Oil Price Shocks

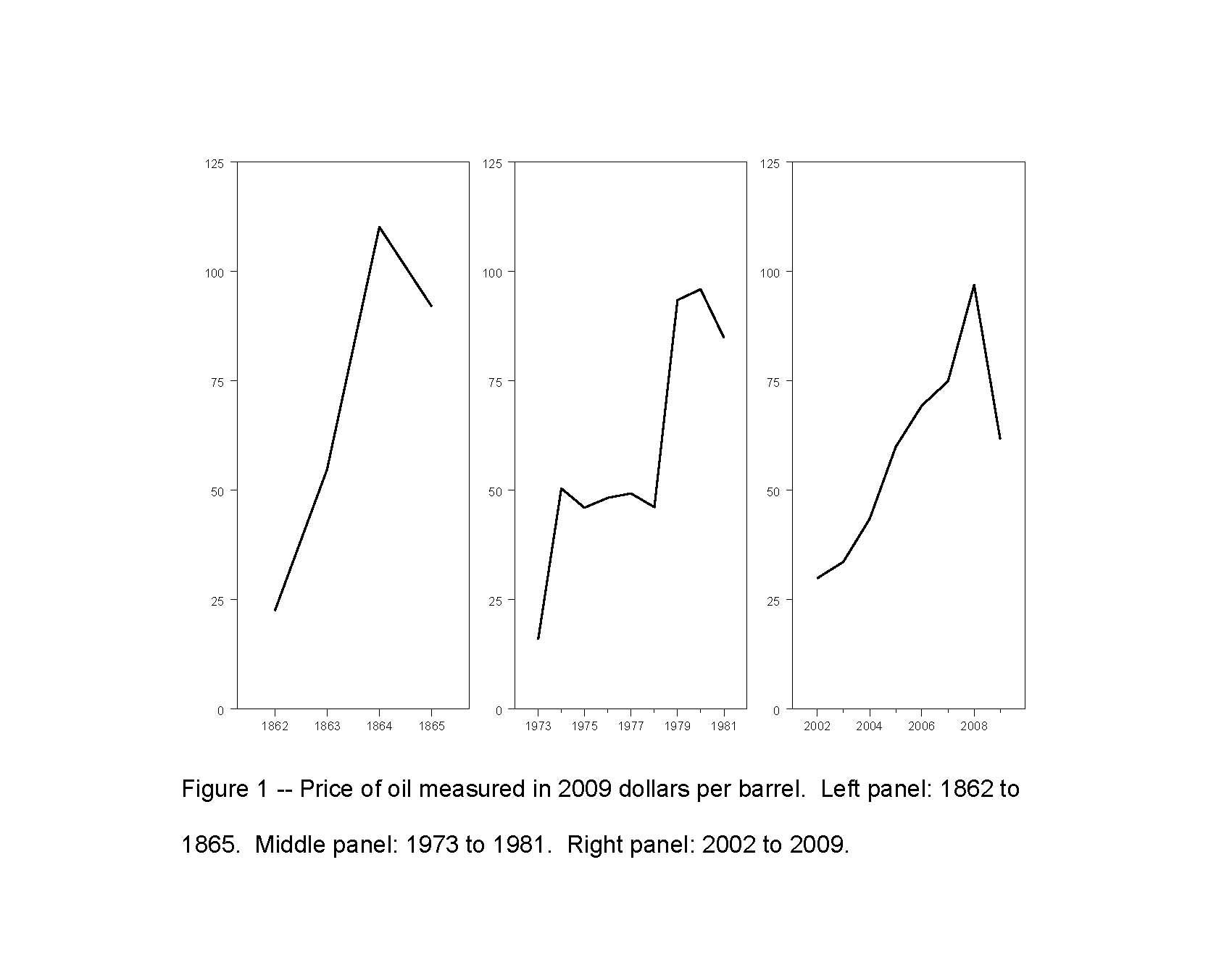

The first decade of the new millennium brought a dramatic increase in the real price of crude petroleum. The price (in 2009 dollars) rose from about $30 a barrel in 2003 to an average of nearly $100 a barrel in 2008 (see the far right panel of Figure 1). Such a rapid price increase was not unprecedented, though. The price of oil rose similarly during the 1970s (middle panel) and during the U.S. Civil War (left panel).

