Consumer Response to a Tax on Sweetened Beverages

Sugar-sweetened beverages contribute over 40 percent of American adults' daily intake of added sugars and are associated with weight gain, which can lead to elevated rates of obesity and diabetes. In response, numerous cities and regions worldwide have implemented taxes on sweetened beverages to encourage healthier consumption patterns.

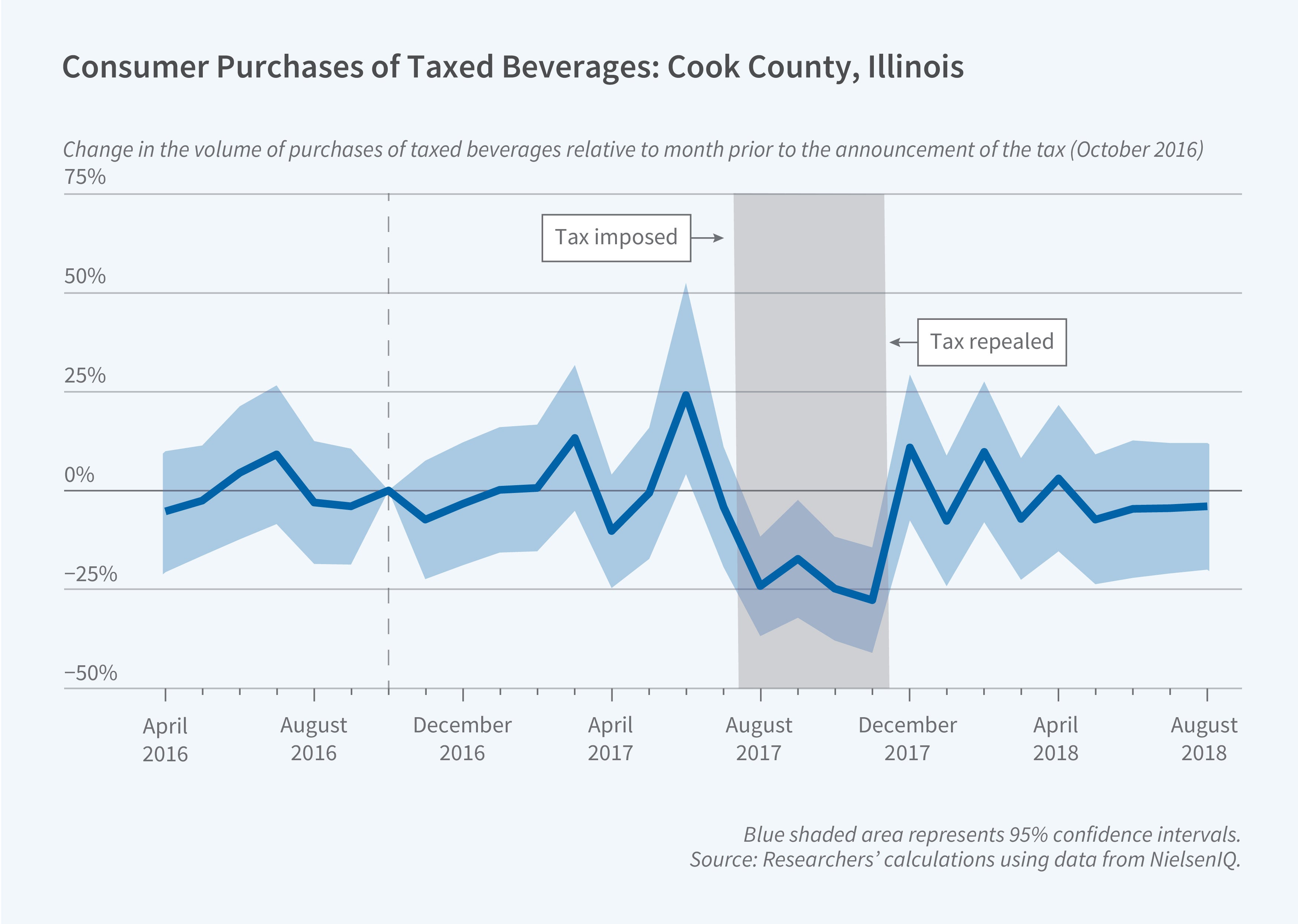

In The Cook County Tax on Sweetened Beverages: The Impact on Purchases of Its Announcement, Implementation, and Repeal (NBER Working Paper 34412), Felipe Lozano Rojas, John Cawley, and David E. Frisvold examine how consumers responded to a one-cent-per-ounce tax on both sugar-sweetened and artificially sweetened beverages that was enacted in Cook County, Illinois, in November 2016, implemented in August 2017, and repealed just four months later in December 2017.

A one-cent-per-ounce tax on sweetened beverages in Cook County, Illinois, reduced household purchases of taxed beverages by 22.5 percent during its four-month implementation, but purchases returned to baseline levels immediately after repeal.

The researchers analyze data from the NielsenIQ Homescan Panel, which tracks household purchases. They use a balanced panel of 1,311 households observed continuously from January 2016 through December 2018, including 712 households in Cook County and 599 in comparison counties (St. Louis, Hennepin, and Ramsey counties). The study covers 10 months before announcement, 9 months between announcement and implementation, 4 months when the tax was effective, and 13 months after repeal.

The study finds no detectable impact on purchases from merely announcing the tax. However, implementation reduced purchases by 22.5 percent for all taxed beverages, 16.5 percent for high-calorie taxed beverages, and 33.0 percent for low-calorie taxed beverages. These reductions translate to approximately four fewer 12-ounce cans per person per month.

The tax's impact did not vary significantly by household income, education, race, or presence of children. Notably, the tax produced no detectable increase in purchases of potential substitutes including bottled water, 100 percent fruit juice, or milk. After the repeal of the tax, purchases returned to baseline levels with no evidence of lasting behavioral change or habit formation.

Most of the tax effect was on the extensive margin—whether households purchased taxed beverages at all—rather than the intensive margin of how much they bought conditional on purchasing any. During the tax period, Cook County households were 37.6 percent less likely to purchase any taxed beverages in a given month. The probability of purchasing high-calorie taxed beverages fell 31.9 percentage points. Store-level data from Cook County show similar but slightly larger reductions in sales than the household data on purchases, perhaps reflecting cross-border shopping.