The Sustainable Investing Proposition

In a recent, widely covered press release, Larry Fink, chief executive of the world's largest asset management company, BlackRock, pledged significant resources toward developing sustainable investing, for example by offering funds that invest using environmental, social, and governance (ESG) criteria along with other considerations to make asset allocation decisions.1 Fink said he views sustainable investing as being in its early stages. The thinking goes that investors worried about climate change increasingly want portfolios of companies that are consistent with their values — much in the way that an earlier generation embraced ethical investing or divestment-from-sin stocks. To the extent that markets are too short-termist to confront long-run risks, high ESG stocks might have high risk-adjusted returns. Depending on how large these excess returns are, a fund portfolio tilted toward high ESG stocks might outperform, or at least not underperform, passive indices. This is what I label the "sustainable investing proposition."

This proposition is controversial among academics and practitioners. Since ESG funds typically have higher fees (due to the costs of in-house research or licensing third-party sustainability scores) and tracking error (since the mandate often requires tilting away from large market capitalization stocks), it is far from a foregone conclusion that ESG scores contain enough expected return information to overcome these initial drags on performance. Indeed, the performance of funds currently using sustainability scores generated by leading ESG ratings agencies is mixed.

Academic studies have found similarly divergent results on whether picking stocks with better environmental, social, and good-governance criteria have higher, comparable, or lower average returns than asset allocations that ignore these considerations. A critical question in evaluating ex post performance is whether the differential returns of allocation strategies that include ESG considerations are attributable to ESG factors, or whether measures of ESG ranking are capturing other firm characteristics that are correlated with ESG scores.

In research with several coauthors over the last decade, I have investigated the validity of a number of key premises underlying the sustainable investing proposition. We use in our analysis ESG measures, produced by MSCI KLD, which rank firms based on product, environment, community, diversity, and governance criteria. MSCI is a global provider of equity and fixed income indices and MSCI KLD is one of the most widely used ESG scores by institutional investors and academics. Our analysis focuses on data for S&P 500 firms over the period 1991 through 2009.

Direct versus Selection Effects

A key premise of sustainable investing is that firms "do well by doing good." This implies that a firm's ranking on ESG criteria has a causal effect on its financial performance, for example by lowering its cost of capital. But to what extent do firm sustainability scores simply reflect potential selection effects, whereby successful firms are more likely to be socially responsible for a variety of other reasons? For instance, firms that have easy access to capital markets might have less leverage in bargaining with labor, and thereby be more likely to fund pensions and have higher ESG scores as a result. In this case, there might be no causal impact of ESG on firms' cost of capital per se, but investors in sustainable companies might inadvertently be exposed to firms with lower costs of capital — those with higher stock valuations and lower expected returns. While such a correlation of firm characteristics might lead to stronger performance of firms with strong ESG scores in some periods, the reason would not be the one associated with the sustainable investment proposition.

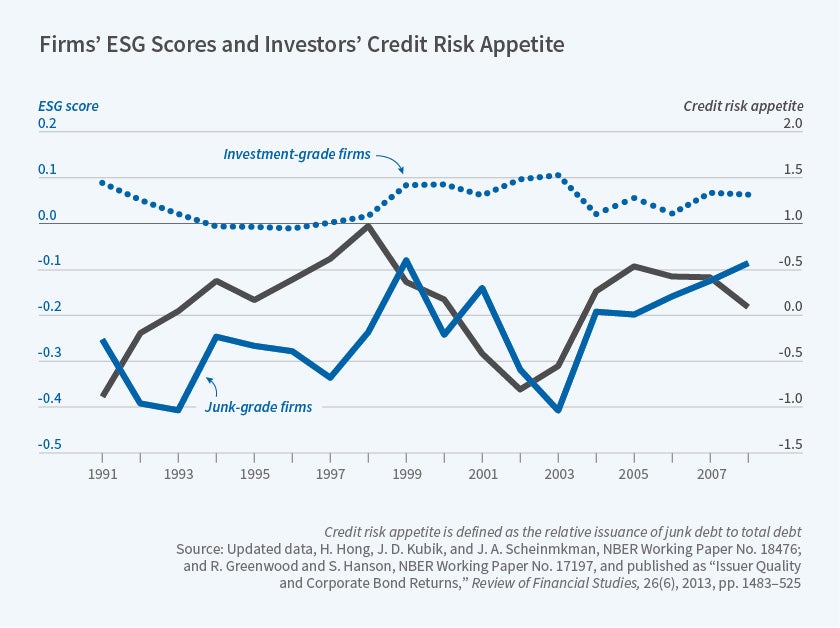

Jeffrey Kubik, José Scheinkman, and I show that these selection effects are likely to be larger than the direct effects of ESG.2 To see why, in Figure 1 we plot the average ESG scores of two groups of firms — investment-grade versus noninvestment-grade or junk firms over the years of 1991 to 2009. The ESG scores are normalized to account for industry differences. The scores of investment-grade firms are almost always higher than those of junk firms. There are two ways to interpret this cross-sectional relationship. The first is that ESG causally leads to better ratings or lower cost of capital. The other is reverse-causality — that firms with better ratings just happen to also be socially responsible.

