Economic Possibilities for Our Children

This is the 40th anniversary of the summer when I first met Marty Feldstein and went to work for him. I learned from working under Marty's auspices that empirical economics was a profoundly important thing, that it had the opportunity to illuminate the world in important ways, that it had the opportunity to change people's perspectives as they thought about economic problems, and that the successful solution or resolution of economic problems didn't happen with the immediacy with which a doctor treated a patient, but did touch and affect the lives of hundreds of thousands, if not millions, of people.

I learned about how to approach economic research from watching Marty. There is a central element that has been a part of his approach to economics, and it has always been a part of mine, both as an economist and a policymaker. It is the approach of many in our profession, but not all. This is the belief that we cannot aspire to know the world with complete precision; that no single parameter will measure with precision how our economy is going to respond to a policy or a shock. Rather, what we can aspire to establish is a combination of logic, modeling, suggestive anecdote and experience, and empirical measurements from multiple different perspectives that lead to an overall view on economic phenomena. That kind of overall view on economic phenomena moves the world forward much more than a precise estimate of a single parameter.

It is very much in that spirit that I want to reflect with you this afternoon on economic possibilities for our children. Keynes wrote a famous essay entitled "Economic Possibilities for Our Grandchildren." I am not Keynes, so I cannot look nearly as far forward as he did. But I am seeking to speak in the same spirit. At a moment of substantial cyclical distress, at a moment of financial preoccupation, I would like to look to the broader technological forces that are operating and that will shape the structure of our economy and how people live over the long term.

I think of my horizon as being more like a generation than the century that Keynes spoke of. At one level, by the way, Keynes did pretty well. He predicted that incomes in the industrialized world would rise eightfold between 1930 and 2030 and they've risen a little more than sixfold so far, so he's looking pretty good on that prediction. But Keynes also got some things wrong. He predicted that as incomes rose eightfold, the workweek would fall to 15 or 20 hours. The reason he got that wrong is something that I hadn't previously reflected on.

When I took introductory economics, a big feature of the textbook was the backward bending labor supply curve, where it was explained that past a certain point, the income effect took over from the substitution effect and so the labor supply curve bent backwards. This does not get much attention in textbooks today. The reason is that people with higher wages now work more hours than people with lower wages. The time series tracks the cross section. Over time, as we have all gotten richer, the number of hours worked for many people has risen.

Keynes missed many other things. He missed that there was a developing world and an industrialized world, for example. And he missed entirely issues relating to the distribution of income, either within countries or across countries. This too contributes to my desire to speak about one generation rather than more.

I believe in a much more anecdotal way than Dale Jorgenson, who has quantified it to an extraordinary degree, that the defining feature of economic growth in this era is the set of changes that are associated with information technology. The single example I find most striking is the self-driving automobile. Automobiles have now been driven from California to New York, stopping at red lights, accelerating, going through green lights, accelerating through yellow lights without being touched by a human hand. And if one thinks about almost any aspect of economic activity, it either has been, is being, or quite possibly will be revolutionized by the application of information technology. In my friend Marc Andreessen's phrase, software is eating the economy.

I am told that there exist software programs that can grade at least some kinds of student papers with more reliability relative to human beings than human beings can grade essays relative to other human beings. Larry Katz has famously remarked that computers do not do empathy, but there have existed for many years computer programs that actually do a credible job of providing psychotherapy. In response to confessionals, they prompt with responses like: "Tell me a little bit more about what's distressing you. That must have been very hard for you. Can you explain a little more fully?" On at least some occasions these programs have been an important source of solace.

In Heathrow Airport, you now check out of the newsstands without passing a human being. Increasing amounts of surgery are done remotely. Think of an industry that a group like this has a particular attachment to–the publishing industry. It is perhaps prototypical of where things are going.

First there were bookstores, then there were superstores, then there was Amazon, and now there are the Kindle and e-books. And at every stage it was better to be a reader, better to be an author, and worse to be an ordinary person involved in the intermediation between the authors and the readers.

