How Economic Shocks Affect Spending

When faced with a common economic shock, such as a temporary drop in income, individuals may respond very differently: Some individuals will cut spending while others will draw on liquid assets or borrow.

My collaborators and I use administrative account data and surveys to analyze differences both in how individuals prepare for economic risks and in how they behave when confronted with shocks. This work helps quantify the economic impact of fiscal stimulus policies such as tax rebates and temporary tax cuts. It also provides insights into how households make choices about spending and saving in a world where income is quite variable.

Naturally Occurring Data and the Response of Spending to Income

Using a dataset that tracks daily banking and credit card transactions and balances for over one million individuals, Michael Gelman, Shachar Kariv, Dan Silverman, Steven Tadelis, and I produce estimates of spending behavior linked to individuals' liquidity.1 These naturally-occurring account data create a comprehensive picture of spending, income, and liquidity with unprecedented precision, frequency, and timeliness, and provide a distinctive understanding of behavior.

The data shed new light on the well-established finding that individuals respond excessively to predictable changes in income. Such excess sensitivity is inconsistent with standard economic models that imply individuals should not let predictable movements in income affect their spending plans when income changes. That some households do spend from temporary and predictable increases in income implies that economic stimulus, for example from tax rebates, will noticeably increase aggregate demand. Hence, having credible estimates of spending from such income shocks is important for predicting the likely effects of countercyclical fiscal policy.

The naturally occurring account data allow a novel classification of spending. Recurring spending can be identified as payments, such as rent, mortgage payments, and utilities that occur at regular intervals and in regular amounts. Much of the measured excess sensitivity of spending to receipt of paycheck owes to the timing of recurring spending after paydays. This timing of payments after paycheck has been noticed in earlier research.2 The finding that much spending after receipt of income is on recurring payments suggests that this behavior results from planned, prudent bill-paying behavior rather than necessarily excess sensitivity to having more cash on hand.

Still some excess sensitivity of spending to paycheck receipt remains that is largely explained by the differences in average liquidity across individuals. For those who typically hold low liquid assets, there is evidence of hand-to-mouth spending fol-lowing the receipt of a paycheck.

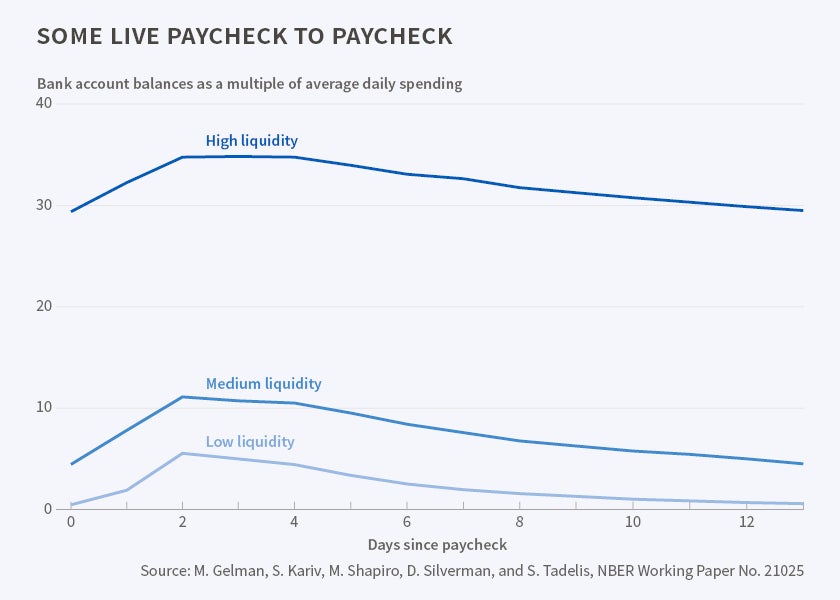

A substantial fraction of individuals have very low liquidity. Figure 1 shows the ratio of bank account balances to average daily spending across the paycheck cycle. Liquidity is expressed as a ratio of checking and savings balances to average daily total spending, so the numbers in the figure can be interpreted as cash on hand relative to typical daily expenditure. The three lines are medians of this liquidity for households in the top, middle, and bottom thirds of the liquidity distribution. The top third of the liquidity distribution is well-positioned to handle an income shock. The median of this group could maintain more than a month of average spending with their checking and savings account balances, even in the days just before their paycheck arrives. The lower two-thirds of the liquidity distribution have a substantially smaller cushion. Over the entire pay cycle, the middle group has median liquid assets equal to 7.9 days of average spending. Liquidity drops to only five days of average spending in the days just before their paycheck arrives. The bottom third of this population is especially ill-prepared, with essentially no liquidity just prior to receiving the paycheck.

