Capital Market Risks in Emerging Markets

International financial integration has increasingly exposed capital markets in emerging nations to shocks that originate outside their domestic economies. Theoretical open-economy macro models propose a variety of mechanisms by which global financial conditions are transmitted from developed to emerging markets. Candidate mechanisms include advanced-economy monetary policy spillovers, the risk-bearing capacity of international financial intermediaries, liquidity in international capital markets, and global exchange rate configurations.

Testing the empirical validity of theoretical open-economy macro models using micro datasets is relatively new to international finance. It is a focus of my research. Microeconomic data are important because aggregate data can mask underlying heterogeneity useful in testing theories about a range of international capital market phenomena, such as the effectiveness of international risk-sharing and the welfare gains from international capital movements. In a series of papers, I use microdata to explore the mechanisms by which global financial conditions impact capital markets in emerging economies.

Capital Flows and International Spillovers

The massive surge of foreign capital to emerging markets in the aftermath of the global financial crisis (GFC) of 2008–09 focused attention on the substantial spillover effects of developed-market monetary policy for emerging market economies. Karlye Dilts-Stedman, Christian Lundblad, and I examine the effects of (unconventional) US monetary policy on emerging market capital flows and asset prices using financial derivatives to identify monetary policy shocks.1 Our high-frequency identification strategy allows us to extract monetary policy shocks and use a dataset on disaggregated global capital flows and positions from the US Treasury to decompose the quantitative impact of US emerging market portfolio holdings into one component due to flows and another due to valuation changes. The findings shed light on the link between US monetary policy shocks, net capital flows, and emerging market equity and bond market returns. An important feature of our identification strategy is that the monetary shocks originate in the United States and are exogenous to the destination-country fundamentals.

The method allows us to disentangle the channels through which US monetary policy shocks alter yields and risk premia in the term structure of US interest rates. Using traded derivatives contracts on Treasury futures, we decompose the interest rate impacts of monetary policy shocks into the effect of revisions in market participants’ expectations about the path of short-term interest rates, and the effect of changes in required risk compensation. Our results confirm that changes in US yields and risk premia significantly impact equity prices and bond yields in emerging markets via the portfolio rebalancing and signaling channels.

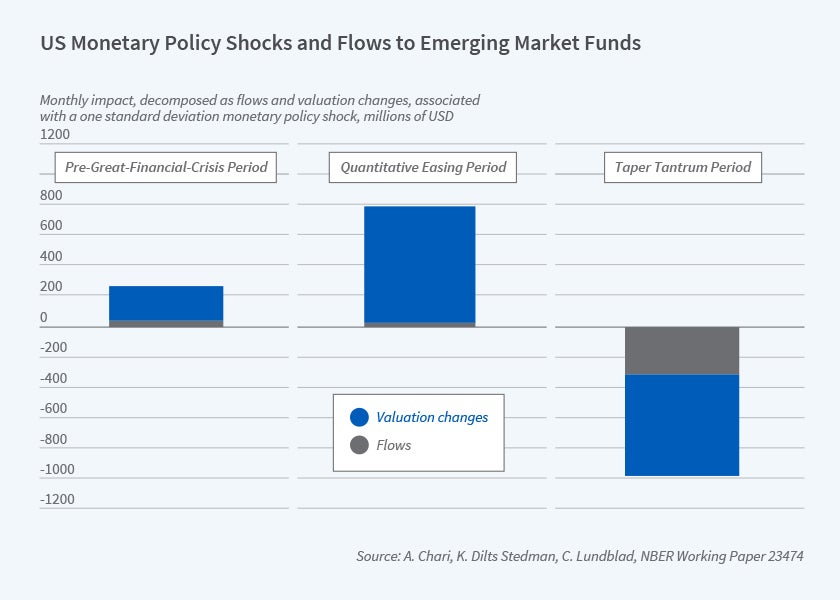

In particular, there is a significant correlation between US monetary policy shocks, bond yields, equity prices, and capital flows to emerging markets. The quantitative easing (QE) and tapering phases of unconventional monetary policy in the aftermath of the GFC represent salient examples of the mechanisms at play. During the QE period, falling term premia affected the market for long-duration assets domestically and internationally. This bears out the importance of US term premia for emerging market assets, particularly equities. Conversely, the taper tantrum episode of 2013 led to rising bond yields, falling equity prices, and significant retrenchments out of emerging market assets, increasing the cost of external finance.

