Fiscal Stress and Inflation

There is growing concern that inflation worldwide is rising. Among the factors that are cited as potential contributors are expansionary monetary policies in the United States, the United Kingdom, and the Euro Area; rapid economic growth in emerging economies; and increases in value-added taxes and commodity prices. In a sequence of recent papers, I suggest another potential culprit: looming fiscal stress and uncertainty about how policies will adjust to resolve that stress.

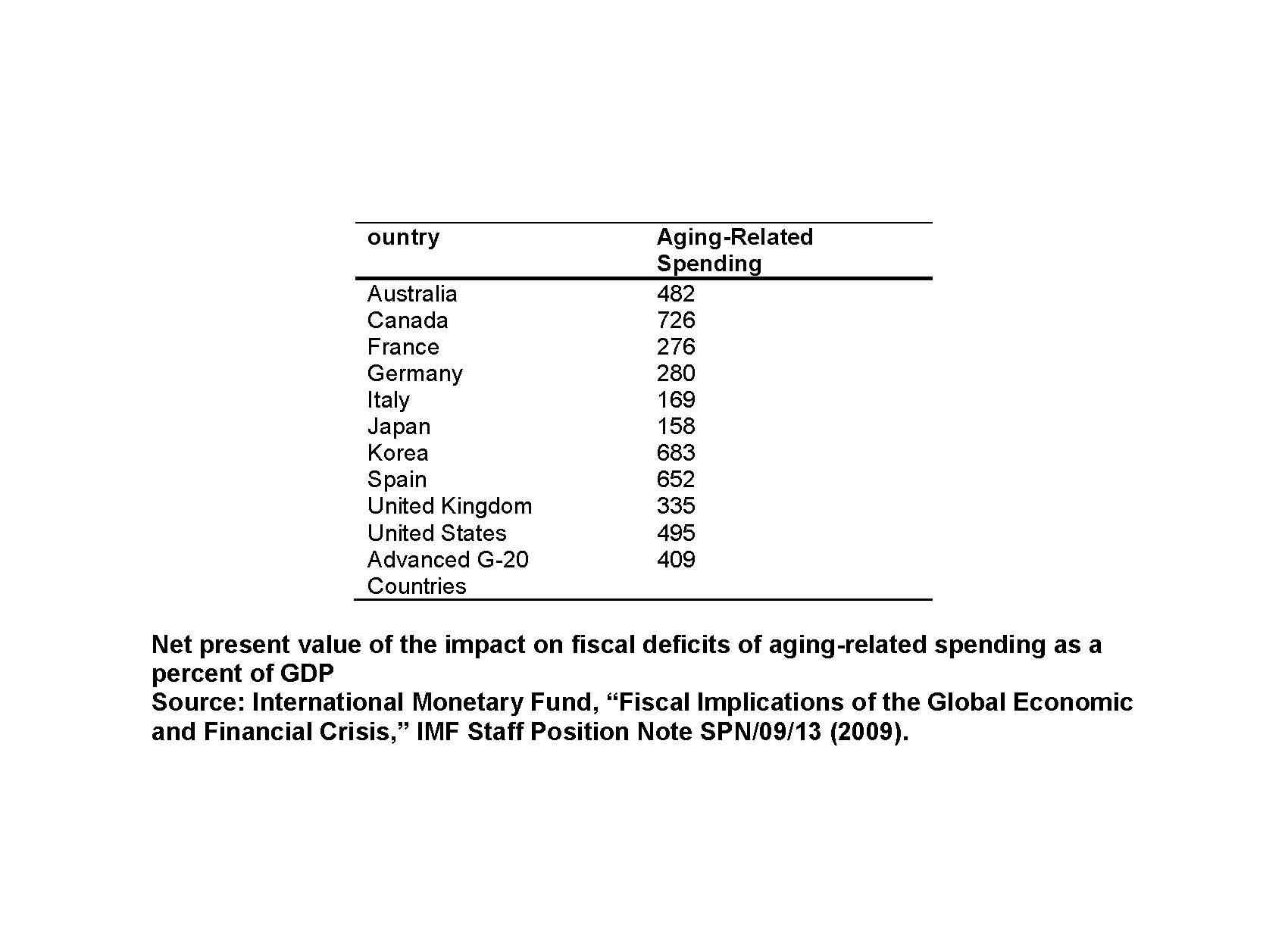

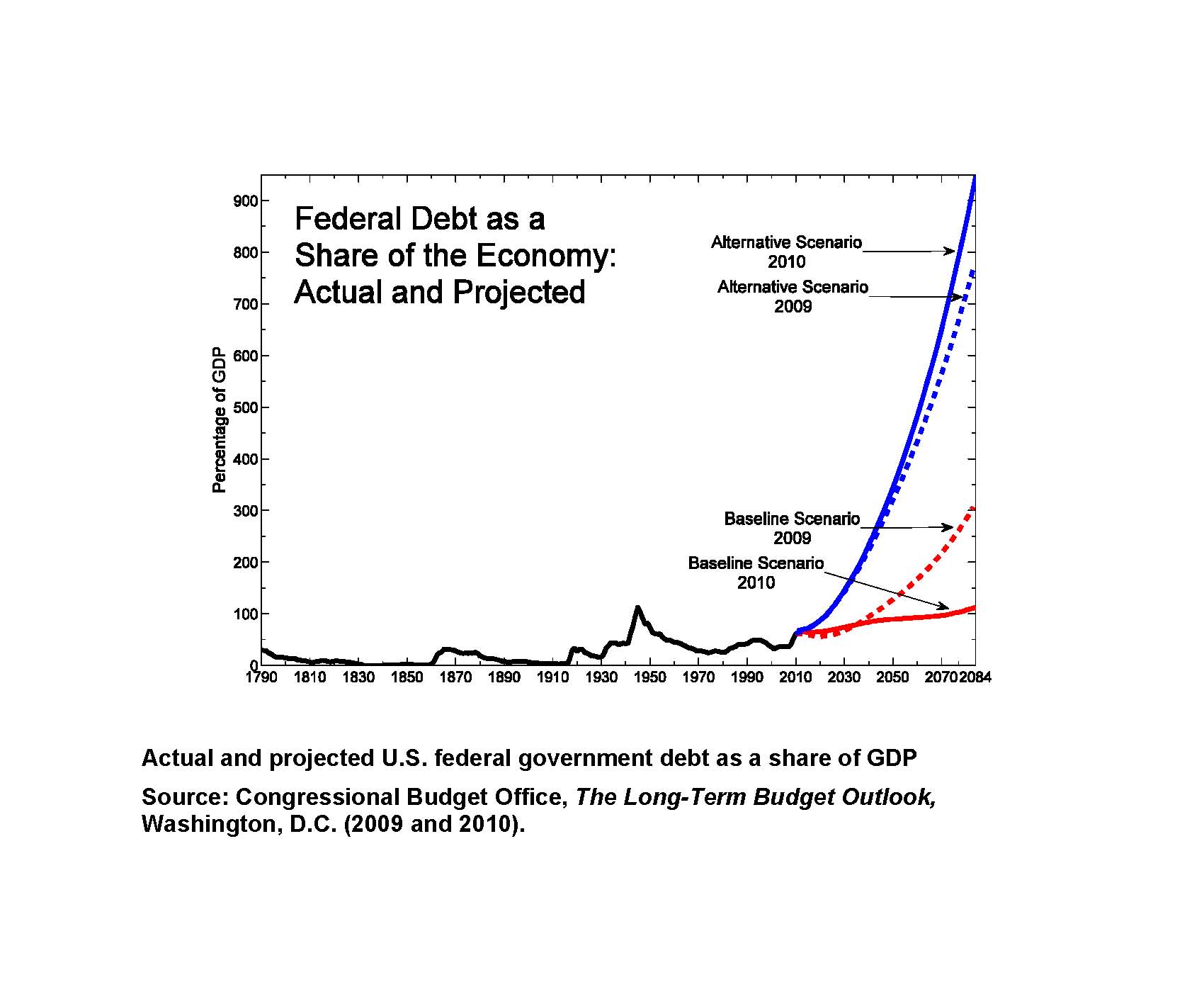

Populations in advanced economies are aging and governments have promised substantially more old-age benefits than they have made provisions to finance. The table below summarizes the "unfunded liabilities" problem that countries face. Overall, the G-20 countries have made spending promises that exceed financing plans and reach as much as 400 percent of their GDP. When the Congressional Budget Office rolls spending commitments and current revenues into debt accumulation, its debt projections are similar to those shown in the figure below.1

What happens next is uncertain. Some policies must adjust, and the fact that bondholders continue to value U.S. federal debt implies that investors expect that policies eventually will adjust. The eventual adjustments will be large. My coauthors and I are therefore pursuing a line of research with three key features: 1) policy regime changes can and do occur; 2) the timing and nature of future regimes are uncertain; and 3) a complete picture requires studying fiscal and monetary policies jointly. 2 Each factor operates strongly through expectations.

