Macroeconomic Policy in a Liquidity Trap

The main focus of my research for nearly two decades has been macroeconomic policy during periods when the central bank has cut the short-term nominal interest rate to zero, periods that are often referred to as exhibiting a liquidity trap. In this summary, I describe my key conclusions.

The work can be divided quite neatly into four parts, roughly following the time line in which it was written. I highlight each phase of my research agenda and three generations of models which evolved along the way. While I focus primarily on my own research, I must acknowledge at the outset that many others have contributed to this research agenda.

First-Generation Models

My interest in the liquidity trap was triggered by events in Japan in the late 1990s. At that time, Japan suffered from subpar growth and deflation, and the short-term interest rate had collapsed to zero. If it could happen in Japan, it could happen here as well, and it seemed to me a first-order priority for those concerned with macroeconomic policy to understand those events.

My first published work on this topic was written with my adviser, Michael Woodford.1 Central to it was the idea that once a central bank is constrained by the zero lower bound (ZLB), it can still have an impact on the economy by giving markets guidance about the evolution of future interest rates, rates that would prevail once the ZLB is no longer binding. For example, it could set explicit thresholds, saying that the interest rate will stay at zero until the price level or unemployment rate reaches a particular level, an idea we formalized in the paper. These results have received quite a bit of attention over the years, perhaps due to the fact that during the Great Recession the Federal Reserve used the analysis, and closely related work by other authors, as part of the rationale for its "forward guidance" policy once the ZLB became a concern.2 Several other central banks — including the Bank of Canada, the European Central Bank, the Bank of Japan, and the Bank of England — utilized this research for similar policy purposes.

Another important result was an "irrelevance" proposition, the idea that increasing the money supply at a zero interest rate has no effect on output or prices if it does not change expectations about future interest rates. Woodford and I further showed that it was irrelevant how this was done, that is, which assets the central bank bought in order to increase the money supply. This was a quite controversial proposition when reported, but one that has stood the test of time, with several central banks more than doubling the monetary base during the most recent crisis, using various purchasing schemes, with little or no apparent effect on prices.3 This was consistent with the empirical prediction of that paper. It was a direct violation, however, of the quantity theory of money, which was a reigning paradigm in the '90s.

A second major theme of my early work was how policies aimed at manipulating expectations, such as forward guidance, could be made credible. Specifically, I wanted to know what could be done by the government to back up an announcement of future intervention by the appropriate use of fiscal policy, exchange rate policy, or various forms of quantitative easing. This was the main focus of the paper, "The Deflation Bias and Committing to Being Irresponsible," the title of which played on Paul Krugman's proposal that the Bank of Japan needed to "commit to being irresponsible."4 It was a theme I would return to repeatedly in work on the Great Depression in order to interpret various government policy actions in the 1930s, an agenda I took up after leaving graduate school at the urging of one of my advisers, Ben Bernanke, and many others.

The Great Depression and the Liquidity Trap

My work on the Great Depression yielded three major conclusions. First, it gave a somewhat novel interpretation of the U.S. recovery that started in 1933, when Franklin Delano Roosevelt took office. It heavily emphasized the role of expectations about future policy and the price level, something that was largely missing from the existing literature, which focused more on static movements in the money supply or government spending as explanatory variables.5 One of the main goals of my work on the regime change in 1933 was to model it in the context of an infinitely repeated game; then, one could interpret many of the actions of the government as having directly affected expectations, something I spent considerable time arguing did indeed happen. A second and somewhat more provocative conclusion was that some of the most controversial elements of the New Deal, such as the National Industrial Recovery Act, were expansionary, rather than contractionary, as the conventional wisdom held at the time, but the act included temporary but highly controversial policies like allowing firms to cartelize to prop up prices, in violation of reigning antitrust laws.6 This was due to the positive effect these policies had on inflation expectations, as higher inflation expectations are expansionary at the ZLB since they reduce the real rate of interest, thereby stimulating demand. These policies were, in other words, part of FDR' s commitment to "reflate" the economy. Third, this research provided a novel interpretation of the 1937 recession, which I termed "The Mistake of 1937." I argued that the mistake was due to the administration's abandonment of the commitment to inflate the price level back to pre-Depression levels.7

