Rare Events and Financial Markets

A rare disaster is an event for which there is a small probability of an extremely bad outcome, leading to a large deterioration in the quality of life. Examples of rare disasters include global warfare, pandemics, and financial crises. Indeed, a pandemic illustrates a key principle about the distribution of possible outcomes of such events. The laws of geometric growth imply that many contagious illnesses die out. Some however spread quickly and pervasively, in a devastating manner. By definition, rare events do not occur very often, but when they do, they have profound economic consequences. These events are difficult to learn about because of their infrequent occurrence. While at any single point in time the probability of such an event occurring is low, nonetheless, they do occur eventually.

What can financial markets teach us about such events? The markets are forward-looking. A case in point is the 2008–09 financial crisis and the ensuing Great Recession. Financial markets reflected elevated probabilities of a disaster as early as 2007. Even with the onset of the financial crisis itself in 2008, it took months before real outcomes reflected what had been anticipated by aggregate stock indices. More recently, markets anticipated the wreckage caused by the current COVID-19 pandemic with steep declines at the end of February. At the time of this writing, the stock market has fallen by about 30 percent, pricing in an event that is worse than the Great Depression, even in the absence of official economic statistics on the impact of the pandemic in the United States.

Conversely, there is the possibility that these events can teach us something about financial markets, since beliefs about rare events may be one of the drivers of asset valuations. These considerations led me to a line of research focused on rare events and financial markets.

Rare Disasters and Volatility

As John Campbell and Robert Shiller demonstrated in a seminal study, aggregate stock market fluctuations appear not to be driven by variations in expected future cash flows or interest rates. In a present-value framework, the only alternative explanation is fluctuations in risk premia and, indeed, low valuations predict high excess returns.1 This raises the question: what drives risk premia? Why do investors not take advantage of what appear to be good times to buy stocks?

My research suggests that risk premia are determined by investors’ beliefs about rare disasters.2 There is some probability that the aggregate economy will suffer a large decline comparable to the Great Depression.3 This probability fluctuates over time. When risk premia are high and valuations are low, investors do not jump in because they fear a low-probability but severe event that will jointly impact corporate earnings and their own economic prospects. Most of the time, the feared event does not actually occur. This explains the evidence that earnings, dividends, and consumption are not, in general, predictable by financial markets. What is predictable is return: Risk premia need to be higher for financial markets to clear. This framework for analyzing risk and return also accounts for the high average equity premium (on average, investors require compensation to hold stocks) and low interest rates (precautionary saving keeps the risk-free rate low).

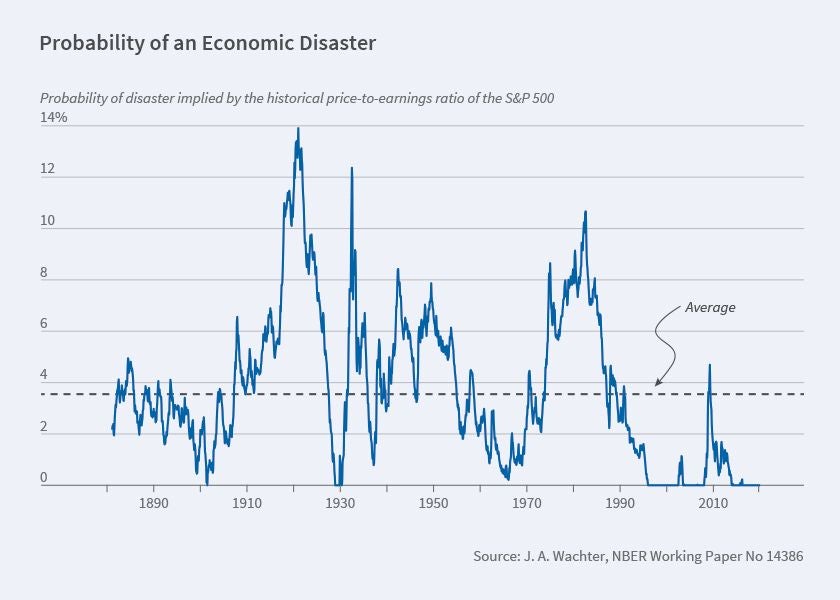

An implication is that one can use financial markets to back out the probability of a rare event. Figure 1 shows the probability of an economic disaster implied by the price-earnings ratio of the S&P 500. This probability was very high and volatile in the 1910–45 period, peaking at 14 percent and reflecting two World Wars and a Great Depression that was global in scope. It was high, though not as high, during the 1970s and early 1980s, and then fell steadily until the most recent financial crisis.