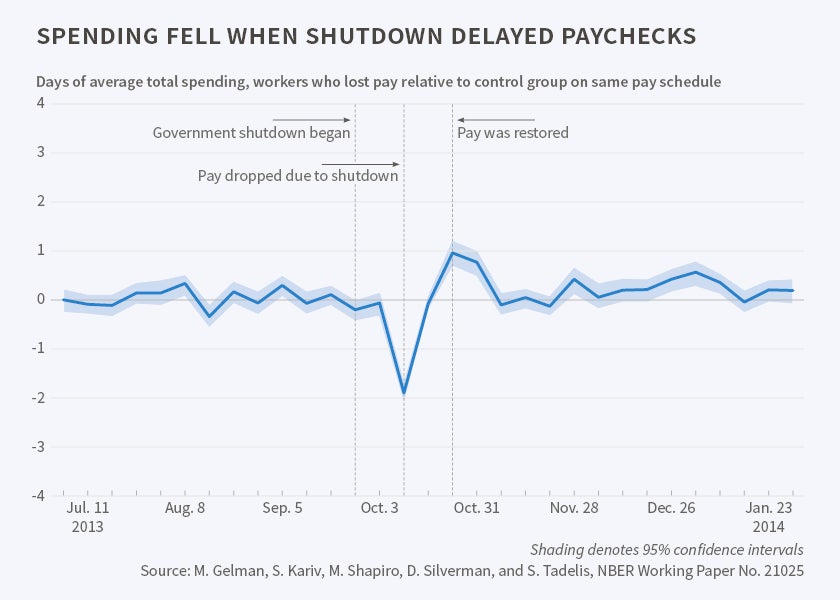

How do individuals—especially those who have very low liquidity prior to receiving an upcoming paycheck—cope with fluctuation in income? With so little cash on hand, they would appear very vulnerable to even a short-lived drop in income. These two facts—low liquidity combined with temporary shocks to income — might lead to the prediction that households would find it difficult to smooth spending. This prediction is hard to test, however, because the temporary shocks to income may be endogenous, or hard to observe. A recent working paper addresses these problems by examining how individuals adjusted spending and saving in response to a temporary drop in income due to the 2013 U.S. government shutdown.3 The shutdown cut paychecks by 40 percent for affected employees, but the delayed pay was recovered within two weeks. Hence, the government shutdown provides quasi-experimental variation in income that bears directly on how individuals react to a negative shock affecting only the timing of income.

Though the shock was short-lived and completely reversed, spending dropped sharply, implying a naïve estimate of the marginal propensity to spend of 58 cents per dollar of lost income. Figure 2 shows the change in spending around the shutdown. The first vertical line is the week the shutdown began. (Weeks in the figure begin on Thursday, the most common payday of government workers.) The middle vertical line indicates the week in which employees affected by the shutdown were paid roughly 40 percent less than their average paycheck. The figure shows the difference in spending between government workers who experienced the temporary pay loss and a control group on the same bi-weekly pay schedule. There is a large gap between the treatment and control group during this week. Similarly, the final vertical line indicates the week of the first regular paycheck after the shutdown. The rebound in spending is discernable for two weeks.

However, this estimate of the drop in spending overstates the decline in consumption. While many individuals had low liquidity, they used multiple strategies to smooth consumption. Interestingly, they did not draw on liquidity, of which they had little, or incremental borrowing. They had no discernable increase in new charges on credit cards. Instead, they smoothed spending by delaying payments including on mortgages and on revolving credit. Deferring a payment is a form of borrowing, and is the principle means that low-liquidity households used to smooth spending during the shutdown. This behavior—while readily evident in the account data that precisely links spending, income, and credit card balances at high frequency—would be very difficult to detect in surveys, which have less precise measurements and aggregate measurements over longer time intervals.

What emerges from these high-resolution data on consumers is a complicated picture of behavior in response to economic shocks. Many consumers do not follow the standard advice by having a substantial cash buffer. Nonetheless, they are able to smooth consumption in the face of a temporary drop in income by changing their timing of payments. Hence, the reaction of spending to a loss of income is less than one would infer from the very low liquidity of many households.

Response of Consumers to Economic Stimulus

In response to economic slowdowns, the federal government frequently takes steps to put more disposable income in the hands of the consumers. The aim of these policies is to stimulate the economy by boosting aggregate consumer spending. To be effective, these policies require that consumers spend at least a fraction of the extra income.

Joel Slemrod, Claudia Sahm, and I have quantified how the response to receipt of such stimulus payments differs across households. Our approach is to ask survey respondents whether they mostly spend, mostly save, or mostly pay debt with the extra income. These questions have been included in the University of Michigan’s Survey of Consumers around the time when new stimulus policies were put in place. This method blends the standard approach in economics of observing behavior in response to change in policy or other shock, such as the analysis of the government shutdown, with the survey approach of directly asking individuals how they responded to the stimulus. The survey question implicitly poses a counterfactual in that it asks respondents to base a response on what their behavior would have been absent the economic stimulus payment. Yet, unlike many hypothetical questions about shocks, the response concerning stimulus payments addresses a payment the respondents actually received and about which they would have had to make a decision.

