Risk-Centric Macroeconomics

Financial markets are central banks’ gateway to the economy. After the global financial crisis and the Great Recession, the Federal Reserve came to the rescue of financial markets with an aggressive mix of conventional and unconventional policies. During the COVID-19 shock, the Fed implemented similar policies even though this shock did not originate in financial markets. In both instances, asset prices rose rapidly in response to policy interventions. Rising asset prices were not a side effect of monetary policy, but instead a central pillar of the recovery strategy. Today, anticipation of the Fed raising rates has roiled financial markets and resulted in a decline in asset prices that is not just collateral damage, but a central component of Fed strategy to reduce aggregate demand and rein in inflation. Since central banks reach the economy through financial markets, understanding their policy actions requires a framework in which central banks closely interact with markets to achieve their objectives. In several recent papers, we develop a risk-centric macroeconomic framework to shed light on the complex links between monetary policy, financial markets, and business cycles.

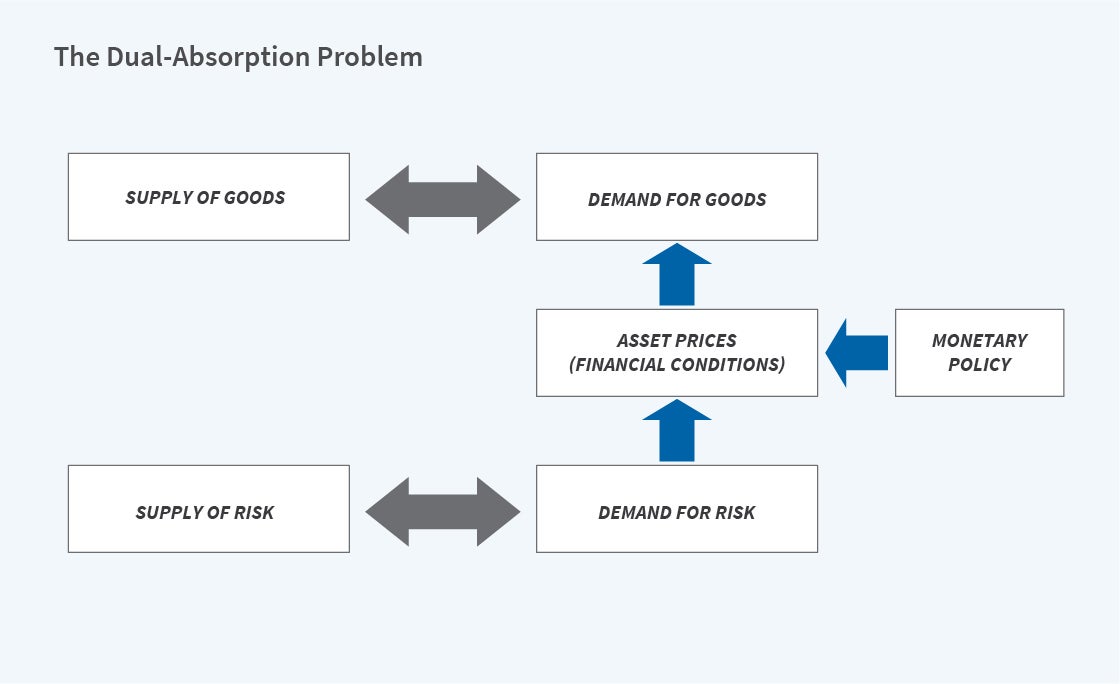

Our framework builds on the observation that the productive capacity of an economy generates two related absorption problems. Figure 1 illustrates them: a goods-absorption problem emphasized in macroeconomics (top row) and a risk-absorption problem emphasized in finance (bottom row). Aggregate asset prices (financial conditions) provide a bridge for spillovers across the two rows. In particular, asset prices are determined in risk markets, but affect aggregate demand. Higher stock and home prices increase consumer wealth and spending. Higher bond prices (lower interest rates) reduce the cost of capital and increase investment and spending on durables. Financial frictions strengthen this link: lower rate spreads (or higher collateral values) increase spending by the constrained firms and households.