In contrast to previous work, extracting the magnitude of the monetary surprises directly from the futures data allows us to quantify the impact of large versus small monetary policy shocks over and above the qualitative statements about the direction of impact that result from the use of event dummies alone. Using monetary surprise magnitudes, we can also directly estimate changes to US investor positions in and flows to emerging markets while controlling for a variety of global-push and destination-specific pull factors.

To illustrate the impact on equity flows, Figure 1 presents the effects of a one standard deviation monetary policy shock in the pre-GFC, QE, and taper tantrum periods, respectively. Using the disaggregated US Treasury International Capital data, the figure decomposes the impact in emerging market positions into changes in flows and valuations. For example, a one standard deviation equity shock in the taper period elicits an equity effect that, on average, represents about 11 percent of monthly market capitalization changes. Given the low average levels of liquidity in these markets, these effects are consequential.

Debt and Distress in Emerging Markets

Periods of expansionary advanced-economy monetary policy can facilitate a rapid buildup of leverage at firms in emerging markets, as witnessed in the aftermath of the GFC. Emerging market corporate leverage and debt levels surged during the period of QE and unconventional monetary policy in the United States, consistent with a fall in the cost of external finance brought about in large part by foreign capital inflows and increased cross-border financial intermediation. In the decade concluding in 2019, credit to nonfinancial corporations in emerging markets more than tripled to $30 trillion, or 98.8 percent relative to GDP. Different from the past, the composition of credit to emerging markets shifted from sovereign to corporate debt. Rising shares of debt held by troubled firms in conjunction with the surge in leverage have led to growing concerns that a wave of corporate defaults in emerging markets could pose a grave risk to financial stability. Tightening external financial conditions on the heels of easy money and a corporate leverage boom can drive up expected default probabilities.

We know relatively little about the determinants of corporate debt and distress in emerging markets. Research in international finance has primarily focused on the real and financial impacts of sovereign credit risk, and how external shocks that affect sovereign default risk impact the macroeconomy. My research brings new micro evidence to bear on the link between global financial conditions and corporate default risk in emerging markets.

Laura Alfaro, Gonzalo Asis, Ugo Panizza, and I explore the rapid expansion of credit to firms in emerging markets following the GFC.2 We document a set of stylized facts about leverage and financial fragility for emerging market firms. During the Asian financial crisis (AFC), corporate debt vulnerability indicators, such as Altman’s Z-score, provide a benchmark for comparison. Firm-level data show that post-GFC, more countries are close to or in the “vulnerable” range of this metric, and average leverage for the entire emerging market sample is higher in the post-GFC period than during the AFC. There is a deterioration in many indicators that measure corporate solvency and the ability to service debt.

Moreover, large firms appear to play an outsized role and disproportionately drive risks in emerging capital markets. In a second paper, we examine the links between the surge in corporate leverage in emerging markets, weakened corporate financial fragility indicators, and firm characteristics.3 We find that firm size plays a critical role in the relationship between leverage, firm fragility, and exchange rate movements. While the relationship between firm-leverage and distress scores varies over time, the relationship between firm size and corporate vulnerability is relatively time-invariant. All else equal, large firms in emerging markets are more financially vulnerable and also systemically important. Consistent with the granular origins of aggregate fluctuations, there is a positive and significant correlation between idiosyncratic shocks to large firms’ sales growth and GDP growth in our emerging markets sample. Relatedly, the negative impact of exchange rate shocks has a more acute impact on the sales growth of the more highly leveraged large firms.

Forecasting Corporate Default Risk in Emerging Markets

Using a novel multicountry dataset on corporate defaults from the Credit Research Initiative of the Risk Management Institute at the National University of Singapore, in two papers, Asis, Adam Haas, and I study factors that drive corporate distress in emerging markets. Established bankruptcy models based on developed-market experience do not capture many idiosyncrasies that affect emerging market firm solvency, particularly emerging market vulnerabilities to global financial conditions. We suggest that the extent of global exposure influences whether deteriorating international credit market conditions reduce emerging market firms’ ability to repay their debts. Consequently, it is not surprising that models developed in the US context perform poorly when applied to the emerging market firms. They may be missing pertinent factors that drive corporate default risk.

Given the universe of accounting, financial market, domestic, and global macro variables that could potentially influence emerging market firms’ solvency, selecting the most relevant variables for gauging corporate resiliency and forecasting distress is a challenging task. In the first paper, Asis, Haas, and I adopt a machine-learning approach to directly confront the issue of variable selection and show how a machine-learning technique, LASSO, can help corporate distress prediction in emerging markets.4 By limiting the analysis to the most relevant subset from a much broader set of accounting, market, and global variables, machine learning can increase a model’s predictive power while maintaining straightforward interpretation.

