Dynamic Corporate Finance under Costly Equity Issuance

Two fundamental concepts in corporate finance are the net present value (NPV) rule and the Modigliani-Miller (MM) irrelevance proposition. When financial markets operate without frictions, when investors can trade securities that correspond to all relevant risks, when investors and managers share the same information, when incentives are aligned, and when there are no tax distortions, then corporate finance boils down to a valuation exercise and a simple investment decision rule: undertake all investments with a positive NPV. How companies and investments are financed is irrelevant.

This characterization of financial markets is frequently taken as approximately valid; a plausible and convenient simplification even if it poorly reflects reality. Corporate income taxation, the interest tax shield for debt, and bankruptcy costs are often the only deviations from this view that are considered when explaining corporate financing choices.

Although tax distortions and bankruptcy costs are obviously relevant, they cannot alone account for most observed corporate financial decisions. They cannot explain why companies hold so much cash, their leverage dynamics, nor their payout, equity issuance, and investment policies. We show in our research that the cost of issuing equity is a key and practically relevant distortion. Because of asymmetric information or incentive misalignment, firms must incur costs when raising external funds1 and these costs are higher for equity than for debt financing.2

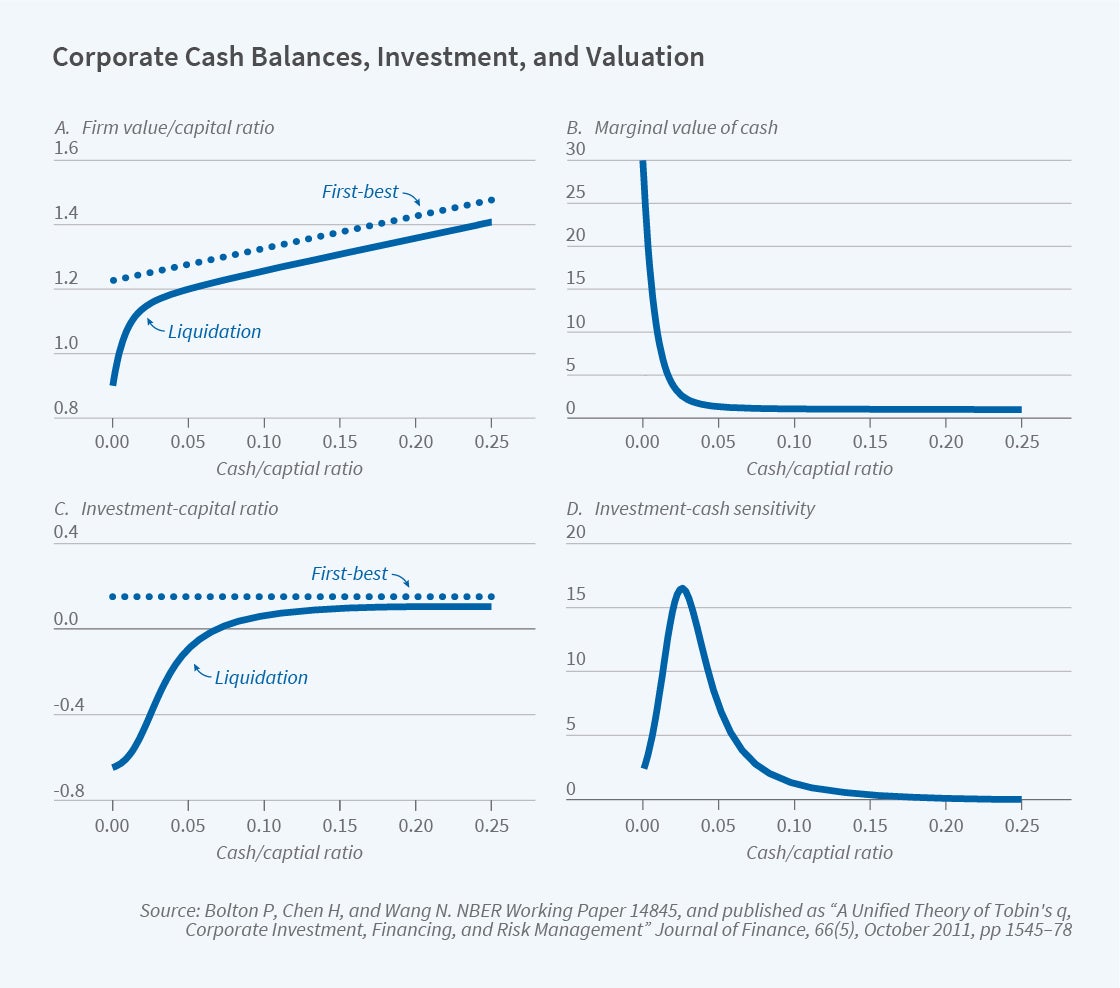

When firms face external financing costs, they seek to avoid such financing. This is a key reason that firms retain earnings and accumulate cash (corporate savings). With Hui Chen, we analyze a dynamic model with three main building blocks: (1) an investment rule based on the marginal value of incremental capital investment relative to its cost, (2) cash, equity, and a credit line as funding sources (together with hedging), and (3) equity issuance costs and cash carry costs.3 A first, key result of our analysis is that investment is no longer determined by equating the marginal cost of investing with the marginal addition to the firm’s valuation from such capital, as in the neoclassical theory of investment. Instead, investment is determined by the ratio of the marginal increase in the firm’s value to the marginal value of cash. The marginal cost of investing equals the marginal product of capital, also known as marginal q, divided by the marginal value of cash.

When firms are flush with cash, the marginal value of cash is about one, so that this equation is approximately the same as the equation under MM irrelevance. But when firms are close to running out of internal funds, or close to the limit of their credit line, the marginal value of cash is much larger than one, so that marginal product may need to yield a much higher return, and optimal investment may be far lower, than the level predicted under MM neutrality.

Figure 1 illustrates the sizable value destruction that a financial crisis can cause, as firms are shut out of capital markets and can only rely on internal funds to continue their operations.4 Panels A and B show that firm value is increasing and concave in cash holdings, that the marginal value of cash always exceeds one, and that it is very large when the firm runs out of cash. Panel C shows that firms substantially cut investment and engage in very costly fire sales when liquidity is low. The firm values a dollar in hand at about $30 and sells about 60 percent of its productive capital at a significant value discount when it is close to being inefficiently liquidated, in sharp contrast to the predictions of the neoclassical theory of investment. Finally, Panel D reveals how nonlinear and nonmonotonic investment-cash sensitivity can be, indicating that investment-cash sensitivity is a poor measure of how financially constrained a firm is.5