In our framework, as in practice, the central bank reaches the economy through financial markets. The central bank’s objectives — to close the output gap and stabilize inflation — are in the top row, but its tools are in the bottom row. The central bank steers aggregate demand by influencing aggregate asset prices through both conventional and unconventional policies. Our framework is useful for understanding both why and how central banks affect asset prices.

Risk-Premium Shocks, Speculation, and Market Interventions

Our first paper addressing these issues establishes our risk-centric framework and shows that financial market phenomena such as time-varying risk premia and financial speculation can induce or exacerbate aggregate demand recessions.1 To illustrate the key mechanisms in our model, consider a period of high asset prices, such as the run-up to the financial crisis and the Great Recession. Suppose asset valuations decline, perhaps because investors recognize risks that they previously overlooked and therefore demand a greater risk premium. The macroeconomic effect of this shock depends on the central bank’s response. If the central bank is unconstrained, it cuts the interest rate enough to stabilize asset prices. This stabilizes aggregate demand and shields the economy from the risk-premium shock. However, if the central bank is constrained, for example by an effective lower bound on nominal interest rates, then the risk-premium shock lowers asset prices. This reduces aggregate demand and exacerbates the recession. More subtly, financial speculation during the boom phase amplifies these effects.

Financial speculation is the trading of financial assets among high-valuation investors (optimists) and low-valuation investors (pessimists). In boom years, optimists overexpose themselves to aggregate risks. When the bust arrives, optimists lose a disproportionate share of their wealth, and financial markets become dominated by pessimists. This compositional change further lowers asset prices and aggregate demand beyond the impact of the initial risk-premium shock. In this context, macroprudential policy that restricts speculation will mitigate the asset price decline during recessions and improve macroeconomic stability. Our analysis suggests that housing market speculation in the run-up to the financial crisis, along with the lack of macroprudential policies that could have countered its effects, exacerbated the subsequent recession.2

The COVID-19 shock was mostly a real shock (to the top row): the virus and the lockdowns led to large declines in both aggregate demand and supply. Nonetheless, the shock also had a large impact on financial markets (the bottom row): financial distress indicators spiked and reached levels not seen since the financial crisis and recession. Equally dramatic was the fast reversal of financial distress once the Fed announced unprecedented financial market interventions. To explain this episode, we extend our framework to incorporate the pervasive heterogeneity in risk tolerance that we see in financial markets: we split investors into risk-tolerant agents (“banks”) and risk-intolerant agents (“households”).3 In this environment, the “banks” naturally take on leverage and are more exposed to an aggregate shock. Thus, a sudden and large real shock such as the COVID pandemic disproportionately hits the “banks.” As these agents scramble to unload assets, the market’s effective risk tolerance falls. With a constrained central bank, the initial decline in risk tolerance triggers a downward spiral in asset prices and risk tolerance. In this context, a central bank’s purchase of risky assets is an extremely powerful tool since it reverses the downward spiral. Our results suggest that the Fed’s aggressive interventions early in the recession prevented a financial crisis and set the stage for the rapid recovery that followed.