"The Mistake of 1937" is one of my favorite papers. I was invited to give the paper as a part of the Bank of Japan's Annual Conference in 2006. This meeting was attended by a large part of the governing board at the bank, and in a youthful fit of over-confidence, I felt that perhaps warning that they were about to repeat the mistake of 1937 would make a difference. The talk, of course, had no apparent effect at the time. The bank raised the short-term nominal rate a few weeks later — precisely what I warned could lead to a recession. The phrase "The Mistake of 1937" caught on, and is used routinely by policy makers and pundits talking about this period. This was probably driven by the fact that Krugman devoted a New York Times column to the paper and used the title for his column when warning the Fed about raising rates prematurely.

The 2008 Crisis: Second-Generation ZLB Models

The work described above was done prior to the economic crisis of 2008, which led me to abandon further work on economic history. The 2008 crisis looked a lot like the type of economic crises that I already had analyzed in previous work and I decided to pursue two main lines of research in response. The first was tightly linked to my earlier theoretical dissertation work, while the second aimed at building a second generation of New Keynesian models to understand what happened, going deeper into the origin of the 2008 crisis and the Great Depression.

Within the first line, I examined how fiscal policy tools could be used instead of, or in addition to, monetary policy in responding to the crisis. Perhaps the most important result was that the "multiplier of government spending" — the increase in output as a consequence of an increase in government spending — was theoretically much greater at the ZLB than under normal circumstances.8 I proved that it had to be above unity in a standard New Keynesian model. This implied that existing empirical estimates of government spending multipliers were not useful. Those estimations depended upon data generated under regular circumstances when the short-term nominal interest rate was positive. This had strong policy implications, as the Obama administration was designing the largest fiscal stimulus program seen since the end of World War II. While this result was anticipated in some of my earlier work, I now showed it explicitly with a series of analytical propositions. Since then a considerable literature has emerged on this question and I have continued to work on it.9

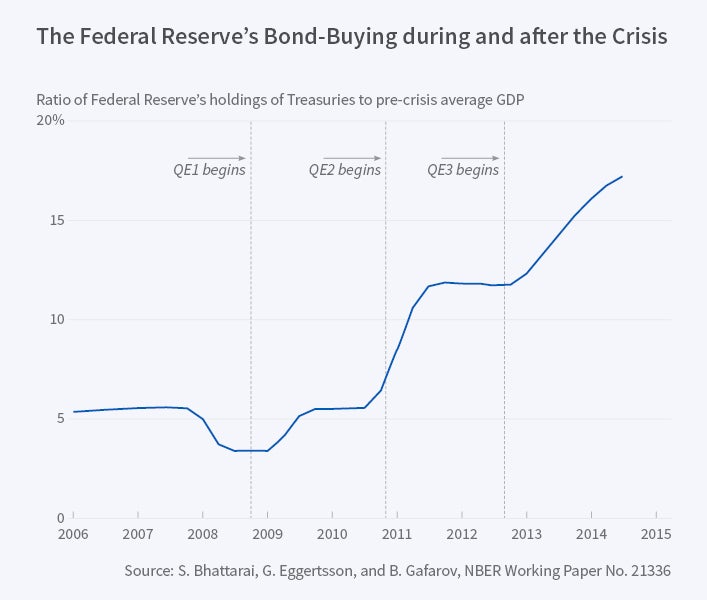

I wrote two other papers studying the policy response to the Great Recession, built to some extent on the theoretical framework I had developed prior to the crisis. The first provides theoretical foundations for some aspect of the Federal Reserve's policy during the crisis, namely the quantitative easing (QE) program in which the Fed bought long-term government bonds [Figure 1].10 One motivation for that paper was that Bernanke has famously quipped "QE works in practice but not in theory." In other words, there was and remains a perception that QE had an important economic effect, yet proper theoretical explanations have been elusive, in part due to the "irrelevance result" I proposed with Woodford in 2003. This paper suggests a particular way in which QE affected expectations about future interest rate policy.

