Enterprise and Incentives for Innovation

All societies have an interest in finding the appropriate incentives and institutions to promote enterprise, knowledge, and innovation. My empirical research in law and economic history sheds light on these sources of long-term development in Europe and the United States during early industrialization, 1750–1930. This was a period of enormous policy variation, which allows us to better identify the nature and consequences of specific measures.

Patents and Inventive Activity

My first book, The Democratization of Invention, empirically examined the genesis and consequences of intellectual property policy in the 19th century.1 European institutions inhibited access owing to their assumption that elites engendered technological and economic progress. The U.S. deliberately departed from precedent to introduce the world's first modern patent system, which, along with effective legal enforcement, facilitated rapid technological progress.2 The evidence indicates how responsive all inventors — women, ordinary artisans, scientists, even economists — were to expected returns and to enforceable property rights. This was the age of patented invention; Kenneth Sokoloff and I found that the propensity to patent was especially high among the "great inventors." 3 The majority of productive inventors came from relatively undistinguished backgrounds, and even in Britain individuals with modest education, rather than scientific elites, created the important advances.4

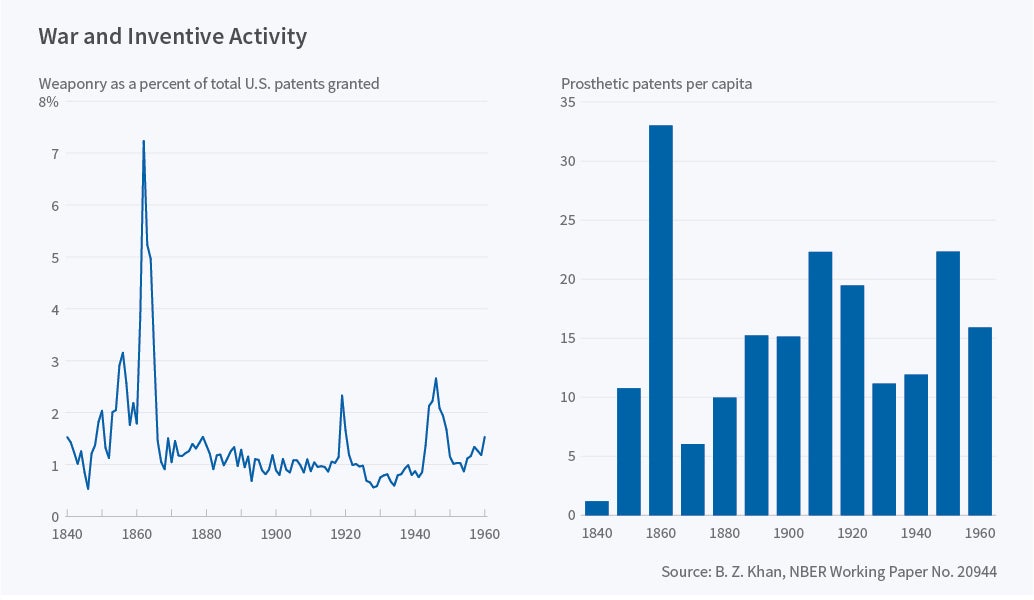

The American Civil War was an exogenous shock that helps to identify the responsiveness of inventors and inventions at the most granular level.5 This conflict marked the advent of technology-intensive warfare, and key military participants as well as the U.S. president were patentees. I traced the lifetime patenting careers of a random sample of inventors, and estimated whether the creators of war-related technologies were first-time inventors, had previously created military inventions, or switched from unrelated inventions. The results indicated that both the rate and direction of inventiveness altered with war-time variation in expected benefits.6 For instance, improvements in prosthetics increased during the war and declined at its conclusion, then rebounded after Congress undertook, in 1870, to continue to underwrite the costs of artificial limbs for veterans [Figure 1].

