Assessing the Fed's Tools at the Zero Lower Bound

Forward guidance and large-scale asset purchases were effective alternatives when the Federal Reserve was unable to stimulate the economy by lowering interest rates.

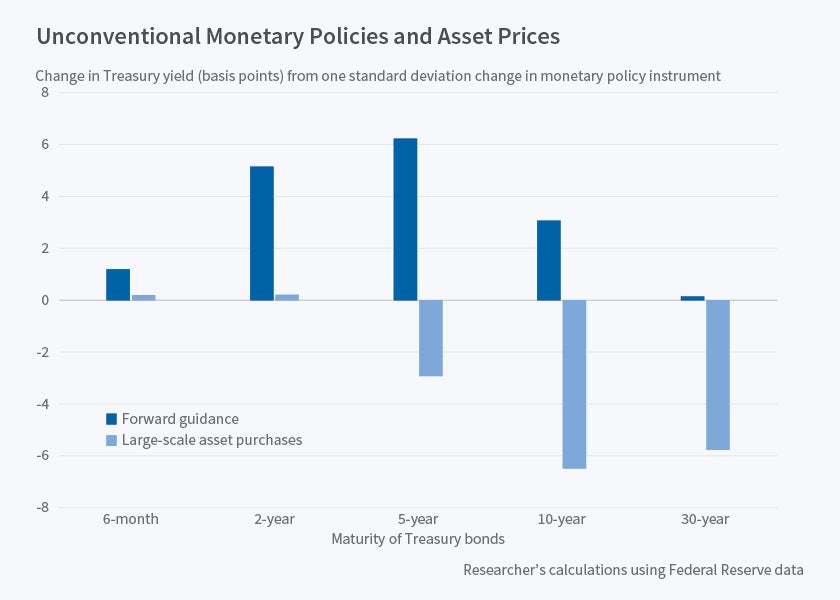

From 2009 to 2015, when the Federal Reserve's target short-term interest rate was close to zero, the central bank employed two other mechanisms in its efforts to boost the economy: forward guidance — information about the future path of the short-term interest rate — and large-scale asset purchases (LSAPs). In Measuring the Effects of Federal Reserve Forward Guidance and Asset Purchases on Financial Markets (NBER Working Paper 23311), Eric T. Swanson reports that both tools had substantial impacts on medium-term Treasury yields, stock prices, and the value of the dollar — impacts not unlike those achieved by changes to the federal funds rate before 2009. Short-term Treasury yields responded more to forward guidance, while LSAPs had a more pronounced effect on longer-term Treasury and corporate bond yields, his study finds. The effects of LSAPs also seem to have been more persistent.

Measuring the market impact of the two nontraditional tools is difficult for a number of reasons. First, the Fed often made announcements about both tools at the same time, making it difficult to disentangle their financial market effects. Second, markets may have interpreted LSAP announcements as having forward-guidance-like implications for the future federal funds rate. Third, financial markets are forward-looking and typically respond only to the unexpected component of Fed announcements, but there is little or no data directly measuring market expectations of these unconventional monetary policy announcements by the Fed.

Swanson addresses these challenges by studying high-frequency changes in a range of indicators of short-, medium-, and long-term interest rates. He looks at market reactions from 1991 to 2015 in a 30-minute window surrounding each Fed announcement regarding the federal funds rate, forward guidance, and/or LSAPs. To identify the distinct effects of each of these policy tools, the study makes three key assumptions: First, LSAPs have no effect on the current federal funds rate. Second, forward guidance affects future, but not current, federal funds rates. And third, LSAPs had a minimal effect on asset prices before 2008. This third assumption is consistent with the Fed essentially not conducting LSAP-type operations until the federal funds rate reached the zero lower bound in late 2008.

To illustrate the findings, consider the Fed's March 2009 announcement of its first LSAP program — popularly known as quantitative easing, or QE1. This announcement caught the markets by surprise. The study estimates this announcement consisted of a 5.6 standard deviation increase in the LSAP factor, and a 1.5 standard deviation decrease in forward guidance. Similarly, in December 2014 and again in March and September of 2015, market participants expected the Fed to signal a rise in rates in the near future, but the central bank instead sounded a cautious approach; these announcements are interpreted as 1.5 to 2.5 standard deviation declines in forward guidance.

After examining the financial market effects of these unconventional Fed policy tools, Swanson concludes that "both forward guidance and LSAPs were essentially just as effective as the federal funds rate itself," when each of these measures is normalized to a consistent measurement framework. However, the effects of LSAPs seem to be largely permanent, while those of forward guidance are less persistent, having a half-life of only about one to four months.

— Laurent Belsie