Measuring the Economy of the 21st Century

The first meeting of the Conference on Research in Income and Wealth (CRIW) occurred in late January of 1936 in the midst of the Great Depression. The general objective of the conferees at this meeting and those that followed was to help fill the void created by the absence of a national statistical system. The CRIW provided conceptual support for the task of developing such a system, and a complex task it was indeed. A national economy is a system of interconnected flows of quantities and payments involving a vast number of goods and services. Fitting all this together into a national accounting framework has justifiably been called one of the "great inventions of the 20th Century."1

We are now well into the 21st century, and as with many other great inventions, there are constant challenges in updating the national statistical system to reflect the current technological environment. GDP is an aggregate measure of the flows of goods and services through product and factor markets, one that provides a statistical portrait of the economy as it evolves over time. However, the process of evolution itself has altered these flows in ways that undermine the accuracy or relevance of past concepts and data sources. The rapid transformation of the U.S. economy brought about by the revolution in information technology has introduced a profusion of new products and processes, new market channels, and greater organizational complexity. Parts of the statistical system are struggling to keep up.

The problem is nowhere more evident than in the difficulties associated with the Internet's contribution to GDP. Valuing the 'net and the wide range of applications offered with little or no direct charge is challenging because there is no reliable monetary yardstick to guide measurement, and their omission or undervaluation surely affects GDP.

