Why Aren’t College Savings Accounts More Widely Used?

Access to higher education remains a significant challenge for many families as college costs rise and public funding declines. Effective college saving strategies can help students offset some of these costs and reduce the burden of their future student loan debt, yet many families do not take up tax-advantaged college savings accounts (CSAs), also known as 529 plans.

In Navigating the College Affordability Crisis: Insights from College Savings Accounts (NBER Working Paper 34126), researchers Guglielmo Briscese, John A. List, and Sabrina Liu analyze administrative data from over 900,000 Illinois 529 plans from 2000 to 2023. They link these data to National Student Clearinghouse records and supplement them with surveys of account owners and parents.

Low financial literacy and misperceptions significantly limit college savings account participation and saving.

The researchers find that approximately 11 percent of Illinois children were beneficiaries of a 529 plan over the past decade, and while there are households saving through CSAs in almost every ZIP code in the state, participation has been concentrated among those who live in places with higher-income, more educated families.

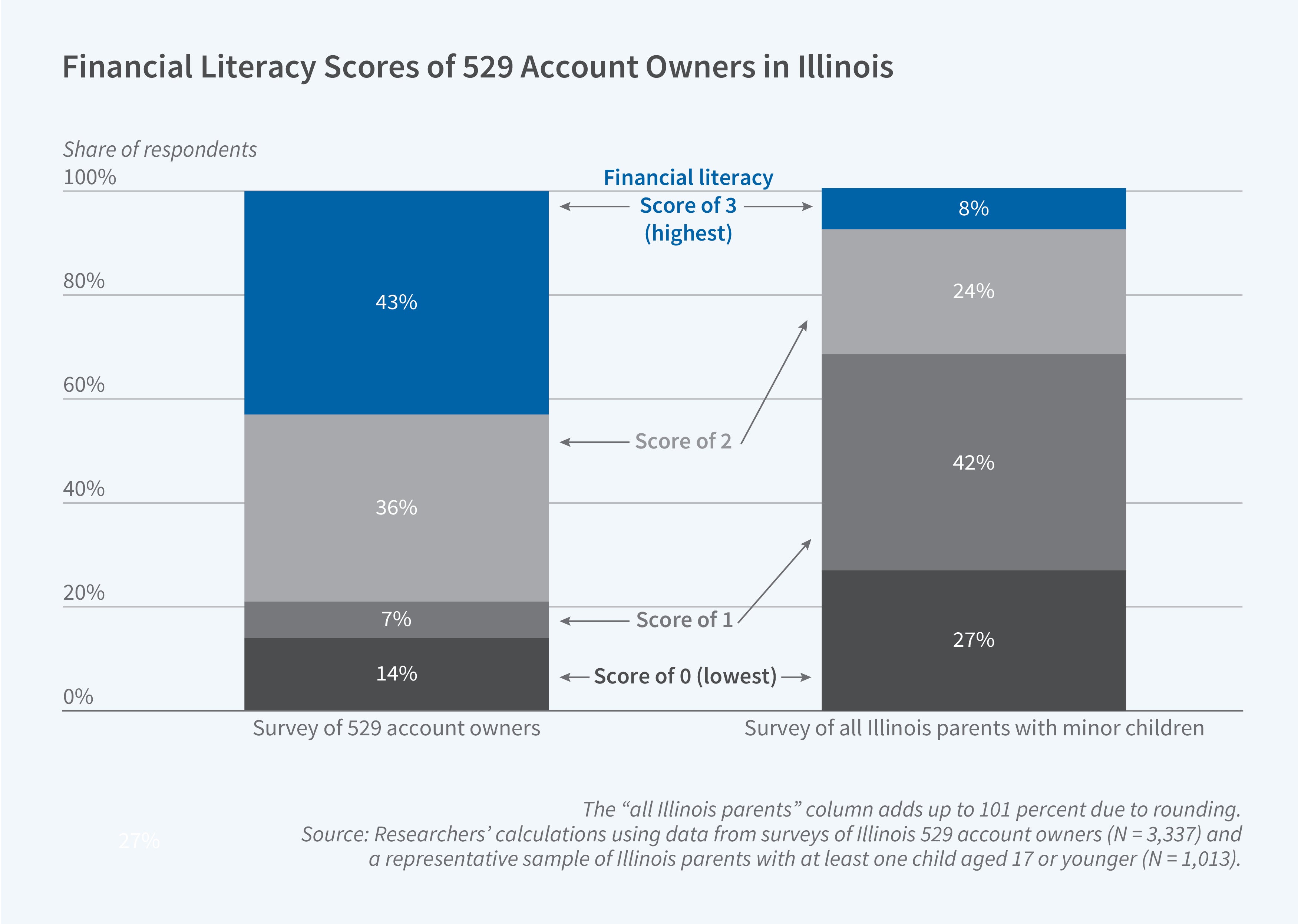

Surveys of representative samples of Illinois parents reveal that low awareness and plan attractiveness played a limited role in explaining disparities in participation. Instead, financial literacy emerges as a critical factor. Among parents with CSAs, 79 percent scored highly on financial literacy measures, compared to just 32 percent of parents surveyed from a representative sample of the state population. Excluding CSA owners from the latter sample, this share drops even further to 19 percent. The researchers also find that misperceptions about the value of saving are widespread. Among parents who do not own CSAs but could save enough to cover 50 percent or more of future college costs, 61 percent still believe their potential savings would not make a substantial difference in covering the future costs of college, a perception that is found across income groups.

The researchers also find significant disparities in saving behavior. In 2023, the top 5 percent of account owners held 29.3 percent ($4.97 billion) of total deposits, while the bottom half collectively owned just 8.3 percent ($1.4 billion). The average balance for the top 1 percent was $531,000, compared to $9,000 for the bottom 50 percent.

Limited attention to saving appears to contribute to these disparities. Many account owners rely on simple heuristics, like saving around $100 monthly, and rarely adjust their contributions. Thirty-six percent of account owners set up automatic contributions, but approximately one-third never adjust these amounts and have lower cumulative savings than those who actively manage their accounts.

The study is also the first to link CSA and National Student Clearinghouse data. Higher CSA balances are associated with an increased likelihood of four-year college enrollment, attendance at selective institutions, and the pursuit of postgraduate degrees.