Liquidity, Mortality, and Early Social Security Claiming

Many of those who choose early benefits have sufficient assets to delay. Early claimers have worse self-reported health, shorter life expectancy, and are more likely to die earlier.

Although full retirement age is 66, eligible Americans may choose to begin receiving Social Security retirement benefits at any time between age 62 and age 70. Even though benefits are reduced for those claiming before age 66, and increased for those who postpone claiming until age 70, roughly a third of beneficiaries claim benefits as soon as possible, at age 62.

In The Financial Feasibility of Delaying Social Security: Evidence From Administrative Tax Data (NBER Working Paper 21544), Gopi Shah Goda, Shanthi Ramnath, John B. Shoven, and Sita Nataraj Slavov use data on people born in 1940 to explore why individuals choose earlier retirement with lower benefits.

The researchers conclude that liquidity constraints "are not likely to be the main reason a significant segment of the population chooses to claim early." Detailed tax return data for 1999 to 2011 suggest that most of those who claimed Social Security before the full retirement age had sufficient liquid assets to delay Social Security benefits until full retirement age. About a third of this group had Individual Retirement Account (IRA) assets equal to at least two years of average Social Security benefits. About a quarter had IRA assets equivalent to at least four years of benefits. Using estimates of total non-retirement financial wealth from the Health and Retirement Study (HRS), which includes checking and savings accounts, certificates of deposits, and stock, bond, and mutual fund holdings, about 64 percent of retirement-age Americans had wealth equal to at least two years of average Social Security benefits, and 54 percent had four years. Yet the vast majority of individuals – about 72 percent – claim before full retirement age.

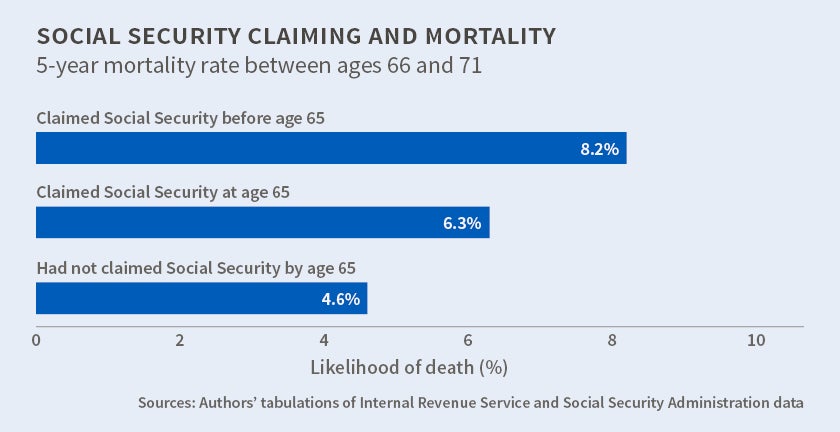

The researchers find that individuals may be exploiting information about their own health; those who choose early benefits have worse self-reported health, think that their life expectancy will be shorter, and are more likely to die earlier than those who claim later. Individuals claiming Social Security benefits before they turn 65 had an 8.2 percent mortality rate in the five-year period between age 66 and age 71. Those who claimed benefits after age 65 had a 4.6 percent chance of dying during that period.

A similar analysis, using more-detailed data from the HRS to control for wealth, age, race, education, and gender, produced similar results. It suggested that those who claim Social Security before age 66 are 3.3 percent less likely to report being in good or excellent health and have a 2.07 percent lower probability of living to age 75. Even though the mortality differences between early claimers and late claimers are significant, they are not large enough on average to eliminate the gain from delayed claiming.

The researchers note that their results are consistent with earlier work showing that retired individuals draw down their personal wealth more slowly than the life cycle model would predict. Only 33 percent of the sample claimed Social Security benefits after they began making withdrawals from their IRA, while 57 percent of the sample claimed Social Security benefits prior to making any IRA withdrawals. There is no evidence that spousal health, long-term care insurance coverage, or expectations about changes in Social Security benefits correlate with early receipt of benefits.

—Linda Gorman