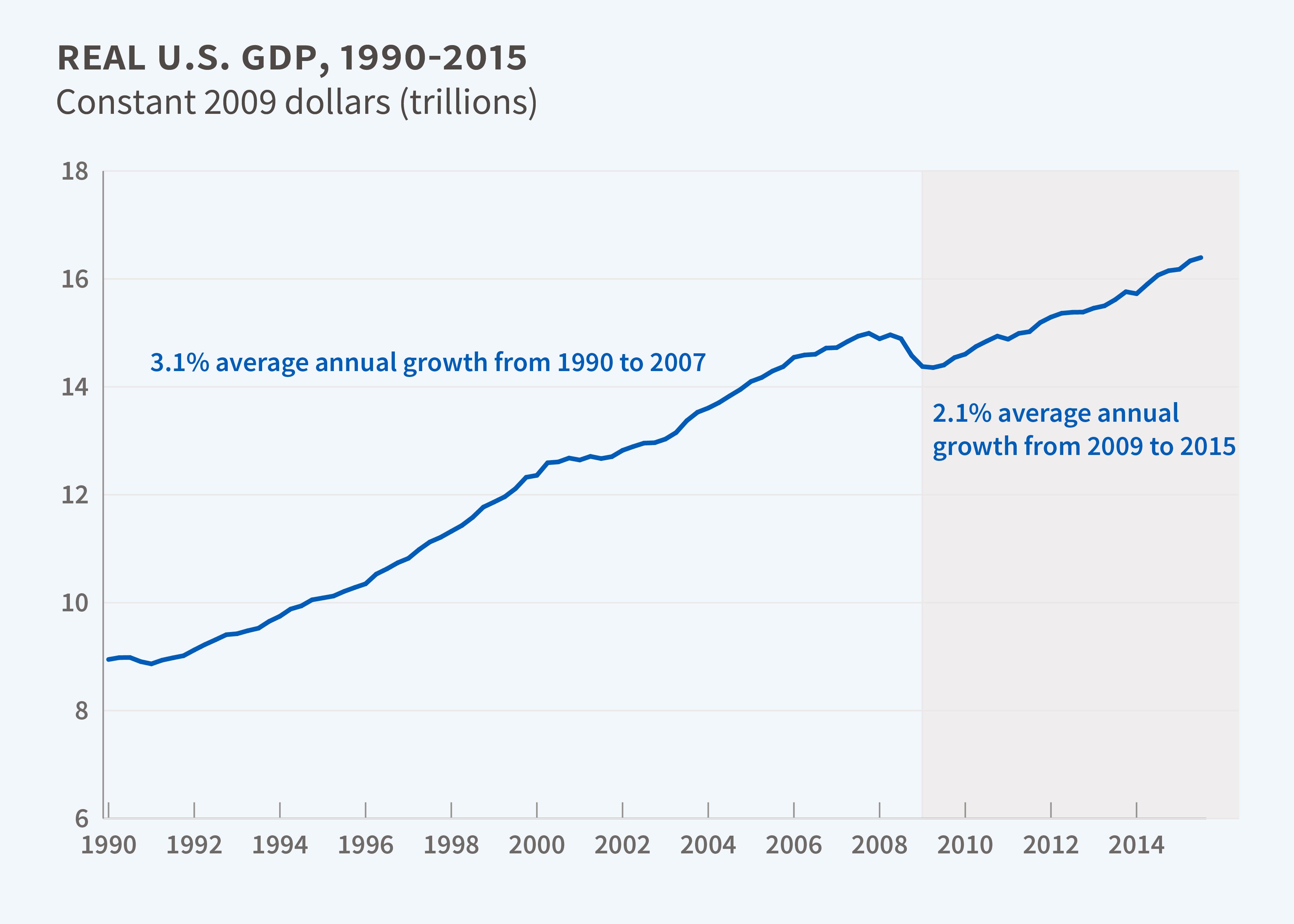

This is important for the recent debate over future living standards and employment. The two percent growth rate of real U.S. GDP since the end of the Great Recession has lagged the long-term historical rate of three percent, inviting speculation about the emergence of a New Normal. [See Figure 1.] This view is reinforced by Robert Gordon's recent suggestion that the growth effects of the information revolution are not of the same order of importance as those of previous technological revolutions and are, in any event, playing out.2 The future may look very different if recent GDP growth is significantly understated because of the mismeasurement of new goods and services.

Sorting out the many issues involved in "measuring" the economy of the 21st century has dominated the CRIW agenda since the early stages of the information revolution; it is a large job, and will occupy the CRIW for years to come. Past and cur-rent efforts are reviewed in this summary, starting with the importance of accurately accounting for new goods and improvements in the quality of existing ones, and the related problem of measuring the output of the service-producing sectors of the economy. The following sections take a closer look at three of the most important service sectors: health care, education, and finance. Subsequent sections focus on capital and labor in the new economy, the role of entrepreneurship and company formation, and the problem of national income accounting in an increasingly globalized world. A final section sums up.

New Goods and Quality Change

In his discussion of "Effects of the Progress of Improvement upon the Real Price of Manufactures" in The Wealth of Nations, Adam Smith dodged the problem of changing product quality by saying "Quality, however, is so very disputable a matter, that I look upon all information of this kind as somewhat uncertain."3 He was referring to price trends in the production of cloth, but fast-forward more than two centuries, to William Nordhaus writing on the history of lighting, when he argues that official price indexes may "miss the most important revolutions in economic history" because of the way they are constructed.4 The quality problem endures and, if anything, has gotten more difficult with the profusion of new and improved goods.

The quality change problem arises when a new version of a good is introduced that embodies characteristics that make it more desirable. The new model may not cost much more than the old, but represents a greater effective amount of output from the user's standpoint. If the price per unit transacted in the market does not change, the substitution of a new unit for an older model will not affect either nominal or apparent real GDP, because the apparent market price has not changed. However, effective real output has increased, and the benefits of the innovation are lost in the official data. Personal computers are an important example, and in the mid-1980s, the Bureau of Economic Analysis began adjusting computer prices to better reflect the technological gains in computing power.

The new goods variant of the product innovation problem is even more challenging because, unlike the quality change problem, there are no prior versions of the good on which to base price comparisons. Current procedures for incorporating new goods into existing price indexes are complicated, but may miss much of the value of these innovations. At the same CRIW meeting at which Nordhaus examined the history of lighting, Jerry Hausman examined the introduction of a new brand of breakfast cereal and found that the treatment (or non-treatment) of new goods in official statistics resulted in a 20 percent up-ward bias in that component of the Consumer Price Index.5 He arrived at a similar conclusion in a subsequent paper on mobile cellular telephones, though the magnitude of the bias is larger.6 By implication, the benefits of important new information technology goods, like the Internet and the many applications it enables, may be subject to significant undervaluation.

