The Impact of Contracting Out on Medicare and Medicaid

More than 120 million Americans currently receive their health insurance through the Medicare or Medicaid programs. Total government spending on the two programs in 2016 is projected to exceed $1.2 trillion. 1

Medicare is a federal program that covers approximately 48 million Americans aged 65 or older, as well as nine million younger adults receiving Social Security Disability Insurance (SSDI) benefits. Medicaid is a means-tested program that, in 2016, provided coverage to more than 74 million low-income individuals. It is financed jointly by the federal government and state governments. More than 10 million "dually eligible" individuals receive health insurance coverage from both programs. Both programs provide coverage for most health care services, with Medicare requiring enrollees to cover a greater share of their costs and Medicaid generally reimbursing health care providers less generously.

During the 1960s, 1970s, and for much of the 1980s, both programs tended to reimburse hospitals, physicians, and other health care providers directly for the cost of each service. One concern with this fee-for-service (FFS) method of reimbursement was that it could give care providers a financial incentive to perform unnecessary or low-value services. Similarly, providers had little incentive to coordinate with one another to optimize services. These concerns and rapid growth in spending for both programs led Medicare in the early 1980s and many state Medicaid programs soon thereafter to test alternative payment models known as managed care. These included health maintenance organizations (HMOs) and others, with the managed care organization typically receiving a fixed amount per member per month to coordinate and finance health care for the enrollee.

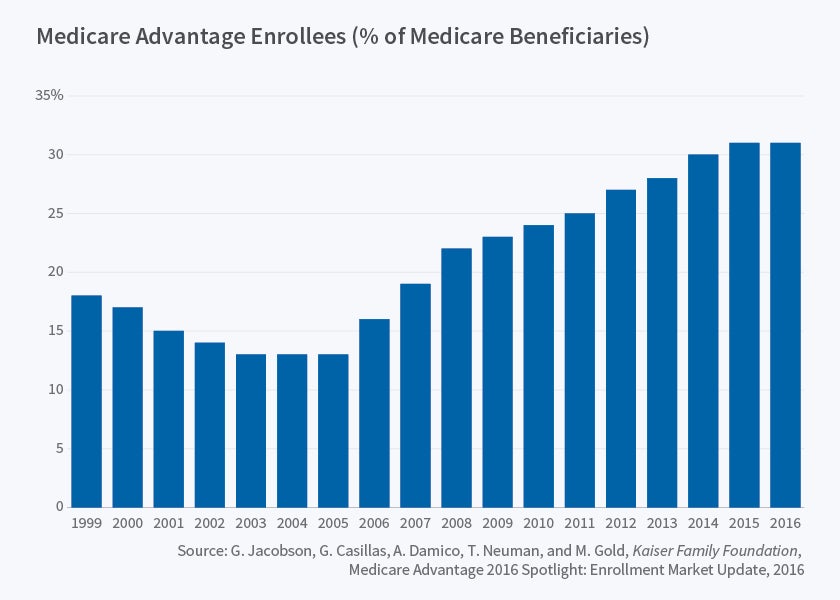

In the years since, a large body of evidence has demonstrated that Medicare managed care recipients utilize significantly less health care than their counterparts in traditional FFS Medicare. However, it is unclear whether this reflects an effect of managed care or instead a difference in the characteristics of those choosing to enroll in Medicare managed care plans, which since 2003 have been referred to as Medicare Advantage (MA). This is especially true because all Medicare recipients have the option to enroll in MA plans, and thus MA enrollees may differ in unobserved ways from those in FFS Medicare. Medicare Advantage has become more important over time. Today, nearly one in three (31 percent) of the nation's 57 million Medicare recipients is enrolled in a MA plan, compared with just one in eight (13 percent) in 2005 [Figure 1]

Jonathan Gruber, Boris Vabson, and I investigated the differences between MA enrollees and all other Medicare beneficiaries for the period 1998 through 2003 in the state of New York. 2 We focused on this time period and on a single state for two reasons: First, we were able to link individual-level hospital discharge data from New York with month-by-month Medicare enrollment data, allowing us to measure health care utilization for the same individual as he or she transitioned from FFS Medicare to MA or vice versa. Second, at the end of 2000, several counties experienced an abrupt reduction in their MA enrollment as certain health insurers exited the MA market. These insurer exits caused MA enrollment to decline to nearly zero in affected counties.

Using longitudinal data, we explored how health care utilization, the quality of health care, and health outcomes changed in response to changes in enrollment status. This analysis had an important advantage over most previous "switcher" analyses, which compared utilization changes for individuals who voluntarily moved from FFS to MA or vice versa, as these changes might have been caused by a change in an individual's demand for care. Our findings demonstrated very large increases in inpatient hospital care for Medicare recipients forced out of MA plans. Hospital utilization increased by an average of 60 percent when individuals switched into traditional FFS Medicare. Interestingly, this finding was almost identical to the analogous estimate of 65 percent from analyses of the RAND Health Insurance Experiment in the 1970s, which randomly assigned patients to managed care plans. The increases in utilization were especially pronounced for elective visits. Our results also showed that the average distance to the hospital fell as enrollees moved into FFS Medicare. This result is explained by MA plans tending to have narrower provider networks than traditional Medicare. Despite the increase in utilization, we found little evidence of a change in the quality of care or in health outcomes. Taken together, the results suggest that MA plans are effective in reducing the utilization of low-value care while having little impact on observable measures of health.

