Debt Is Supported by Firms’ Value as Going Concerns

Debt backed by the value of the firm as a going concern, rather than asset-based debt, features prominently in corporate capital structures.

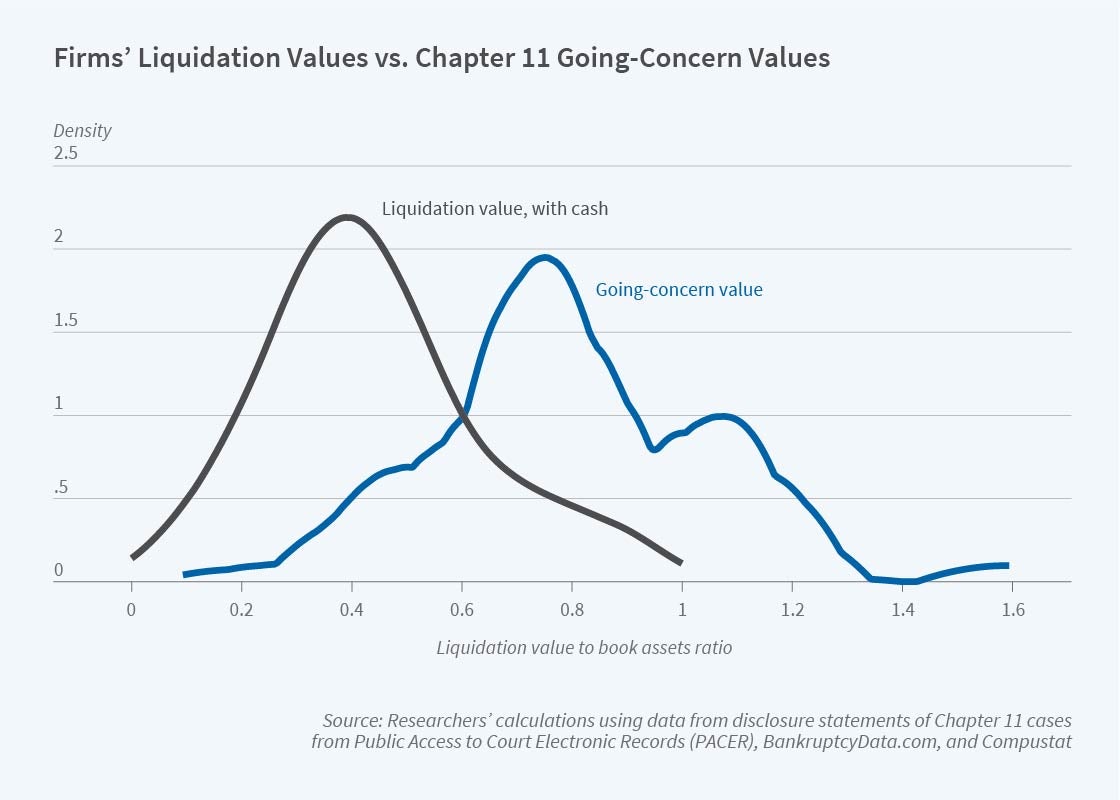

Roughly three-quarters of noninvestment-grade firms in nonfinancial industries carry debt that exceeds the estimated liquidation value of their property, plant, equipment, and working capital. This suggests that a substantial amount of corporate debt takes the form of cash flow-based lending, where creditors have payoffs backed by firm value as an operating business and place more emphasis on monitoring firms’ operating performance. Even for secured debt, at least one third is secured by the firm as an operating business rather than by discrete assets.

In Two Tales of Debt (NBER Working Paper 27641), Amir Kermani and Yueran Ma examine the determinants of firms’ debt capacity. They discuss three kinds of debt: asset-based debt that gives creditors claims against the liquidation value of discrete assets, cash flow-based debt with weak control rights that gives lenders claims against a firm as a whole but typically does not allow them to intervene in business decisions, and cash flow-based debt with strong control that gives creditors claims against the firm as a whole and allows them to engage in active monitoring of a firm’s business decisions. Active monitoring may include imposing restrictive financial covenants designed to ensure managerial effort.

The researchers collected data from liquidation analyses included in Chapter 11 filings for 387 public nonfinancial companies that filed for bankruptcy from 2000 to 2016. By combining liquidation recovery rates from this dataset with Compustat data, they estimated that nonfinancial firms’ liquidation value of fixed assets and working capital is only 23 percent of book value on average, with an inter-quartile range of 12 percent to 33 percent. Using a variety of commercial databases, they also collected data on the composition and contractual provisions of public companies’ outstanding debt. The data show that variations in firms’ debt contracts are a function of their liquidation value, their value as an operating business, their indebtedness, and their size.

The share of asset-based debt is high when a firm’s book leverage — the value of total debt divided by the book value of total assets — is below 10 percent, and falls as borrowing rises. Firms use more cash flow-based bonds with weak control for medium levels of borrowing, and eventually have a greater prevalence of cash flow-based loans with strong control for high levels of leverage. Companies with lower liquidation values have more cash flow-based debt and more intensive creditor monitoring of their performance. They also pay higher interest rates when they borrow through asset-based debt. Overall, total leverage does not depend on the liquidation value of discrete assets, except among small public firms and firms with negative earnings.

Nonfinancial firms’ assets are often specific to their business and have low liquidation values. Nonetheless, institutional arrangements in the United States, such as creditor monitoring, covenants, and Chapter 11 corporate restructuring, help firms borrow well beyond liquidation values. The researchers conclude that financial development requires not just secure property rights, but also institutional structures that enable creditors to monitor managerial actions and enforce control rights to maximize the value of a business as a going concern.

— Linda Gorman