Papers on various aspects of price measurement have appeared frequently in other CRIW proceedings, and in 2004 the CRIW hosted a conference on Price Index Concepts and Measurement devoted to the subject.7 Papers in the resulting volume, published in 2009, ranged over theoretical areas in price measurement, from the reassessment of quality change in computer prices and the issue of outlet substitution bias to measurement problems in specific applications in finance, health, and education.8 An earlier volume, Hard-to-Measure Goods and Services: Essays in Honor of Zvi Griliches, published in 2007, included six papers devoted to price measurement. One, by Jaison Abel, Ernst Berndt, and Alan White, moves beyond the rapid increase in the power of computer hardware to show that improvements in software also are important.9

The question of how much product innovation has been omitted from estimates of real GDP is germane to the issues raised by Gordon. If the upward bias in price indexes is of the magnitude suggested by Nordhaus, Hausman, and others, then the growth in real GDP may be considerably greater than the official estimates suggest.10 Whether the bias has increased in recent years and is large enough to offset the apparent slowdown in recent growth is another matter. It is a subject that will undoubtedly be on the agendas of future CRIW conferences.

The Services Sector Problem

The private services-producing sectors of the U.S. economy constitute some four-fifths of recent private business value added. Not only do they account for a large fraction of GDP, these sectors are essential for understanding the trends in aggregate economic growth. In his introduction to the CRIW volume Output Measurement in the Service Sectors, Zvi Griliches wrote that the much-discussed productivity slowdown of the 1970s and 1980s might be due to two factors: "Baumol's disease," in which the relative labor intensity and a high income elasticity of demand doom these sectors to slower productivity growth, and the possibility that the output of these sectors was inherently more difficult to measure.11

Fast forward, again, to the 2007 CRIW paper by Barry Bosworth and Jack Triplett on service sector productivity.12 This paper revisits and updates Griliches' earlier finding that services were a drag on overall growth during the slowdown. Looking at a longer period, they report a speed-up in services relative to the goods-producing sectors: Labor productivity growth in services rose from an annual rate of 0.7 percent in 1987–1995 to 2.6 percent for 1995–2001, while the corresponding numbers for the goods-producing sectors were 1.8 percent and 2.3 percent, respectively. They also find that 80 percent of the increase in overall labor productivity growth after 1995 came from the contribution of information technology in the service sectors, contrary to the Baumol hypothesis that services were inherently resistant to productivity change.

Sorting out changing sectoral trends is made more difficult because the output of the services sectors is resistant to accurate measurement, in part because the quality change problem is particularly large in many of these sectors, and in part because of their very nature. Griliches also observed that a "problem arises because in many services sectors it is not exactly clear what is being transacted, what is the output, and what services correspond to the payments made to their providers."13 A simple contingency-state model illustrates the problem. The outcome of expert advice or intervention (e.g., medical, legal, financial, educational, management consulting) can be thought of as a shift from an initial state of being to a post-intervention state, where "state" refers variously to the condition of wellness, legal or financial position, knowledge, etc. The subject purchases expert services, X, in the expectation or hope that they will have a positive outcome. However, the outcome also depends on the subject's own efforts and initial state of being. Measured GDP records the payment for X, and perhaps ancillary expenses incurred (e.g., joining a health club), but not necessarily the value of the outcome to the recipient, which may be different and is often complex and subjective.

A fundamental problem arises when trying to separate X into price and quantity components in order to measure real GDP: In what units do you measure X? Doctors and lawyers may provide information but bill by the visit, or the hour, or the procedure. This is their "output," and it is not measured in bits or bytes of expert information. The service providers usually do not sell guaranteed outcomes, since the advice they provide may not be heeded and outcomes are often uncertain. There is a parallel problem in the units in which outcomes are measured: Whatever these units are, they are not necessarily the same for buyers and sellers. But if there are no clear units of measurement, how is it possible to determine the level of output and tell if improvements in technology have increased outcome-based output over time? This is a problem for understanding the factors driving recent GDP growth, given the service sector's technological dynamism in recent years and the increased availability of expert advice and information on the Internet.

Selected Service Industries

Rising health care costs and the aging of the baby boomers have focused much attention on the health services sector. Not surprisingly, the measurement of health care cost and output has been the subject of two recent CRIW meetings: the 2001 Medical Care Output and Productivity conference and the 2013 Measuring and Modeling Health Care Costs conference.14 The 31 papers in the two conference volumes range over a number of issues, many organized around what Berndt and David Cutler, the editors of the first volume, call the "outcomes movement" in health economics, which is the attempt to measure the health impact of medical care rather than the amount expended. The paper by Triplett in this volume elaborates on this point, arguing that it is not the expenditure on health care inputs that is needed for the study of medical productivity, but the output associated with these inputs and how it has changed over time. Anyone who remembers a visit to the dentist in the 1950s can testify to the enormous gains in efficacy and patient comfort that have occurred. Huge advances have been made in diagnostics (e.g., the MRI), treatment (e.g., laparoscopic surgery), and drug therapies (e.g., statins). Any attempt to measure real output in the health sector and its contribution to real GDP growth must account for these advances. More technology is on the way, with gene-based therapies, robotic surgery, and diagnoses that make use of the potential of Big Data. A pure expenditure approach misses some of the most important technological advances of the last 50 years.