A second key result concerns the firm’s optimal cash-inventory policy. That involves continuous management of cash reserves through adjustments in investment, asset sales, and corporate hedging between two barriers: a lower bound at which the firm must tap external financing after exhausting all its cash reserves, and an upper bound at which the firm has accumulated enough cash that it is safe to pay out any additional earnings. Our model provides insights into how these bounds depend on factors such as the growth rate and volatility of earnings, external financing costs, and capital adjustment costs. It can thus provide part of an explanation for why the average cash-to-assets ratio for US public corporations more than doubled from 1980 to 2006, and remained elevated after the 2008 financial crisis.6

Market Timing and Financial Crises

Our model predicts that cash holdings increase when earnings volatility rises, but this is not an adequate explanation for the rise in corporate savings. A more plausible explanation is the risk of a financial crisis, which causes a jump in the cost of external financing and possibly even a financial market shutdown.

With Chen, we further explore how firms’ financial policies are affected by anticipation of random financial crises.7 We show that during such a crisis, firms delay payout, cut investment, and engage in fire sales of assets even when their productivity remains unaffected, all to avoid incurring prohibitive equity issuance costs. This is especially true when a firm enters the crisis with low cash reserves. We also find that in normal or boom times, when external financing costs are affordable (cheap), firms optimally time their equity offerings and issue equity even when there is no immediate need for external funds. Along with the timing of equity issuance by firms with low cash holdings in good market conditions, there is also optimal timing of stock repurchases by firms with large cash holdings. Just as firms with low cash holdings seek to take advantage of low costs of external financing to raise more funds, firms with high holdings will be inclined to disburse their cash through stock repurchases when financing conditions improve. This result is consistent with the finding that aggregate equity issuances and stock repurchases are positively correlated.8 When the perceived probability of a crisis rises, firms invest more conservatively, issue equity sooner, and delay payouts to shareholders, all to increase cash hoards that will help them through the impending crisis. Finally, we demonstrate that firms’ risk premia have two components: productivity and financing. Both risk premia change substantially with firms’ cash holdings, especially in a crisis when external financing conditions are poor.

Real Options and Financial Flexibility

Real-options theory, which applies when investments are lumpy and irreversible, is an important subfield of corporate finance that generally assumes that firms operate in an MM environment. With Jinqiang Yang, we show that the presence of external financing costs fundamentally alters the value and exercising decisions associated with real options.9 To avoid incurring external financing costs, firms delay investment until they have sufficient funds, and mostly finance their investments with internally generated funds, consistent with the empirical evidence.