This set of developments is going to be the defining economic feature of our era, and we are seeing its consequences in many aspects. When I was an MIT undergraduate in the early 1970s, a young economics student was exposed to the debate about automation. There were two factions in those debates. There were the stupid Luddite people, who mostly were outside of economics departments, and there were the smart progressive people, who at that time were personified by Bob Solow. The stupid people thought that automation was going to make all the jobs go away and there wasn't going to be any work to do. And the smart people understood that when more was produced, there would be more income and therefore there would be more demand. It wasn't possible that all the jobs would go away, so automation was a blessing. I was taught that the smart people were right.

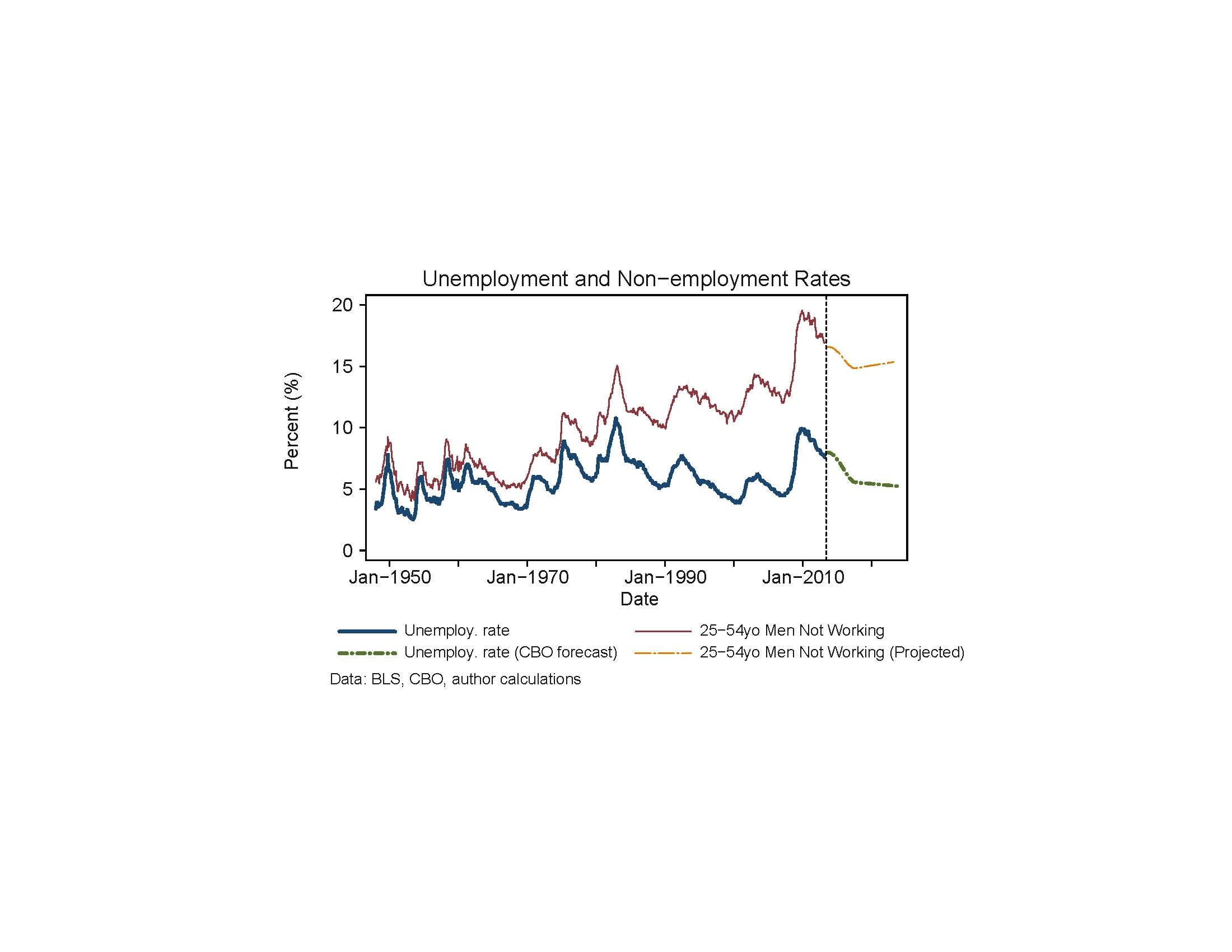

Until a few years ago, I didn't think this was a very complicated subject; the Luddites were wrong and the believers in technology and technological progress were right. I'm not so completely certain now. I have done the simplest of statistical exercises, plotting the non-employment rate for men 25 to 54 and then adjusting for trend and cycle and extrapolating. Not, I hasten to say, because they're the most important group in our society (and they are, by the way, a group of which I am no longer a part), but only because they are a group where there is the strongest prevailing social expectation that they will be working.

What you see is that in a secular sense, going back a long time, the fraction of them who are not working once one takes the cycle out has been increasing. I summarize this by saying that in the 1950s and 60s, one in 20 men between the age of 25 and 54 was not working. If you do a simple extrapolation based on trend and cycle to the period a decade from now, between one in six and one in seven men between the age of 25 and 54 will not be working.

And as you would expect, these patterns are substantially more pronounced if you are less educated. They are substantially more pronounced if you are in a disadvantaged group than if you are in an advantaged group. This is associated with what is also a defining feature of our time. In the United States today a higher fraction of the workforce receives disability insurance than does production work in manufacturing. (Many workers in the manufacturing sector are not production workers.)

These phenomena are related. No one could give a Feldstein lecture without recognizing the possibility that a social insurance program had a distorting disincentive effect and that is certainly the case with respect to disability insurance. But I think it is also fair to say that the evolution and growth of disability insurance is substantially driven also by the technological and social changes that are leading to a smaller fraction of the workforce working.