To gauge which channel is larger, we also plot in Figure 1 a measure of credit risk appetite developed by Robin Greenwood and Samuel Hanson that is defined as the relative issuance of junk debt to total debt.3 The idea is that junk firms are much more sensitive to common shocks in risk appetite, whether rational or behavioral in nature, than investment-grade firms. They show that junk debt relative to total debt issuance is a good measure of this common or macroeconomic time-varying risk appetite.

Notice that the ESG scores of the junk firms strongly track this credit risk appetite measure. Even though individual firm normalized ESG scores cannot causally influence aggregate credit risk appetites, they nonetheless strongly co-move with this appetite measure, thereby pointing to selection effects largely driving ESG scores. Indeed, if ESG scores have a large direct effect on a firm's rating or access to credit, we would expect average corporate ESG scores to fall as credit risk appetite in the macroeconomy rises. This is because the marginal return to additional corporate actions to improve ESG scores, and thereby lower the cost of capital, is likely to be smaller when the firm already has access to finance, as is likely when risk appetite is high.

Pecuniary versus Non-Pecuniary Motives

Another key premise of sustainable investing is that sustainability scores capture strategic positioning of firms to address long-run risks; that is, motives for corporate actions that raise ESG scores are profit-driven, just like investments in plant and equipment or advertising. There are also non-pecuniary factors that contribute to variation in the behaviors that affect firms' ESG ratings. Corporate taxes, for example, can influence the incentives for firms to make charitable contributions; agency issues can also be important. Since sustainability scores cannot distinguish between pecuniary and non-pecuniary motives for ESG investment by firms, the link between sustainable corporate behaviors and subsequent performance is likely to be more tenuous if non-pecuniary motives account for a substantial part of the variation in ESG scores.

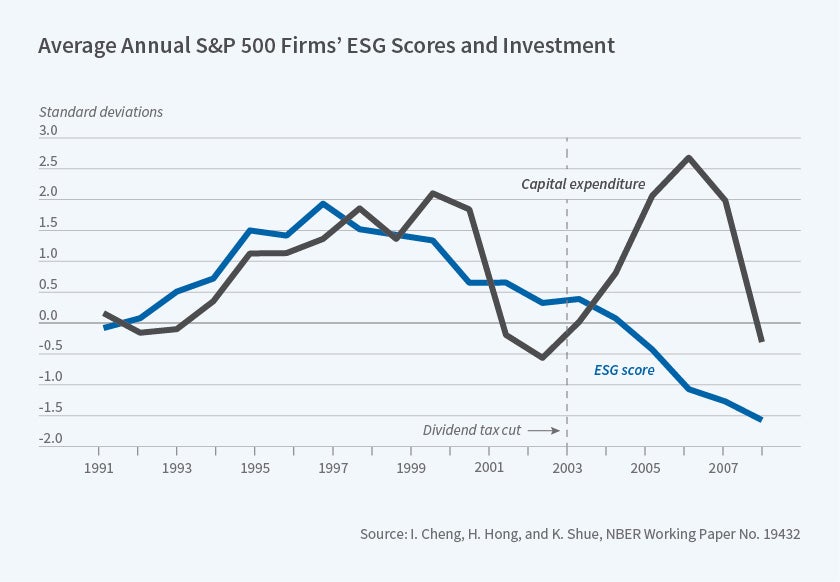

Using two quasi-experiments, Ing-Haw Cheng, Kelly Shue, and I show that firm sustainability scores are significantly influenced by non-pecuniary motives for corporate actions.4 The first experiment is provided by the 2003 reduction in shareholder dividend taxes in the United States.

Theories of the effect of dividend taxes on firm investments predict that tax cuts should lead to positive or at least nonnegative effects on investments. See, for example, work by James Poterba and Lawrence Summers.5 To the extent ESG spending is profit-driven or pecuniary in nature, as a form of investment or as an offset to firm production as in pollution-abatement models, we expect firm sustainability scores should track firm capital expenditures and that the dividend tax cut should have had positive or at least nonnegative effects on firm ESG scores.