One of the fundamental features of the American patent system was its role in facilitating markets in technology and the mobilization of venture capital. Naomi Lamoreaux and Sokoloff showed how trade in patents promoted a specialization and division of labor among inventors, who were able to leverage their inventive ability to obtain funding.7 Endogenous trade in markets was favorably influenced by American patent rules, notably the centralized examination system, which filtered applications for novelty and provided a signal of technical merit.8 U.S. knowledge markets were much more extensive relative to their international competitors, and the ability to trade secure inventive assets was especially significant for disadvantaged inventors who did not possess the means or connections to appropriate returns from manufacturing enterprises.9

Innovation Prizes

Economists who model innovation incentives often reference historical "facts" like the prizes for longitude and the Daguerreotype "patent buyout." However, examination of original archival records reveals inaccuracies that undermine central claims of their theories.10 Daguerre, for instance, never obtained a French patent and, instead, lobbied for and gained government payouts in a classic example of rent-seeking. My research provides systematic empirical evidence regarding how innovation prizes work in practice, the political economy of these administered incentives, and potential deadweight losses from associated inefficiencies.

The most creative identification strategies are only as good as the underlying data and, as economic historians stress, effective economic inquiry requires meticulous attention to institutional details and context. To avoid biases associated with any one source, my analysis triangulates by employing extensive datasets with detailed information on inventors, inventions, and institutions from the United States and Europe.

The renowned Royal Society of Arts (RSA) in London provides a valuable opportunity to investigate the efficiency of ex ante inducement — prizes as incentives for invention.11 The society initially was averse to patents and prohibited the award of prizes for patented inventions, so the two mechanisms were substitutes rather than complements. My dataset encompasses several thousand monetary and honorary prizes, patent records, and detailed archival information about the application and decision-making process. Committees were typically unable to identify or induce worthwhile inventions. Inventors of valuable discoveries secured patents and bypassed the prize system; they submitted minor contrivances to the RSA for consideration. Owing to such adverse selection, prizes were negatively related to the course of future important technologies. The RSA ultimately became disillusioned with the prize system. Officials acknowledged that the important British inventions had been associated with patenting, and their efforts had been "futile" because of the institution's hostility to patents. As a result, the society switched from offering inducement prizes towards lobbying for reforms to strengthen the patent system.

Patent rights represent novel inventions that satisfy known rules, and economists have a thorough understanding of their advantages and shortcomings as a measure of inventive activity. International industrial exhibitions add to our knowledge but are rather more problematic as indices of invention.12 World's fairs were not necessarily representative of any country's population of inventors, inventions, patents, or industry. For instance, the United States was at war during the 1862 Paris Universal Exhibition, so only 128 Americans participated among the total of over 26,000 exhibitors. At the Great Exhibition of 1851 in London's Crystal Palace, the rules allowed displays by manufacturers and other noninventors. Exhibits often had nothing to do with inventions, and their date and place of creation were unknown.13 Decentralized juries, many with no technical expertise, bestowed medals for reasons ranging from workmanship to aesthetics, while relatively few awards recognized novel inventions.

Some of these drawbacks can be addressed by examining pooled cross-sections from the same event and city over time. My datasets include approximately 30,000 innovation prizes from the regularly occurring industrial exhibits of the American Institute of New York, the Massachusetts Mechanics Association, the Franklin Institute of Philadelphia, the Mechanics Association of Ohio, the St. Louis Agricultural and Mechanics Association, the Mechanics Institute of San Francisco, and others. In addition to the information on inventions and innovations, the data incorporate extensive details about exhibitors, judges, and the rationale for decisions.

What can we learn from such data? Industrial exhibitions, whether national or international, tell us little about the propensity to patent or the use of patent protection. A single exhibit of, say, a steam engine, could comprise numerous patented components. Patentees must be identified from the names of the exhibitors when researchers are making a match, but many participants in the exhibition were third-party agents, manufacturers and sellers, not actually inventors. As a result, only a small percentage of entries can be matched with patentees and their patents. Even if it were possible to identify patentees with zero error, and a large fraction of exhibits were found to be unpatented, this does not imply that inventors were actively avoiding patents and the patent system. Instead, many exhibits were simply not eligible for a patent, because they lacked novelty or their subject matter was inherently unpatentable.

