Mortgage Lending and Housing Markets

At the onset of the last housing crisis, it was widely believed that the lenders who extended subprime mortgages and the homeowners who had taken out those loans were responsible for the housing boom, bust, and ensuing economic crisis. With the benefit of hindsight — and aided by much better data and research designs — academic researchers now have a clearer view. The credit expansion during the housing boom was not concentrated in the subprime sector, and the majority of foreclosures during the crisis were not associated with subprime mortgages. African-American and Hispanic homebuyers paid higher mortgage costs relative to comparable homebuyers during the last cycle, independent of whether they used subprime or prime loans. Finally, those minorities were hurt most by the foreclosure crisis, especially when they bought homes at or near the peak of the housing boom.

Much of my recent research focuses on understanding three key issues related to subprime mortgages and minority borrowers during the last housing cycle: the role of subprime loans during the housing boom, the foreclosure crisis, and the vulnerability of minority homeowners during the boom and bust.

Subprime Mortgages and the Housing Boom

Joseph Gyourko and I uncover basic stylized facts about the foreclosure crisis by constructing a panel of housing ownership sequences that contains more than 33 million ownership spells from 1997 to 2012.1 These data, acquired from CoreLogic, are based on the universe of housing transactions for almost 100 Metropolitan Statistical Areas. We merge them with the Home Mortgage Disclosure Act files in order to add more loan features and demographics. Importantly, this panel includes details on every type of option available for financing a home purchase — prime and subprime mortgages, cash, and governmental loans — as well as for refinancing during an ownership spell. This fixes the missing data problem of research conducted early in the cycle that relied solely on subprime mortgage data.

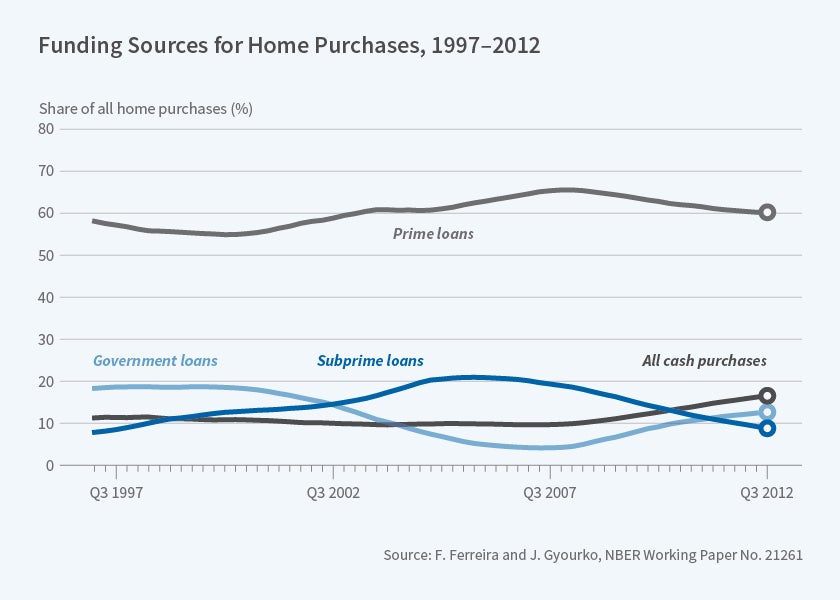

Figure 1 documents the market shares of the different sources of funding used by homeowners. The subprime sector, which included many alternative loans issued to higher-risk borrowers, indeed expanded its share of the market over the course of the housing boom, roughly doubling to just over 20 percent. However, this came at the expense of the government-insured subsector — Federal Housing Administration and Veterans Affairs loans — not the prime mortgage sector. Prime mortgages were always the dominant loan type across the cycle, with their share hovering around 60 percent, and in fact increasing almost 10 percentage points from 2000 to 2006. Finally, those using only cash to purchase a house constituted a relatively stable 10 to 11 percent of the sample until 2010, after which this share increased to 16 percent, due to the unavailability of credit during that period and the increase in the relative number of cash investors.

The aggregate data indicate that subprime did not take over the mortgage market during the housing boom; the pattern was rather one of broad-based expansion of credit. This has been corroborated by other recent studies. For example, Manuel Adelino, Antoinette Schoar, and Felipe Severino find that the mortgage expansion was shared across the entire income distribution, as opposed to being concentrated in low-income groups.2 Christopher Foote, Lara Loewenstein, and Paul Willen demonstrate that, since high-income borrowers tend to use mortgages with higher loan amounts, wealthy borrowers accounted for most of the increase in outstanding mortgage debt in dollar terms.3 Neil Bhutta looks at the dollar value of mortgage inflows to reveal that first-time homebuyers, even the ones with low credit scores, experienced only modest growth in credit inflows.4 He finds that the largest inflows were in fact due to investors, not households. And to put the proverbial last nail in the coffin of the "subprime caused the boom" narrative, Stefania Albanesi, Giacomo De Giorgi, and Jaromir Nosal show that credit growth was concentrated in the prime segment, and that so-called high-risk borrowers had similar growth in virtually all debt categories during the early 2000s.5

Foreclosure Crisis

Gyourko and I also document how housing distress evolved over the cycle. Distress is defined as a home being lost to foreclosure or short sale. Foreclosed homes are explicitly identified in the DataQuick files by a distress code that indicates the date the home was lost by the previous owner. A short sale is defined as a transaction in which the sales price is no more than 90 percent of the outstanding balance on all existing debt.