An intriguing finding regarding macroeconomic announcements suggests the importance of disaster risk. Over half of the equity premium — the excess return on equities relative to safe assets such as Treasury bills — is realized on days of scheduled macroeconomic announcements. Yet these days do not exhibit greater stock market volatility. Yicheng Zhu and I show that this finding is hard to reconcile with rational expectations unless there is a small chance that investors will learn very bad news about the macroeconomy on such days.4 That is, part of what macroeconomic announcements communicate is the susceptibility of the economy to economic disaster.

Other Asset Classes

For further evidence of the role of rare disasters in asset markets, one can look to options data.

A put option on a stock index gives the holder the right to sell a basket of stocks for a fixed value known as the strike price. Put options are therefore insurance against a decline in the stock market. Prices of put options, particularly “out-of-the-money’’ options for which the strike is low relative to the current index value, are an important place to look for the probabilities market participants place on rare disasters.

According to the Black-Scholes model, volatility implied by puts should be constant across strikes. Yet implied volatility is strongly decreasing in the strike: the further out-of-the-money, the greater the option price relative to what the model would predict under the assumption of constant volatility. The question therefore is: why do investors not take advantage of this premium and write put options, particularly out-of-the-money ones? The rare-disaster framework offers a unified explanation of this puzzle and the behavior of the aggregate stock market. Sang Byung Seo and I show that the same rare-disaster-based model that accounts for aggregate stock market behavior also explains put prices.5 Puts are expensive because investors place a non-trivial probability on stock market crashes that have systemic consequences.

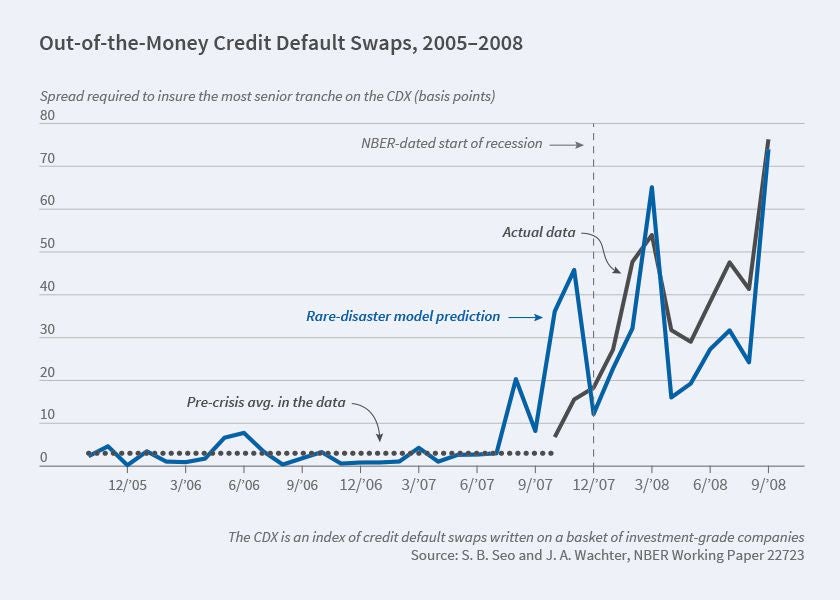

What about the most extreme rare events? Prior to the crisis, one could look for the probabilities of such events in the prices of the senior tranches on the CDX, an index of credit default swaps written on a basket of investment-grade companies. Figure 2 shows the time series of spreads required to insure the most senior tranche on the CDX. Prior to 2007, the spread was essentially zero. In early 2008, by contrast, investors were willing to pay close to $1 to insure $100 of a portfolio consisting of large, investment-grade firms. For the tranche to be affected, roughly 40 percent of these firms would need to go into default. Could these prices possibly be rational? A rare-disaster model, because it allows for equilibrium pricing, can speak to prices across asset classes. Indeed, Seo and I show that a rare-disaster model fitted to the time series of option prices can also explain the behavior of the CDX tranche spreads.6 These prices can be reconciled with rational expectations provided that investors anticipated an increased probability of a second Great Depression in 2007–08.

Rare Disasters, Unemployment, and Investment

A longstanding puzzle in macroeconomics concerns the volatility and cyclical patterns in unemployment. Unemployment is negatively correlated with vacancies and uncorrelated with labor market productivity, contrary to the prediction of standard models.7 However, it strongly correlates with the stock market. To explain these facts, Mete Kilic and I build a model in which firms invest in finding workers.8 Firm owners base their decision to invest in workers on forecasts of labor productivity — productivity that will be disrupted in the case of a rare disaster. During periods of elevated disaster risk, the stock market declines, and firms cease to invest in hiring. The model thus explains how fears of a financial crisis or depression could lead to sharply increased unemployment, even as productivity remains high. It also explains why unemployment strongly correlates with the stock market.