Adjusting expenditures (X) to reflect better outcomes is not a simple matter, as the contingent-state model illustrates. Out-comes have a subjective component, like improved quality of life, and depend on the pre-treatment state of health. Expenditures are price-denominated, whereas outcomes are not, at least not in their pure state. However, progress can be made by adjusting the price estimates used to deflate nominal-price expenditure data for those outcomes that can be measured (e.g., cures, survival rates), and by the use of disease-based price indexes to better reflect the bundle of services received by the consumer. This is an important step for measuring the growth in real GDP, given the growing size of the health sector and the manifest importance of advances in medical technology.

The same general line of analysis applies to the education sector. The overall objective of schooling is to move a student from one state of knowledge or capability to another. The "output" of the sector, as measured by educational attainment, has increased dramatically in the United States, as have per capita expenditures. The fraction of the adult population with a bachelor's degree increased from less than 10 percent in 1960 to around 30 percent today, and some two-thirds of high school graduates go on to some form of tertiary education. The improvement in educational outcomes is another matter. The recent "Nation's Report Card" from the National Assessment of Education Progress reported that literacy and numeracy scores of 12th graders have been stagnant in recent years, and that a majority of students are stuck at skill levels that are rated below proficient, with one-quarter of students below "basic" in reading and one-third below "basic" in mathematics.15 International comparisons have found similar results.

However, test scores are only one aspect of the educational process, and formal education is only part of the maturation and skill development process. In a paper presented at the 2015 CRIW conference on Education, Skills, and Technical Change: Implications for Future U.S. GDP Growth, Valerie Ramey and I note that factors like family and peer environments also matter, and that "cognitive and noncognitive skills developed by age three have fundamental effects on life outcomes and on the ability to learn. Schools thus have little control over student characteristics, a key input into their production functions, and the deficits revealed by test score data are not simply a reflection of weak schools - though they undoubtedly contribute to the problem."16 Initial conditions are important and affect the link between expenditures and outcomes. Still, the apparent lack of progress in test scores is of concern when assessing educational output in general and prospective gains from IT-related innovations like online education.

The difficulty that statisticians have in keeping up with rapid changes in technology and markets is another complicating factor. This is nowhere more apparent than in the financial services sector in the years after the financial crisis and sharp economic downturn. Why wasn't a crisis of such huge proportion more evident beforehand in official aggregate statistics of the economy? The papers presented at the CRIW conference that led to the 2015 volume Measuring Wealth and Financial Intermediation and Their Links to the Real Economy attempt to answer this question.17 In our summary, Marshall Reinsdorf and I argue that "The possibilities introduced by the IT revolution transformed the way stocks were traded and financial markets were organized... facilitated innovations in the areas of securitized lending and financial derivatives... [and the] organization of the financial intermediation industry also changed as some activities migrated to unregulated industries with few data reporting requirements."18 We go on to observe that new financial instruments and market innovations are disruptive and take time to understand and integrate into large scale macro data systems like the national accounts, which have requirements of temporal consistency and breadth of coverage that limit the rate at which the accounts can change and the detail needed to anticipate disruptive change before it occurs.