In terms of forecasting corporate distress, the variable selection exercise using machine learning suggests that models that include global financial conditions perform best in times of crisis. The omission of these variables may provide a clue for the underperformance of standard bankruptcy models that have not been tailored to the emerging market context. Models that only include accounting and market variables have better predictive power during normal times.

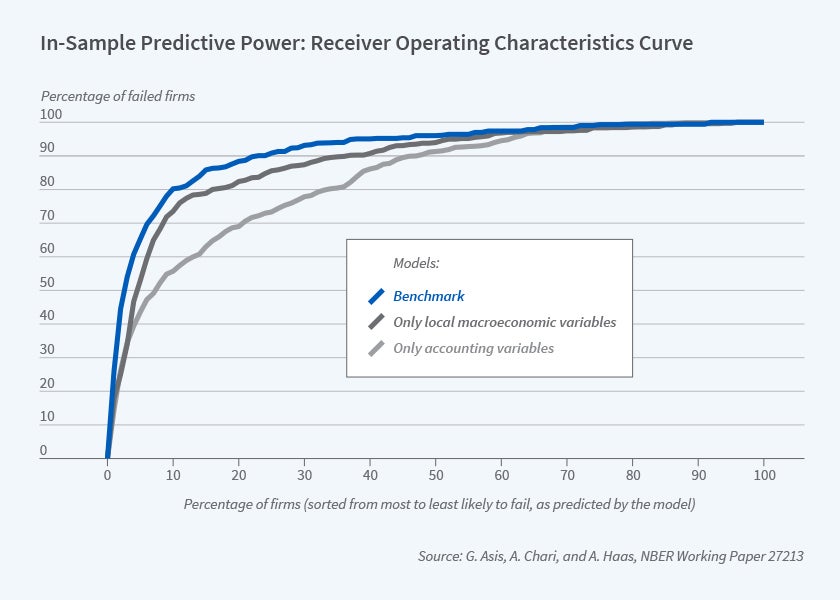

The existing literature uses several measures of a model’s predictive power, mostly ranking firms by their estimated probabilities of default. However, studies differ in the number of firms and defaults, the size of the quantiles to group firms, and the allocation of distressed firms across quantiles making cross-model comparisons difficult. We rely on the receiver operating characteristics (ROC) score, also known as the “area under the curve” (AUC), that uses the cumulative fraction of defaults as a function of the ordered population of firms from most to least likely to fail as predicted by the model. The ROC curve plots the true positive rate, based on the number of firms that default, against the false positive rate, based on the number of firms predicted to default that do not, for different threshold settings.

The extant literature on distress risk does not account for the exposure of emerging market firms to global financial shocks. This is the focus of our second paper.5 The ROC curves in Figure 2 illustrate the importance of global factors in the identification of distressed firms. They display the curves associated with our main specification that includes global variables, one that only has local macroeconomic variables, and one that includes only accounting variables. The benchmark model that includes global variables performs substantially better in identifying at-risk firms. Over 80 percent of the defaulting firms are included in the top 10 percent of firms when ranked by predicted default probability (blue curve). The specification that includes only accounting variables takes nearly 40 percent of the sample to get to this same rate of identification (light gray curve).

Our findings suggest that increased corporate leverage can make firms more exposed to adverse shocks to their cash flows and asset values, driving up default probabilities. Tightening global financial conditions can exacerbate rollover and currency risks. In the absence of optimal hedging, exchange rate depreciation can impose a significant strain on the ability of emerging-market firms to service foreign currency-denominated debts. Therefore, deteriorating global financial conditions can directly impact credit risk, elevating corporate default probabilities, particularly for firms with weak fundamentals. The data suggest that global financial variables, such as US interest rates, shifts in global liquidity, and foreign investor risk aversion, have significant predictive power for corporate distress risk in emerging markets.

We also explore the asset pricing implications of our measure of distress risk. Do riskier firms command a higher risk premium? Prior literature using US data documents an inverse correlation between distress risk and future stock returns, referred to as the “distress risk premium puzzle.” In contrast, we find strong evidence of a positive distress risk premium in emerging market stocks. Future twelve-month stock returns are monotonically increasing in the probability of corporate default, and the pattern is robust to the inclusion of a variety of standard asset pricing controls. The impact of a global “risk-off” environment on default risk is higher for firms whose returns are more sensitive to a composite global factor that measures external financing conditions.

