Cost of Living Adjustments in Public Sector Retirement Plans

Nearly one in seven US workers is a state or local government employee. These employees are eligible for retirement benefits through about 300 state administered and 6,000 locally administered pension plans, most of which are defined benefit plans.

Many state and local pension plans face a funding gap. Across all plans, the ratio of plan assets to plan liabilities was 72 percent in 2019. Many public sector retirement plans are prohibited by their state constitutions from changing the pension benefit formula for employees after the point of hire. However, plans generally do have discretion over annual cost-of-living adjustments (COLAs), which affect both current and future retirees. Changes in the COLA can dramatically alter the lifetime value of pension benefits.

In The Prevalence of COLA Adjustments in Public Sector Retirement Plans (NBER RDRC Working Paper NB20-13), researchers Maria Fitzpatrick and Gopi Shah Goda explore the frequency of COLA adjustments in state and local government workers’ pension plans.

The authors collect new data on COLAs for public sector retirement plans nationwide. The data collection effort involved searching legislative records and pension plan websites and documents, as well as contacting plan administrators. They obtain complete data on 49 plans in 30 states between 2005 and 2018. Next, the authors match plans to state and local workers in the American Community Survey (ACS), a large nationally representative survey, using workers’ location and occupation. This process yields information on COLAs for 52 percent of public employees in the ACS.

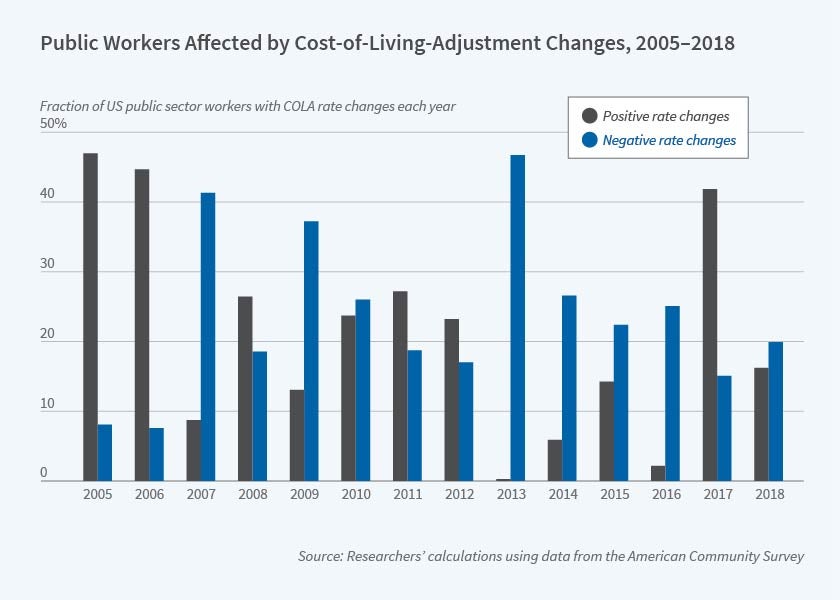

The authors find that COLA changes are quite prevalent for public sector workers between 2005 and 2018. In each year, an average of 45 percent of workers experience a change in their COLA. The mix of positive and negative COLA changes varies quite a bit — in 2017, for example, 42 percent of workers have an increase in the COLA and 15 percent have a decrease, while in 2013, less than 1 percent experience an increase in the COLA while 47 percent experience a decrease. In general, there are more positive changes prior to the Great Recession and more negative changes in more recent years.

Next, the authors consider the implications of their findings for retirement and benefit claiming decisions. For workers close to retirement, a negative COLA change that lowers the present value of future pension benefits could lead public sector workers to work longer in order to raise their lifetime income. Some workers might delay retiring from their government job in order to increase the size of their public sector pension, while others might seek work outside the public sector in order to increase the size of their Social Security benefit. Public sector workers who are eligible for Social Security may also delay claiming this benefit to increase its value.

To begin to explore these implications, the authors conduct an analysis using stylized examples of sample workers. For someone who starts a government job at age 22 and is eligible for pension benefits after 30 years, moving from a 3 percent annual COLA to no COLA would reduce the present value of lifetime pension benefits by 36 percent. Applying estimates from the previous literature of how workers adjust their retirement in response to a change in pension wealth suggests that this COLA change would translate to a delay in retirement of 4.7 months.

In concluding, the authors note, “the sheer number of workers affected by these [COLA] changes — 60 million over the 14 years covered by our database — suggests that these changes, which have not been studied on a broad scale, could have significant changes on retirement and Social Security.”

The research reported herein was performed pursuant to grant #RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of NBER, SSA or any agency of the Federal Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.