Pandemic-Induced Remote Work and Rising House Prices

From December 2019 to November 2021, US house prices grew by 23.8 percent, the fastest rate on record. At the same time, the COVID-19 pandemic reshaped where and how Americans work. In November 2021, 42.8 percent of employees worked from home either part- or full-time. Some reports suggest that a significant fraction of pandemic-induced remote work may become permanent.

In Housing Demand and Remote Work (NBER Working Paper 30041), John A. Mondragon and Johannes Wieland find that the shift to remote work induced by COVID-19 caused a large increase in housing demand and accounted for at least half of recent aggregate house price growth. They offer a fundamentals-based explanation for the record increase in house prices and suggest that the future trajectory of remote work may be a key determinant of housing demand and house prices in the future.

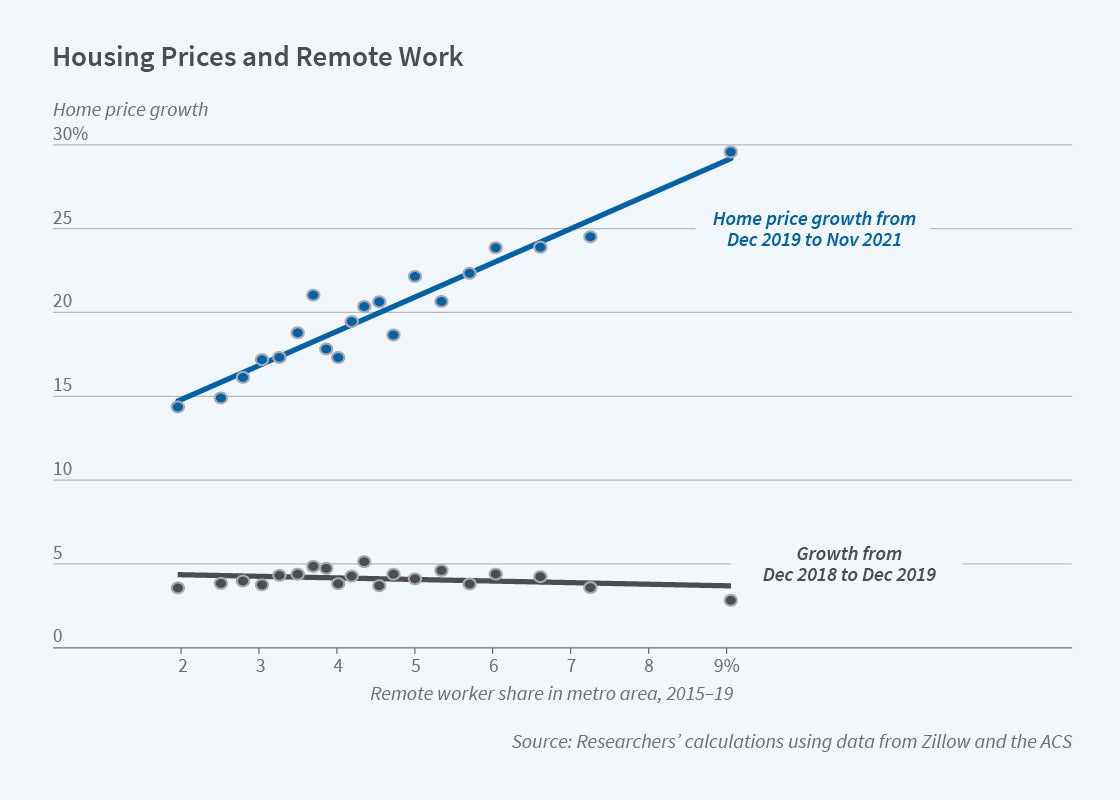

Areas in which more people worked remotely before COVID-19 experienced higher house price growth over the course of the pandemic.

The researchers estimate the effect of remote work on housing demand and house prices using variation in the propensity for remote work across core-based statistical areas. They find that areas where remote workers accounted for a larger share of employment prior to the pandemic also experienced larger increases in remote work during the pandemic. This finding is not affected by adding controls for local economic characteristics, such as population density or labor market outcomes before and during the pandemic.

The researchers show that areas with more exposure to remote work saw significantly higher house price growth. One additional percentage point of workers engaged in remote work during the pandemic implies an additional 0.93 percent increase in house prices from December 2019 to November 2021 after controlling for the effect of net migration on house prices. This cross-sectional estimate, combined with the aggregate shift to remote work, implies that remote work raised aggregate US house prices by 15.1 percent. They validate this aggregation using a general equilibrium model of housing demand, migration, and remote work choice.

The researchers note that if the shift to remote work raised housing demand, it should also have resulted in increased rents. They find effects of remote work on rental price growth that are almost identical to those on house price growth. They also show, in a more limited sample of locations, that greater exposure to remote work predicts a decline in commercial rents, consistent with reduced demand for office space. Local inflation excluding shelter is only weakly associated with exposure to remote work, consistent with an increase in the demand for housing relative to other goods. Remote work is also positively associated with an increase in issuance of building permits.

The researchers conclude that house price growth during the pandemic largely reflected a change in fundamentals rather than a speculative bubble.

— Lauri Scherer