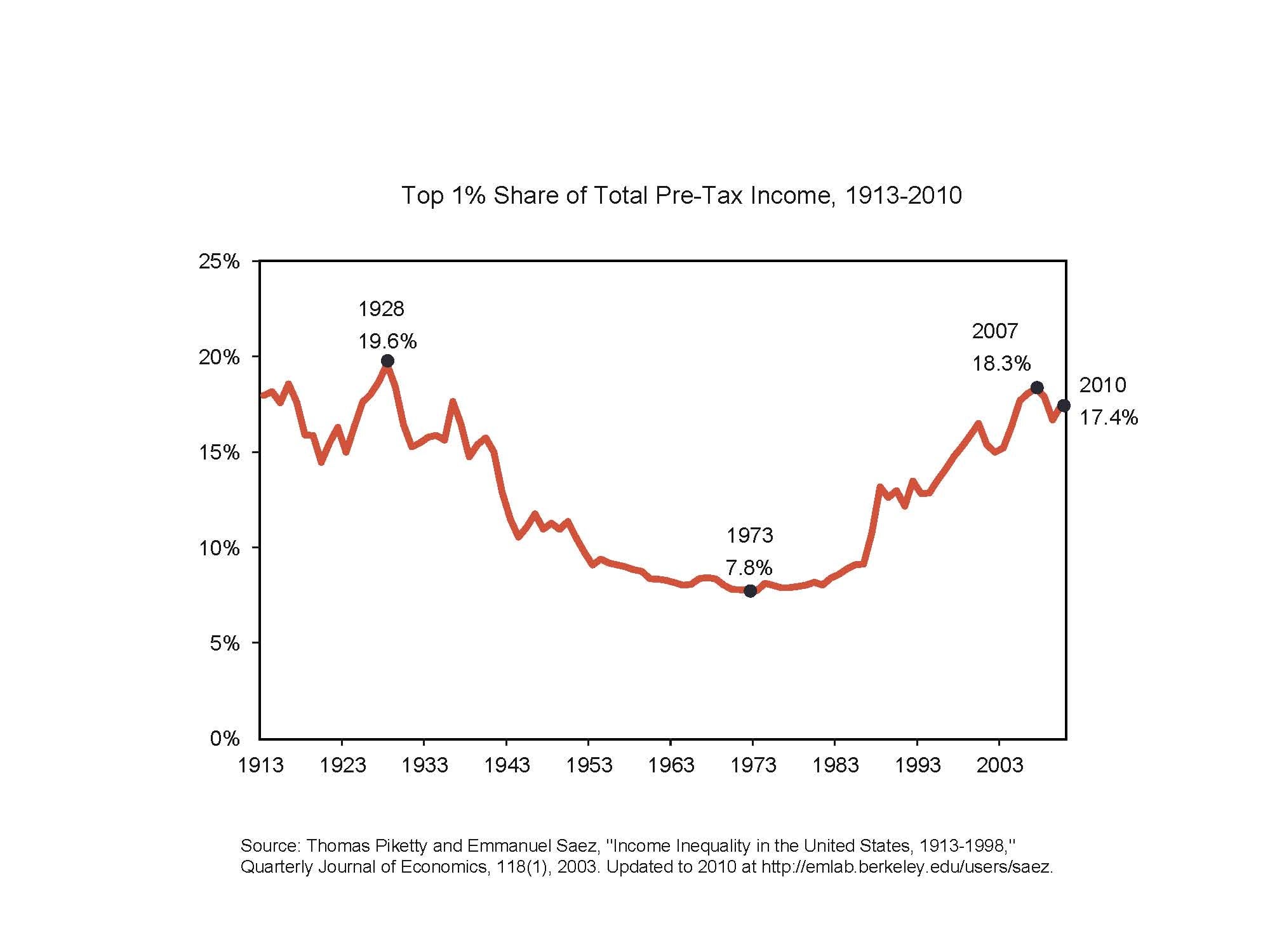

At the same time, as has famously and repeatedly been noted, the share of income going to the top one percent of our population has steadily increased. One can debate how to treat capital gains. One can debate whether to talk about individuals or about family units. There are a hundred aspects of the numbers that one can debate, but I think it will be difficult to escape the conclusion that the very top group in our society is receiving about ten percent more of the total income than they were a generation ago, that that is the equivalent of $10,000 per household unit for everyone else, and that it represents a substantial portion of median family income.

