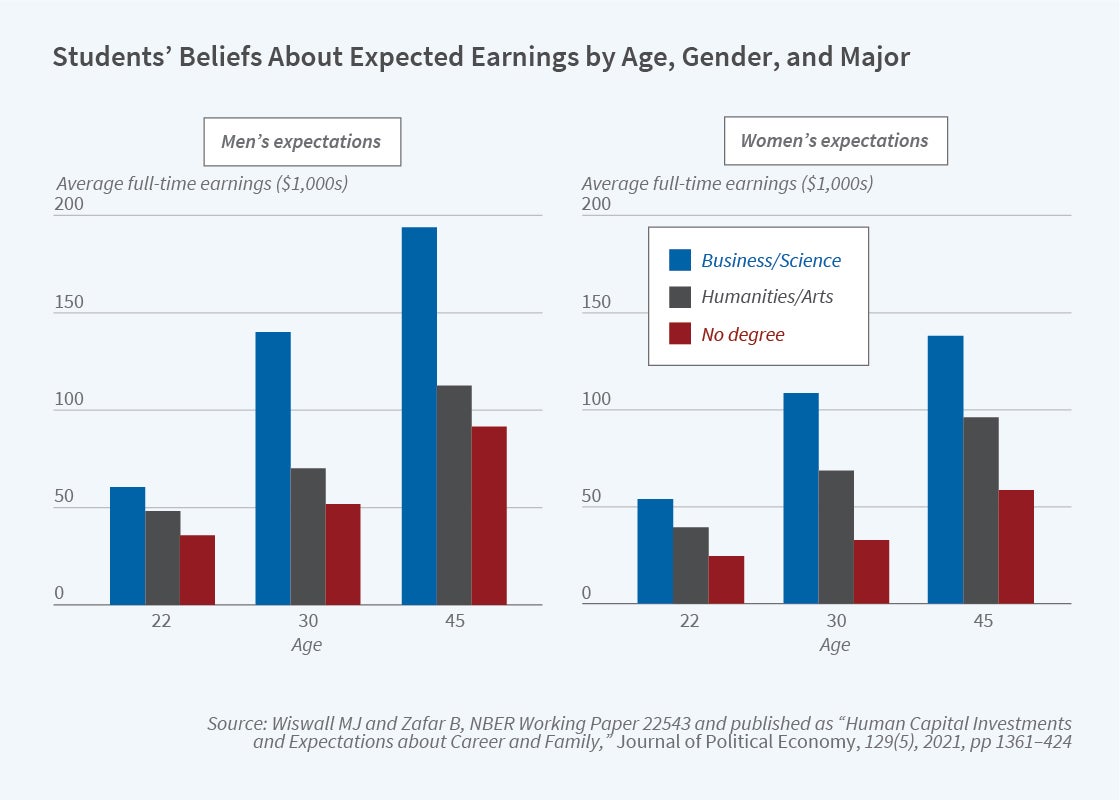

To understand how students believe their earnings would evolve through their life cycle, we asked questions about expected earnings at three future ages: just after college graduation (age 22–23), age 30, and age 45. We also included questions to elicit perceptions about uncertainty in future earnings. Figure 1 summarizes average expected earnings for our sample. Our survey respondents believe that their earnings would grow rapidly as they aged, that their earnings would be higher if they majored in science or business rather than humanities or arts, that completing a college degree even in lower-paying fields would provide higher earnings than no degree at all, and that the earnings premium associated with higher earning majors would increase as they age. We also see that students anticipate a gender gap: average earnings beliefs of male students are higher than the average beliefs of female students, with the gap largest at older ages. When we compare these self-beliefs about own future earnings with population beliefs about current average earnings for graduates aged 30, respondents report that they believe their own earnings will exceed the current population average, even adjusting for inflation, which is unsurprising given the high-ability sample.