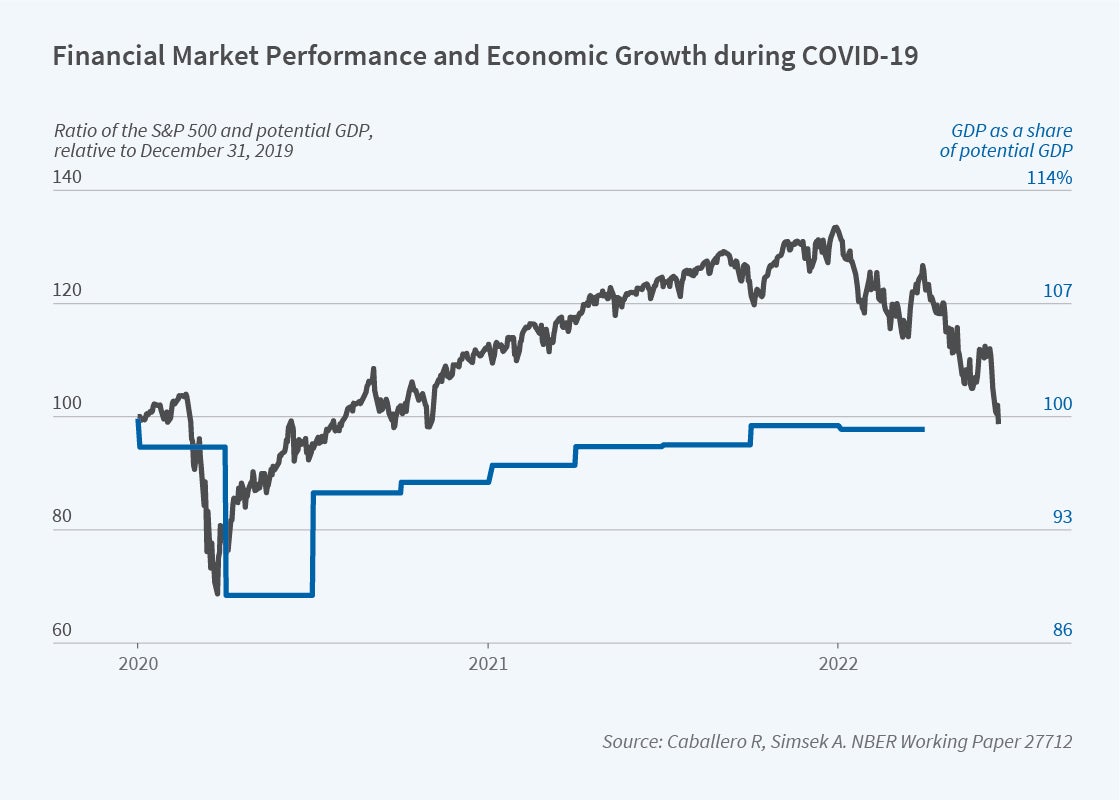

Asset Price Overshooting and the Wall Street/Main Street Disconnect

Although the Fed’s COVID response prevented a financial meltdown, it also led to a disconnect between the performance of the real economy and that of the financial markets. Figure 2 shows that by the end of 2020, US output was still significantly below its long-run potential, whereas stock, house, and bond prices vastly exceeded pre-pandemic levels. This robust recovery of asset markets was primarily due to aggressive monetary and fiscal policy support. By mid-2022, the disconnect between the real economy and the markets had disappeared. [See Figure 2.] A rapid recovery created inflationary pressures and induced the Fed to announce a gradual withdrawal of monetary policy support. This announcement led to a sharp decline in asset prices and reconnected the markets and the economy.

In recent work, we show that these patterns are consistent with our framework once we incorporate a realistic friction: aggregate demand inertia.4 At the microeconomic level, inertia can emerge from various adjustment costs faced by households and firms. At the macroeconomic level, inertia implies that aggregate demand tends to stay at its current level and responds to asset prices slowly. In this context we show that when output is — or is expected to be — below its potential, monetary policy optimally induces asset price overshooting. The central bank tunes up the asset price signal to compensate for the inertial response of aggregate demand to asset prices. This policy creates a large, temporary disconnect between financial markets and the real economy, but it also accelerates the recovery. As output recovers, the central bank gradually raises interest rates and reverses the asset price overshooting, which reconnects the markets and the economy. The observed temporary disconnect and the subsequent reconnection between asset prices and the real economy are consistent with optimal monetary policy.

Policy Lags: Disagreements and “Mistakes”

In our baseline framework, an unconstrained central bank is very powerful. It perfectly knows the state of the economy, and it immediately affects aggregate demand by changing asset prices. This power contrasts with the well-known “long-and-variable” lags of monetary policy. With policy lags, the central bank’s actions depend on its beliefs about future economic activity. The recent surge in inflation is a reminder that the central bank’s beliefs matter for policy and macroeconomic outcomes. The Fed was reluctant to tighten policy in 2021, anticipating a rapid recovery in aggregate supply. However, the supply recovery was delayed and demand was more robust than the Fed anticipated, which led to high inflation.