The oil price increase during the 1970s was spurred by three dramatic geopolitical events: the embargo and production cutbacks by the Arab members of OPEC in 1973-4; the Iranian revolution in 1978-9; and the Iran-Iraq war which began in 1980. A century earlier, strong demand associated with the U.S. Civil War and a big tax on crude's competitor, alcohol, were factors in a comparable boom. By contrast, the oil price run-up of 2005-8 did not seem to be associated with significant geopolitical disruptions.

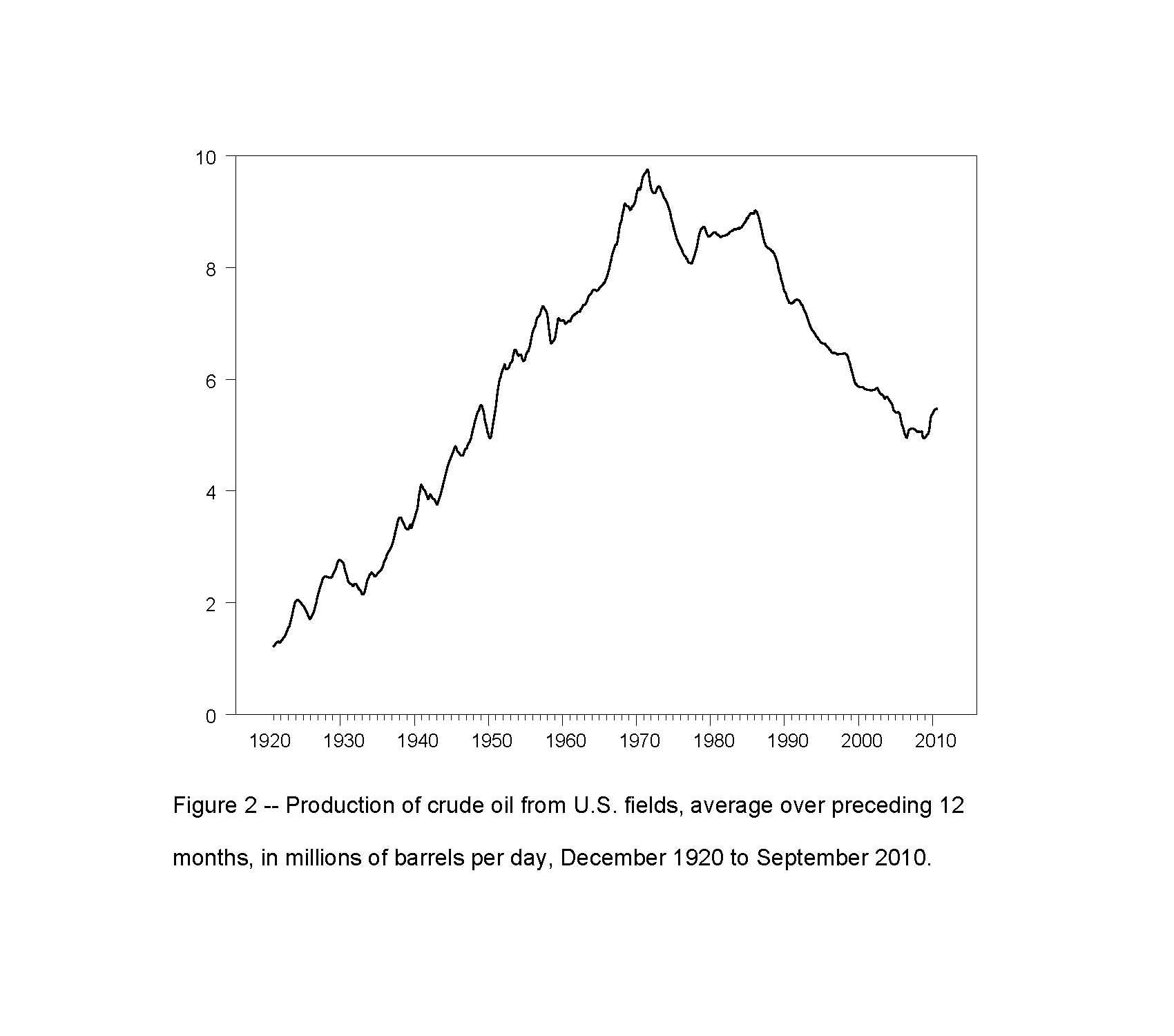

The three episodes shown in Figure 1 have one theme in common: declining production from the maturing oilfields on which the world had been depending at the time. Flows from the initial Pennsylvanian fields fell quickly as the reservoirs were exploited, and total world oil production fell during 1862-4 before more productive new fields were found to replace them. Thanks to discoveries in Texas and California, for example, the United States was to remain the world's biggest oil producer until the early 1970s, when production from maturing U.S. fields began what proved to be a permanent decline (see Figure 2). That loss of U.S. production was one reason the world suddenly came to depend so much more on the volatile Middle East. Over the most recent decade, production has begun to fall significantly from mature fields in the North Sea and Mexico, and output from Saudi Arabia failed to increase. In recent assessments,1 I conclude that stagnating global production coinciding with remarkable growth in demand from the newly industrialized economies were the most important factors in the oil price increases over 2005-8.