Risk-on/Risk-off and Tail Events

My research on corporate default risk illustrates how changes in global financing conditions can affect emerging market firms. It is clear that tail events such as sudden stops present pressing challenges. Further, the mapping from global risk-on/risk-off positioning to capital flows and returns is conditional on the measure of risk used and the severity of the episode. Identifying the transmission of global financial conditions to local markets requires different sources of risk and plausible exogeneity with respect to local fundamentals. However, existing research has primarily focused on the first moment of the relevant distributions of aggregated risk measures. In ongoing work, Dilts-Stedman, Lundblad, and I turn our attention to the full distribution of emerging market capital flows and returns. We characterize how extreme capital flow and returns realizations are tied to global risk appetite (“risk-on/risk-off” or RORO).6

While imprecisely defined, the RORO terminology has come into pervasive use in the financial press and among policymakers since the GFC. We view RORO shocks as a reflection of the variation in global investor risk aversion. Since investors rebalance their portfolios towards safe assets in the face of risk aversion shocks, RORO variation has important implications for asset price determination, particularly for so-called “risk assets.”

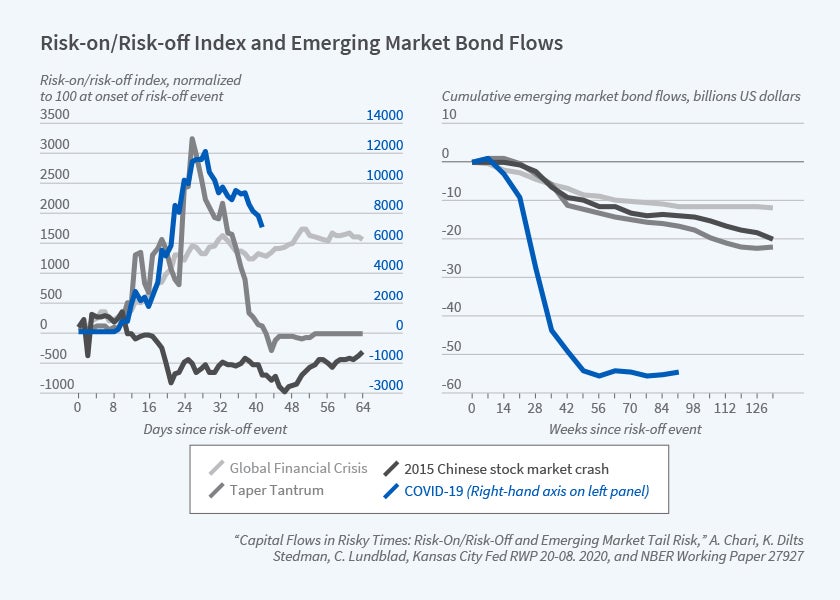

We build a multifaceted RORO index to capture realized variation in global investor risk appetite. Our index, along with constituent subindices, exhibits significant skewness and fat tails. With fat tails, extreme events become both more probable and potentially more destabilizing. As examples, we observe sharp risk-off movements during the GFC, the European debt crisis, the 2015 Chinese stock market crash, the taper tantrum, and the COVID-19 crisis.

Figure 3 shows cumulative outflows from emerging market bond funds during these widely recognized, risk-off events along with corresponding cumulative changes in our RORO index. The episodes are associated with severe outflow realizations, highlighting the necessity of modeling tail risk specifically.

Our results show that the distributional features of global investor risk appetite have important implications for capital flows and return distributions in emerging markets, and lead us to conclude that focusing only on measures of central tendency is incomplete.

Endnotes

“Taper Tantrums: QE, Its Aftermath and Emerging Market Capital Flows,” Chari A, Dilts- Stedman K, Lundblad C. NBER Working Paper 23474, June 2017, and forthcoming in The Review of Financial Studies, April 2020.

“Lessons Unlearned? Corporate Debt in Emerging Markets,” Alfaro L, Asis G, Chari A, Panizza U. NBER Working Paper 23407, May 2017.

“Corporate Debt, Firm Size and Financial Fragility in Emerging Markets,” Alfaro L, Chari A, Asis G, and Panizza, U. NBER Working Paper 25459, January 2019, and Journal of International Economics 118, May 2019, pp. 1–19.

“In Search of Distress Risk in Emerging Markets,” Asis G, Chari A, Haas A. NBER Working Paper 27213, May 2020.

“Capital Flows in Risky Times: Risk-On, Risk-Off and Emerging Market Tail Risk,” Chari A, Dilts- Stedman K, Lundblad C. NBER Working Paper 27927, and Federal Reserve Bank of Kansas City RWP 20-08. 2020.