The second paper in this vein, written with Andrea Ferrero and Andrea Raffo, was motivated by the deep recession in the southern periphery of Europe following the 2008 crisis.11 The periphery countries were unable to fight the slump by devaluing their own currency on account of the euro, and they could not engage in an aggressive fiscal expansion due to high levels of public debt. As a result, many policy makers turned to "structural reforms" as a panacea. The paper showed that while structural reforms, defined as policies that increase the potential output of the economy, are expansionary in the long run, they are contractionary in the short run due to their deflationary effects if the central bank is constrained by the ZLB. The key insight, as in the case of the article on the New Deal, was built on what I had earlier termed as the "paradox of toil," according to which the usual rules of macroeconomics can be stood on their head at the ZLB. 12

The second line of research I pursued in response to the crisis sought deeper theoretical foundations for the source of ZLB episodes. The first generation of models I had written assumed that the shocks that triggered the crisis were a reduced form of "preference shock." Krugman and I modeled the origin of the crisis in a more fundamental way based on the idea of a "Minsky moment."13 This refers to the work of Hyman Minsky, and suggests that the 2008 crisis came about due to debtors realizing in the "Minsky moment" that they had overextended themselves by taking on too much debt, after which there was a rapid contraction of spending ("deleveraging") by borrowers. To make up for this drop in spending, some other economic agents had to step in and start spending more. The way this happened in our theory was via reduction in short-term real interest rates that induced savers to spend. The key point was that the required reduction in the real interest rate resulting from a "Minsky moment" might easily bring the economy to the ZLB, which would then lead to the type of macroeconomic challenges that had been such a strong focus of my earlier work.

This debt deleveraging theory of the crisis had readily testable implications, including the idea that regions in the U.S. in which consumers had taken on larger amounts of debt should have suffered more during the crisis than other areas. A considerable literature has emerged that supports predictions of this kind using micro-data, the best-known of which are a series of papers by Atif Mian and Amir Sufi summarized in their book, House of Debt.14 I continued this line of research in a recent paper with Pierpaolo Benigno and Federica Romei.15 We take the debt deleveraging idea and incorporate it into what has become known as the standard New Keynesian model, a consensus model formed prior to the crisis. We show how the standard model can be nested in a more general setting, which includes the forces associated with debt deleveraging and banking crisis, and argue that this new framework should become the post-crisis benchmark model in the New Keynesian literature. We also illustrate several important policy implications of the proposed new benchmark model and how the policy conclusion changes relative to the earlier benchmark model.

This second line of research also includes a joint paper with Marco Del Negro, Ferrero, and Nobuhiro Kiyotaki.16 While much of the focus of the paper is on the effect of various Fed policies during the crisis, at its heart is once again an attempt to model in more detail the origin of the economic crisis of 2008. This turns out to be necessary to rationalize various types of policy interventions the Federal Reserve implemented in the early part of the crisis involving emergency loans. The paper proposes that an important element of the crisis is the reduction in liquidity that occurred because several asset classes became harder to sell. It argues that the emergency assistance of the Federal Reserve via various liquidity facilities may have prevented the second coming of the Great Depression.

Post Crisis: Third-Generation Models of Secular Stagnation

My most recent work has grappled with the fact that existing models have a difficult time explaining the long duration of the Great Recession and the fact that the U.S. nominal interest rate is still close to zero almost a decade after the shocks that led to the recession occurred. The second-generation models predicted a temporary debt deleveraging cycle which should have led to a recession that was more short-lived. Similarly, the first-generation models plainly assumed that the shocks giving rise to the crisis were temporary. Moreover, those models "blow up" in the presence of very long-lasting shocks: They do not permit well-defined, bounded solutions in such cases. I have referred to these conditions as "deflationary black holes" in some of my work.