Industrial fairs do, however, offer valuable insights into the operation of prize systems, into creativity that does not qualify for patent protection, and into the commercialization of innovations.14 Americans were skeptical about prizes, highlighting their transactions costs and the potential for cognitive dissonance or corruption when juries and administrators, rather than markets, determined values and winners. Empirical analyses of the datasets consistently find that prize awards were largely idiosyncratic, and unrelated to proxies for productivity like inventive human capital or the value of the invention. Decisions often reflected the identity of the participants, both exhibitors and judges, rather than the nature of the discovery. In Britain, the probability of a prize being awarded to an inventor was unaffected by variables such as the inventor's qualifications and experience; the most significant determinant of an award was whether the individual had an elite background.15 Similarly, American prize winners typically belonged to more privileged classes than the general population of patentees, as gauged by their wealth and occupational status.16 As inducements for new inventions, prizes frequently failed to result in creations that were scalable or valuable in the marketplace. Prizes undoubtedly offered valuable advertisement for sponsors and winners but this benefit declined as professional marketing practices developed.

Welfare analysis of patents tends to focus on the potential for monopoly, a longstanding concern of American common law even before the Sherman Act.17 However, patent rules also mandate disclosure so others can replicate the results or discover competitive substitutes. The creators of the American patent system specifically designed mechanisms to enable the diffusion of technical information. To estimate the role of patents and prizes in generating knowledge spillovers, I tested for spatial auto-correlation in patents and in prizes covering unpatented technical innovations.18 In keeping with the contract theory of patents, patented inventions were associated with statistically significant spatial autocorrelation, consistent with the prevalence of knowledge spillovers. By contrast, prize-winning innovations were not spatially dependent. Patenting further boosted prize innovations in adjacent counties, and such spatial effects were large and significant. In short, patents created spillovers for both patented inventions and unpatented innovations; whereas prizes were less effective in generating such externalities, perhaps owing to a lack of specific mechanisms to diffuse information.

Even today, women are poorly represented in the annals of technology, so patent and prize data offer an indispensable resource for gender studies. A sample of over 12,000 inventions and innovations by female patentees and participants in prize-granting institutions in Britain, France, and the United States enables the systematic assessment of women's creativity within the market and household.19 My dataset distinguishes between improvements in consumer final goods, changes in designs, and other forms of technological creativity. The results show that women, especially nonpatentees, were significantly more likely than men to produce these types of incremental consumer-oriented improvements. A general implication is that, by empirically missing such consumer innovations, economists continue to underestimate women's contributions to technological change and social welfare.

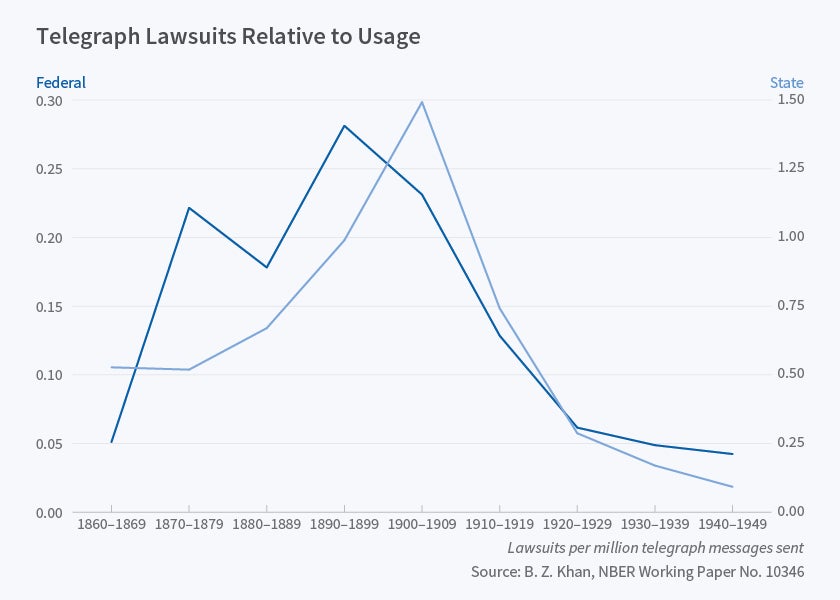

Legal records comprise another underused resource that can shed light on the link between markets and incentives for cooperative behavior and innovation.20 Courts and legal institutions in the United States were not biased towards the wealthy, but enhanced access by all citizens.21 My book showed that inventive activity was bolstered by a judiciary committed to enforcing property rights for all inventors. Rules and standards were not static, but effectively altered in response to technological innovations.22 From the perspective of a world where mail was delivered by stagecoach, the advent of the telegraph was far more transformative to communications than the change from a landline to a cellphone. A myopic focus on "explosions" in patent litigation fails to appreciate that litigation about all areas of law — patents, property, contracts and torts alike — was inevitably associated with the advent of any important innovation.23 As Figure 2, on total civil litigation related to the telegraph, illustrates, productive institutional responses ultimately accommodated and resolved the transactions costs and conflicts associated with disruptive innovation.

