Unemployment Benefit Replacement Rates during the Pandemic

Due to federal relief efforts, two-thirds of unemployed workers are receiving benefits larger than their lost earnings, and a fifth are receiving benefits that are at least double their lost earnings.

Paying unemployment insurance benefits to those who lose their jobs provides them with financial support as they look for work. If a state sets benefits too high, it may discourage job-finding and delay beneficial labor reallocation. If benefits are too low, the unemployed may suffer from inadequate resources to sustain a minimum standard of living.

In US Unemployment Insurance Replacement Rates during the Pandemic (NBER Working Paper 27216), Peter Ganong, Pascal J. Noel, and Joseph S. Vavra calculate the distribution of unemployment insurance benefits under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Under this legislation, the federal government added $600 per week to state unemployment insurance (UI) benefits. As a result, the researchers estimate, half of the eligible unemployed are now entitled to total unemployment benefits that replace at least 134 percent of their lost wages. Two-thirds are eligible for benefits larger than their lost earnings, and a fifth are eligible for benefits that at least double their lost earnings.

The researchers construct quarterly earnings histories for workers using earnings data from the Current Population Survey Annual Social and Economic Supplement. They then apply the UI benefit formula for each state to calculate UI benefits, and they add payments under the CARES Act. The CARES Act adds the same fixed amount to all workers’ benefits, which leads to unemployment benefits that exceed wages at the lower end of the wage distribution. The mean prior weekly earnings of the unemployed were almost $1,000 a week, while the median was less than $750 a week.

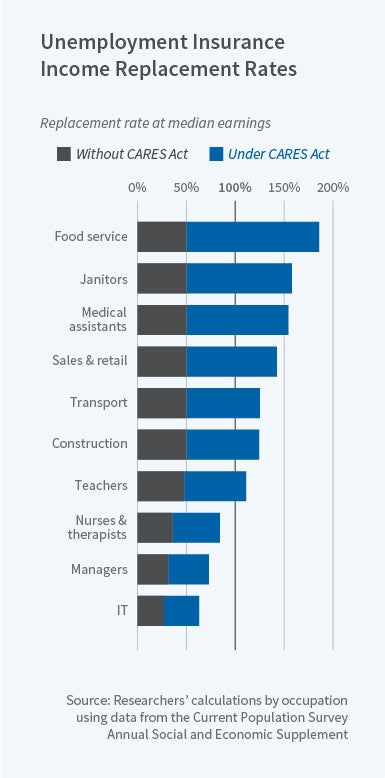

The generosity of unemployment benefits varies across states, but prior to CARES most states replaced 30–50 percent of lost earnings. With the additional $600-a-week payment from CARES on top of these baseline benefits, total payments now equal or exceed previous earnings for 68 percent of workers. The median beneficiary receives an amount equal to 134 percent of lost wages. In the bottom 20 percent of the income distribution, total unemployment benefits — UI plus CARES — are more than twice lost wages.

Because median lost wages are much lower than mean lost wages, and the CARES benefit boost was designed to generate a 100 percent earnings replacement for someone with mean earnings, total unemployment benefits now exceed lost wages for the median unemployed worker in every state. In Maryland, the median eligible unemployed worker receives benefits equal to 129 percent of lost earnings. In New Mexico, this value is 177 percent.

The researchers conclude that the CARES Act benefits provide substantial income expansion and liquidity for low-income unemployed workers. They also affect the distribution of resources within income groups. For example, janitors who stay on the job may be paid less than unemployed janitors collecting 158 percent of their prior wage, and laid-off retail workers collect 142 percent of their prior wage while their colleagues who remain at work receive only their prior wage — and have to work.

The researchers note that when using a fixed increment to benefits for all unemployed workers, it is “quite difficult to achieve high replacement rates for most workers without also having replacement rates over 100 percent for many workers.” They note that a federal policy that topped up state UI benefits to a fixed percentage of the prior earnings that states use to calculate unemployment benefits would do a superior job of replacing lost income without paying benefits that exceed lost wages.

—Linda Gorman