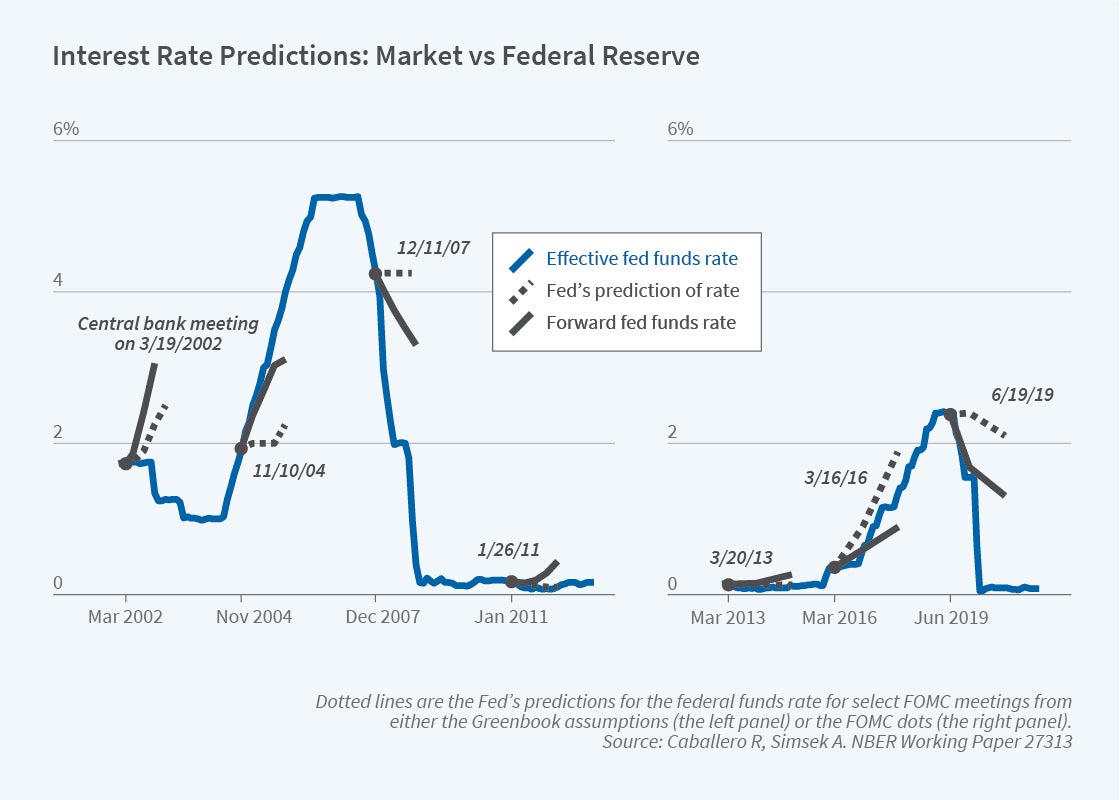

Since the central bank’s beliefs drive policy, there can be tension when the central bank and the financial markets do not share the same beliefs. Figure 3 shows that the Fed and the markets routinely disagree about future interest rates. How should a central bank respond to these disagreements?

We address this question by building a model in which the central bank and the market disagree about future aggregate demand.5 The market considers the central bank’s interest rate decisions that do not match its own belief to be mistakes. Optimal monetary policy incorporates these perceived mistakes: to minimize the output gap, the central bank sets a policy interest rate that partially reflects the market’s view. The central bank expects to implement its view gradually: it waits for the market to adjust its belief toward the bank’s before setting the ideal policy rate under the bank’s view. In addition to influencing optimal policy, disagreements provide a microfoundation for monetary policy shocks. Policy announcements that reveal a surprise change in the central bank’s belief affect financial markets like textbook policy shocks, even though they are optimal given the central bank’s belief. More damaging tantrum shocks arise when the market misinterprets the central bank’s belief and overreacts to its announcement. We find that uncertainty about tantrums can justify prudential gradualism and communication policies. The central bank talks to the market, not to persuade the market, which is opinionated, but to clarify its own beliefs and prevent misinterpretations.

