Developments in the Asset Management Industry

Over the last two decades, the asset management industry has witnessed dramatic developments in both industrial organization and product offerings. Two or three decades ago, the industry was dominated by small asset managers primarily offering active portfolio management services. Today, the industry is significantly more concentrated and the leading products are index-based passive investment vehicles. My recent research examines some of the consequences of these developments.

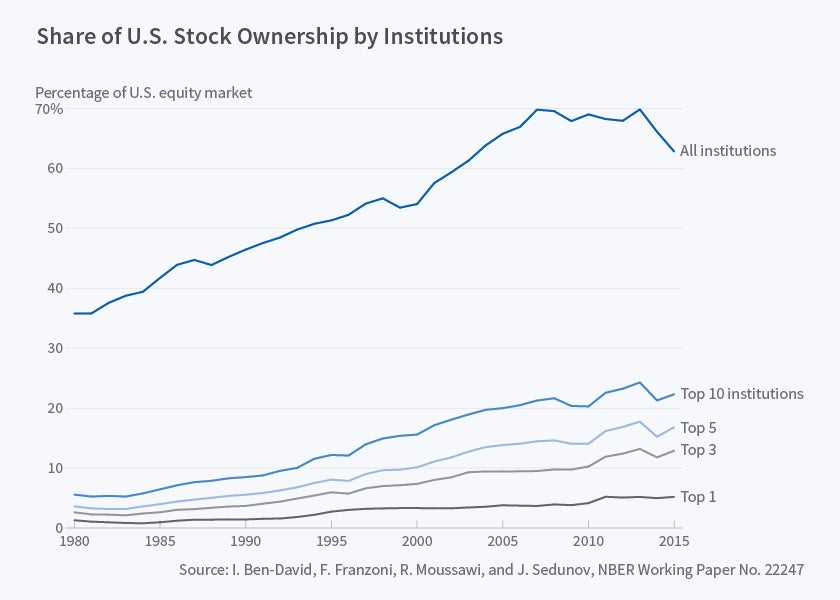

The asset management industry is significantly more concentrated today than a few decades ago. Figure 1 shows the dramatic increase in industry concentration: in the United States, the top 10 managers owned about 5 percent of the U.S. stock market in 1980, whereas in 2016 they owned about 23 percent. Francesco Franzoni, Rabih Moussawi, John Sedunov, and I find that this development has increased the volatility of the underlying securities in the U.S. stock market.1 Our hypothesis is that this increase in concentration has led to disproportionately larger trades by asset managers, which in turn has led to greater volatility in the underlying securities.

There are many anecdotal examples of this phenomenon. For example, the September 2014 departure of Bill Gross, co-founder of PIMCO, the largest bond fund, led to large withdrawals. In turn, PIMCO's Total Return Fund had to liquidate a large fraction of its holdings, leading to an impact on bond and futures prices. Other examples include trades by the London Whale in JP Morgan and the computer glitch at the large broker Knight Capital that led to massive selloff of equities in 2012. But massive trades by large institutions are not necessarily a result of cataclysmic events. They may be the result of portfolio rebalancing, or correlated trades across units within the organization — for example, if units use the same information provided by a single research department, or flows from investors are driven by a marketing effort of the organization. Nevertheless, large institutions could cause market disruptions since their trades are large relative to typical market volume.

We identify the causal effect of large institutional investors on volatility using two main techniques: First, we exploit the fact that prior research documented that top institutional ownership is higher for local stocks, thus allowing a plausibly exogenous shock to top institutional ownership. Second, we examine the change in institutional ownership following the 2009 merger of Barclays Global Investors, the largest asset manager, and BlackRock, the 14th largest. Following the merger, the size of the largest asset manager increased by 40 percent. Using these identification strategies, we find that the large trades of the top institutional investors increase volatility. We suggest that these trades introduce noise to prices, and that the effects are particularly strong during times of market stress.