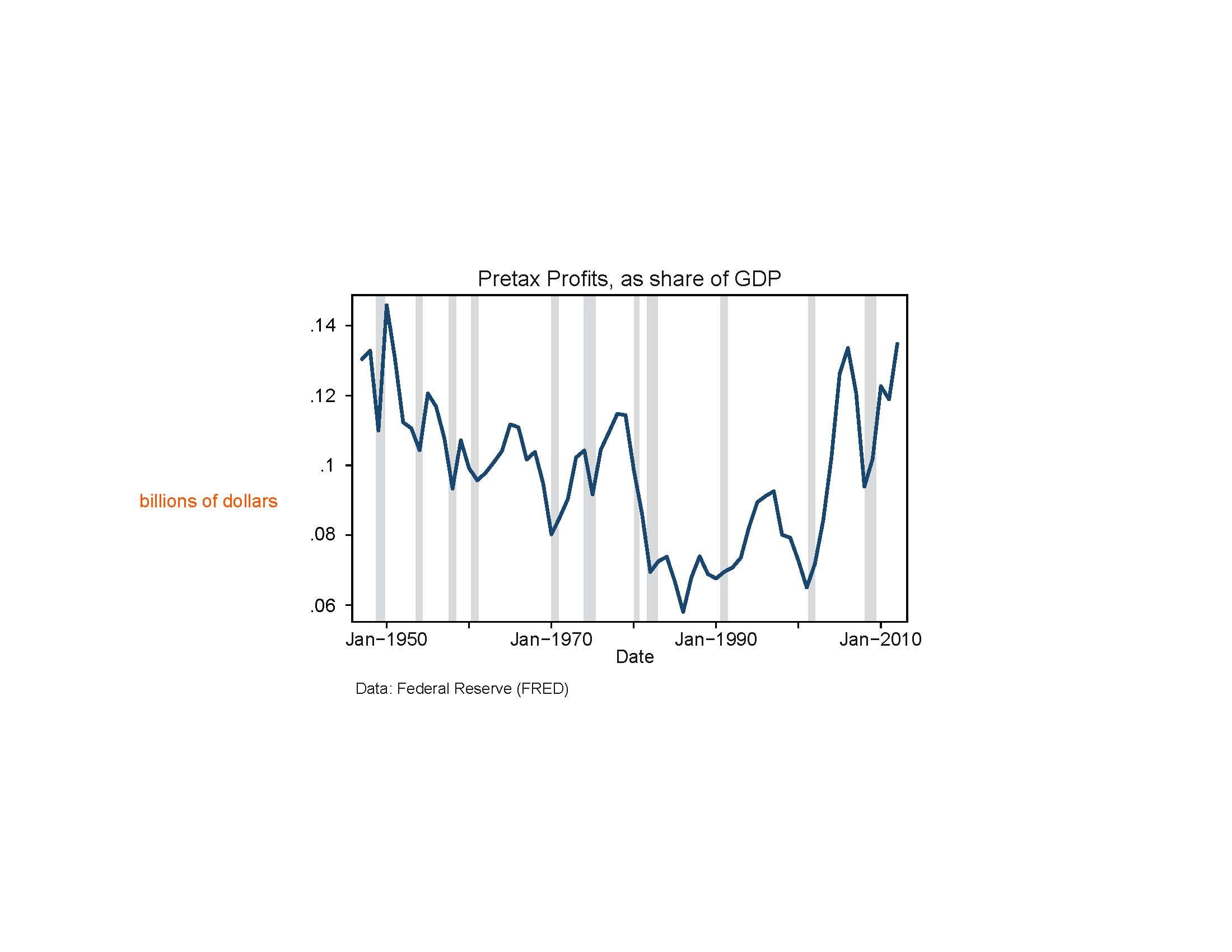

At the same time the profit share in total income has been rising. This is a subject dear to my heart because it dates back to the first paper that I was privileged to publish, a paper with Marty in 1977. Marty and I wrote a paper entitled, "Is the Rate of Profit Falling?" And we managed to look at the data and conclude that the rate of profit was not falling. That is a reflection of the fact that we were looking at the rate of return, not the profit share, and had a variety of refinements that are not there.

It is also a reflection, no doubt, of Marty's prescience. He knew that the rate of profit would not be falling. So, I am glad to have answered the question, "Is the rate of profit falling?" in the negative in 1977. And there's a question as to whether our paper is due for a sequel, perhaps entitled, "Is the Rate of Profit Rising?" because it does seem to be rising in recent years.

What is a way of thinking about all of this? I've come to a very simple "metaphor" (I hesitate to dignify this thought with the word "model"). We are used to thinking of production functions. Output is a function of capital and labor. Capital augments labor: it raises the productivity of labor. If there are only two factors, they have to be complements. If there's more capital, the wage has to rise. Now imagine that capital can be put to one of two uses. It can be put to the use in the production function that we are accustomed to thinking about or it can be used to substitute for labor. That is, you can take some of the stock of machines and, by designing them appropriately, you can have them do exactly what labor did before. I am suggesting replacing the production function

- Y = F(K, L)

with

Y = F(βK, L + λ(1 ‒ β)K).

In this setting one unit of capital is the equivalent of λ units of labor. A moment's thought will reveal that capital will be deployed in these two uses to the point where their marginal productivity is the same, and that will determine what share of the capital stock is used in the customary way and what share is used to substitute for labor.