In our model, investment, financing, payout, and abandonment policies all depend on both earnings fundamentals and the firm’s cash holdings. We show that when cash holdings are depleted — following a crisis, for example — low investment persists even when earnings fundamentals fully recover. After a crisis, firms are in repair mode, seeking to rebuild their internal funds. Also, firms favor investments with front-loaded earnings, and payout policy is different depending on whether the firm is in a growth or a mature phase. In a mature phase a more profitable firm pays out more, while in a growth phase it pays out less.

Managing Keyman Risk

In addition to the cost of raising external funds, moral hazard is an important source of financial constraints. With Yang, we explore a dynamic model where the source of moral hazard is inalienability of human capital10 — what is commonly referred to as ”keyman risk” in the tech industry to describe the risk that key employees could leave the firm.11 It is often noted that tech companies stand out in terms of their cash holdings. We explain these tech company cash policies in terms of mitigation of keyman risk.

How do tech companies retain their most valuable engineers? Essentially by offering enough deferred state-contingent compensation. We show that the larger the company’s cash holdings and borrowing capacity, the greater its ability to retain talent by making credible compensation promises. We also describe the company’s optimal risk management policy, showing how the company’s idiosyncratic and aggregate risk exposures can be set to reduce both the cost of retaining talent and the cost of financing. In our model, physical capital is illiquid and depreciates randomly. The firm faces risk with respect both to its future financial performance and to the outside options of key employees. To retain risk-averse employees, the company optimally compensates them by smoothing their consumption and limiting their risk exposure.

We show that the objective of corporate risk management is not achieving an optimal risk-return profile for investors; they can do that on their own. Rather, risk management is designed to offer optimal risk-return profiles to risk-averse, under-diversified, key employees. The company is, in effect, both the employer and the asset manager for its key employees. Indeed, corporations invest 40 percent of their liquid savings in risky financial assets, and less-constrained firms invest more in the market portfolio.12

We further show that when companies are severely financially constrained they cut compensation, reduce investment, engage in asset fire sales, and reduce hedging positions, with the primary objective of surviving by honoring liabilities and retaining key employees.13

Leverage Dynamics under Costly Equity Issuance

An important lesson from dynamic models of corporate finance is that “capital structure is not static, but rather evolves over time as an aggregation of sequential decisions.”14 With Yang, we build on the work of Christopher Hennessy and Toni Whited and show how leverage dynamics can be naturally explained by companies’ efforts to avoid incurring equity issuance costs.15 We consider a company that can issue equity and short-term debt, facing both cash-flow diffusion and jump shocks. As in the MM trade-off theory widely taught in MBA classes, when the company faces no equity issuance costs it always stays at its target leverage, defined as the point at which the benefits from debt financing are equal to expected bankruptcy costs. In our model, debt has a net funding advantage over equity because shareholders are impatient. When making a profit, the company uses it to pay down debt to the extent that it stays at its target leverage, and when making a loss it raises just enough new equity to return to its target leverage. These predictions are clearly counterfactual.

However, when we incorporate equity issuance costs, the model yields plausible average leverage outcomes and leverage dynamics. First, and somewhat paradoxically, it is optimal for companies to target lower leverage when they face higher equity issuance costs. Indeed, when it is costly to issue equity, it is best to avoid incurring such costs too often, which is achieved by keeping leverage low to be able to cover a future loss by borrowing, which is cheaper. Second, the company’s leverage increases following a loss and decreases following a profit realization. Leverage can then only increase in response to earnings losses. When the company attains its low leverage target any additional profit is paid out, and when leverage reaches the company’s debt capacity any additional loss either triggers a costly recapitalization via equity issuance or — when the jump loss is very large — a default. When leverage is close to the recapitalization target, the expected change in leverage is negative, so that leverage tends to revert to the recapitalization target. But when leverage passes a certain threshold, the expected change in leverage is positive, so that the company enters a leverage death spiral.

These leverage dynamics are consistent with the empirical evidence pointing to the heterogeneity of corporate leverage of firms with similar characteristics.16 Companies, in effect, behave like households with credit card debt, except that they also have an option to issue external equity to deleverage. As credit card revolvers, firms pay down their debt when they receive a positive earnings shock, and they increase their debt when they have no option to do otherwise, consistent with empirically observed leverage dynamics.17

Dynamic Trade-off Theory under Costly Equity Issuance

With Chen, we add equity issuance costs to the standard dynamic trade-off theory model of capital structure.18 An important additional cost of debt financing in this expanded model is debt service: debt payments drain the firm’s cash holdings, which increases the risk of incurring equity issuance costs. Also, realized earnings are separated in time from payouts to shareholders, so that savings have both a corporate tax, when savings are inside the firm, and a personal tax component, when savings are outside the firm. In this setting, standard measures of the net tax benefits of debt are no longer valid.