One challenge for Medicare since the program's introduction of managed care in the early 1980s has been to determine appropriate payments to insurers. Through the early 2000s, managed care plans typically were paid 5 percent less per patient than the average for someone with the same age, gender, and county of residence. The rationale for reimbursing less than traditional FFS Medicare was that insurers could control costs sufficiently to still earn a profit. However, insurers benefited from positive selection because low-utilization Medicare recipients opted into the plans. Partly because of evidence that Medicare was spending more for MA enrollees than if they had remained in FFS Medicare, beginning in 2004 the federal government moved to a risk-adjustment system that paid plans more if they enrolled individuals with certain medical conditions. For example, an insurer would receive a certain increment to the plan payment if a Medicare recipient had diabetes. This shift to risk-adjustment was designed to increase insurers' incentives to compete on price and quality rather than on the ability to "cream-skim" low-cost enrollees.

Jason Brown, Ilyana Kuziemko, William Woolston, and I investigated the effects of this shift to risk adjustment on MA enrollment and on Medicare expenditures. 3 We developed a simple model which showed that, even with risk adjustment, plans have a strong financial incentive to select certain types of Medicare recipients. A Medicare recipient with a relatively mild case of diabetes would be more profitable than an otherwise identical recipient with a more serious case. Consistent with our model's prediction, we found that MA plans enrolled Medicare recipients with more adverse health conditions after the shift to risk adjustment, with this reflected in a higher average risk score. However, conditional on this risk score, Medicare recipients enrolling in MA plans had lower costs than the average. Because of this, overpayments to MA plans did not fall after the shift to risk adjustment. The hoped-for Medicare savings had not materialized by the final year of the study period, 2006. Furthermore, we found no evidence of significant improvements in the average quality of care following this policy change.

These studies did not address how the quality of care in MA plans changes with the generosity of plan reimbursement. Amanda Starc, Vabson, and I explored this issue by leveraging a policy-induced increase in MA reimbursement in metropolitan areas with a population of 250,000 or more relative to areas below this threshold. 4 More specifically, the policy reform that we studied introduced a floor on the benchmark for plan reimbursement in areas with relatively low per-capita FFS expenditures. Areas with populations of 250,000 or more had their benchmark set 10.5 percent higher than areas with smaller populations. We focused on metropolitan areas with populations between 100,000 and 600,000 and compared the quality of MA coverage for those above the 250,000 threshold with those below.

Consistent with past research, we found MA enrollment to be very responsive to the generosity of plan reimbursement, with the 10.5 percent increase in reimbursement causing a 13 percentage point increase in MA enrollment. This enrollment increase was partially driven by the entry of new insurers to the market, with an average of two additional insurers entering in response to the additional reimbursement. Despite the increase in MA enrollment, our results suggested little improvement in the quality of care as measured by patient out-of-pocket costs, coverage for additional services, or satisfaction. We estimated that less than 20 percent of the additional reimbursement passed through to consumers in the form of more generous coverage; pass-through was highest in areas with the most competition among MA plans. This was broadly consistent with my previous research with Leemore Dafny and Subbu Ramanarayanan, which found that a reduction in competition leads to higher costs for consumers. 5

While my recent studies point to some of the challenges in contracting with private insurers in the Medicare program, my previous research with Fiona Scott Morton on Medicare Part D suggested the possibility of very large benefits to such contracting. 6 We explored the effect of Medicare Part D, which relied on private insurers to provide and finance prescription drug treatments, on pharmaceutical prices. Our results revealed that contracting with private plans substantially lowered pharmaceutical prices for drugs sold differentially to Medicare recipients. The likely mechanism for this was the greater negotiating power that the plans had relative to individual Medicare recipients, many of whom were previously uninsured for prescription drug expenses.