Enterprise and Family Networks

Another theme of my research, the organization of firms, highlights the role of family networks in the mobilization of capital. Some scholars regard familial connections as inefficient, with potential both for corruption and for exploitation of unrelated shareholders. My results support a more positive interpretation of such personalized relationships in enterprise and innovation.

An empirical study of female entrepreneurs in 19th-century France reveals that their activities were enhanced by participation in family firms.24 Women were constrained by discriminatory laws that inhibited their ability to hold property, write contracts, and retain separate earnings.25 Family firms reduced such transaction costs and allowed women to engage successfully in market exchange. The French experience suggests that family-based enterprises can provide a means for integrating relatively disadvantaged groups into the market economy as managers and entrepreneurs.

Studies of family networks typically focus on insiders, such as directors and other corporate elites. By contrast, I have collated unique panel data encompassing all of the shareholders in an economy-wide sample of antebellum Maine corporations.26 The dataset includes information on the age, occupation, and wealth of each investor as well as the voting rights, restrictions on directors, and legal liability rules of each firm. I find that "related investing" characterized the entire ownership structure, and personal ties were especially prevalent among women, less-wealthy shareholders, and small investors. Such networks facilitated capital mobilization, especially for inexperienced investors, arguably by reducing the risk and transactions costs of new ventures. Ongoing research examines the links between related investing and corporate governance, age, and portfolio composition. Moreover, these data allow us to investigate the Bagehot Hypothesis, which suggests that unlimited liability rules have implications for the wealth composition of shareholders.

In sum, my research helps to explain overarching growth patterns: the universal prevalence of family networks in business, the early decline of innovation prizes, the success of American patent institutions that resulted in its global diffusion, and the rise of the United States as a leading industrial nation. The results highlight the central role of market-oriented incentives, in tandem with open-access economic and legal institutions, in promoting technological progress and social welfare.

Endnotes

B. Z. Khan, The Democratization of Invention: Patents and Copyrights in American Economic Development, 1790–1920, New York, New York: Cambridge University Press, 2005.

B. Z. Khan, "Looking Backward: Founding Choices in Innovation and Intellectual Property Protection," in D. Irwin and R. Sylla, eds., Founding Choices: American Economic Policy in the 1790s, Chicago, Illinois: University of Chicago Press, 2010, pp. 315–42.

B. Z. Khan and K. L. Sokoloff, "Institutions and Technological Innovation during the Early Economic Growth: Evidence from the Great Inventors of the United States, 1790–1930," NBER Working Paper 10966, December 2004, and American Economic Review, 94 (2) 2004, pp. 395–401, and in T. Eicher and C. Garcia-Penalosa, eds., Institutions and Economic Growth, Cambridge, Massachusetts: MIT Press, 2006, pp. 123–58.

B. Z. Khan, "Knowledge, Human Capital and Economic Development: Evidence from the British Industrial Revolution, 1750–1930," NBER Working Paper 20853, January 2015.

B. Z. Khan, "War and the Returns to Entrepreneurial Innovation among U.S. Patentees, 1790–1870," Brussels Economic Review, 52 (3/4), 2009, pp. 239–74.

B. Z. Khan, "The Impact of War on Resource Allocation: 'Creative Destruction' and the American Civil War," NBER Working Paper 20944, February 2015, and Journal of Interdisciplinary History, 46 (3), 2015, pp. 315–53.

N. Lamoreaux and K. L. Sokoloff, "Intermediaries in the U.S. Market for Technology, 1870-1920," NBER Working Paper 9017, June 2002, and in S. L. Engerman, P. T. Hoffman, J.-L. Rosenthal, and K. L. Sokoloff, eds., Finance, Intermediaries, and Economic Development, New York, New York: Cambridge University Press, 2003, pp. 209–46.

