Underwriting Based on Cash Flow Helps Younger Entrepreneurs Access Credit

Younger entrepreneurs are disadvantaged in small business loan markets because lenders rely heavily on personal credit scores, which favor long histories of repaying debt. In Modernizing Access to Credit for Younger Entrepreneurs: From FICO to Cash Flow (NBER Working Paper 33367), researchers Christopher M. Hair, Sabrina T. Howell, Mark J. Johnson, and Siena Matsumoto document this fact and show that younger entrepreneurs benefit from underwriting that augments personal credit scores (like FICO) with cash flow data. They analyze comprehensive data from three fintech companies serving small businesses, comprising about 1.1 million loan applications and 74,000 loans originated between 2013 and 2024.

Traditional FICO-based credit scoring can limit credit access for young entrepreneurs.

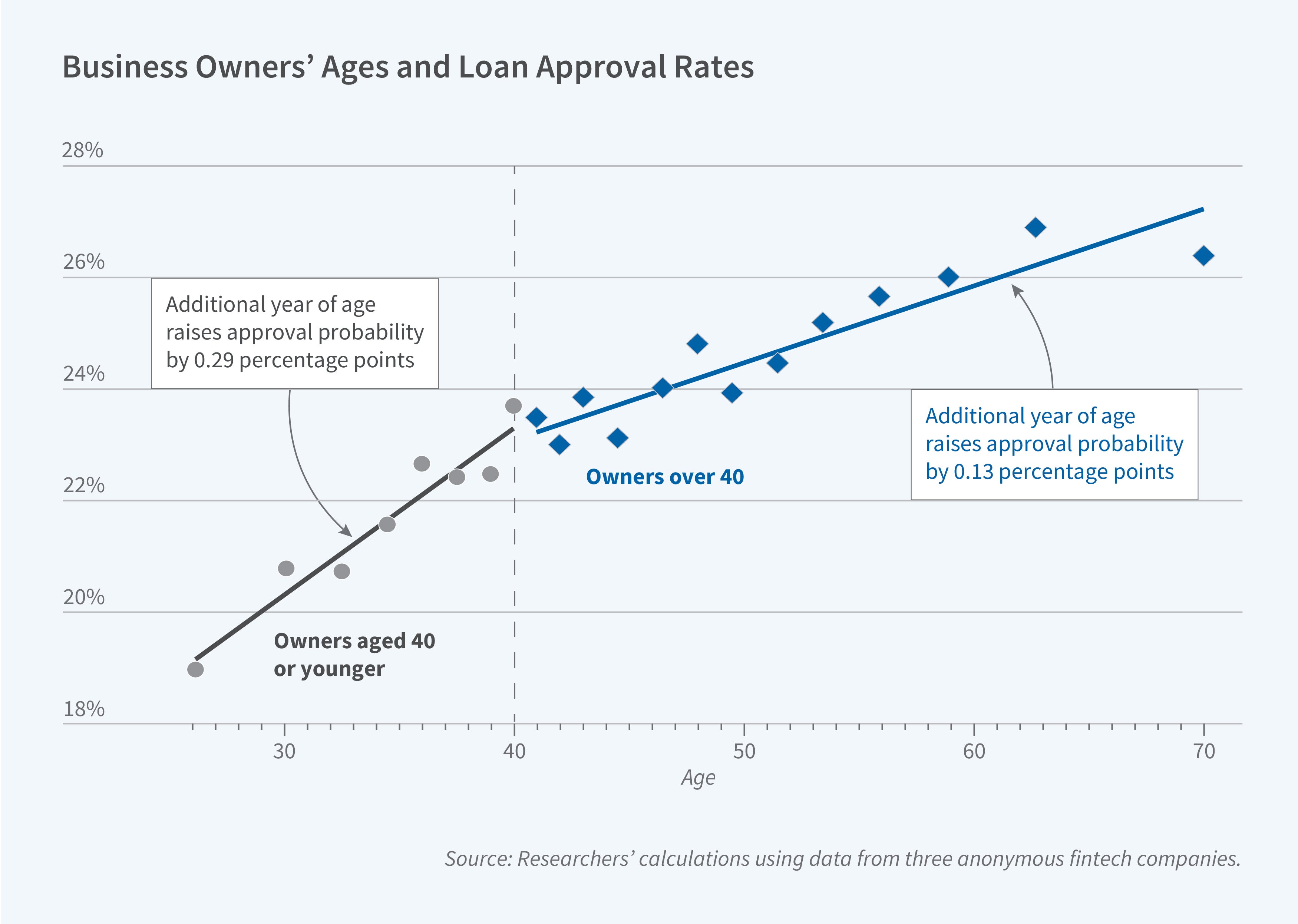

The authors show that FICO scores rise almost linearly with age—from below 670 for entrepreneurs under 30 to 720 for those over 70—while cash flow metrics show much smaller differences across age groups. Despite similar default rates after loan origination, approval rates increase significantly with entrepreneur age.

Traditional loan models rely heavily on FICO scores, while “cash-flow-enhanced” models incorporate variables from business checking accounts, such as revenue inflows, balance volatility, and financial distress indicators like overdrafts. Adding cash flow variables significantly improves default prediction, with the gain in predictive power being substantially larger for younger owners consistent with FICO being noisier and is mechanically lower for young.

The researchers show how variation in lenders' reliance on cash flow data affects loan approval probabilities. They use a causal within-application design to study what happens when the same application is sent to multiple lenders. They find that assignment to a cash-flow-intensive lender increases approval chances for entrepreneurs under 40 by 2.4 percentage points (12 percent of the mean approval rate). This effect is concentrated among low-FICO applicants and validated through business survival data, confirming that the increased approvals do not reflect excessive risk-taking by cash-flow-intensive lenders.

To identify which borrower groups benefit from switching models, the researchers develop a novel analytical framework called "Tail Analysis for Comparative Outcomes" (TACO). This method can be used by researchers and practitioners to compare any two models and is especially useful for comparing the impacts of different machine learning models without having to separately train the model on different groups.

Comparing outcomes between a FICO-driven and a cash-flow-enhanced underwriting model, they find that entrepreneurs under 35 have a TACO ratio of 1.37, meaning 37 percent more young people benefit from switching to cash flow models than are harmed by it. For low-FICO entrepreneurs under 40, the TACO ratio reaches 2.08, indicating they are more than twice as likely to benefit from cash flow underwriting as to be harmed by it. Even among high-FICO applicants, cash flow models favor younger borrowers.

This project was partially conducted on data gathered for a project using federal funds under award MB22OBD8020266-T1-01 to FinRegLab from the Minority Business Development Agency, US Department of Commerce.