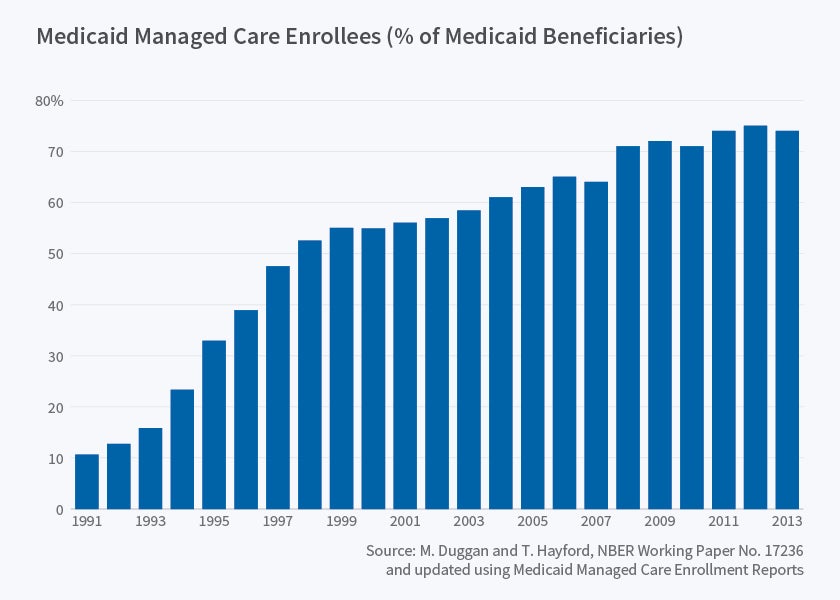

While most of my research on private insurer contracting has focused on the Medicare program, in recent and ongoing work I am also estimating the effects for Medicaid. More than 70 percent of Medicaid recipients are currently enrolled in managed care plans, up dramatically from just 10 percent in the early 1990 [Figure 2]. In contrast to Medicare, where all recipients have the option to enroll in managed care plans, many states introduced mandates during the 1990s and 2000s that required some or all of their Medicaid recipients to enroll in managed care plans. These mandates were frequently rolled out county-by-county, as in California during the 1990s.7

A primary motivation for shifting Medicaid recipients from FFS into managed care plans has been to control costs. But, perhaps surprisingly, there is little empirical evidence suggesting that Medicaid managed care (MMC) does lower costs. To investigate this issue, Tamara Hayford and I used Centers for Medicare & Medicaid Services (CMS) data on each state's Medicaid spending by service category and year to explore the effect of MMC on state Medicaid expenditures. 8 We also assembled data on state and local MMC mandates to serve as a plausibly exogenous source of MMC enrollment. Our results demonstrated that the mandates significantly increased MMC enrollment, with an increase of four MMC recipients for every 10 Medicaid recipients "exposed" to an MMC mandate. This effect was not one-for-one because some Medicaid recipients were already voluntarily enrolled at the time of the mandates, while other Medicaid recipients were exempt.

Using the MMC mandates as an instrument for MMC enrollment, we found little evidence to suggest that MMC contracting reduced Medicaid spending. However, the effect of the mandates appears to vary across states as a function of the generosity of provider reimbursement. According to data from a survey of health care providers conducted two years before the start of our study period, in some states Medicaid reimbursed physicians, hospitals, and other health care providers much less generously than did private insurers. Thus, even if a private insurer could significantly lower utilization, it is plausible that spending would increase due to the higher prices that they pay providers. However, some states actually had Medicaid reimbursement that was comparable to that paid by private insurers. In those states, a reduction in utilization could translate into a reduction in Medicaid spending. Consistent with this, our results suggest that Medicaid spending did fall in states that began our study period with relatively high rates of provider reimbursement. Taken together, our results demonstrate that the spending effects of MMC contracting vary across states as a function of their FFS program's parameters, with some states well-positioned to reap budget savings and others likely to see an increase in Medicaid spending.

Endnotes

Centers for Medicare and Medicaid Services (CMS) Office of the Actuary, "Table 3. National Health Expenditures; Historical and Projections, 1960–2025," 2016.

M. Duggan, J. Gruber, and B. Vabson, "The Efficiency Consequences of Health Care Privatization: Evidence from Medicare Advantage Exits," NBER Working Paper 21650, October 2015, and forthcoming, American Economic Journal: Economic Policy.

J. Brown, M. Duggan, I. Kuziemko, and W. Woolston, "How does Risk Selection Respond to Risk Adjustment? Evidence from the Medicare Advantage Program," NBER Working Paper 16977, April 2011, and American Economic Review, 104 (10), pp. 3335–64.

M. Duggan, A. Starc, and B. Vabson "Who Benefits when the Government Pays More? Pass-Through in the Medicare Advantage Program," NBER Working Paper 19989, March 2014, and Journal of Public Economics, 141, 2016, pp. 50–67.

L. Dafny, M. Duggan, and S. Ramanarayanan, "Paying a Premium on Your Premium? Consolidation in the U.S. Health Insurance Industry," NBER Working Paper 15434, October 2009, and American Economic Review, 102 (2), April 2012, pp. 1161–85.

M. Duggan and F. Scott Morton, "The Effect of Medicare Part D on Pharmaceutical Prices and Utilization," NBER Working Paper 13917, April 2008, and American Economic Review, 100 (1), 2010, pp. 590–607.

M. Duggan, "Does Contracting Out Increase the Efficiency of Government Programs? Evidence from Medicaid HMOs" NBER Working Paper 9091, August 2002, and Journal of Public Economics, 88 (12), 2004, pp. 2549–72.

M. Duggan and T. Hayford, "Has the Shift to Managed Care Reduced Medicaid Expenditures? Evidence from State and Local-Level Mandates," NBER Working Paper 17236, July 2011, and Journal of Policy Analysis and Management, 32 (3), 2013, pp. 505–35.