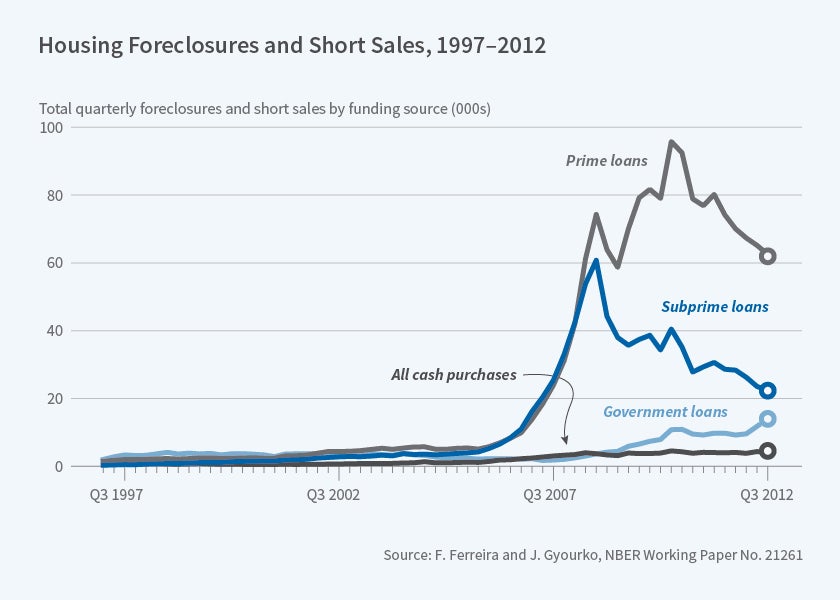

The initial finding of distress is consistent with much previous research: Subprime subsector borrowers' distress spiked first, beginning in 2006, and quickly reached double-digit percentage rates by the time the global financial crisis hit in 2008. But we find that this initial shock in subprime distress was spatially concentrated in a relatively small number of metropolitan areas in central California.

Much less well known is the fact that there was a surge in prime subsector distress within a few months of the initial surge in subprime borrower home losses. The rate of home loss for prime borrowers never approached that of subprime borrowers, but it remained high through 2012. Because prime borrowers far outnumber subprime borrowers, even with a lower foreclosure rate they still account for twice as many home losses as subprime borrowers. Figure 2 shows the total number of home losses by quarter in this sample, by type of home financing source.

Hence, the foreclosure crisis that started in 2006 was still not over in 2012. Though it started in the subprime subsector, it did not remain there for very long, and it ultimately became a broad housing market phenomenon. This pattern of distress is also found by Albanesi, De Giorgi, and Nosal, who report that the rise in mortgage default during the foreclosure crisis was concentrated in the middle of the credit score distribution, not among low-credit score borrowers.

Gyourko and I also find that loan-to-value ratios at the time of house purchase did not vary much by type of mortgage. But over the course of a homeowner's time in her house, the loan-to-value ratio varies, partly as a function of loan repayment but also as a function of house price movements. Rising house prices result in lower loan-to-value ratios. These ratios on the overall housing stock reached their lowest levels between 2005 and 2006; this may have influenced the perception that housing markets were healthy. As home prices fell after 2006, current loan-to-value ratios shot up, turning into negative equity, and foreclosure rates rose. Adelino, Schoar, and Severino find that default rates went up predominantly in areas with large house price reductions. Within those areas, the largest default effects were concentrated among high-income and high credit-score borrowers.

Defaults and foreclosures can happen because of strategic reasons — keeping up with monthly mortgage payments may not be worthwhile once a house has negative equity — and also simply because of changes in homeowners' ability to make payments due to the unemployment shock of the Great Recession. An important data limitation still faced by researchers is the difficulty of linking microdata on employment and incomes with individual-level data on credit and housing choices. Kristopher Gerardi, Kyle Herkenhoff, Lee Ohanian, and Willen use data from the Panel Study of Income Dynamics to circumvent this problem and find that change in ability to pay is the main factor explaining mortgage default.6

Vulnerability of Minority Homeowners

Improved datasets also helped Patrick Bayer, Stephen Ross, and me to understand and to compare mortgage costs by race and ethnicity during the last housing boom. This was not an easy task, because valid comparison required us to identify whites, African Americans, and Hispanics with similar creditworthiness, demographics, loan characteristics, etc. We dealt with this empirical challenge by assembling a unique panel data set that links individual housing transactions, individual mortgage decisions and demographics, and individual credit data. We leverage this panel to examine pricing of mortgages that vary by race of the homeowner separately from the racial composition of the neighborhood. The panel also includes a representative sample of all mortgages, not just subprime loans. Finally, it contains all standard risk factors that are typically considered in mortgage underwriting.