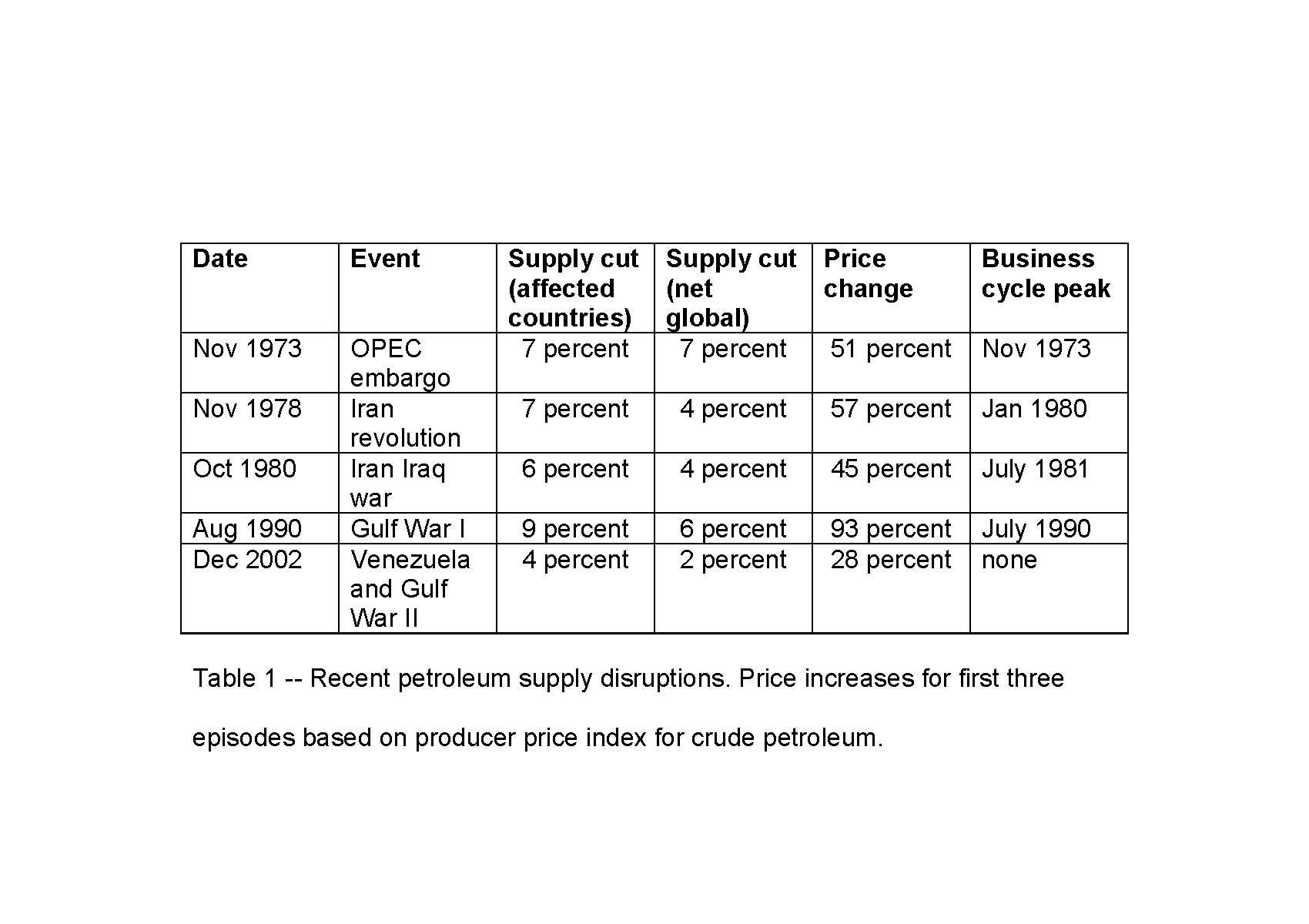

I review the history of the oil market in a new working paper.2 Table 1 presents from that research the summary of the five most recent petroleum supply disruptions. In most of these episodes, the lost oil production from the affected countries was offset in part by production increases elsewhere. Boosts in production from Saudi Arabia were the most significant offsetting factor. The first four events listed were followed by economic recessions. In the paper, I note that in fact all but one of the 11 U.S. recessions since World War II were preceded by a sharp increase in the price of crude petroleum, a pattern I first noted in 19833 when there were only eight postwar recessions for which the observation could be made.

One mechanism by which oil shocks likely contribute to economic recessions is through the automotive sector, because consumers postpone purchases or shift spending away from larger domestically manufactured vehicles.4 Paul Edelstein and Lutz Kilian5 document the empirical significance of this effect, and Valerie Ramey and Dan Vine6 demonstrate that it continues to be quite important despite changes in the American economy over time. Gasoline price increases also have been observed to have a significant depressing effect on measures of consumer sentiment.

In a recent paper7 I document that automobile purchases, consumer sentiment, and overall consumer spending in 2007-8 responded to the oil price increase in much the same way as had been observed in earlier episodes. Had it not been for the decline in the auto sector alone, U.S. real GDP would have increased by 1.2 percent between 2007:Q4 and 2008:Q3, a period that was subsequently characterized by the NBER Business Cycle Dating Committee as the first year of our most recent recession. Given the likely additional contribution of the oil price shock to other components of consumer spending, it seems quite reasonable to conclude that oil prices were an important factor in the initial stages of the most recent economic downturn.

This mechanism would not necessarily operate in reverse to stimulate the economy when oil prices go down. To the extent that postponement of vehicle purchases is part of the propagating mechanism when the price of oil goes up, consumers would not be expected to accelerate purchases when the gasoline price declines. Some of the macroeconomic effects of oil shocks come from difficulties in reallocating specialized labor and capital out of the disfavored sectors, which is exacerbated by the Keynesian multiplier process that results from unemployed auto workers. Indeed, Michael Owyang and I8 find that the oil price collapse in the mid-1980s seemed to induce a regional recession in the major U.S. oil-producing states. In other research9 I explore the evidence of nonlinearities in the effects of oil price changes on the level of economic activity, and I recently reviewed10 the economic literature that has addressed this question. That research suggests that at the moment, when memories of $4 gasoline are still fresh in consumers' minds and spending patterns have not reverted to pre-2007 values, we might expect these nonlinear multiplier effects to be less significant.