If you reflect on this a bit longer, you'll realize that three things happen. One, the availability of capital that substitutes for labor augments production opportunities. You can always choose not to use it. So, the level of output has to rise. Second, when capital is reallocated to substituting for labor, the stock of effective labor rises and the stock of conventional capital falls, and so wage rates fall. Third, the capital share, understood to include the total return to capital of both varieties, rises. That's just a corollary of output rising and wages falling. This pattern is similar to what we have seen take place. I suspect that this reflects the nature of the technical changes that we have seen: increasingly they take the form of capital that effectively substitutes for labor.

Now one could augment this story in various ways. If one augmented the production function to include entrepreneurs, for example, it would not be difficult to address the rising share of income going to the top one percent of the population. My conjecture is that for the next generation we are likely to see this process continue, both because of the very substantial scope for current levels of computing power to support capital-labor substitution on a larger scale, and because of the scope for increased computational power to make possible capital-labor substitution of a kind that we have not seen to date.

The likely consequence? Increased levels of output but at the same time growing pressure on wages. Given the observation I noted earlier, this will greatly pressure the income distribution. Not only will divergent wages increase inequality but the supply response will magnify these effects. It may well be that, given the possibilities for substitution, some categories of labor will not be able to earn a subsistence income.

I think this description captures a very important aspect of what may play out over the next generation. But there is a second aspect that I think is also profoundly important - the reality that a sector's great success in spurring productivity can make it less and less important economically. This is something that was first pointed up for me by Bill Nordhaus, who demonstrated that not quite at the pace of Moore's Law, but at something close, the illumination sector of our economy has enjoyed great productivity growth. There's only one problem. Most of us actually want it to be dark at night and there would be no particular advantage to this room being substantially more brightly lit. And so, vast productivity growth in illumination has been associated with the substantial shrinkage of the illumination sector, at least as measured by the share of employment in it. Candle making was an important occupation and an important industry in the 1800s. The production of light is no longer a defining aspect of economic activity today.

I believe phenomena of this type are going to be very important for understanding the evolution of our economies going forward. The obvious example, of course, is agriculture where today less than one percent of the population produces enough food for all of us and much more. Headed in this direction also, potentially, is manufacturing. The most recent data I've been able to find, which are about five years old, suggest that in China a smaller fraction of the workforce is engaged in manufacturing employment today than was in 1990, despite the tremendous progress and gains in competitiveness that the Chinese manufacturing sector has enjoyed. It is the same story as above: rapid productivity growth associated with inelastic demand leads to fewer and fewer people being engaged in the activity.

The extent to which differential productivity growth characterizes our economy is, I think, sometimes underappreciated. The Bureau of Labor Statistics normalizes the consumer price indices at 100 in the period 1982 to 1984. Below are some recent values of the Consumer Price Index (CPI) for 2012.

| Good or Service | September 2012 CPI Value (1982-4 = 100) |

| College Tuition and Fees | 706 |

| Medical Care Services | 445 |

| Medical Care | 419 |

| Services | 272 |

| Energy | 258 |

| Food | 234 |

| All Items | 231 |

| Housing | 223 |

| Transportation | 224 |

| Apparel | 127 |

| Durables | 112 |

| Toys | 53 |

| Televisions | 5 |

Source: Bureau of Labor Statistics

Television sets at five stand out. That is obviously a reflection of a rather energetic hedonic effort by the Bureau of Labor Statistics. One suspects that equally energetic hedonic efforts are not applied to every consumer price. But nonetheless, the simple fact is that the relative price of toys and a college education has changed by a factor of ten in a generation. The relative price of durable goods or clothing as a category and all goods has changed by a factor of almost two in a generation.

This table provides a somewhat different perspective on the common and valid observation that real wages have stagnated in the United States. The observation that real wages are stagnant reflects wages measured in terms of the overall consumer price index. But this obscures the truth that real wages measured in terms of different goods have behaved very differently.

