China's Trade Policies

Recent developments in China's trade policy include discussions of the possibility of joining the Trans-Pacific Partnership, exploration of mega trade deals with a number of trade partners, and enactment of a China-Korea free trade agreement. My research program applies numerical simulation methods to various economic models of China and its trading partners to analyze the potential impacts of such changes. The work draws on the output of two research efforts by young Chinese scholars that intensively examined a broad range of Chinese economic topics.1

China and the TPP

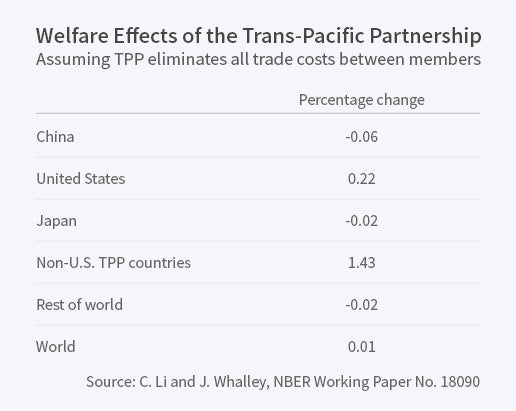

The Trans-Pacific Partnership (TPP) is a proposed regional arrangement among 13 countries; China is not a participant. Chunding Li and I assess the potential effects of the TPP on China and other countries.2 We use a numerical five-country global general equilibrium model which incorporates trade costs and a monetary structure that incorporates inside money and thereby allows for impacts on trade imbalances. Trade costs are calculated using a method based on gravity equations. Our simulation results show small negative effects of the TPP on China and other non-TPP countries.

We also find that total world production and welfare will increase under a TPP regional free trade initiative and TPP will benefit member countries significantly. Smaller TPP countries gain proportionally more than the U.S. because of their substantial intra-Pacific trade. These results appear to be reasonably robust to changes in key model parameters, such as price elasticities of demand.

We use our model to simulate the effects of Japan joining the TPP and find that this would be a beneficial step for Japan and all other TPP countries, but that this action would have negative effects on China and the rest of the world. We evaluate the effect of China joining the TPP, and find that China and other TPP countries would all gain, while non-TPP countries would be hurt. In our model, the effects of TPP are different from those of global free trade. Global free trade benefits all countries, but TPP benefits only member countries. Moreover, the positive effects of global free trade are considerably higher than those of TPP.

China and Mega Trade Deals

Li, Jing Wang, and I explore potential impacts on China and other major countries of mega trade deals beyond TPP.3 These include the Regional Comprehensive Economic Partnership (RCEP), China-Japan-South Korea Free Trade Agreement, China-TPP, and possible China-U.S. and China-India free trade agreements. We also use numerical general equilibrium simu-lation methods, but introduce two important novelties. First, we divide trade costs into tariff and non-tariff barriers and again calculate trade costs between countries empirically using gravity-model methodology. This allows exploration of free-trade agreement effects from both tariff and non-tariff reduction. Secondly, we use an inside money structure to form an endogenous trade imbalance model that captures important realities in China’s large trade imbalances. Using a 13-country Armington-type global general equilibrium model, we endogenously determine trade imbalance effects from the trade initiative and calibrate our model to a base case capturing China's large trade surplus. We calibrate the model to 2011 data and use counterfactual simulations to explore the effects.

Our simulation results show that almost all mega deal member countries will gain and nearly all mega deal non-member countries will lose. The more non-tariff barriers are eliminated, the more significant the impacts the mega deal will have on all countries. All mega deals will benefit China in terms of welfare, trade, exports, and imports. Comparatively, the RCEP and China in the TPP generate the highest welfare outcomes in the model. The next highest is a China-Japan-Korea free trade agreement (FTA), and then a China-U.S. agreement. For the U.S., China in the TPP generates the highest welfare gain. The next highest is a China-U.S. FTA. For the European Union, all China-involved mega deals except a China-U.S. FTA generate negative welfare outcomes. For Japan, RCEP generates the highest welfare gain; the next highest is China in the TPP. For Ko-rea, RCEP generates the highest welfare gain, followed by a China-Japan-Korea FTA. For India, RCEP generates the highest welfare gain, followed by a China-India FTA.