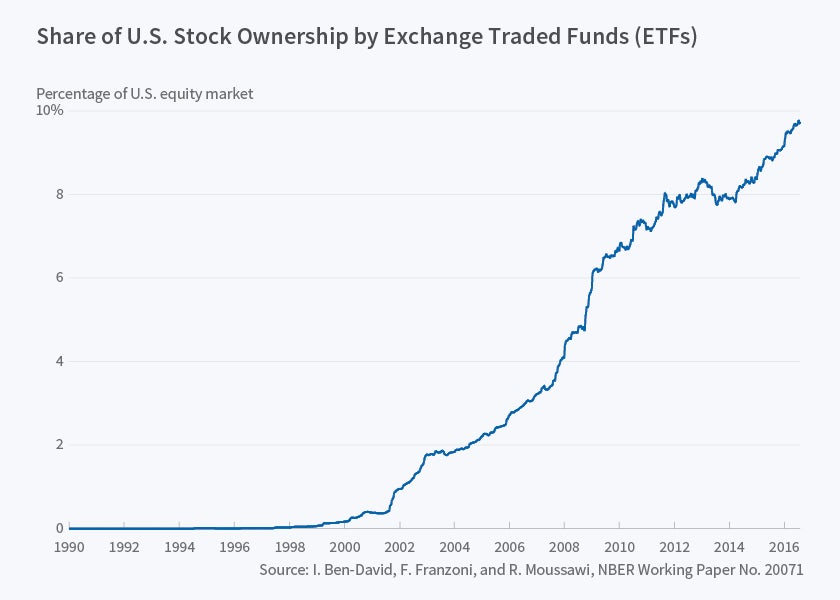

Another significant development in the asset management industry is the introduction of exchange-traded funds (ETFs). These investment instruments have been one of the fastest-growing asset classes over the last two decades. ETF securities were first issued in the mid-1990s. Today, they account for over 10 percent of the U.S. stock market capitalization and over 35 percent of traded volume. By investing in ETFs, investors have indirect exposure to a basket of securities, typically defined based on an index, and enjoy continuous trading in real time as well as low transaction and management costs. While ETFs can provide some advantages to investors, these novel securities may also pose challenges to the integrity of the securities market. My research examines some of the possibly unintended effects of the growth of ETFs.2 The discussion presented here is based on my recent survey of the literature, which was co-authored with Franzoni and Moussawi.3

ETFs are structured as funds that hold a basket of securities, or hold derivatives, in a way that replicates the performance of an index. The funds issue shares against these assets, and thus allow investors to hold and trade shares that are backed by a basket of securities. In this respect, their structure is similar to that of closed-end funds. Investors who trade the shares of an ETF, like those who trade in closed-end funds, trade with each other in the secondary market. There is, however, an important distinction between closed-end funds and ETFs. One of the major disadvantages of closed-end funds is that the secondary market often shows a premium or a discount of the fund's share price relative to the underlying basket's net asset value (NAV). This can make the fund unappealing to investors who wish to track the underlying index closely.

There are two arbitrage mechanisms that force the ETF share price to track net asset value very closely. One form is operationalized by approved participants (APs), financial agents designated by the ETF sponsor who arbitrage the ETF shares against the securities in the underlying basket. If the price of the ETF is greater than the NAV, then an AP would buy the basket of underlying securities in the market and exchange it with the ETF sponsor for newly created ETF shares, which will be sold later in the market. The reverse transaction takes place when the ETF is undervalued relative to the basket's NAV: the AP buys the ETF in the open market and sells it to the ETF sponsor in exchange for a basket of the underlying securities. Later, the AP sells the basket of securities in the open market. These transactions create price pressure on both the ETF shares and the shares of the underlying securities, narrowing the price discrepancy. This form of arbitrage is effectively an expansion and contraction of the supply of ETF shares in real time in response to mispricing.

The other form of arbitrage is done by market participants (arbitrageurs). Whenever an arbitrage opportunity arises, they buy the cheap asset and short-sell the expensive one. With sufficient price pressure, the price gap between the assets closes. This means that the ETF effectively tracks the basket of underlying securities very closely.

While there is broad agreement that ETFs broaden investment possibilities and provide low-cost and diversified vehicles for investors, there is an ongoing debate about their effects on the volatility, correlation structure, and liquidity of the underlying securities. The apparently advantageous feature of continuous trading and tight arbitrage may sometimes impair the pricing of securities in the underlying portfolio. Whenever there is a deviation between the prices of the ETF and that of the underlying portfolio, APs and arbitrageurs have an incentive to engage in trading. Any divergence in prices will trigger arbitrage, even if its source of mispricing is a temporary liquidity shock to the ETF. Consider what happens if a large hedge fund chooses to rebalance its portfolio and purchases a large number of ETF shares. This increase in demand does not bear fundamental information about the underlying value of the index and thus, in theory, should not result in an increase in the value of the underlying securities. However, through the arbitrage mechanism, this demand shock will translate into an increase in the price of the underlying securities. The large purchase transaction increases the market price of the ETF, leading to overpricing of the ETF relative to the price of the underlying securities. This leads APs and arbitrageurs to short sell the ETF and to purchase the underlying portfolio, creating price pressure on both types of securities. The result is that the non-fundamental disturbance in ETF pricing due to a non-fundamental shock is transmitted to the underly-ing stocks through the arbitrage mechanism.