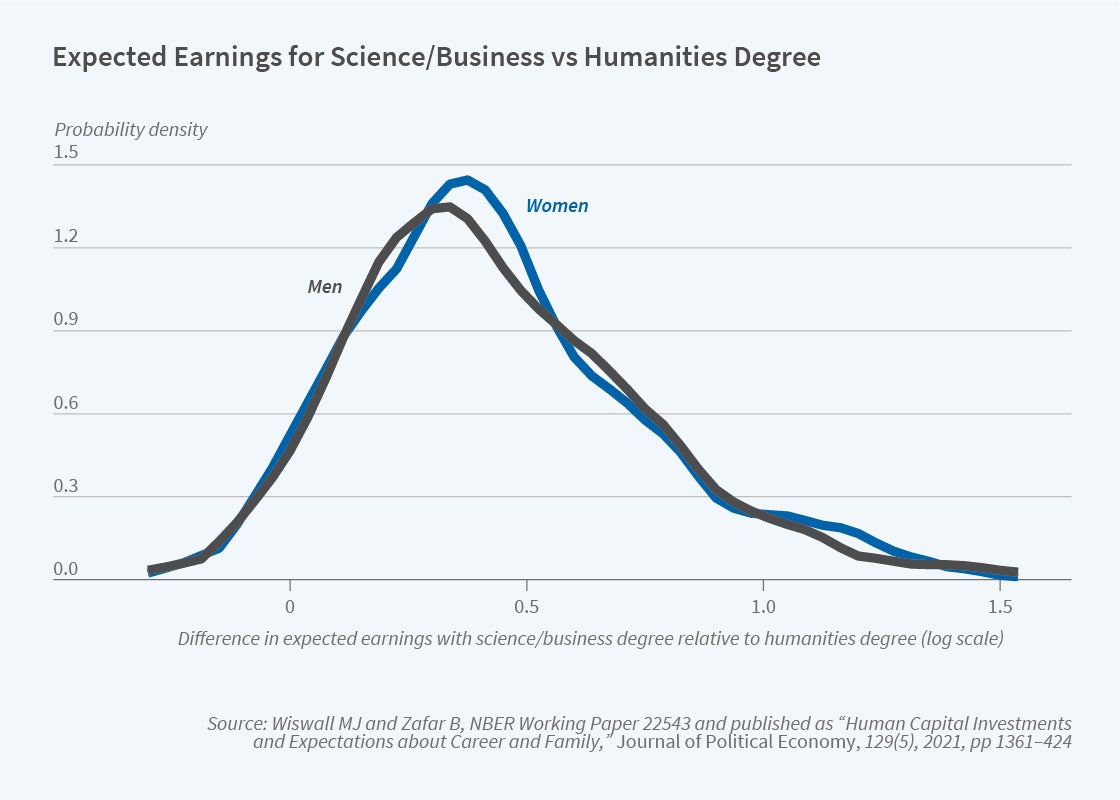

One of the important advantages of these data is that we can use them to construct the full distribution of individual perceptions of the earnings return to major choices. These ex ante returns are the subjective treatment effects of major choice anticipated by the students while they are in college. Figure 2 presents the sample distribution of the log of the anticipated age 30 earnings return to a science or business degree relative to a humanities or arts degree. The average expected return (the average ex ante treatment effect) is approximately 43 percent for female and 52 percent for male students. The figure makes clear that there is also a wide distribution in anticipated earnings return, with some individuals expecting a very high return (more than a 100 percent difference in earnings), others a small return, and for a small minority even a negative return.1

Using Beliefs to Estimate Preferences

We use our collection of beliefs data in otherwise standard models of expected utility from major choice, substituting the beliefs data for a particular model of how expectations are assumed to be formed. For earnings, a standard approach would be to use realized earnings from a prior cohort and variables such as college admissions test scores and grades, in addition to demographics, to predict each student’s future earnings from completing each major. This approach essentially assumes that students make the same prediction of earnings as the researcher. Our expectations data, providing earnings beliefs for each respondent for each major, enables us to relax these assumptions, allowing for heterogeneity in earnings beliefs beyond that captured by observable variables. We can then estimate preferences for majors, and the relative utility students place on earnings and other aspects of majors, robust to mis-specifying the expectations of students.

The disadvantage of our approach is the possibility of measurement error in the beliefs data we collect. While the overall patterns we document are reasonable, some responses are nonsensical. In part this may occur because, unlike in many studies of beliefs in the context of games played in a lab setting, we cannot incentivize students for “correct” answers to belief questions about future events and for various counterfactual outcomes that will never be realized. In addition to using various estimating strategies to account for measurement errors, we also conducted follow-up surveys when our respondents were in their mid- to late 20s. The follow-up data indicate a strong positive correlation of beliefs elicited earlier and actual realized outcomes, giving us confidence that our data are representative of students’ true beliefs.

Information Interventions

Information provision has been used in many contexts as a low-cost way to influence decision-making. We designed an information intervention in the context of our research on major choice for two purposes: the traditional one of assessing whether our intervention can improve decision-making and welfare, and, in addition, as a method to identify preferences. Motivated by prior studies which found that individuals have biased beliefs about the population distribution of earnings, we focused on providing earnings information to college students.