With interest rates still close to zero around the world, and inflation low but not approaching any explosive negative numbers, many started suggesting that we need to consider models in which a low interest rate can persist for an arbitrarily long time. The proposition that we could be in for a very long slump — without any natural pushback to normalcy — is the secular stagnation hypothesis. It was posited by Alvin Hansen in 1938 in his presidential address to the American Economic Association, shortly after "the Mistake of 1937," when the future of the American economy looked grim indeed.17 This hypothesis was recently resurrected by Lawrence Summers in a speech at the International Monetary Fund.18

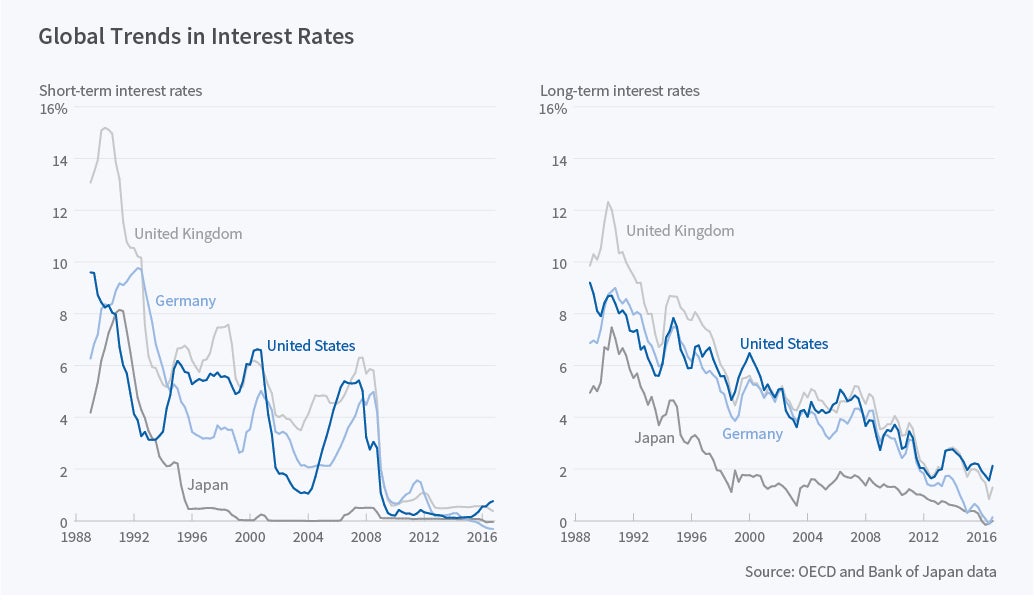

Neil Mehrotra and I formalize the secular stagnation hypothesis in a theoretical model which I consider to be a key contribution to "third generation" modeling of the ZLB.19 Our model provides a much stronger rationale for aggressive fiscal policy relative to monetary policy in the optimal policy mix. At the heart of this work is the idea that something more than financial collapse may have been behind the crisis of 2008. The drop in real interest rates we have seen in recent years appears to be the result of a broader worldwide trend that dates back well before the recent financial turbulence [Figure 2].20Accordingly, in this model, we focus not only on financial shocks — which still remain very important — but also on slower moving trends such as increasing inequality, population dynamics, and a fall in the relative price of investment over time as well as the observed slow-down in productivity. All these forces can put downward pressures on the real interest rate and, unlike financial shocks, they are unlikely to return to where they were quickly, if at all. Moreover, this new generation of models has some fundamentally new implications for policy relative to the first two generations. In particular, monetary policy becomes much more challenging as a solution to insufficient demand.

Following up on the first paper with Mehrotra, he and I started joint work with Summers on secular stagnation, some of which is coauthored by Sanjay Singh.21 One of the key insights of this work is that while under regular circumstances a current account deficit transmits lower interest rates from the surplus country to the deficit country, which is expansionary, when the ZLB is binding, the trade deficit will instead transmit a recession. This provides a theoretical foundation for the prospect of trade and currency war in low-interest environments. Overall, this highlights an increased value of cross-country policy coordination in these circumstances.

Endnotes

G. Eggertsson and M. Woodford, "Optimal Monetary Policy in a Liquidity Trap," NBER Working Paper 9968, September 2003, and published as "The Zero Bound On Interest Rates And Optimal Monetary Policy," Brookings Papers on Economic Activity, 1, 2003, pp. 139-235; and G. Eggertsson and M. Woodford "Policy Options in a Liquidity Trap," American Economic Review, 94 (2), 2004, pp. 76-9.