Financial Markets and Central Banks: A Love-Hate Relationship

Our latest work unifies and extends the mechanisms described above to develop a monetary policy asset pricing model.6 A general theme underlying our research is a two-speed economy: a slow and unsophisticated macroeconomic side [top row in Figure 1], and a fast and sophisticated financial market side [bottom row]. We formalize the two speeds by separating the macroeconomic and the financial market sides of the economy. Spending decisions are made by a group of agents (“households”) that respond to aggregate asset prices, but with noise, delays, and inertia. Asset prices are determined by another group of agents (“the market”), who have their own beliefs, are forward looking, and immediately incorporate economic shocks and the likely monetary policy response to these shocks. The central bank mediates between these two sides to establish macroeconomic balance. It wants to influence the behavior of households, but it needs to go through the market.

Our analysis revolves around one idea: when the central bank is unconstrained and acts optimally, the needs of the macroeconomy as perceived by the central bank become key drivers of aggregate asset prices. The central bank stabilizes asset price fluctuations driven by risk-premium or belief shocks (“the Fed put/call”). The central bank’s main concern with these types of financial shocks, which hit the bottom row in Figure 1, is preventing them from spilling into the real economy. On the other hand, the central bank destabilizes asset prices in response to aggregate demand or supply shocks that induce macroeconomic imbalances. When these types of real shocks hit the top row in Figure 1, the central bank uses asset prices to offset the shock’s macroeconomic impact. Moreover, while the central bank controls asset prices, it also cooperates with the market to achieve its desired asset price level. We show that disagreements and “mistakes” not only affect the optimal policy rate, as in our previous papers, but also create a policy-risk premium and can lead to a behind-the-curve phenomenon in which the market expects the central bank to aggressively reverse its policy.

In summary, risk-centric macroeconomics is a framework that sheds light on the links between monetary policy, asset prices, and business cycles. While much work remains to be done, this framework can already explain the broad contours of the monetary policy response to the last two recessions, as well as the love-hate relationship between central banks and financial markets.

Endnotes

“A Risk-Centric Model of Demand Recessions and Speculation,” Caballero R, Simsek A. NBER Working Paper 23614, revised February 2020, and The Quarterly Journal of Economics 135(3), August 2020, pp. 1493–1566. See also “Prudential Monetary Policy,” Caballero R, Simsek A. NBER Working Paper 25977, revised March 2020.

A growing empirical literature provides evidence that housing speculation amplified the Great Recession. See the concluding section of “The Macroeconomics of Financial Speculation,” Simsek A. NBER Working Paper 28426, revised February 2021, and The Annual Review of Economics 13, 2021, pp. 335–369.

“A Model of Endogenous Risk Intolerance and LSAPs: Asset Prices and Aggregate Demand in a ’COVID-19’ Shock,” Caballero R, Simsek A. NBER Working Paper 27044, revised March 2021, and The Review of Financial Studies 34(11), November 2021, pp. 5522–5580.

“Monetary Policy and Asset Price Overshooting: A Rationale for the Wall/Main Street Disconnect,” Caballero R, Simsek A. NBER Working Paper 27712, revised June 2022. See also “A Note on Temporary Supply Shocks with Aggregate Demand Inertia,” Caballero R, Simsek A. NBER Working Paper 29815, March 2022.

“Monetary Policy with Opinionated Markets,” Caballero R, Simsek A. NBER Working Paper 27313, revised June 2022. Forthcoming in American Economic Review.

“A Monetary Policy Asset Pricing Model,” Caballero R, Simsek A. NBER Working Paper 30132, June 2022.