In one of our studies, we find that students logically revised their beliefs in response to the information. Students who underestimated average population earnings tended to revise upward their beliefs about their own earnings after the information treatment, and vice versa.2 By comparing changes in subjective probabilities of majoring in each field with the changes in subjective expectations about earnings and other characteristics of the major, we can measure the relative importance of each of these characteristics in the choice of major, free of bias stemming from the correlation of unobserved preferences with observed beliefs about majors. We find that earnings considerations are a significant factor in major choice, but a smaller factor than would be indicated using only baseline, cross-sectional data.

Non-Earnings Considerations

Early seminal work on human capital investments focused on “career concerns” motivations for human capital investment, where the motivation is solely the gain in one’s own future labor income. While earnings are of course an important consideration, human capital could affect life in many ways, and there could be a number of other motivations for human capital investments. For example, several recent studies have analyzed marriage market “returns” to human capital investment in which human capital affects an individual’s marriage prospects and the “quality” of potential spouses. Do young people actually consider these kinds of issues when making key human capital decisions?

In a very recent study, we used our study of NYU students to look beyond earnings considerations and asked students their beliefs about marriage, spousal earnings, fertility, and labor supply.3 These data allow us to analyze how young people perceive the trade-offs in career and family as they contemplate different human capital choices. Female college students, in particular, believe completing a science or business major, rather than a humanities or arts degree, would tend to lower marriage rates and lead to a delay in having children. Men, in contrast, perceive major choice to have no effect on these aspects of their later personal lives. We also elicit students’ beliefs regarding the earnings of potential spouses if they themselves were to complete different degrees, and find that male and female students alike perceive a large “spousal return” to completing higher-earning degrees, indicating that they believe this choice will yield not only higher earnings for themselves but marriages to higher-earning spouses as well.

Understanding Beliefs and Tastes

Two of the most important conclusions that emerge from our work concern gender. First, there are systemic gender-specific differences in beliefs, and these matter for choice of a major. Second, while earnings are a motivating factor in major choice, nonpecuniary factors — what economists typically refer to as “tastes” — play a major role, in particular in the higher likelihood of women completing humanities and arts degrees.

So why do men and women have systematically different beliefs? To answer this question, in our 2017 paper with Ernesto Reuben, we combined a laboratory experiment to measure behavioral traits— risk preferences, overconfidence, and competitiveness — with our NYU survey of labor market expectations and education choices.4 We find that the competitiveness and overconfidence measures, but not the risk aversion measure, are significantly related to the student’s expectations about future major-specific earnings, with earnings expectations increasing with the level of competitiveness and overconfidence. Importantly, the experimental measures explain as much of the gender gap in earnings expectations as a rich set of control variables, including students’ SAT scores, race, and family background. In addition, the experimental measures are not significantly related to the control variables, and thus have additional explanatory power.

The second main takeaway of our work — that tastes are a dominant driver of major choice — points to a natural question: what do these tastes capture? To unpack this, we use a hypothetical job choice methodology to recover student-level preferences for workplace amenities such as future earnings growth potential, dismissal probability, and work hours flexibility.5 We find substantial willingness to pay for nonpecuniary aspects of jobs, and considerable heterogeneity in preferences for these attributes. We find that women have a much higher average preference for workplace hours flexibility and more-secure jobs, while men have a higher average willingness to pay for jobs with higher earnings growth potential. Finally, we show that the job preferences young adults held in college relate to their major choices, and through a later follow-up survey four years after the initial survey, to the types of jobs they actually hold after graduation.

Endnotes

Figures 1 and 2 are taken from “Human Capital Investments and Expectations about Career and Family,” Wiswall M, Zafar B. Journal of Political Economy 129(5), 2021, pp. 1361–1424.

“Determinants of College Major Choice: Identification Using an Information Experiment,” Review of Economic Studies 82(2), 2015, pp. 791–824. See also “How Do College Students Respond to Public Information about Earnings?” Wiswall M, Zafar B. Journal of Human Capital 9(2), 2015, pp. 117–169.

“Human Capital Investments and Expectations about Career and Family,” Wiswall M, Zafar B. Journal of Political Economy 129(5), 2021, pp. 1361–1424.

“Preferences and Biases in Educational Choices and Labor Market Expectations: Shrinking the Black Box of Gender,” Reuben E, Wiswall M, Zafar B. Economic Journal 127(604), 2017, pp. 2153–2186. See also our recent paper with Arpita Patnaik and Joanna Venator: “The Role of Heterogeneous Risk Preferences, Discount Rates, and Earnings Expectations in College Major Choice,” Patnaik A, Venator J, Wiswall M, Zafar B. forthcoming, Journal of Econometrics.

“Preference for the Workplace, Investment in Human Capital, and Gender,” Wiswall M, Zafar B. The Quarterly Journal of Economics 133(1), 2018, pp. 457–507.