To motivate this research, some background on monetary-fiscal interactions is helpful. At a general level, monetary and fiscal policies have two tasks to perform: control inflation and stabilize the value of government debt. There is a beautiful symmetry between the two policies. The conventional assignment -- call it Regime M -- tasks monetary policy with controlling inflation and fiscal policy with stabilizing debt. But an alternative assignment -- Regime F -- has monetary policy maintain the value of debt and fiscal policy control inflation. Regime F characterizes the U.S. policy mix leading up to the 1951 Treasury Accord and, arguably, describes recent policies. 3 Many economists regard Regime M as the normal state of affairs and have studied it extensively.

Macroeconomists often equate Regime F to Sargent and Wallace's (1981) "unpleasant monetarist arithmetic" regime. They infer that it necessarily leads to high inflation rates, and they dismiss it as irrelevant to advanced economies with independent central banks.4 But the fiscal theory of the price level is an alternative policy mix that delivers Regime F without necessarily producing the extremely high inflation rates associated with unpleasant arithmetic. This theory plays off the fact that the vast majority of government debt issued by advanced economies is nominal -- denominated in domestic currency -- so that changes in the price level can change the value of outstanding debt. 5 If fiscal policy does not consistently raise the present value of primary surpluses whenever debt rises and monetary policy does not consistently combat rising inflation with sharply higher nominal interest rate -- that is, does not always obey the Taylor principle -- then a fiscal theory equilibrium emerges. Fluctuations in current and expected surpluses feed directly into current or future inflation and monetary policy stabilizes debt by preventing higher inflation from transmitting into still higher nominal interest rates and, therefore, real debt service.

One example demonstrates the economic mechanisms in Regime F: consider a one-time increase in transfers (or a cut in taxes), financed by new nominal debt issuance. With no offsetting increase in current or expected tax obligations, households feel wealthier at the initial price level and try to increase their consumption. Higher demand for goods drives up the price level -- reducing the value of debt -- and continues to do so until the wealth effect dissipates and households are content with their original consumption plan. News of higher future transfers (or lower future taxes) sets off the identical chain of events, so the current price rises to equate the value of outstanding debt to the lower expected discounted surpluses. 6

Our research on fiscal stress feeds the Congressional Budget Office's projections of federal government transfers -- Social Security, Medicare, and Medicaid -- into a variety of formal models, but treats those transfers as "promised." These promises are initially honored and paid for with debt sales and distorting taxation. As marginal tax rates rise, though, the private sector grows increasingly disgruntled, increasing the probability that the economy will hit its fiscal limit - the point at which political resistance prevents taxes from continuing to rise. Promised transfers continue to grow relentlessly, so further policy adjustments must occur. We posit that people ascribe some probability to Regime M -- where monetary policy targets inflation and entitlements reform stabilizes debt -- and some probability to Regime F - where promised transfers are delivered and monetary policy stabilizes debt. Uncertainty plays a crucial role in agents' decisions, as probability distributions describe both the fiscal limit and future regimes. We compute rational expectations equilibriums, which require that policies be sustainable in the long run. 7

Several robust implications for inflation emerge from this research. First, if people believe that Regime F could occur in the future, then the central bank loses control of actual and expected inflation. A higher likelihood of Regime F, even if the regime is temporary, produces a larger increase in inflation. Second, effects on inflation from fiscal stress can be small and gradual or large and sudden, depending on agents' beliefs about possible future policy regimes. Small and gradual effects can be difficult to glean from early warning signals of inflation, such as long-term interest rates, particularly because the effects arise through expectations of distant policy adjustments. Third, because larger accumulations of debt produce larger run-ups in inflation, postponing eventual fiscal adjustments raises inflation risks. Finally, even when long-run expectations are anchored on Regime M -- where monetary policy can control inflation perfectly -- the central bank's loss of inflation control can be dramatic along the transition path.