We find that African-American and Hispanic borrowers are 103 percent and 78 percent more likely to receive high-cost mortgages for home purchases, after controlling for individual credit scores, other risk factors, and whether the borrower used a prime or subprime loan. A large fraction of this effect is due to sorting of borrowers across lenders with a particular characteristic. This most important lender characteristic is not something observed at the time of origination; instead, it is related to the behavior of these companies during the foreclosure crisis. These lenders disproportionally foreclosed properties during the Great Recession. The role of lenders in the foreclosure crisis remains an understudied topic.

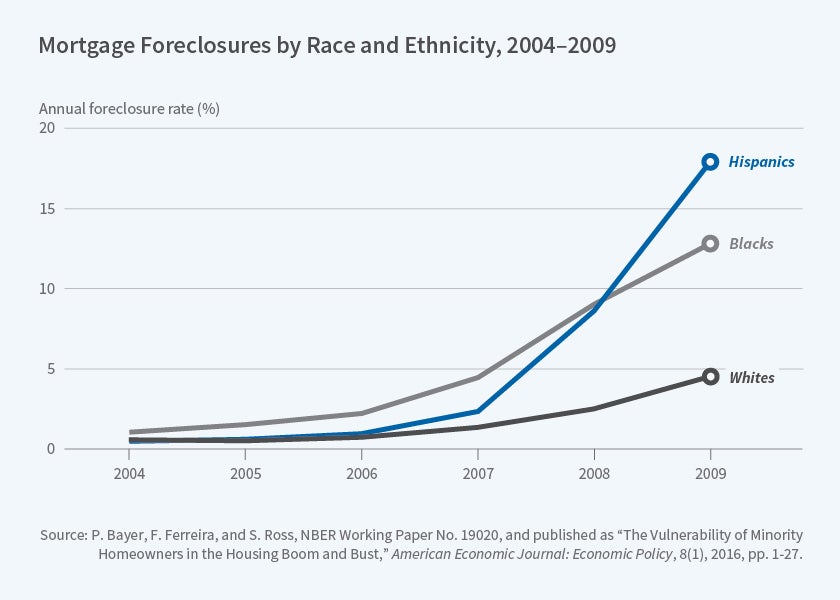

Bayer, Ross, and I in a separate paper also analyze differential rates of mortgage foreclosures and delinquencies faced by minority homeowners.7 We first show that, while all homeowners had negligible 90-day delinquency and foreclosure rates in 2004 and 2005, very large racial and ethnic differences emerged by 2008 and 2009 [see Figure 3]. The numbers are stark: More than 1 in 10 minority homeowners in the sample had a delinquent mortgage in 2009, compared with 1 in 25 for white households.

Using the same panel data, we estimate that minorities were 3 percent more likely to experience foreclosure than white homeowners with similar credit scores, loan characteristics, demographics, house type, neighborhood, and lender.8 This difference is especially pronounced for loans originated near the peak of prices during the housing boom. And the differential foreclosure effect by minority status seems to be explained largely by the lower rates of employment among African Americans.

Taken together, these estimates provide evidence that minority households drawn into homeownership late in the housing boom were especially vulnerable, both because they acquired assets at peak prices and because they suffered unemployment consequences of the downturn more acutely.

Endnotes

F. Ferreira and J. Gyourko, "A New Look at the U.S. Foreclosure Crisis: Panel Data Evidence of Prime and Subprime Borrowers from 1997 to 2012," NBER Working Paper 21261, June 2015.

M. Adelino, A. Schoar, and F. Severino, "Loan Originations and Defaults in the Mortgage Crisis: The Role of the Middle Class," NBER Working Paper 20848, January 2015, and The Review of Financial Studies, 29(7), 2016, pp. 1635–70.

C. Foote, L. Loewenstein, and P. Willen, "Cross-Sectional Patterns of Mortgage Debt during the Housing Boom: Evidence and Implications," NBER Working Paper 22985, December 2016.

S. Albanesi, G. De Giorgi, and J. Nosal, "Credit Growth and the Financial Crisis: A New Narrative," NBER Working Paper 23740, August 2017.

K. Gerardi, K. Herkenhoff, L. Ohanian, and P. Willen, "Can't Pay or Won't Pay? Unemployment, Negative Equity, and Strategic Default," NBER Working Paper 21630, October 2015.

P. Bayer, F. Ferreira, and S. Ross, "What Drives Racial and Ethnic Differences in High-Cost Mortgages? The Role of High-Risk Lenders," NBER Working Paper 22004, February 2016, and The Review of Financial Studies, 31(1), 2018, pp. 175–205.

P. Bayer, F. Ferreira, and S. Ross, "The Vulnerability of Minority Homeowners in the Housing Boom and Bust," NBER Working Paper 19020, May 2013, and American Economic Journal: Economic Policy, 8(1), 2016, pp. 1–27.