In Figure 2, we see that average firm sustainability scores, which tracked average firm capital expenditure before the 2003 dividend tax cut, diverge substantially afterward. The tax cut occurs at around the same time as the recovery from the early 2000s recession. Capital investments naturally rebound but ESG scores actually decline significantly after the tax cut, inconsistent with the pecuniary motive. This decline in ESG scores occurs over a period when ESG is receiving increasingly more, not less, attention from media, investors, and regulators.

This negative association of the tax cut with ESG is, however, consistent with a non-pecuniary, tax-motivated delegated giving channel. Assuming that shareholders take the standard tax deduction and do not itemize deductions for charitable giving, which is the case for many employees of firms, those who want to support sustainable causes might be able to do so in a more tax-efficient manner if the firm makes a charitable gift and reduces their dividend payouts than if the firm pays a dividend and the individual makes a gift. A cut in dividend taxes hence increases the relative price of giving inside versus outside the firm, and can explain why firm ESG scores fall subsequent to the tax cut.

To the extent such giving decisions are delegated to managers, agency problems can then naturally arise, and firms with high ESG scores might be expected to underperform rather than outperform low ESG scores. To address such an agency motive, we exploit a regression discontinuity (RD) experiment using close proxy contests regarding shareholder-initiated governance proposals. The identifying assumption is that close votes around the 50 percent cut-off are random in terms of whether a governance proposal is passed, and represent plausibly exogenous shocks to corporate governance. Vincente Cuñat, Mireia Giné, and Maria Guadalupe find that close passage of shareholder proposals increases firm value by about 2 percent.6

We find that firms in which shareholder proposals narrowly pass also experience significantly slower growth in goodness scores than firms in which the proposals narrowly fail, consistent with some ESG investments being value-reducing and motivated by agency problems.

The Past versus the Future of Sustainable Investing

Finally, while my papers raise challenges to the sustainable-investing proposition, it is important to keep in mind that my research and many other studies of related questions use data from a period when sustainability issues were arguably less important than they are likely to be going forward. This addresses a third key premise of sustainable investing: The risks to sustainability are large. In other words, the historical importance of considering a firm's positioning regarding sustainability risks, as measured by ESG scores, may have been small, because such risks might have been small in the past. If, indeed, regulation will likely be tighter and the climate risks to capital markets greater, then the direct effects of firm sustainability might become larger and the sustainable-investment proposition more convincing in the future.

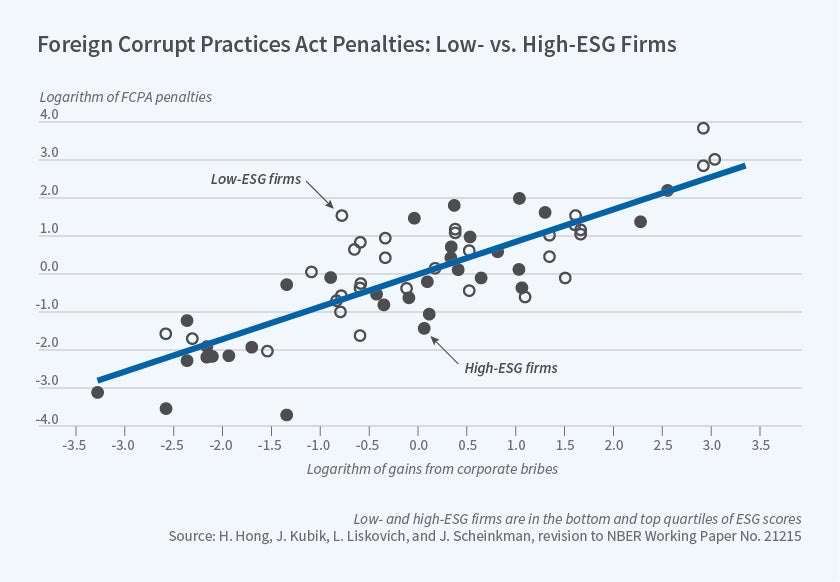

To this end, my work with Jeffrey Kubik, Inessa Liskovich, and Scheinkman estimates the value of ESG for bargaining settlements of the Foreign Corrupt Practices Act (FCPA).7 The FCPA penalizes parent firms headquartered in the U.S. for bribery crimes committed by employees located at foreign subsidiaries. Bribery and consequent FCPA penalties are a significant corporate risk that can amount to billions of dollars. That is, firms that have been affected by FCPA cases are firms for which sustainability issues had a first-order effect on near-term profits, and the affected firms may provide some foreshadowing on the role of ESG considerations for many firms going forward. We therefore focus on the effect of ESG ranking on the settlements exacted from these firms, which translate directly into shareholder returns.