This research demonstrates that inflation can arise for fiscal reasons that are beyond the control of independent central banks. It also suggests that efforts by central banks to offset fiscally-induced inflation through more aggressive monetary policy cannot succeed if fiscal policies and their expectations are inconsistent with the central bank's inflation goals.

1. The CBO posits a constant inflation rate over the projection period, implying that inflation achieves some target level throughout.

2. H. Chung, T. Davig, and E.M. Leeper, "Monetary and Fiscal Policy Switching," NBER Working Paper No. 10362, March 2004, and Journal of Money, Credit and Banking 39(4), pp. 809-42 (2007); T. Davig and E.M. Leeper, "Fluctuating Macro Policies and the Fiscal Theory," NBER Working Paper No. 11212, March 2005, and in NBER Macroeconomics Annual, vol. 21, D. Acemoglu, K. Rogoff, and M. Woodford eds., Cambridge: MIT Press, 2006, pp. 247-98; T. Davig and E.M. Leeper, "Monetary-Fiscal Policy Interactions and Fiscal Stimulus," NBER Working Paper No. 15133, July 2009, and European Economic Review 55(2), pp. 211-27 (2011); E.M. Leeper, "Anchoring Fiscal Expectations," NBER Working Paper No. 15269, August 2009, and Reserve Bank of New Zealand Bulletin 72(3), pp. 7-32 (2009); E.M. Leeper, "Anchors Aweigh: How Fiscal Policy Can Undermine the Taylor Principle," NBER Working Paper No. 15514, November 2009, and in Monetary Policy Under Financial Turbulence, Santiago: Central Bank of Chile, pp. 411-53 (2010); T. Davig, E.M. Leeper, and T.B. Walker, " 'Unfunded Liabilities' and Uncertain Fiscal Financing," NBER Working Paper No. 15782, February 2010, and Journal of Monetary Economics 57(5), pp. 600-19 (2010); T. Davig, E.M. Leeper, and T.B. Walker, "Inflation and the Fiscal Limit," NBER Working Paper No. 16495, October 2010, and European Economic Review 55(1), pp. 31-47 (2011) ; E.M. Leeper, "Monetary Science, Fiscal Alchemy," NBER Working Paper No. 16510, October 2010, and forthcoming Macroeconomic Challenges: The Decade Ahead, Kansas City: Federal Reserve Bank of Kansas City ; T. Davig and E.M. Leeper, "Temporarily Unstable Government Debt and Inflation," NBER Working Paper No. 16799, February 2011; E.M. Leeper and T.B. Walker, "Fiscal Limits in Advanced Economies," NBER Working Paper No. 16819, February 2011.

3. For a derivation of these two policy regimes, see E.M. Leeper, "Equilibria Under 'Active' and 'Passive' Monetary and Fiscal Policies," Journal of Monetary Economics 27(1), pp. 129-47 (1991). Pre-Accord policies are discussed in M. Woodford, "Fiscal Requirements for Price Stability," NBER Working Paper No. 8072, January 2001, and Journal of Money, Credit and Banking 33(3), pp. 669-728 (2001). Recent policies are examined by J.H. Cochrane, "Understanding Policy in the Great Recession: Some Unpleasant Fiscal Arithmetic," NBER Working Paper No. 16087, June 2010, and European Economic Review 55(1), pp. 2-30 (2011).

4. T.J. Sargent and N. Wallace, "Some Unpleasant Monetarist Arithmetic," Federal Reserve Bank of Minneapolis Quarterly Review 5 (Fall), pp. 1-17 (1981).

5. Sargent and Wallace rule out the fiscal theory a priori by using perfectly indexed debt.

6. Sticky prices and long-term bonds alter the inflation dynamics, but not the underlying economic logic.

7. This work takes sovereign debt default off the table, which is reasonable for the United States, but suspect for other countries. Some recent work connects fiscal limits to the probability of default [H. Bi, "Sovereign Risk Premia, Fiscal Limits and Fiscal Policy," CAEPR Working Paper No. 007-2010, Indiana University, May (2010); H. Bi and E.M. Leeper, "Sovereign Debt Risk Premia and Fiscal Policy in Sweden," NBER Working Paper No. 15810, March 2010; H. Bi, E.M. Leeper, and C. Leith, "Stabilization versus Sustainability: Macroeconomic Policy Tradeoffs," manuscript, Indiana University, November (2010)].