Disaster fears can also explain corporate issuance and repayment patterns. João F. Gomes, Marco Grotteria, and I revisit the empirical finding that relative quality of bond issuance predicts future bond excess returns: when this quality is low, future bond returns are also predictably low.9 This finding is puzzling: if low bond returns are predicted, why don’t investors shun bond markets, and why doesn’t issuance dry up? We show first that variance in issuer quality is driven by the quality of firms repaying their debt. This suggests an investment-based explanation, and indeed the data appear to be driven by investment rather than bond issuance per se. If some firms are more exposed to rare disasters than others, then these firms will cease investing and repay their debt when disaster risk is highest. It follows that high disaster-risk periods are times when the riskiest firms repay debt. Net issuer quality appears high in these periods because repaying firms are the riskiest firms. At the same time, future bond returns are high — an equilibrium result because investors require higher returns to compensate for the elevated risk.

A second credit-market puzzle is that sharp run-ups in consumer debt predict financial crises. Gomes, Grotteria, and I show that this too can be understood in terms of value-maximizing behavior of financial institutions.10 When disaster probabilities are high, the continuation value for the financial institution is low. In the absence of moral hazard, this would lead the firm to reduce investments, as in the foregoing discussion. Yet moral hazard, due to an explicit or implicit government guarantee, adds an important wrinkle. The loss of franchise value in a rescue deters institutions from inefficient investment. When the risk of a rare event diminishes franchise value, this deterrent also diminishes. Engaging in risky lending, paradoxically, protects equity holders at the expense of depositors. We show that such a model can account for the observed connection between risky household credit and financial crises.

Conclusion

Ignoring rare events in asset pricing may be just as much of a mistake as ignoring risk itself. Indeed, the risk associated with small probabilities of large shocks can often dominate other, more-standard sources of risk. A short perusal of any newspaper shows that rare events are an important part of what average investors think about. The fact that asset valuation combines expectations, risk, and covariance implies that rare macroeconomic outcomes cannot but be important for asset prices.

Because rare events are difficult to learn about, particularly if their probabilities are non-constant, much work remains to be done in understanding the dynamics of these rare-event beliefs. Are these beliefs consistent with rational Bayesian updating? How do we think about rare-event beliefs in an economy with a wider range of outcomes than even the richest of models that we can create? These are interesting questions for future research.

Endnotes

“The Dividend-Price Ratio and Expectations of Future Dividends and Discount Factors,’’ Campbell J, Shiller R. NBER Working Paper 2100, December 1986, and The Review of Financial Studies 1(3), Fall 1988, pp. 195–228.

“Can Time-Varying Risk of Rare Disasters Explain Aggregate Stock Market Volatility?’’ Wachter J. NBER Working Paper 14386, October 2008, revised March 2012, and The Journal of Finance 68(3), 2013, pp. 987–1035.

The model is calibrated to international consumption and GDP data; see “Macroeconomic Crises since 1870,’’ Ursua J, Barro R. NBER Working Paper 13940, April 2008, and Brookings Papers on Economic Activity, 39(1), Spring 2008, pp. 255–350.

“The Macroeconomic Announcement Premium,’’ Wachter J, Zhu Y. NBER Working Paper 24432, March 2018.

“Option Prices in a Model with Stochastic Disaster Risk,’’ Seo S, Wachter J. NBER Working Paper 19611, November 2013, revised August 2015, and Management Science 65(8), August 2019, pp. 3449–3469.

“Do Rare Events Explain CDX Tranche Spreads?” Seo S, Wachter J. NBER Working Paper 22723, October 2016, and The Journal of Finance 73(5), October 2018, pp. 2343–2383.

“The Cyclical Behavior of Equilibrium Unemployment and Vacancies,” Shimer R. American Economic Review 95(1), March 2005, pp. 25–49.

“Risk, Unemployment, and the Stock Market: A Rare-Event-Based Explanation of Labor Market Volatility,’’ Kilic M, Wachter J. NBER Working Paper 21575, September 2015, revised May 2016, and The Review of Financial Studies 31(12), December 2018, pp. 4762–4814.

“Cyclical Dispersion in Expected Defaults,’’ Gomes J, Grotteria M, Wachter J. NBER Working Paper 23704, August 2017, and The Review of Financial Studies 32(4), April 2019, pp. 1275–1308. For related findings, see: “Issuer Quality and Bond Returns,’’ Greenwood R, Hanson S. The Review of Financial Studies 26(6), June 2013, pp. 1483–1525.

“Foreseen Risks,’’ Gomes J, Grotteria M, Wachter J. NBER Working Paper 25277, November 2018, revised July 2019.