B. Z. Khan, "Selling Ideas: An International Perspective on Patenting and Markets for Technology, 1790–1930," Business History Review, 87 (1), 2013, pp. 39–68.

B. Z. Khan, The Democratization of Invention: Patents and Copyrights in American Economic Development, 1790–1920, New York, New York: Cambridge University Press, 2005.

B. Z. Khan, "Inventing Prizes: A Historical Perspective on Innovation Awards and Technology Policy," NBER Working Paper 21375, July 2015, and Business History Review, 89 (4), 2015, pp. 631–60.

B. Z. Khan, "Prestige and Profit: The Royal Society of Arts and Incentives for Innovation, 1750–1850," NBER Working Paper 23042, January 2017.

B. Z. Khan, "Inventing Prizes: A Historical Perspective on Innovation Awards and Technology Policy," NBER Working Paper 21375, July 2015, and Business History Review, 89 (4), 2015, pp. 631–60.

The Royal Commission, "Official Catalogue of the Great Exhibition of the Works of Industry of All Nations," Robert Ellis, ed., London, United Kingdom: Spicer Brothers, 1851, https://archive.org/stream/officialcatalog06unkngoog#page/n10/mode/2up

B. Z. Khan, "Going for Gold: Industrial Fairs and Innovation in the Nineteenth-Century United States," Revue Économique, 64 (1), 2013, pp. 89–114.

B. Z. Khan, "Premium Inventions: Patents and Prizes as Incentive Mechanisms in Britain and the United States, 1750–1930" in D. L. Costa and N. Lamoreaux, eds., Understanding Long-Run Economic Growth: Geography, Institutions, and the Knowledge Economy, Chicago, Illinois: University of Chicago Press, 2011, pp. 205–34.

B. Z. Khan, "Inventing in the Shadow of the Patent System: Evidence from 19th-Century Patents and Prizes for Technological Innovations," NBER Working Paper 20731, December 2014.

B. Z. Khan, "Antitrust and Innovation before the Sherman Act," Antitrust Law Journal, 77 (3), 2011, pp. 1001–29.

B. Z. Khan, "Of Time and Space: Technological Spillovers among Patents and Unpatented Innovations during Early U.S. Industrialization," NBER Working Paper 20732, December 2014.

B. Z. Khan, "Designing Women: Technological Innovation and Creativity in Britain, France and the United States, 1750–1900," NBER Working Paper 23086, January 2017.

B. Z. Khan, " 'Justice of the Marketplace': Legal Disputes and Economic Activity on America's Northeastern Frontier, 1700–1860," Journal of Interdisciplinary History, 39 (1), 2008, pp. 1-35; B. Z. Khan, "Commerce and Cooperation: Litigation and Settlement of Civil Disputes on the Australian Frontier," The Journal of Economic History, 60 (4), 2000, pp. 1088–119.

B. Z. Khan, " 'To Have and Have Not': Are Rich Litigious Plaintiffs Favored in Court?" NBER Working Paper 20945, February 2015.

B. Z. Khan, "Technological Innovations and Endogenous Changes in U.S. Legal Institutions, 1790-1920," NBER Working Paper 10346, March 2004, and "Innovations in Law and Technology, 1790–1920," in M. Grossberg and C. Tomlins, eds., Cambridge History of Law in America, vol. 2, New York, Neew York, Cambridge University Press, 2008, pp. 483–530, 796–801.

B. Z. Khan, "Trolls and Other Patent Inventions: Economic History and the Patent Controversy in the Twenty-First Century," George Mason Law Review, 21, 2014, pp. 825–63.

B. Z. Khan, "Invisible Women: Entrepreneurship, Innovation, and Family Firms in France during Early Industrialization," NBER Working Paper 20854, January 2015, and The Journal of Economic History, 76 (1), 2016, pp. 163–95.

B. Z. Khan, "Married Women's Property Laws and Female Commercial Activity: Evidence from United States Patent Records, 1790–1895," The Journal of Economic History, 56 (2), 1996: 356–88.

B. Z. Khan, "Related Investing: Corporate Ownership and Capital Mobilization during Early Industrialization," NBER Working Paper 23052, January 2017.