How Quantitative Easing Affected Mortgage Refinancing

The first phase of quantitative easing in the U.S. made credit more easily available, lowered interest rates, and stimulated over $600 billion in refinancing activity and $76 billion in additional consumption.

Central banks seeking to stimulate economic activity in the aftermath of the Great Recession have purchased a range of financial assets, including mortgages and corporate bonds. How such purchase programs operate, and whether they produce the desired result, is the subject of vigorous debate.

In How Quantitative Easing Works: Evidence on the Refinancing Channel (NBER Working Paper 22638), Marco Di Maggio, Amir Kermani, and Christopher Palmer find that the Federal Reserve's purchase of $1.25 trillion in qualifying mortgage bonds between late 2008 and the first quarter of 2010 stimulated over $600 billion in refinancing activity by making credit more easily available and by lowering interest rates. They estimate that the combination of lower interest payments and equity extraction by homeowners who refinanced their homes created $76 billion in additional consumption.

Government sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac guarantee mortgages that meet certain criteria for maximum loan sizes and loan-to-value (LTV) ratios. Loans that qualify for a guarantee are called conforming loans. U.S. law restricts Federal Reserve mortgage purchases to guaranteed loans, which heightens the segmentation of the markets for conforming and non-conforming mortgages when financial intermediaries are unable to rebalance across segments.

The researchers estimate differences in interest rates and mortgage origination volumes in the conforming and non-conforming mortgage markets (including both "jumbo" mortgages that exceed conforming loan limits and other non-conforming loans that have over 80 percent LTV ratios) during Federal Reserve market interventions from 2008 through 2014. They study 2006-13 data from the credit bureau Equifax, merging processing data and credit data from over 30 million loans, or roughly 65 percent of the mortgage market.

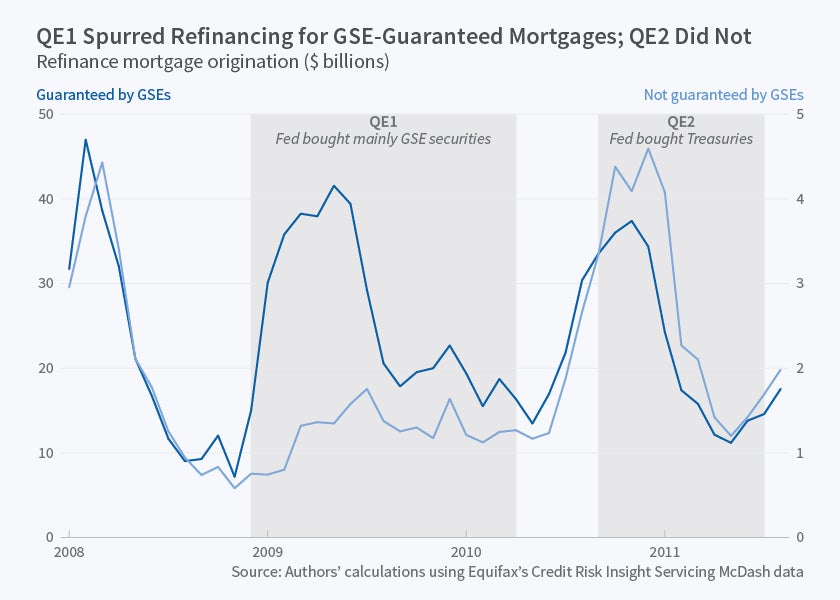

The first quantitative easing program (QE1) operated between November 2008 and April 2010. The Federal Reserve purchased $1.25 trillion in GSE-guaranteed mortgage-backed securities (MBS), as well as $175 billion in debt issued by Freddie Mac and Fannie Mae and $300 billion in U.S. Treasury securities. These MBS purchases amounted to between 50 and 70 percent of each month's new GSE-guaranteed mortgage originations. The second quantitative easing program (QE2), which operated from September 2010 to June 2011, was restricted to purchases of U.S. Treasury securities. Purchases in the third quantitative easing program (QE3), from 2012 to 2014, were roughly evenly divided between GSE mortgage-backed securities and U.S. Treasury securities.

During QE1, interest rates in the conforming mortgage market decreased by more than 100 basis points. The spread between interest rates in the conforming and jumbo markets increased by 40 to 50 basis points. Because interest rates reflect only how households that were able to refinance their homes fared, the researchers examine individual refinancing decisions and the total volume of mortgage refinancing. QE1's differential loosening of credit led to a 170 percent increase in conforming-mortgage origination and only a 20 percent increase in jumbo-mortgage origination. In QE2, when purchases were limited to U.S. Treasuries, rates in both markets declined by about 35 basis points, and there was no identifiable increase in the spread between the two mortgage markets. New loan originations increased by about 65 percent. In QE3, when the Fed continued purchasing Treasury debt and returned to purchasing conforming mortgages, rates fell in both mortgage markets by about 18 basis points. Loan originations rose by 15 to 30 percent. As Fed buying in the conforming market tapered off at the end of QE3, interest rates in the conforming market rose and its loan originations fell 30 percent. Loan originations in the non-conforming market were unaffected.

The researchers conclude that the effects of Federal Reserve mortgage purchases were strongest in the conforming loan market, where they were "effective at inducing new debt origination and cheaper monthly payments for households." However, the limited spillovers from QE1 suggest that because of strong segmentation when the banking sector is in distress, asset purchase programs primarily affect the market segments in which these purchases occur. The researchers estimate that loosening of GSE loan-to-value caps from 80 to 90 percent could have increased QE1's impact by 20 percent, thereby underscoring the way in which macroprudential policy can enhance or weaken the effects of unconventional monetary policy.

—Linda Gorman