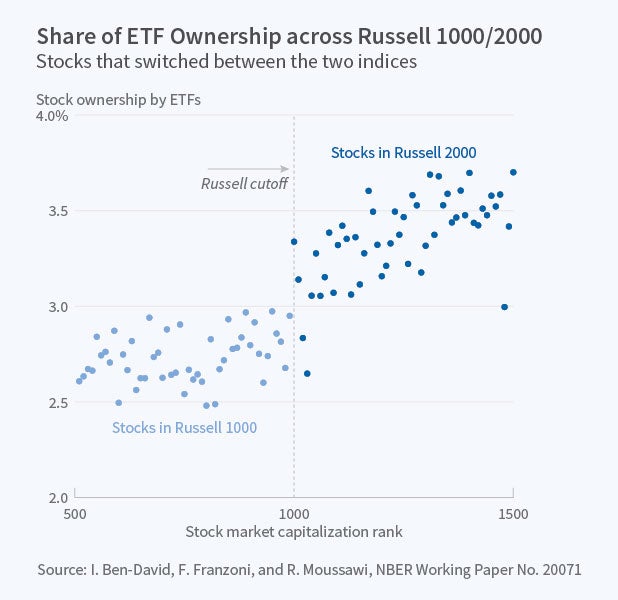

Franzoni, Moussawi, and I find evidence that stock ownership by ETFs leads to an increase in the volatility of the securities in the underlying portfolios.4 The main empirical challenge is determining whether ETF ownership actually causes the increase in volatility. Our approach is to compare stock volatility and ETF ownership for stocks that switch between the Russell 1000 and Russell 2000 indices. FTSE Russell maps stocks to their indices broadly according to the stocks' market capitalization. The largest 1000 U.S. stocks constitute the Russell 1000 and the following 2000 smaller stocks make up the Russell 2000. Both indices are value-weighted. What makes this classification interesting is that stocks in the top of the Russell 2000 have significantly higher weight in that index than stocks in the bottom of the Russell 1000 in their index. When a stock's market capitalization declines enough to move the stock from the Russell 1000 to the Russell 2000, the demand among ETFs to hold the stock increases dramatically following the move. In an opposite manner, when a stock moves from the Russell 2000 to the Russell 1000, ETF ownership decreases. This discrete jump in ETF ownership allows us to test the hypothesis that an increase in ETF ownership causes an increase in volatility, and a reverse effect when ETF ownership decreases. Our empirical analysis confirms that stocks that were reclassified experience a sharp increase in ETF ownership [see Figure 3] and a simultaneous increase in volatility. The increase in volatility appears to stem from the arbitrage activity between ETF prices and the prices of the underlying portfolio. We also find that stock returns following large ETF flows tend to revert, suggesting that the increase in volatility reflects greater noise in stock prices.

In recent years there is mounting evidence that arbitrage activity does not always match the textbook example, as seen in the case of ETFs. In another project, Franzoni, Moussawi, and I examine arbitrage activity by hedge funds in the U.S. stock market prior to and during the financial crisis of 2007–09.5 We often think about hedge funds as textbook arbitrageurs that take positions in securities in the face of mispricings, and therefore help correct them. In contrast, our study finds that hedge funds significantly reduced their holdings in U.S. stocks ahead of the crash of 2008. This activity was driven primarily by funding constraints, where hedge funds that were leveraged and hedge funds that experienced investor withdrawals reduced their equity positions the most. Overall, this evidence shows that hedge funds did not contribute to stabilizing prices in the financial crisis of 2007–09.

Hedge funds do not only abstain from the market in volatile times, they may also increase the noise in prices. In a study by Franzoni, Augustin Landier, Moussawi, and I, we document that hedge funds manipulate stock prices around reporting dates.6 In particular, we report that stock prices that are owned by hedge funds at the end of the month experience a temporary price jump in the last minutes of the trading day. The effect reverses the following morning. This price pressure is likely to be targeted at inflating monthly returns and performance compensation.

The rising concentration in the asset management industry and the rise of ETFs not only change the way investors invest, but also affect the character of the securities market. Large asset managers induce non-fundamental volatility through large trades, and ETFs propagate liquidity shocks originated by investors. Furthermore, arbitrageurs, and specifically hedge funds, may not always absorb and correct these shocks and may even contribute to the noise in prices. These findings suggest that the performance and risk of securities is not only determined by their cash flows and prospects but also by the nature of their investors.

Endnotes

I. Ben-David, F. Franzoni, R. Moussawi, and J. Sedunov, "The Granular Nature of Large Institutional Investors," NBER Working Paper 22247, May 2016.

I primarily discuss ETFs, which are the largest investment vehicle among exchange traded pooled investment vehicles. These vehicles are collectively called exchange traded products (ETPs), and include ETFs; exchange traded notes (ETNs), which are senior debt notes and do not invest in a portfolio of securities or a portfolio of derivatives on those securities; and exchange traded commodities (ETCs), which provide investors exposure to individual commodities or baskets and can be structured as funds or notes.

I. Ben-David, F. Franzoni, R. Moussawi, "Exchange Traded Funds (ETFs)," NBER Working Paper 22829, November 2016.

I. Ben-David, F. Franzoni, and R. Moussawi, "Do ETFs Increase Volatility?" NBER Working Paper 20071, April 2014.