Racial Disparities in Outcomes of Bankruptcy Filings

Filing for bankruptcy can allow heavily indebted individuals and households to start fresh without the burden of previous debt. However, many bankruptcy filings are denied, which means that filers’ debts are not relieved. In Racial Disparities and Bias in Consumer Bankruptcy (NBER Working Paper 33575), Bronson Argyle, Sasha Indarte, Benjamin Iverson, and Christopher Palmer document racial disparities in the rates of successful bankruptcy filings.

Controlling for case characteristics, non-White Chapter 13 bankruptcy filers are 3.6 percentage points more likely to have their cases dismissed than White filers.

The researchers consider both Chapter 7 and Chapter 13 bankruptcy filings. In Chapter 7 bankruptcy, all debts are forgiven after the filer forfeits or pays the value of nonexempt assets, such as a second car or home equity over the state-exemption limit. In Chapter 13, filers retain their property and are granted debt relief after completing a repayment plan, typically lasting up to five years. Bankruptcy cases are administered by trustees, court official whose duties include assessing the accuracy of filers’ financial reporting, disbursing payments to creditors, and recommending dismissal to judges. Chapter 13 trustees generally exercise more subjectivity when deciding whether to dismiss a filer’s case without debt relief. For example, Chapter 13 trustees can respond to nonpayment by either dismissing the case, requesting a modification of the plan, or seek an immediate discharge of debt.

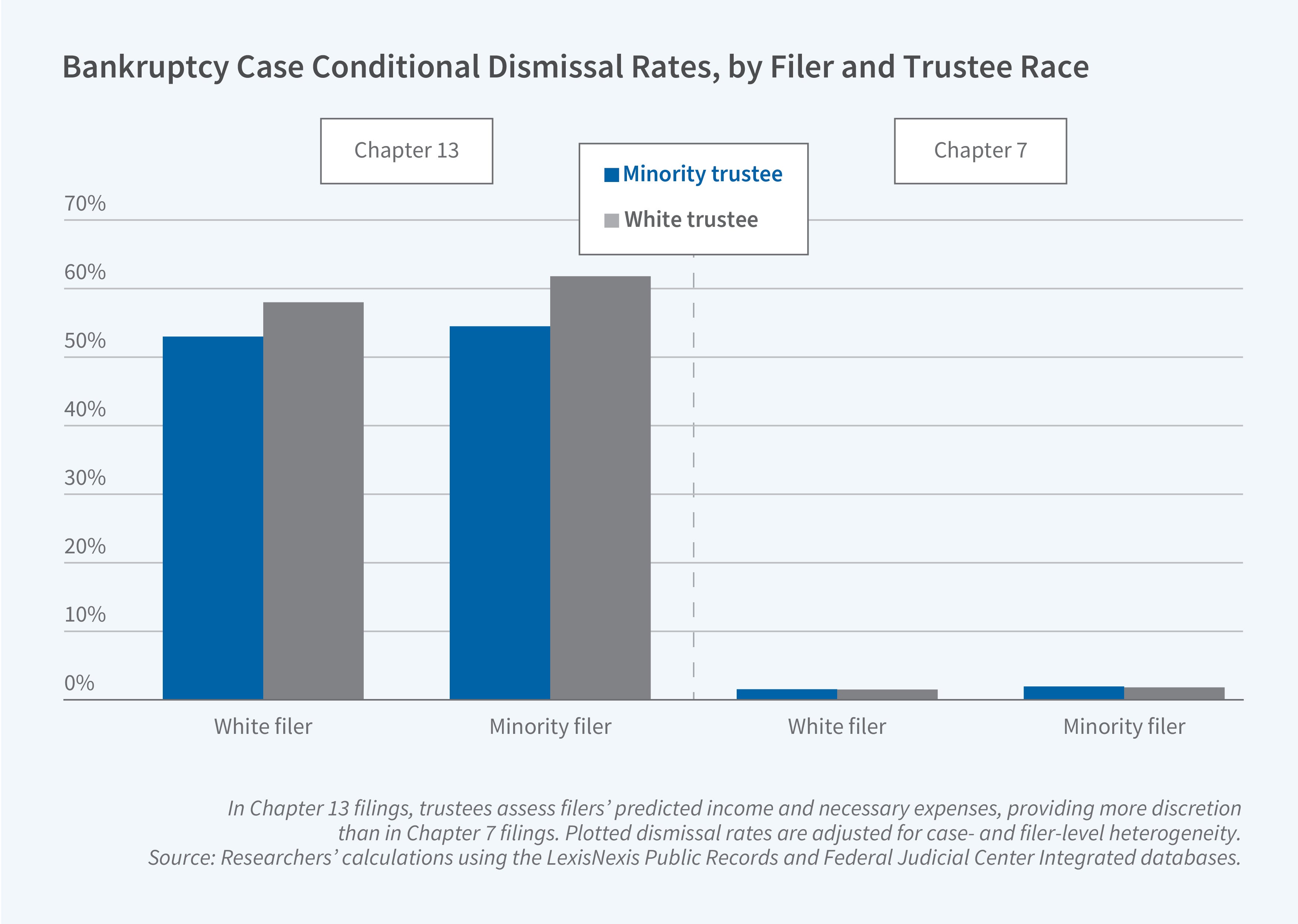

Chapter 7 dismissal rates are much lower, 2.7 percent, than Chapter 13 dismissal rates, 61 percent. This contributes to large differences in overall bankruptcy filing dismissal rates across racial groups. While 46 percent of Black bankruptcy filers choose Chapter 13, only 23 percent of White filers do.

The researchers document substantial differences in the outcomes for White and non-White bankruptcy filers. Non-White Chapter 13 filers are 12.7 percentage points more likely to have their cases dismissed than White filers. These disparities are 13.4 percentage points for Blacks and 11.7 percentage points for Hispanics. For Chapter 7 bankruptcy, non-White filers are 2.3 percentage points more likely to have their cases dismissed. When the researchers control for observable case characteristics, such as the filer’s income, ZIP code, and whether they are represented by an attorney, the Chapter 13 disparity declines to 3.6 percentage points and the Chapter 7 disparity to 0.3 percentage points.

The researchers exploit the quasi-random assignment of bankruptcy cases to trustees to compare the dismissal rates when the trustees and filers belong to the same or different racial and ethnic groups. They find that when a non-White Chapter 13 filer is assigned to a White bankruptcy trustee, their case is 2.3 percentage points more likely to be dismissed than when the case is assigned to a non-White trustee. The researchers find no such differences in disparities in Chapter 7 dismissal rates when the trustee and filer are or are not members of the same racial or ethnic group, a finding that they attribute to the more limited discretion of Chapter 7 trustees.

— Greta Gaffin

The researchers acknowledge financial support from the Alfred P. Sloan Foundation, the MIT Racism Research Fund, The Wharton School’s Jacobs Levy Equity Management Center for Quantitative Financial Research, and NSF CAREER Grant 1944138 (Palmer).