China and Trade Policy Bargaining

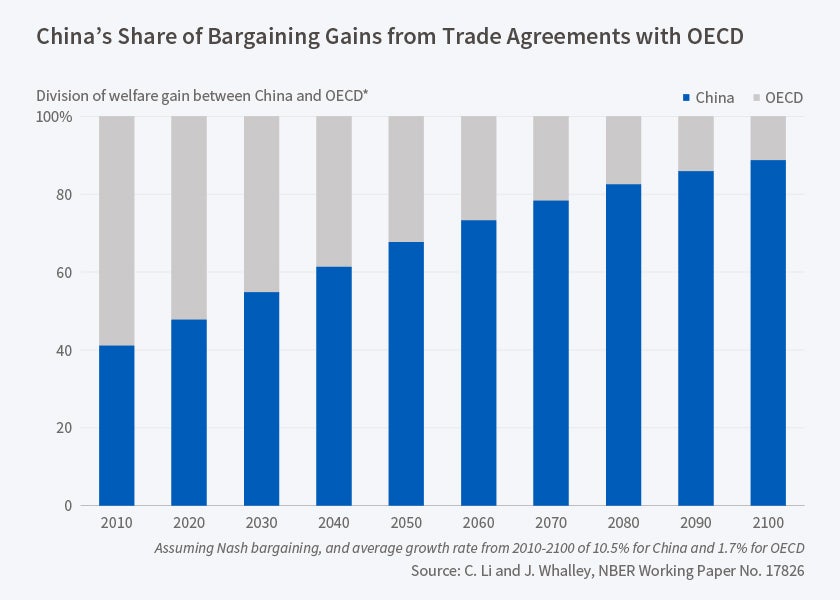

Timing is an issue in China's trade bargaining, since the country is growing faster than its OECD partners. Li and I use a multi-country, single-period numerical general equilibrium model which describes the economies of China and its major trading partners to examine the outcomes of trade policy bargaining solutions — bargaining over tariffs and financial transfers—over time.4 We compute gains relative to non-cooperative Nash equilibria (NE) for a range of model parameterizations. This yields a measure of both absolute and relative gain to China from global trade policy bargaining. We calibrate the model to base case data for 2008 and use a model formulation in which there are heterogeneous goods across countries. The gains from trade bargaining accrue more heavily to countries other than China when we focus on the economic circumstances in 2008 than when we use data from a later year. We consider the impact of differing prospective national growth estimates, which sharply increase China's size relative to its trading partners. Our objective is to assess how China's gains from bargaining change over time, and in particular whether they grow at a faster rate than GDP.

Our simulation results show that China's welfare gains from bargaining with the OECD increase over time if all countries keep their present GDP growth rates. Using the Nash Equilibrium solution concept, China's share of global bargaining gains in the simulation is 41 percent in 2010, 67.7 percent in 2050, and 88.7 percent in 2100. [See Figure 2.] This shows growth in bargaining gains at roughly the rate of increase in relative GDP. China's annual average growth rate in its trade bargaining welfare gain is about 11 percent, just a little higher than its GDP growth rate. The comparable statistic for the OECD is about 6 percent, higher than its GDP growth rate. When we use an alternative Kalai-Smorodinsky (KS) solution concept, things are different. China's share of global gains is initially smaller—only 10.6 percent in 2010—but grows much more rapidly to 70.9 percent in 2050 and to 99.1 percent in 2100. We get these results under the assumption that China maintains its growth rate at 10.47 percent, its average in 2001-10, and the OECD stays at a rate of 1.66 percent, its average in the same period.

These findings imply important differences when using Nash and KS bargaining solution concepts for numerical policy-based work. With asymmetric shifts in the utility possibility frontier due to growth, the Nash bargaining approach uses tangencies between an implicit Cobb-Douglas preference function and the utility possibility frontier, while the KS uses a utopia point proportional to intersections with axes. The two equilibrium concepts behave differently. Additionally, if China joins with India and Brazil to bargain jointly with the OECD, China's welfare gain from bargaining increases by 40 percent compared to the Nash bargaining China-OECD case. We also find that if we take account of the relative size of China's economy by making a purchasing power parity correction to our initial calibration, China's welfare gain would be even larger.