That finding is of course extremely relevant in the Spring of 2011, as dramatic developments in North Africa and the Middle East are leading many people to wonder whether we are about to see a replay of the historical pattern. The significant production disruptions at the time of this writing have been confined to Libya, which had been contributing about 2 percent of global oil production. If this is the end of the story, then it would be perhaps comparable to the 2002-3 Venezuela-Iraq disruptions, and significantly smaller than the supply disruptions that were associated with economic recessions. However, given the turbulent history of the Middle East, even if current events are contained, it seems quite likely that sometime within the next decade there will be broader conflicts with significant implications for world oil supplies.

Apart from the possibility of dramatic geopolitical developments, there is another lesson we can learn from studying the past. Falling production from mature fields in Oil Creek, Pennsylvania in the 1860s and in the United States as a whole after 1971 ended up being more than replaced by much more productive fields discovered elsewhere. So far, that has yet to happen in the new millennium, and the potential demand is enormous as countries like China enter the automotive age. Saudi Arabia has provided a critical buffer for many historical production shortfalls, but it is far from clear that the kingdom is going to continue to play that role. Even if we somehow maintain stability in the Middle East, meeting the world's growing thirst for oil poses a daunting challenge for the next decade.

1. J. Hamilton, "Understanding Crude Oil Prices", NBER Working Paper No. 14492, November 2008, and Energy Journal 30 (2009, no. 2), pp. 179-206, and "Causes and Consequences of the Oil Shock of 2007-08", NBER Working Paper No. 15002, May 2009, and Brookings Papers on Economic Activity (Spring 2009), pp. 179-206.

2. J. Hamilton, "Historical Oil Shocks," NBER Working Paper No. 16790, February 2011.

3. J. Hamilton, "Oil and the Macroeconomy since World War II," Journal of Political Economy (April 1983), pp. 228-48.

4. J. Hamilton, "A Neoclassical Model of Unemployment and the Business Cycle," Journal of Political Economy 96 (June 1988), pp. 593-617, and T. Bresnahan and V. Ramey, "Segment Shifts and Capacity Utilization in the U.S. Automobile Industry," NBER Working Paper No. 4105, June 1992, and American Economic Review Papers and Proceedings 83 (1993, no. 2), pp. 213-18.

5. P. Edelstein and L. Kilian, "How Sensitive Are Consumer Expenditures to Retail Energy Prices?" Journal of Monetary Economics 56 (2009, no. 6), pp. 766-79.

6. V. Ramey and D. Vine, "Oil, Automobiles, and the U.S. Economy: How Much Have Things Really Changed?" NBER Working Paper No. 16067, June 2010, and forthcoming, NBER Macroeconomics Annual.

7. J. Hamilton, "Causes and Consequences of the Oil Shock of 2007-08", NBER Working Paper No. 15002, May 2009, and Brookings Papers on Economic Activity (Spring 2009), pp. 179-206.

8. J. Hamilton and M. Owyang, "The Propagation of Regional Recessions," NBER Working Paper No. 16657, January 2011, and forthcoming, Review of Economics and Statistics.

9. J. Hamilton, "What Is an Oil Shock?", NBER Working Paper No. 7755, June 2000, and Journal of Econometrics 113 (April 2003), pp. 363-398.

10. J. Hamilton, "Nonlinearities and the Macroeconomic Effects of Oil Prices," NBER Working Paper No. 16186, July 2010, and forthcoming in Macroeconomic Dynamics.