In those parts of the economy that are well modeled by the introductory economics textbook treatment of widgets - firms producing a thing with workers with increasing marginal costs in a somewhat competitive industry, such as durables, clothes, and cars - we've seen continuing, very substantial growth in real wages as measured by the purchasing power of things that our economy produces. The reason that real wages in aggregate have stagnated is that much of what people buy are things where there are issues of fundamental scarcity: energy, the land under the houses we buy, and goods and services that are produced in complicated, heavily public-sector-inflected ways. Medical care and educational services are examples of the latter category.

Where production has taken place in the classic way we teach, productivity growth has continued. There has been progress. Real wages measured in those terms have increased substantially. It's just that a larger and larger share of our economy is in sectors that are not well thought of as widgets produced by competitive firms. They are sectors where property rights, scarcities, intellectual property, and the like are of fundamental importance.

This is a way of thinking about a question that has always, and to some extent continues, to puzzle me - what I think of as the paradox of alternative dystopias. On the one hand there is the Peter Thiel-Robert Gordon dystopia that holds that we used to make rapid productivity growth progress and we no longer do. And look - real wages and median family income have been relatively stagnant for a long time. On the other hand there is the Erik Brynjolfsson-Mark Andreessen-Kurt Vonnegut dystopia that holds that machines are going to displace labor and so there are going to be very few jobs left for regular people. It seems like they can't both be true, that it can't both be that machines have the capacity to displace all the labor and that there is no capacity to enjoy rapid productivity growth.

Perhaps the resolution lies in the fact that a great deal of productivity growth can take place but it is in a sense self-limiting by demand. A larger share of the economy will inevitably migrate to those remaining residual sectors where the capacity to generate rapid productivity growth is low.