China's Service Trade

Services are an increasingly important part of China's trade. Chen and I discuss the country's service trade performance from 1980 to 2010, focusing on service subsectors in both the Chinese and the world economies.5 We summarize and present data on the size of China's service trade, its growth rate, sectoral decomposition, comparative advantage, and degree of openness. The data suggest that despite China's high growth rate, development of service trade lags behind merchandise trade. The openness index for China's service trade differs across subsectors, and the international competitiveness of major service subsectors remains low. We examine China's service trade in light of prospective development strategies and assess potential effects on the Chinese and global economies. China has adjusted its long-term policy bias in favor of merchandise manufacturing and heavy industries to encourage high-tech manufacturing and services in its far-reaching 12th Five-Year Plan. A series of facilitating policies on taxation, finance, land use, and other elements has been launched to boost the service trade, which already has had large impacts on the country's economic growth, employment, and technology diffusion. The potential global impacts of China's service trade development include changes in China's competitiveness in offshore service outsourcing, shifts in global FDI patterns and flows, and international migration of educated labor.

The Shanghai Pilot Free Trade Zone

China still maintains relatively rigorous capital controls for both state security and policy independence reasons. The adoption of the China (Shanghai) Pilot Free Trade Zone in September 2013 was part of an ambitious new round of reform, designed to liberalize the capital account and facilitate trade in the small area of Shanghai to which the zone's special policies apply. Daqing Yao and I discuss the reasons for and objectives of China's adoption of such a zone and review its first year of operation.6 We find that the main impacts of the zone has not been its trade volume or foreign investment, but the institutional innovation it has generated. The most significant changes include implementation of a "negative list" model for foreign investment management, more efficient operation of new trade supervisory institutions for trade execution, the launch of financial reform experiments on capital account convertibility and in financial services, and the cutting of red tape in administration.

The Shanghai zone is a trial introduction of both floating exchange rates and capital account liberalization into China's macro policy mix. We examine three measures to evaluate its effects: the price spread between the Chinese yuan in Hong Kong and mainland China, the yield gaps between Renminbi accounts in onshore and offshore markets, and the extent to which changes in China's money supply lead to changes in foreign interest rates. We find that the yield gap between three-month notes onshore and offshore declined after the founding of the Shanghai zone. Our results more generally suggest that China's capital controls have weakened since initiation of the zone.

The zone incorporates many policy innovations such as free trade accounts and a negative list for foreign investment, as well as new trade facilities. These reforms enable funds to flow in and out of China more freely, and integrate the Chinese financial market more into the international market.

Endnotes

One was a "Young China Scholars Network on China's Policy Options in a Post Crisis World" sponsored by Western University, the Centre for International Governance Innovation (CIGI, Waterloo), and the International Development Research Centre (IDRC, Ottawa) between 2010 and 2013. Another was a six-year (October 1, 2009, to September 31, 2015) project titled "The Western-CIGI-China (BRIC)-Ontario Project" which was supported by Western University, Ontario Research Fund (ORF), CIGI, and a number of Chinese universities and research institutions.

C. Li and J. Whalley, "China and the TPP: A Numerical Simulation Assessment of the Effects Involved," NBER Working Paper 18090, May 2012, and published as "China and the Trans-Pacific Partnership: A Numerical Simulation Assessment of the Effects Involved," The World Economy, 37(2), 2014, pp.169-92.

C. Li, J. Wang, and J. Whalley, "Numerical General Equilibrium Analysis of China's Impacts from Possible Mega Trade Deals," NBER Working Paper 20425, August 2014, and published as "Impact of Mega Trade Deals on China: A Computational General Equilibrium Analysis," Economic Modelling, 57, 2016, pp. 13–25.

C. Li and J. Whalley, "China's Potential Future Growth and Gains from Trade Policy Bargaining," NBER Working Paper 17826, February 2012, and published as "China's Potential Future Growth and Gains from Trade Policy Bargaining: Some Numerical Simulation Results," Economic Modelling, 37(C), 2014, pp. 65–78.

J. Whalley and H. Chen, "China's Service Trade," Journal of Economic Surveys, 28(4), 2014, pp. 746–74.

D. Yao and J. Whalley, "The China (Shanghai) Pilot Free Trade Zone: Background, Developments and Preliminary Assessment of Initial Impacts," NBER Working Paper 20924, February 2015, and The World Economy, 39(1), 2016, pp. 2–15.