Labor and Capital in the New Economy

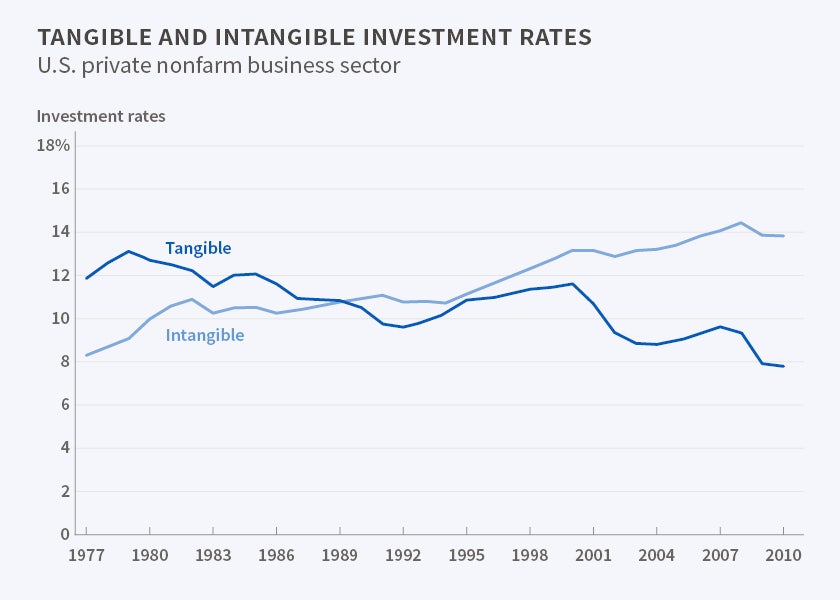

The input side of the economy has also been affected by the digital revolution. This is apparent in the 2005 volume Measuring Capital in the New Economy, which is largely devoted to the growing importance of intangible capital formation.19 This form of capital investment includes scientific and other R&D, brand equity, customer lists and reputation, worker training, and management and human resource systems. Carol Corrado, Daniel Sichel, and I find that investment in intangibles has become the dominant source of business capital formation, far outstripping the rate of investment in tangible plants and equipment, where the rate has been on a downward trajectory. [See Figure 2.]In 2010, the investment rate in the latter was around 8 percent, versus an estimated rate of 14 percent for intangibles.21 This is relevant for the debate over slowing productivity growth, since most of the studies do not include intangible capital and thus omit a major and growing source of technological and organizational innovation.

Measuring intangible capital presents a host of problems, since much of it is produced with firms on "own account" without a market transaction to fix prices and quantities. However, while the problems are difficult, progress is possible. In a major advance in innovation accounting, the Bureau of Economic Analysis successfully incorporated own-account R&D into the national accounts in 2013, along with artistic originals.

Labor markets also are changing, and the 2010 volume Labor in the New Economy takes up some important issues, including the outsourcing of jobs, job security, "good" jobs versus "bad" jobs, the aging of the workforce, different forms of worker compensation, and rising wage inequality.22 The IT revolution has also affected the workplace through an increase in the demand for non-routine skills at the expense of jobs demanding routine skills, a central theme of the conference Education, Skills, and Technical Change: Implications for Future U.S. GDP Growth. Future changes in the labor market will undoubtedly inspire future CRIW research on issues like changing labor force demographics and participation rates, deindustrialization and technological obsolescence, wage inequality, and the rise of the "gig" economy, in which growing numbers of Americans no longer have long-term employment with a particular firm but work "gigs" for a number of clients.

Firm dynamics are another important dimension of innovation on the production side of the economy. The 2009 volume Producer Dynamics: New Evidence from Micro Data looks at the processes of firm entry, growth, and exit, which are integral parts of resource reallocation and growth in a market economy.23 Advances in the construction and availability of microdata from statistical agencies, particularly longitudinal microdata, have enabled researchers to track new firms over their lifetimes. The papers in this volume cover a broad range of issues, including cross-country differences in firm dynamics, job openings and labor turnover, and the dynamics of young and small businesses. The firm dynamic issues are also the subject of the forthcoming conference volume Measuring Entrepreneurial Businesses: Current Knowledge and Challenges, which includes papers on high-growth young firms, entrepreneurial quality and performance, venture capital, job creation in small and large firms, and immigrant entrepreneurship.24

Globalization and International Trade

The globalization of the world economy has also received attention in the conference on International Trade in Services and Intangibles in the Era of Globalization.25 The delivery of many services has traditionally involved physical proximity, but this is changing with the revolution in information and communication technology. The new technologies have enhanced the capacity for global trade in legal, financial, medical, and communication services as well as in software. The editors of the conference volume note that world trade has grown more rapidly than world production, and that trade in services has grown faster than trade in goods. These flows have added an international dimension to the pricing and quantity measurement problem already noted for services in general, and have added problems associated with currencies and taxes.

