COVID-19’s Impact on Older Workers’ Employment and SSDI

The COVID-19 pandemic led to an unprecedented loss of 22 million jobs in early 2020. Older workers were not immune from this event, and indeed, could have been disproportionately affected. Older workers face greater health risks from the virus, and those seeking new employment after job loss may encounter limited demand or employers unwilling to take on older workers. Workers age 62 and above also have the option of retiring and collecting Social Security benefits. All of this points to the potential for the pandemic to lead to an increase in retirement.

Alternatively, older workers might choose to delay retirement in order to recover lost earnings, or if remote work is less physically demanding or offers greater autonomy. And even if older workers do exit employment, access to extended unemployment benefits or economic impact payments may reduce the incentive to apply for Social Security Disability Insurance (SSDI) or to claim early retirement benefits.

In The Impact of COVID-19 on Older Workers’ Employment and Social Security Spillovers (NBER Working Paper 29083), researchers Gopi Shah Goda, Emilie Jackson, Lauren Hersch Nicholas, and Sarah See Stith assess the impact of COVID-19 on older adults. The authors use a variety of data sources, including the Current Population Survey, Social Security administrative data on applications for retirement and disability benefits, and Google Trends data.

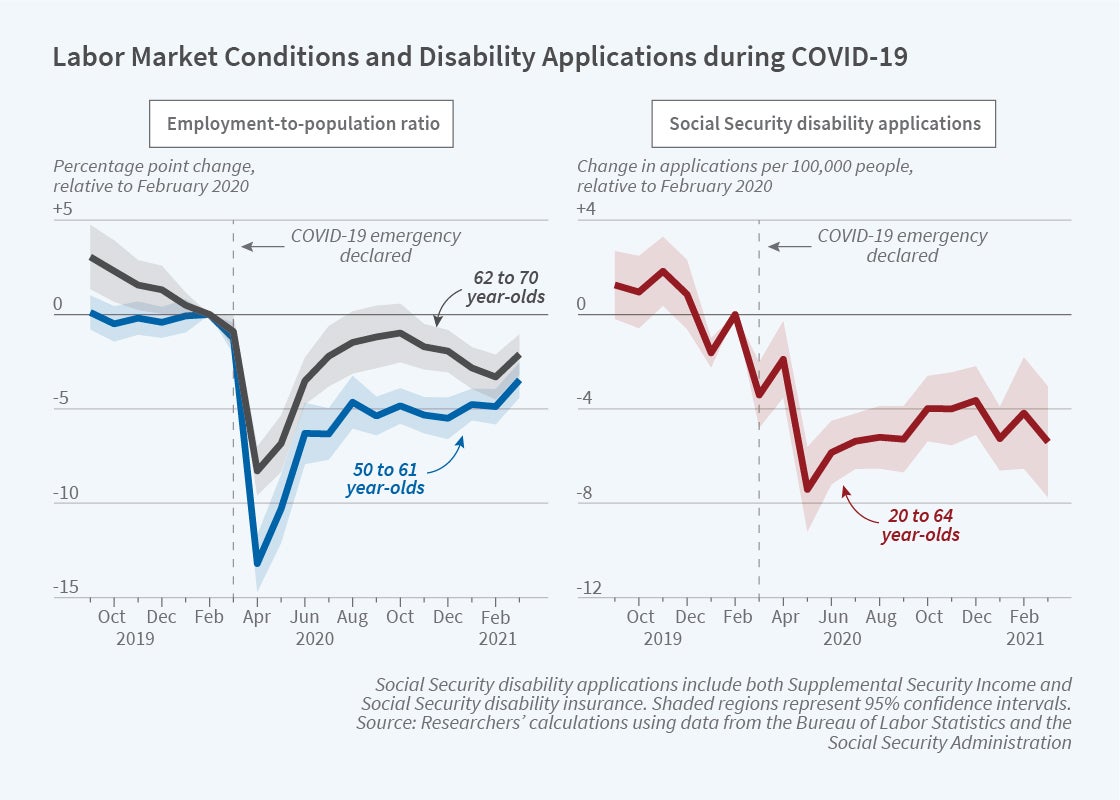

The authors find that employment among older workers fell sharply in April 2020 before slowly recovering and leveling off. Between March 2020 and March 2021, employment for workers age 50 to 61 fell by 5.7 percentage points, on average, relative to what would have been predicted based on prior trends and seasonal patterns, a decline of 8.3 percent. For workers age 62 to 70, the decline was 3.9 percentage points, on average, or 10.7 percent. The share of the employment decline attributable to increases in unemployment was 63 percent in the younger group and 50 percent in the older group. Declines in employment were larger for older females, nonwhite individuals, and less educated individuals.

Declines in applications for disability benefits were even larger — 4 fewer SSDI and/or SSI applications per 100,000 individuals aged 20 to 64, a 15 percent decline relative to the pre-COVID mean. Declines were concentrated in Supplemental Security Income (SSI) applications, as there was a 22 percent drop in SSI-only applications and an 18 percent drop in concurrent SSI and SSDI applications versus. a 6.5 percent drop in SSDI-only applications.

Interestingly, the authors do not find evidence of a significant change in applications for Social Security retired worker benefits. However, there was a decrease in applications filed in field offices or by phone and an increase in applications filed via the internet.

As the authors note, a number of factors may have influenced the demand for Social Security and disability benefits as well as the ability of the programs to supply these benefits. The Social Security Administration closed its offices to in-person applications on March 17, 2020, limiting applications to phone and online filing. Stay-at-home policies reduced internet access by closing facilities such as public libraries. Restrictions on non-essential medical appointments may have limited the ability of potential disability applicants to establish eligibility. Expanded unemployment benefits and economic impact payments may have delayed the need for disability or retirement benefits or reduced eligibility for means-tested SSI benefits. A shift to remote work may have enabled some with work limitations to remain employed. Finally, a disproportionate number of older individuals and individuals with pre-existing conditions died from COVID-19, potentially reducing the population at the margin of program application. Understanding the role of these various factors in driving the decrease in disability applications will be important for predicting the long-term impact of the pandemic on program finances.

There remains substantial uncertainty about the long-term effects of the pandemic on the economy. As extended unemployment benefits expire, higher vaccination rates and changes in the prevalent virus strain allow the economy to be more or less open, and employers redesign some workplaces and occupations to accommodate the flexibility to work from home, ongoing research will continue to monitor changes in employment outcomes among older workers and spillovers onto the Social Security program.

The research reported herein was performed pursuant to grant #RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of NBER, SSA or any agency of the Federal Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.