For examples, see speeches by the President of the Philadelphia Fed, Charles Plosser, "Forward Guidance," 2013; Janet Yellen's 2009 speech "U.S. Monetary Policy Objectives in the Short and Long Run"; or Ben Bernanke for an early reference in "Some Thoughts on Monetary Policy in Japan," 2003.

G. Eggertsson and K. Proulx, "Bernanke's No-Arbitrage Argument Revisited: Can Open Market Operations in Real Assets Eliminate the Liquidity Trap?" NBER Working Paper 22243, May 2016.

G. Eggertsson, "The Deflation Bias and Committing to Being Irresponsible," Journal of Money, Credit, and Banking, 38 (2), 2006, pp. 283-321.

G. Eggertsson, "Great Expectations and the End of the Depression," American Economic Review, 90 (4), 2008, pp. 1476-516.

G. Eggertsson, "Was the New Deal Contractionary?" American Economic Review, 102 (1), 2012, pp. 524-55.

G. Eggertsson and B. Pugsley, "The Mistake of 1937: A General Equilibrium Analysis," Bank of Japan's Monetary and Economic Studies, 24 (S-1), 2006, pp. 151-90.

G. Eggertsson, "What Fiscal Policy is Effective at Zero Interest Rates?" in D. Acemoglu and M. Woodford, eds., NBER Macroeconomics Annual 2010, Volume 25, Chicago, Illinois: University of Chicago Press, 2011, pp. 59-112.

M. Denes, G. Eggertsson, and S. Gilbukh, "Deficits, Public Debt Dynamics and Tax and Spending Multipliers," The Economic Journal, 123 (566), 2013, pp. 133-63.

S. Bhattarai, G. Eggertsson, and B. Gafarov, "Time Consistency and the Duration of Government Debt: A Signalling Theory of Quantitative Easing," NBER Working Paper 21336, July 2015.

G. Eggertsson, "The Paradox of Toil," Federal Reserve Bank of New York Staff Report No. 433, February 2010.

G. Eggertsson and P. Krugman, "Debt, Deleveraging, and the Liquidity Trap: A Fisher-Minsky-Koo Approach," The Quarterly Journal of Economics, 127 (3), 2012, pp. 1469-513.

A. Mian and A. Sufi, House of Debt: How They (and You) Caused the Great Recession, and How We Can Prevent It from Happening Again, Chicago, Illinois: University of Chicago Press, 2015.

P. Benigno, G. Eggertsson, and F. Romei, "Dynamic Debt Deleveraging and Optimal Monetary Policy," NBER Working Paper 20556, October 2014.

M. Del Negro, G. Eggertsson, A. Ferrero, and N. Kiyotaki, "The Great Escape? A Quantitative Evaluation of the Fed's Liquidity Facilities," NBER Working Paper 22259, May 2016, and forthcoming in American Economic Review.

A. Hansen, "Economic Progress and Declining Population Growth," American Economic Review, 29(1), 1939, pp. 1-15.

For futher discussion see L. Summers, "U.S. Economic Prospects: Secular Stagnation, Hysteresis, and the Zero Lower Bound," Business Economics, 49 (2), 2014, pp. 65-73.

G. Eggertsson, and N. Mehrotra, "A Model of Secular Stagnation," NBER Working Paper 20574, October 2014.

G. Eggertsson, N. Mehrotra, and J. Robbins, "A Model of Secular Stagnation: Theory and Quantitative Evaluation," NBER Working Paper 23093, January 2017.

G. Eggertsson, N. Mehrotra, and L. Summers, "Secular Stagnation in the Open Economy," NBER Working Paper 22172, April 2016, and American Economic Review, 106 (5), pp. 503-7; and G. Eggertsson, N. Mehrotra, S. Singh, and L. Summers, "A Contagious Malady? Open Economy Dimensions of Secular Stagnation," NBER Working Paper 22299, June 2016, and forthcoming in the IMF Economic Review.