This framework can be extended beyond the traditional corporate setting. With Ye Li and Yang, we show that costly equity issuance also plays a critical role in understanding the dynamics of a bank’s balance sheet, bank valuation, and the effects of equity capital and leverage regulation.19 We develop a dynamic theory of banking in which the role of deposits is akin to that of productive capital in the neoclassical theory of investment for nonfinancial firms. We show that deposits create value for well-capitalized banks. However, the marginal value of deposits can turn negative for undercapitalized banks, as further inflows of deposits may require the bank to raise more costly equity capital to comply with leverage regulations. Our predictions on bank valuation and dynamic asset-liability management are broadly consistent with the evidence, and our model offers new insights into the dynamics of banking in a low interest rate environment.

In sum, our research shows that avoiding future costly equity issuance is a key motive driving various aspects of dynamic corporate financial behavior.

Endnotes

“Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have,” Myers SC, Majluf NS. Journal of Financial Economics 13(2), 1984, pp. 187–221.

"The Capital Structure Puzzle,” Myers SC. The Journal of Finance 39(3), 1984, pp. 574–592.

“A Unified Theory of Tobin’s q, Corporate Investment, Financing, and Risk Management,” Bolton P, Chen H, Wang N. NBER Working Paper 14845, April 2009, and The Journal of Finance 66(5), 2011, pp. 1545–1578.

“Do Investment-Cash Flow Sensitivities Provide Useful Measures of Financing Constraints?” Kaplan SN, Zingales L. The Quarterly Journal of Economics 112(1), 1997, pp. 169–215. “The Corporate Propensity to Save,” Riddick LA, Whited TM. The Journal of Finance 64(4), 2009, pp. 1729–1766.

“Why Do US Firms Hold So Much More Cash Than They Used To?” Bates TW, Kahle KM, Stulz RM. The Journal of Finance 64(5), 2009, pp. 1985–2021, and “Is There a US High Cash Holdings Puzzle after the Financial Crisis?” Pinkowitz LF, Stulz RM, Williamson RG. The Ohio State University Fisher College of Business Working Paper No. 2013-03-07.

“Market Timing, Investment, and Risk Management,” Bolton P, Chen H, Wang N. NBER Working Paper 16808, February 2011, and Journal of Financial Economics 109(1), 2013, pp. 40–62.

“The Timing of Financing Decisions: An Examination of the Correlation in Financing Waves,” Dittmar AK, Dittmar RF. Journal of Financial Economics 90(1), 2008, pp. 59–83.

“Investment under Uncertainty with Financial Constraints,” Bolton P, Wang N, Yang J. NBER Working Paper 20610, July 2019, and Journal of Economic Theory 184, November 2019, 10.1016.

“A Theory of Debt Based on the Inalienability of Human Capital,” Hart O, Moore J. The Quarterly Journal of Economics 109(4), 1994, pp. 841–879.

“Optimal Contracting, Corporate Finance, and Valuation with Inalienable Human Capital,” Bolton P, Wang N, Yang J. NBER Working Paper 20979, March 2019, and The Journal of Finance 74(3), 2019, pp. 1363–1429.

“Precautionary Savings with Risky Assets: When Cash Is Not Cash,” Duchin R, Gilbert T, Harford J, Hrdlicka C. The Journal of Finance 72(2), 2017, pp. 793–852.

“Boarding a Sinking Ship? An Investigation of Job Applications to Distressed Firms,” Brown J, Matsa DA. The Journal of Finance 71(2), 2016, pp. 507–550.

“Presidential Address: Collateral and Commitment,” DeMarzo P. The Journal of Finance 74(4), 2019, pp. 1587–1619.

“Leverage Dynamics and Financial Flexibility,” Bolton P, Wang N, Yang J. NBER Working Paper 26802, February 2020. This research builds on “How Costly is External Financing? Evidence from a Structural Estimation,” Hennessy CA, Whited TM. The Journal of Finance 62(4), 2007, pp. 1705–1745.

“Do Firms Rebalance Their Capital Structures?” Leary MT, Roberts MR. The Journal of Finance 60(6), 2005, pp. 2575–2619, and “Back to the Beginning: Persistence and the Cross‐Section of Corporate Capital Structure,” Lemmon ML, Roberts MR, Zender JF. The Journal of Finance 63(4), 2008, pp. 1575–1608.

“Corporate Deleveraging and Financial Flexibility,” DeAngelo H, Gonçalves AS, Stulz RM. The Review of Financial Studies 31(8), 2018, pp. 3122–3174.

“Dynamic Banking and the Value of Deposits,” Bolton P, Li Y, Wang N, Yang J. NBER Working Paper 28298, December 2020.