Virtually all cases are settled via bargaining between the parent company and prosecutors from the Department of Justice and/or the Securities and Exchange Commission. Settlements are publicly announced and reveal detailed case data not only on sanctions, but also on revenues obtained from bribes. We expect high ESG parent firms to receive lower sanctions as a fraction of the size of the bribery revenues, the reason being that firms with good ESG scores are more likely to be treated favorably by juries (i.e., a halo effect) should bargaining fail and their cases go to trial. They might also be more cooperative with prosecutors, thereby reducing the costs of investigations.

Figure 3 plots the relationship between the natural logarithm of sanctions on the y axis and natural log of the bribery revenues on the x axis. We see a very pronounced linear and upward sloping relationship between sanctions and illicit revenues, as we would expect from FCPA sentencing guidelines. We also plot observations for low ESG firms (bottom quartile of scores) and high ESG firms (top quartile of scores). High ESG firms are more likely to be below the prediction line, while low ESG firms are much more likely to be above the prediction line. A one standard deviation increase in the independent variable ESG score leads to a decrease in the dependent variable log sanction to bribery revenue ratio that is nearly 20 percent of the standard deviation of the dependent variable.

The main omitted-variables concern is that the subsidiaries of high ESG firms for whatever reason commit less egregious foreign bribes that are not completely captured by case data. To this end, we instrument firm sustainability scores using the length of the legal code of the state where the firm is headquartered, which is measured in kilobytes and developed by Casey Mulligan and Andrei Shleifer.8 The exclusion restriction is that the egregiousness of bribes by employees at foreign subsidiaries is uncorrelated with this state-level regulation measure. Consistent with this exclusion restriction, kilobytes of state law is uncorrelated with bribery revenues or bribe length. But it is strongly correlated with firms' ESG scores, giving us a first-stage regression. Instrumental variables estimates are twice as big as the ordinary least squares ones.

Another important consideration is that climate-change risks will be more manifest in the future. As a result, sustainable investing might evolve from studying these coarse scores to modeling the exposure of firms to such risks, be it exposure to carbon or to natural disasters. In work with Weikai Li and Jiangmin Xu, I demonstrate the value of this alternative approach by studying whether prices of food stocks efficiently discount climate-change risks.9 In a world with greater regulatory scrutiny or greater climate change risks, a sustainable-investing approach that is robust to these concerns might deliver value to investors.

Endnotes

A. Mooney and P. Smith, "As the climate changes, ESG investing powers into the mainstream," Financial Times, Nov. 18, 2018.

H. Hong, J. Kubik, and J. Scheinkman, "Financial Constraints on Corporate Goodness," NBER Working Paper No. 18476, October 2012. H. Hong, J. Kubik, and J. Scheinkman, "Financial Constraints on Corporate Goodness," NBER Working Paper No. 18476, October 2012.

R. Greenwood and S. Hanson, "Issuer Quality and the Credit Cycle," NBER Working Paper No. 17197, July 2011, and published as "Issuer Quality and Corporate Bond Returns," The Review of Financial Studies, 26(6), 2013, pp. 1483–525.

I. Cheng, H. Hong, and K. Shue, "Do Managers Do Good with Other People's Money?" NBER Working Paper No. 19432, September 2013.

J. Poterba and L. Summers, "The Economic Effects of Dividend Taxation," NBER Working Paper No. 1353, May 1984.

V. Cuñat, M. Giné, and M. Guadalupe, "The Vote is Cast: The Effect of Corporate Governance on Shareholder Value," NBER Working Paper No. 16574, December 2010.

H. Hong and I. Liskovich, "Crime, Punishment and the Halo Effect of Corporate Social Responsibility," NBER Working Paper No. 21215, May 2015. The plot and analysis are from an upcoming revision to this paper that is joint with Jeffrey Kubik and José Scheinkman.

C. Mulligan and A. Shleifer, "Population and Regulation," NBER Working Paper No. 10234, January 2004. Published as "The Extent of the Market and the Supply of Regulation," Quarterly Journal of Economics, 120 (4), 2005, pp. 1445–73.

H. Hong, W. Li, and J. Xu, "Climate Risks and Market Efficiency," NBER Working Paper No. 22890, December 2016, and Journal of Econometrics, 208 (1), 2019, pp. 265–81.