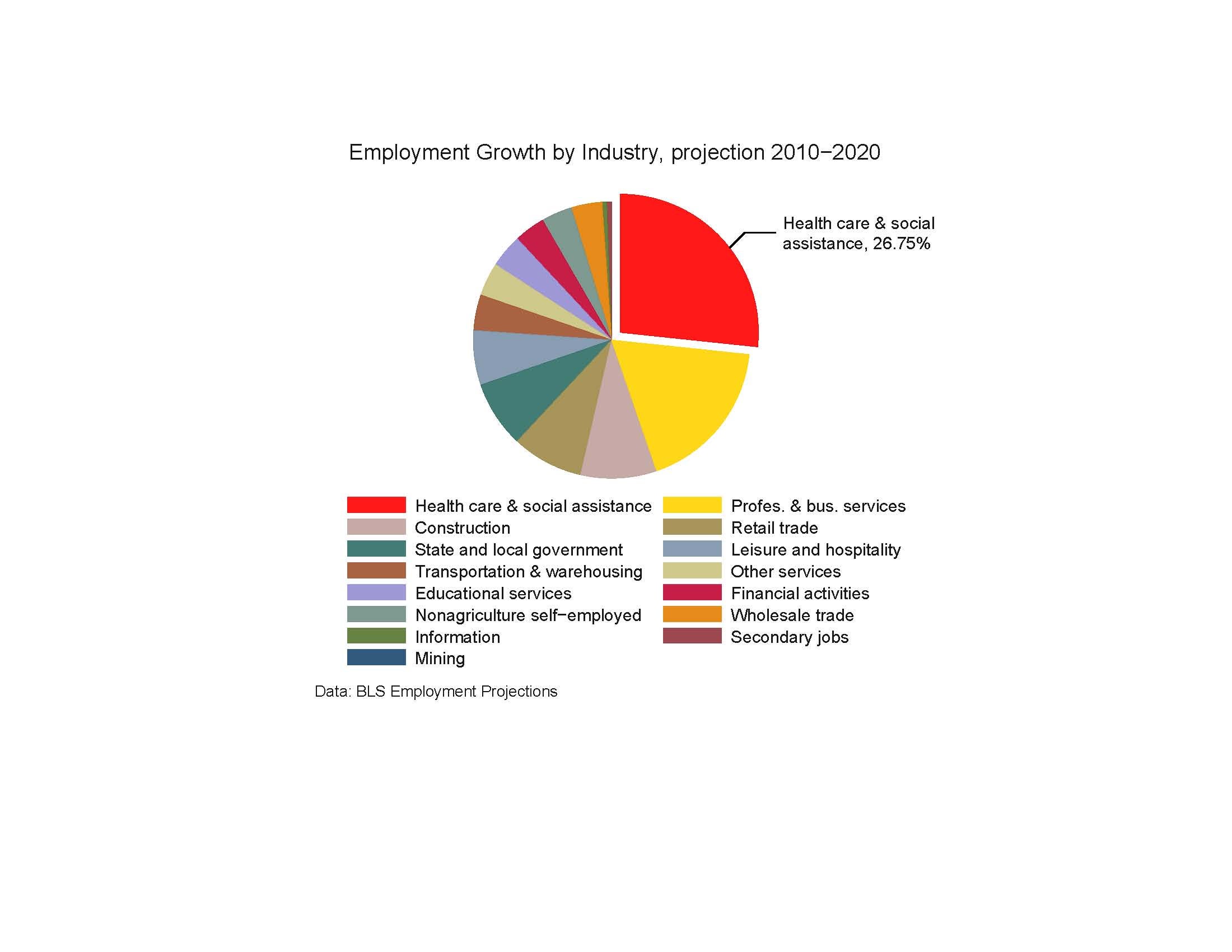

Let me close with a final observation - a projection. To the right is the BLS's projection of where job growth is going to come from over the next decade.

What stands out as by far the largest industry is healthcare and social assistance, clearly public-sector inflected. Other important growth sectors are state and local government, construction (in part something that takes place in the public sector), and educational services. I bet that when BLS next updates this, the projections on growth in retail trade, transportation and warehousing, and wholesale trade are going to have come considerably down given the trends that are underway.

As a society, we are going to need to come to grips over the next couple of decades with what has been called Moynihan's Corollary to Baumol's Law. Baumol's Law is the set of observations surrounding productivity growth in some but not all sectors, which I have sought to discuss. Moynihan's Corollary is the propensity for the slow-growing sectors to end up in the public sector.

It is conventional to discuss the future of the public sector in terms of the past of the public sector, to suggest that the United States historically has some threshold of revenue generated or public spending that is in the range of 20 percent of GDP, and that those are norms that should carry us forward. One of the first things I learned from Marty, the observation that the distortion associated with taxes rises not with the tax rate but with the square of the tax rate, suggests a certain caution about the expansion of the public sector. Yet if one thinks about the 100-to-1 relative price change between television sets and goods of that kind that are dominantly produced in the private sector, and goods like healthcare and education, in which the public sector's role is substantially greater, one has to admit that it is not entirely apparent that the past should necessarily be a guide for the future with respect to the scale of the public sector.

Whether the expansion of those sectors as a share of the economy necessitates a growing share of the public sector in the economy, or whether the share of healthcare and education that takes place in the public sector should decline will be a matter of great public debate. As a country, and not without controversy, we do not seem to be moving toward a smaller public role in healthcare. Nor do other countries in the world. But that will, perhaps, change over time.

In conclusion, I invite you to consider how the prodigious change associated with information technology that may be qualitatively different from past technological change may have defining implications for our economy going forward. If I have caused you to reflect on the fact that very substantial relative price changes are likely to be associated with dramatic changes in the structure of employment, the nature of economic activity, and the relative importance of the widget-producing firm in our economy, and to consider the implications this will have for the future of the subject with which I began my career in economics under Marty's tutelage, public economics, then I will have served my purpose this afternoon.