Summing Up

Since 2000, 15 CRIW conferences have been held, and the proceedings, published or in process, contain well over 200 papers. The great diversity of topics covered is impossible to summarize in a short review, and many important topics have been omitted.26 Some measurement issues, in areas such as medical services, banking, price measurement, and education, have been considered in many conferences.

A full list of conferences, and links to the papers they contain, can be found at: https://www.nber.org/programs-projects/projects-and-centers/conference-research-income-and-wealth?page=1&perPage=50.

Endnotes

P. A. Samuelson and W. D. Nordhaus, cited in J. S. Landefeld, "GDP: One of the Great Inventions of the 20th Century," Bureau of Economic Analysis, U.S. Department of Commerce, Survey of Current Business, January 2000.

R. J. Gordon, "Is U.S. Economic Growth Over? Faltering Innovation Confronts the Six Headwinds," NBER Working Paper 18315, August 2012; Also, R. J. Gordon, The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War, The Princeton Economic History of the Western World, Princeton, New Jersey: Princeton University Press, forthcoming January, 2016.

A. Smith, The Wealth of Nations, volume 1, 1776, Irwin Paperback Classics in Economics, Homewood, Illinois: Richard D. Irwin, 1963, p. 195.

W. D. Nordhaus, "Do Real Output and Real Wage Measures Capture Reality? The History of Lighting Suggests Not," In T. Bresnahan and R. J. Gordon, eds., The Economics of New Goods, Studies in Income and Wealth, Vol. 58, Chicago, Illinois: The University of Chicago Press, 1997, pp. 29–66.

J. Hausman, "Valuation of New Goods under Perfect and Imperfect Competition," In T. Bresnahan and R. J. Gordon, eds., The Economics of New Goods, Chicago, Illinois: University of Chicago Press, 1996, pp. 209–37.

J. Hausman, "Cellular Telephone, New Products, and the CPI," NBER Working Paper 5982, March 1997, and Journal of Business & Economic Statistics, 17(2), 1999, pp. 188–94.

W. E. Diewert, J. Greenlees, and C. R. Hulten, eds., Price Index Concepts and Measurement, Studies in Income and Wealth, No. 70, Chicago, Illinois: University of Chicago Press, 2009.

R. C. Feenstra and C. Knittel, "Reassessing the U.S. Quality Adjustment to Computer Prices: The Role of Durability and Changing Software," pp. 129–60; and J. Hausman and E. Leibtag, "CPI Bias from Supercenters: Does the BLS Know that Wal-Mart Exists?" pp. 203–31, both in W. E. Diewert, J. Greenlees and C. R. Hulten, eds., Price Index Concepts and Measurement, Studies in Income and Wealth, No. 70, Chicago, Illinois: University of Chicago Press, 2009.

J. R. Abel, E. R. Berndt, and A. G. White, "Price Indexes for Microsoft's Personal Computer Software Products," In E. R. Berndt and C. R. Hulten, eds., Hard-to-Measure Goods and Services: Essays in Honor of Zvi Griliches, Studies in Income and Wealth, Vol. 67, Chicago, Illinois: The University of Chicago Press, 2007, pp. 269–89.

See, for example, M. Bils, and P. J. Klenow, "Quantifying Quality Growth," NBER Working Paper 7695, May 2000, and American Economic Review, 91(4), 2001, pp. 1006–30.

Z. Griliches, ed., Output Measurement in the Service Sectors, Studies in Income and Wealth, Vol. 56, Chicago, Illinois: University of Chicago Press, 1992; See, also, Z. Griliches, "Productivity, R&D, and the Data Constraint," American Economic Review, 84(1), 1994, pp. 1–23.

B. P. Bosworth and J. E. Triplett, "Services Productivity in the United States: Griliches's Services Volume Revisited," In E. R. Berndt and C. R. Hulten, eds., Hard-to-Measure Goods and Services: Essays in Honor of Zvi Griliches, Studies in Income and Wealth, Vol. 67, Chicago, Illinois: The University of Chicago Press, 2007, pp. 413–47.

D. M. Cutler and E. R. Berndt, eds., Medical Care Output and Productivity, Studies in Income and Wealth, Vol. 62, Chicago, Illinois: University of Chicago Press, 2001; and A. Aizcorbe, C. Baker, E. R. Berndt, and D. M. Cutler, eds., Measuring and Modeling Health Care Costs, forthcoming in NBER Book Series, Studies in Income and Wealth.