We have used this approach to study a variety of economic stimulus policies: the change in the withholding table in 1992, the tax rebates of 2001 and 2008, the 2009–10 tax credit, and both the onset and expiration of the 2011–12 payroll tax holiday.4 While there are some differences across the various policies, responses to the policies since the 2001 rebate have some strong common features.

First, the implied marginal propensity to consume (MPC) is between one-quarter and one-third. This MPC is non-zero, so it implies that the stimulus policies will have a non-negligible effect on aggregate spending. The estimates from the surveys are consistently much lower than MPCs commonly used to project the effectiveness of countercyclical policies.5 Hence, these findings suggest that the per-dollar of stimulus effect on aggregate demand is modest relative to standard estimates.

Second, the most common response to receiving extra income is to pay off debt. From the standpoint of aggregate demand, saving a rebate or using it to pay off debt are equivalent. That the modal response to a tax rebate or payroll tax cut is to pay off debt gives added insight into why the stimulus spending effect of these policies is attenuated. To the extent that a fiscal stimulus results from an economic downturn where consumers are cutting back spending because of a debt overhang—as was certainly the case in 2008 and its aftermath—it is not surprising that consumers use a tax rebate for balance sheet repair rather than spending. Hence, rebates or temporary tax cuts may be implemented precisely when consumers have relatively little inclination to spend, and hence such policies may be less effective in stimulating the economy than would be estimated based on consumer behavior on average.

Third, there is no evidence that the MPC from tax rebates or temporary tax cuts varies with income. This finding runs counter to the conventional wisdom that low-income individuals are more likely to be liquidity-constrained and therefore have higher MPCs.6

A recent survey analyzing the expiration of the two percent payroll tax holiday at the end of 2012 provides additional evidence of the importance of balance sheet considerations for household decision-making. Many households that reported using the extra two percent of income during the 2011–12 payroll tax holiday to pay off debt indicated that they would continue to pay off debt at the same rate following the expiration of the tax holiday.7 The behavior of these "balance-sheet households" is hard to reconcile with standard economic theories concerning the determinants of consumption, and since the survey evidence largely explains the anomalous drop in consumption after the expiration of a payroll tax cut, such behavior should be taken seriously.

Endnotes

M. Gelman, S. Kariv, M. D. Shapiro, D. Silverman, and S. Tadelis, "Harnessing Naturally Occurring Data to Measure the Response of Spending to Income," Science, 345(6193), 2014, pp. 212–15.

See, for example, M. Stephens, "'3rd of the Month': Do Social Security Recipients Smooth Consumption Between Checks?" NBER Working Paper 9135, August 2002, and American Economic Review, 93(1), 2003, pp. 406–22.

M. Gelman, S. Kariv, M. D. Shapiro, D. Silverman, and S. Tadelis, "How Individuals Smooth Spending: Evidence from the 2013 Government Shutdown Using Account Data," NBER Working Paper 21025, March 2015.

R. Triffin, M. D. Shapiro and J. Slemrod, "Consumer Response to the Timing of Income: Evidence from a Change in Tax Withholding," NBER Working Paper 4344, April 1993, and American Economic Review, 85(1), 1995, pp. 274–83; M. D. Shapiro and J. Slemrod, "Consumer Response to Tax Rebates," NBER Working Paper 8672, December 2001 and American Economic Review, 93, 2003, pp. 381–96; M. D. Shapiro and J. Slemrod, "Did the 2008 Tax Rebates Stimulate Spending?" NBER Working Paper 14753, February 2009, and American Economic Review, 99(2), 2009, pp. 374–9; and C. R. Sahm, M. D. Shapiro, and J. Slemrod, "Check in the Mail or More in the Paycheck: Does the Effectiveness of Fiscal Stimulus Depend on How It Is Delivered?" NBER Working Paper 16246, July 2010 and American Economic Journal: Economic Policy, 4(3), 2012, pp. 216–50. The estimates across policies are quite similar except for the 1992 change in withholding (which had a higher mostly spend rate than the subsequent policies).

Congressional Budget Office, "Options for Responding to Short-Term Economic Weakness," Washington, D.C.: The Congressional Budget Office, 2008. For a point estimate of the MPC more in line with standard assumptions, see J. A. Parker, N. S. Souleles, D. S. Johnson, and R. McClelland, "Consumer Spending and the Economic Stimulus Payments of 2008," NBER Working Paper 16684, January 2011 and American Economic Review, 106(6), 2013, pp. 2530–53.

The finding that the MPC is not a function of the level of income, however, is consistent with recent work by Greg Kaplan and Giovanni Violante: G. Kaplan and G. Violante, "A Model of the Consumption Response to Fiscal Stimulus Payments," NBER Working Paper 17338, August 2011, and Econometrica, 82(4), 2014, pp. 1199–1239.

C. R. Sahm, M. D. Shapiro, and J. Slemrod, "Balance-Sheet Households and Fiscal Stimulus: Lessons from the Payroll Tax Cut and Its Expiration," NBER Working Paper 21220, May 2015.