The Nation's Report Card, "Are the Nation's Twelfth-Graders Making Progress in Mathematics and Reading?" National Assessment of Educational Progress (NAEP), U.S. Department of Education, Institute of Education Sciences, National Center for Education Statistics, National Assessment of Educational Progress, 2013.

C. R. Hulten and V. Ramey, "Skills, Education, and U.S. Economic Growth: Are U.S. Workers Being Adequately Prepared for the 21st Century World of Work?" in Education, Skills, and Technical Change: Implications for Future U.S. GDP Growth, CRIW conference held October, 2015.

C. R. Hulten and M. B. Reinsdorf, eds., Measuring Wealth and Financial Intermediation and Their Links to the Real Economy, Studies in Income and Wealth, Vol. 73, Chicago, Illinois: University of Chicago Press, 2015.

C. R. Hulten and M. B. Reinsdorf, "Introduction" to Measuring Wealth and Financial Intermediation and Their Links to the Real Economy, Studies in Income and Wealth, Vol. 73, Chicago, Illinois: University of Chicago Press, 2015, p. 2.

C. A. Corrado, J. Haltiwanger, and D. Sichel, eds., Measuring Capital in the New Economy, Studies in Income and Wealth, No. 65, Chicago, Illinois: University of Chicago Press, 2005.

C. A. Corrado and C. R. Hulten, "How Do You Measure a Technological Revolution?" American Economic Review, 100(2), 2010, pp. 99–104; and C. A. Corrado and C. R. Hulten, "Innovation Accounting," in D. W. Jorgenson, J. S. Landefeld, and P. Schreyer, eds., Measuring Economic Sustainability and Progress, Studies in Income and Wealth, Vol. 72, Chicago, Illinois: The University of Chicago Press, 2014, pp. 595–628.

C. A. Corrado, C. R. Hulten, and D. Sichel, "Measuring Capital and Technology: An Expanded Framework," in C. A. Corrado, J. Haltiwanger, and D. Sichel, eds., Measuring Capital in the New Economy, Studies in Income and Wealth, Vol. 65, Chicago, Illinois: The University of Chicago Press, 2005, pp. 11–41. In a subsequent paper, the authors find that the growth in the stock of intangible capital has become the largest single systematic source of the growth in output per hour in the non-farm business sector over the period 1995–2007. C. A. Corrado, C. R. Hulten, and D. Sichel, "Intangible Capital and U.S. Economic Growth," NBER Working Paper 11948, January 2006, and Review of Income and Wealth, 55(3), 2009, pp. 661–685.

K. G. Abraham, J. R. Spletzer, and M. J. Harper, eds., Labor in the New Economy, Studies in Income and Wealth, Vol. 71, Chicago, Illinois: University of Chicago Press, 2010.

T. Dunne, J. B. Jensen, and M. Roberts, eds., Producer Dynamics: New Evidence from Micro Data, Studies in Income and Wealth, Vol. 68, Chicago, Illinois: University of Chicago Press, 2009.

J. Haltiwanger, E. Hurst, J. Miranda, and A. Schoar, eds., Measuring Entrepreneurial Businesses: Current Knowledge and Challenges, forthcoming in NBER Book Series, Studies in Income and Wealth, Chicago, Illinois: University of Chicago Press; Conference held December 16–17, 2014.

M. B. Reinsdorf and M. Slaughter, eds., International Trade in Services and Intangibles in the Era of Globalization, Studies in Income and Wealth, Vol. 69, Chicago, Illinois : University of Chicago Press, 2009.

There have been papers on measurement methodology, in keeping with the CRIW's origins, including, as examples, papers on the "architecture" and design of the national accounts, the treatment of consumer expenditures, and the use of scanner data (D. W. Jorgenson, J. S. Landefeld and W. D. Nordhaus, eds., A New Architecture for the U.S. National Accounts, Studies in Income and Wealth, Vol. 66, Chicago, Illinois: University of Chicago Press, 2006; C. Carroll, T. Crossley, and J. Sabelhaus, eds., Improving the Measurement of Consumer Expenditures, Studies in Income and Wealth, Vol. 74, Chicago, Illinois: University of Chicago Press, 2015; R. C. Feenstra and M. D. Shapiro, eds., Scanner Data and Price Indexes, Studies in Income and Wealth, Vol. 64, Chicago, Illinois: University of Chicago Press, 2003).